Shares for the future: will good times return for this cheap stock?

He used to love this company, but columnist Richard Beddard worries that it has been caught off guard by events too many times. It must now rebuild if it is to reclaim former glories.

12th April 2024 15:02

by Richard Beddard from interactive investor

It is with a heavy heart that I score XP Power Ltd (LSE:XPP).

True, the shine wore off last year when the company incurred a massive fine, but the hope that a business with an exemplary strategy might overcome its drift into debt still burned bright...

Scoring XP Power: fluttering red flags

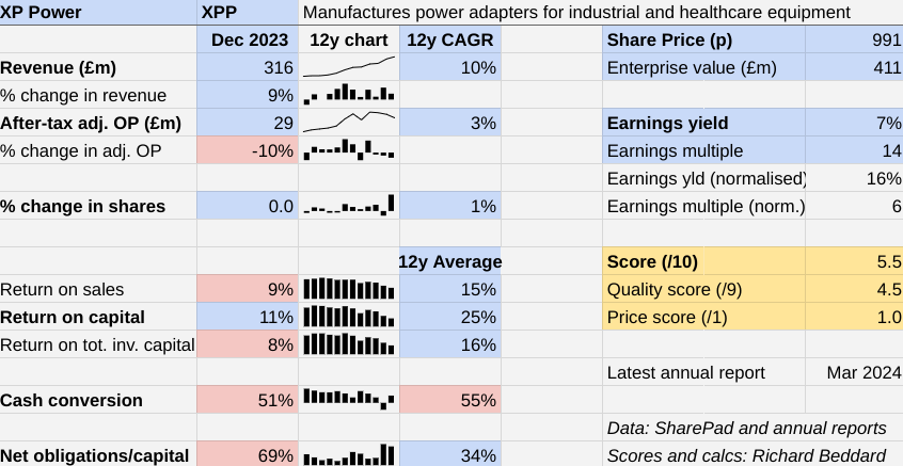

Revenue in the year to December 2023 increased 9%, but adjusted profit fell for the third year running, this time by 10%.

XP Power supplies power converters to equipment manufacturers in three markets: semiconductors, industrial and healthcare.

- Learn with ii: ISA Allowance | ISA Investment Ideas | Transfer a Stocks & Shares ISA

In 2023, it endured a slump in the semiconductor market, but buoyant conditions in its other two markets. Uncharacteristically, though, around the end of the financial year orders from less cyclical industrial and healthcare customers fell too.

This is because XP Power’s multinational customers had stockpiled components to mitigate delays and shortages as the global economy recovered from the pandemic. Now they are eating into their stock, rather than ordering power converters.

XP Power is facing a simultaneous decline across all markets at a bad time, when it is strapped for cash.

The Past (dependable) [1]

- Profitable growth: Barely, on a heavily adjusted basis [0.5]

- Strong finances: Net obligations are 69% of capital [0]

- Through thick and thin: Barely, on a heavily adjusted basis [0.5]

The first thing to note is the profit figures are a best-case scenario because they ignore substantial real costs deemed one-off. Including these costs, return on capital was only 8%, 3% less than the adjusted return.

Last year unadjusted return on capital was negative, due mostly to legal costs.

Although Matt Webb, XP Power’s new chief financial officer, says he is determined to keep adjustments to a minimum, his debut set of accounts are riddled with them.

In 2023, the company racked up exceptional restructuring costs as it sought to rebuild its finances, relocation costs for two facilities in California where the company had been unable to extend the leases, costs relating to a new factory in Malaysia, costs incurred in the relocation of work from factories in the West to Asia, and ongoing legal fees.

The legal fees relate to XP Power’s appeal against last year’s US court judgement that it had stolen trade secrets from a Swiss rival.

Despite a “Funding plan”, which is saving the company money through redundancies, reduced capital expenditure, and the suspension of the dividend, and despite £44 million raised by selling new shares to investors, XP Power was still mostly funded by debt at the year end.

