Shares for the future: why this stock’s still in my top five

This company has always been a firm favourite with analyst Richard Beddard, and it remains one of his highest-ranking stocks despite getting a slightly lower score this time.

11th April 2025 15:04

by Richard Beddard from interactive investor

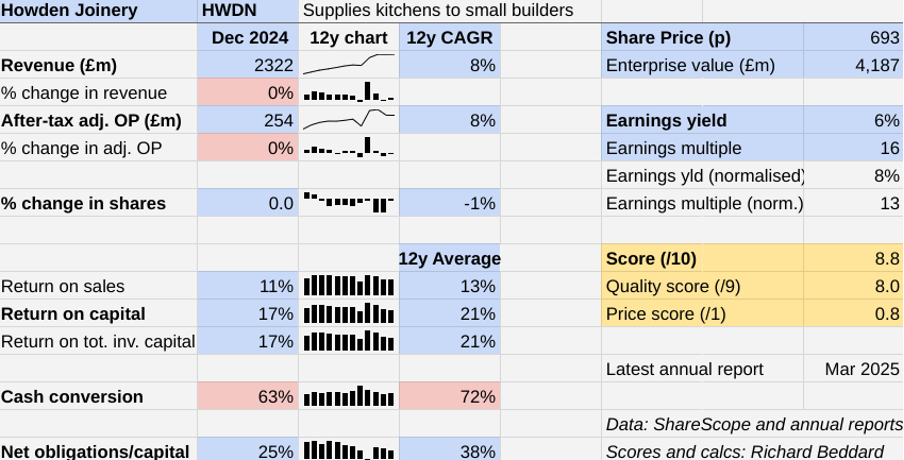

Howden Joinery Group (LSE:HWDN) did not grow revenue or profit, but the company says it grew market share in the year to December 2024. That is what we should expect from the dominant fitted kitchen supplier when we’re feeling more hard up.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Scoring Howden: Old Faithful

Revenue was flat, and so was profit. In the UK, same store sales fell just over 1%. Howdens’ much smaller depot network overseas, in France and Ireland, accounts for about 9% of revenue. Overseas same depot sales grew 4%, also in challenging markets.

The Past (dependable) [3]

- Profitable growth: 8% CAGR revenue and profit growth [1]

- Strong finances: No bank debt [1]

- Through thick and thin: Lowest return on capital (RoC) 15% in 2020 [1]

Nevertheless, revenue is 47% higher than it was in 2019, because of high demand for kitchens in 2021 and 2022. More time at home as the pandemic abated, encouraged us to make improvements.

This brought spending forward from subsequent years, which along with tougher economic times caused revenue to contract in 2023. Although revenue stabilised in 2024, the company expects the market to contract again. If revenue growth returns, it is likely to be muted.

Profit growth of 18% since 2019 has not kept pace with revenue growth. Higher costs have contributed to lower profit margins.

In 2024, RoC was 17%, below the long-term average of 21%.

In addition to inflated employee and material costs, the international stores are still getting established and are loss-making. Lower volumes mean Howdens’ factories are less efficient. The company is selling proportionally more entry-level kitchens. From this month, higher employers’ National Insurance costs will also bite.

Over the next few years, the company expects profit margins to recover due to annual price rises, efficiency gains, growing volumes, and as it achieves break-even overseas.

Although cash conversion is sub-par, the peculiar trading conditions during the pandemic resulted in a spike in cash inflows. The average, consequently, overstates Howdens cash generation.

- Share Sleuth: building a cash pile to go shopping in the sales

- Shares for the future: here’s how I rank this simple AIM stock

Cash conversion in 2024 was typical of non-pandemic years. Although Howdens only generated 63% of profit as cash, this is a feature of the business rather than a bug.

The company extends credit to small builders and maintains an exceptionally high level of stock availability (especially in its busiest season, near the year-end), which consumes cash. Capital expenditure on new depots and revamps does too.

