Shell shares break records amid threat of wider Middle East war

They’ve tripled in value over the past three years and have surged more recently as trouble flares in the Middle East. Here’s what analysts think of the oil major’s current prospects.

17th October 2023 14:13

by Graeme Evans from interactive investor

“Never sell Shell”, the old stock market adage that lost its lustre during the pandemic, is back in the spotlight after the oil giant’s shares this week traded at a record high.

Plenty of interactive investor clients think the landmark is the right moment to reduce their exposure, judging by the volume of sell orders on today’s most-traded list.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Those who saw an opportunity when shares stood below 1,000p after 2020’s first dividend cut since the Second World War will be more than justified bailing out with the price as high as 2,774p.

Source: Refinitiv. Past performance is not a guide to future performance.

Timing an exit, however, is never easy and there are plenty in the City who see further upside for shares as new boss Wael Sawan carries out his rebuilding of Shell (LSE:SHEL) distributions.

Bank of America and UBS, for example, have both published price targets of 3,000p in recent weeks, the latter doing so after the company’s robust third-quarter trading update. The pair’s forecasts are based on long-term Brent crude oil price assumptions of $70-75 a barrel.

- Stockwatch: the implications for investors of new Middle East conflict

- ii view: good news for Shell's gas trading business

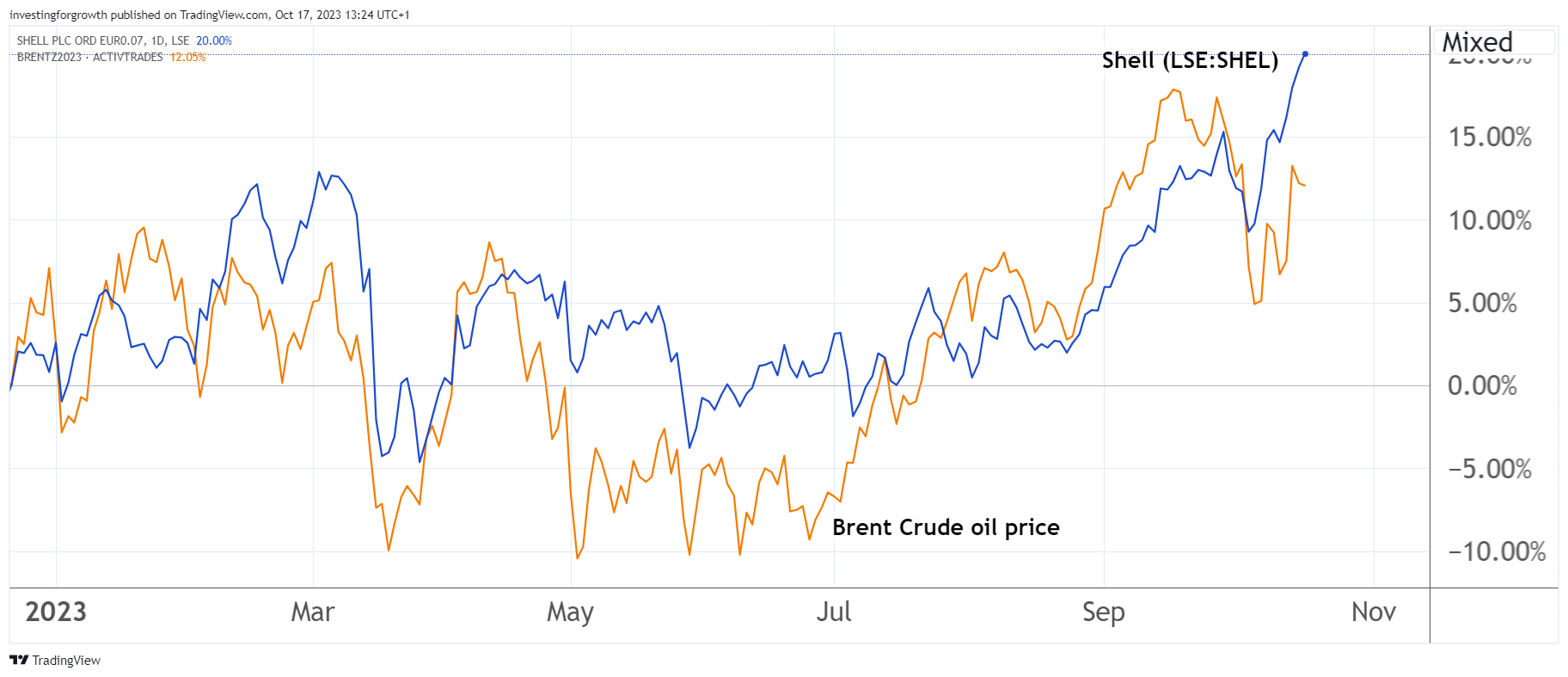

Shell shares have risen 10% since 4 October and are now in record territory because oil and gas prices have reignited on supply fears caused by the Middle East conflict.

Brent crude topped $95 a barrel last week, continuing the upward run of the past month after Saudi Arabia and Russia extended voluntary production cuts until the end of the year.

The $100 a barrel threshold remains in sight, although the prospect of elevated interest rates well into 2024 means there’s also the potential for global oil demand to slow.

Source: TradingView. Past performance is not a guide to future performance.

For now, the period of heightened energy prices has pushed Shell’s cash flows much higher and allowed the company to reduce debt and raise shareholder returns.

The most recent dividend payment landed in accounts on 18 September after Sawan increased the second-quarter distribution by 15% to $0.33 a share. Now trading with a forecast dividend yield of 4.4%, the latest payment by Shell compared with $0.47 before April 2020’s landmark cut rebased the figure back to $0.16 a share.

Last month’s increase came on the back of a pledge to distribute 30-40% of cash flow from operations through the cycle, up from 20-30% previously.

Sawan’s plans are underpinned by his enhanced focus on performance and stronger capital and spending discipline, including a structural reduction in operating costs of $2-3 billion by the end of 2025.

- Merryn Somerset Webb: a commodities supercycle like never before

- The four FTSE 100 income stars returning big money in October

A new capital expenditure target of $22-25 billion a year for 2024 and 2025 is down from the previous range of $23-27 billion.

Sawan has dialled back on some low-carbon energy investments but remains committed to the 2050 net-zero target put in place by his predecessor Ben van Beurden.

For now, the company will seek to bolster cash flows by extending its “advantaged position” in upstream operations.

Its new pledge will see the company stabilise liquids production up to 2030, rather than the cut of 1-2% a year originally proposed. This is in line with BP (LSE:BP.), which has also taken a step back from its previous low carbon commitments.

However, Shell still plans to invest $10-15 billion across 2023 to 2025 to support the development of low-carbon energy solutions including biofuels, hydrogen, electric vehicle charging and carbon capture storage.

Sawan, who is due to announce third-quarter results on 2 November, told investors recently: “We are investing to provide the secure energy customers need today and for a long time to come, while transforming Shell to win in a low-carbon future.

“Performance, discipline, and simplification will be our guiding principles as we allocate capital to enhance shareholder distributions, while enabling the energy transition.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.