XP Power expects lower revenue in 2024, although it says trading should begin to improve in the second half of the year as customer stock levels normalise and demand from semiconductor equipment manufacturers picks up.

The Present (distinctive) [2.5]

- Discernible business: Manufacturer of power converters for critical equipment [1]

- With experienced people: Limited experience at the top [0.5]

- That creates value for customers: Reliable, efficient, easy to design in [1]

Although we use power converters every day when we charge our phones or laptops or use the washing machine, the converters XP Power manufactures power much more complex equipment like industrial robots and surgical tools.

These machines have exacting and multifarious power requirements, and the power converter designs are a result of collaboration between equipment and power converter manufacturer. XP Power is well placed to deliver this because of its large field sales force and broad range of designs.

The company’s strategy is to develop low-power converter families for electronic equipment. These converters can be customised relatively easily so they fit the requirements of customers, mostly in North America and Europe.

Recent acquisitions have allowed XP Power to supply a greater range of converters to the same blue-chip customers, which is an important part of the company’s strategy. These power converters are more complex RF (radio frequency) and high voltage systems. They power processes like plasma etching in semiconductor manufacturing.

Twenty years ago, XP Power was a distributor just starting to develop its own low-power supplies and today it has 8.8% share of this estimated $3.7 billion market, which is quite an achievement. Its newer high-power markets are smaller but potentially lucrative.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- The UK stocks just as good as America’s Magnificent Seven

It is too early to say whether buying into the RF and high voltage markets has been a successful strategy, though, because the acquisitions are recent and because the court’s verdict means XP Power cannot use the RF intellectual property it was judged to have stolen.

Overseeing this difficult period for the company is a fairly green board. Chief financial officer Matt Webb joined last October and chair Jamie Pike joined last April.

The elder statesman is chief executive Gavin Griggs whose tenure as chief executive has coincided with XP Power’s troubled years. He joined as chief financial officer in October 2017, around the time the company allegedly stole the trade secrets.

He succeeded long standing chief executive Duncan Penny in January 2021, just as the first pandemic related dents in XP Power’s estimable financial track record were about to appear.

Too often since then, XP Power has been caught off guard by events: the size of the damages awarded against it last year, the slump in demand from semiconductor manufacturers, and most recently the requirement to relocate two facilities in California.

Creditably, in the annual report Mr Griggs accepts that the company should have been financially better prepared for these events.

According to its going concern statement, XP Power expects to be in business in 2026, although the severe downside scenario only gives it “modest headroom”, code for close to breaching the terms agreed with its lenders.

The Future (directed) [1]

- Addressing challenges:Legal dispute, ongoing investment [0.5]

- With coherent actions: Appeal, restructuring [0]

- That reward all stakeholders fairly: Employees, shareholders are suffering, will customers retain faith? [0.5]

The company was well within its banking covenants at the end of 2023, but the problem with the going concern statement is that it addresses individual risks: recession, the loss of a big customer or major manufacturing facility, for example. It was a combination of circumstances that got XP Power into trouble, and it still faces many of them.

On top of that, the cost cutting required to restore the company’s finances is interfering with XP Power’s ability to invest through downturns, a hallmark of its strategy over the last two decades. In the past, its investment led approach has enabled it to win more business when rivals are in trouble.

Although net product development costs increased in 2023 and “design wins” - projects that should one day enter production - are at a record high, XP Power only introduced 11 new product families in 2023, the lowest number in recent times and 19 less than it targets.

Some product families are more valuable than others, so judging the company by quantity alone could be misleading. But the paucity of new families does make me wonder about future design wins, which translate into orders and ultimately sales.

XP Power has deferred the construction of a much-vaunted factory in Malaysia, originally slated for completion this year. Twice as big as its state-of-the art Vietnamese factories and still planned for 2026, this initiative is strategically important for three reasons.

- The Income Investor: are BP and Rio Tinto a buy for dividends?

- Wild’s Winter Portfolios 2023-24: up 25% with one month to go

First, it further reduces XP Power’s dependence on its facilities in China, which may be necessary for geopolitical reasons. Second, it is designed to be environmentally friendly, and XP Power sells itself on its environmental credentials. Third, manufacturing in Malaysia, like China and Vietnam, is relatively low cost.

Layoffs and restructuring suggest these cannot be great times to be working at XP Power. The company's employee engagement score as surveyed by Gallup gives some reassurance. It was 3.99 out of 5 in 2023, slightly above 2022 and broadly typical of the last four years. The company says it is in the 41st percentile of similar sized companies in the Gallup database. Slightly above average, in other words.

The full-time voluntary employee turnover rate is very high, though, at 37%, up from 31% two years ago. In Asia, where the company does most of its manufacturing and employs the majority of its staff, it is 48%.

The price (discounted?) [1]

- Yes. A share price of 991p values the enterprise at about £411 million, 6 times normalised profit.

I used to love XP Power for its predictability, but now virtually the only thing going for it is the low share price and the memory of a good strategy that the company cannot currently afford.

To be a good long-term investment it must rebuild its financial strength while preserving its culture and reputation.

A score of 5.5 out of 10 indicates that I am on the fence. I hope XP Power can do it, but I do not know if it will.

It is ranked 34 out of 40 shares in my Decision Engine.

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report. Scores change daily due to price changes.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Bunzl (LSE:BNZL), Howden Joinery Group (LSE:HWDN), Judges Scientific (LSE:JDG) and Macfarlane Group (LSE:MACF) have all published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

0 | Company | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.8 | |

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | |

3 | Manufacturer of scientific equipment for industry and academia | 8.6 | |

4 | Supplies kitchens to small builders | 8.6 | |

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | |

6 | Translates documents and localises software and content for businesses | 8.5 | |

7 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 8.4 | |

8 | Manufactures filters and filtration systems for fluids and molten metals | 8.3 | |

9 | Distributor of protective packaging | 8.2 | |

10 | Manufactures/retails Warhammer models, licences stories/characters | 7.8 | |

11 | Manufactures natural animal feed additives | 7.8 | |

12 | Imports and distributes timber and timber products | 7.8 | |

13 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.6 | |

14 | Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

15 | Distributes essential everyday items consumed by organisations | 7.5 | |

16 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.4 | |

17 | Sources, processes and develops flavours esp. for soft drinks | 7.4 | |

18 | Online retailer of domestic appliances and TVs | 7.3 | |

19 | Whiz bang manufacturer of automated machine tools and robots | 7.2 | |

20 | Sells hardware and software to businesses and the public sector | 7.0 | |

21 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 7.0 | |

22 | Makes marketing and fraud prevention software, sells it as a service | 7.0 | |

23 | Online marketplace for motor vehicles | 7.0 | |

24 | Supplies vehicle tracking systems to small fleets and insurers | 6.6 | |

25 | Manufactures specialist paper, packaging and high-tech materials | 6.6 | |

26 | Manufactures vinyl flooring for commercial and public spaces | 6.5 | |

27 | Operates tenpin bowling and indoor crazy golf centres | 6.5 | |

28 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.4 | |

29 | Manufactures military technology, does research and consultancy | 6.4 | |

30 | Sells promotional materials like branded mugs and tee shirts direct | 6.0 | |

31 | Surveys and distributes public opinion online | 6.0 | |

32 | Publishes books, and digital collections for academics and professionals | 5.9 | |

33 | Flies holidaymakers to Europe, sells package holidays | 5.9 | |

34 | XP Power | Manufactures power adapters for industrial and healthcare equipment | 5.5 |

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.4 | |

36 | Manufactures sports watches and instrumentation | 5.4 | |

37 | Supplies software and services to the transport industry | 5.3 | |

38 | Acquires and operates small scientific instrument manufacturers | 4.8 | |

39 | Retails clothes and homewares | 4.8 | |

40 | Runs a network of self-employed lawyers | 4.6 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns XP Power and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.