Nevertheless, Howdens’ cash conversion is strong enough to fund a dividend and buybacks. The company had no bank debt at the year-end, as usual, and net financial obligations including operating leases and the pension deficit were at an historic low, compared to operating capital.

The Present (distinctive) [3]

- Discernible business: Dominant UK kitchen supplier, trade only [1]

- With experienced people: Experienced chief executive [1]

- That creates value for customers: confidential terms, high availability [1]

Howdens wants to make things easier for small builders. Because it does not sell directly to home owners, its prices are confidential, and builders can set their own margins.

By designing and manufacturing its own cabinets and worktops, it can ensure they are easy to install. It provides enough credit so builders can finish an installation and be paid before they need to settle up. It keeps almost everything they need in stock, so work is not held up while orders are fulfilled. The depots are in easily accessed (and cheaper) edge-of-town locations. Howdens’ kitchen designers work with the builders’ customers to plan their kitchens.

The builders recruit customers and collect products and materials, so Howdens is spared the cost of expensive showrooms and spends less on advertising.

When Howdens was founded in 1995 this business model was unique, and there is nothing to rival it in scale in the UK. Ireland and France, where the company is in start-up mode, are fragmented markets with no Howdens-like incumbent.

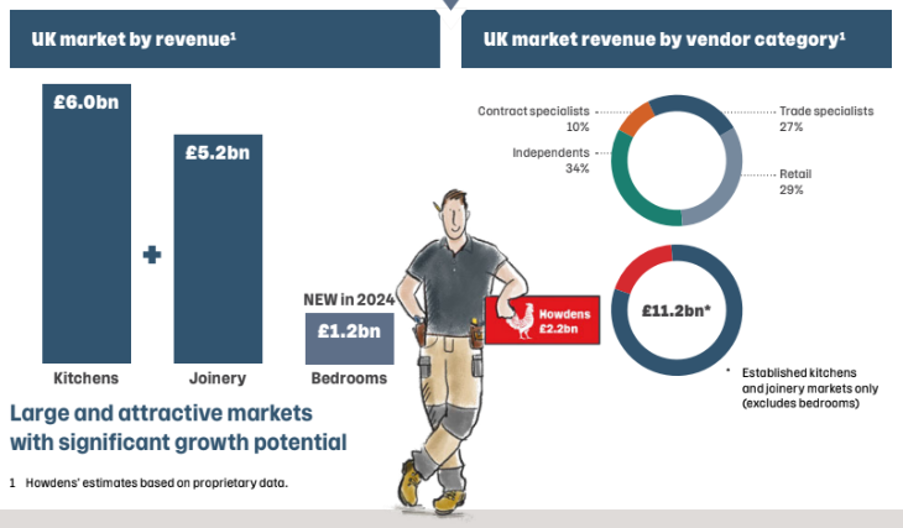

The company says its addressable market in the UK, including kitchens, joinery products and bedrooms, is £12.4 billion. This means that according to Howdens’ own data, it has more than a 19% market share, and a 70% or so share of the trade specialist market.

Source: Howden Joinery annual report 2025

Scale means Howdens can manufacture an increasing proportion of its products efficiently in its own UK factories, and distribute them through its own network of warehouses and depots. Control of quality and security of supply underpin the near 100% availability of key components.

It also makes Howdens a powerful buyer of appliances, drawer rails and other components. Although it does not make them, it has input into the design and markets them as its own brands.

Howdens’ founder retired in 2018, and it has only had one chief executive since. He is Andrew Livingstone. The only other board-level executive is chief financial officer of four years Paul Haynes, who is stepping down. An executive committee includes Howdens lifers.

The Future (directed) [2]

- Addressing challenges:Saturation in the UK [0.5]

- With coherent actions: New products, international expansion [0.5]

- That reward all stakeholders fairly: Worthwhile for all concerned [1]

Howdens operated 869 depots at the year-end, and reckons it has scope for 1,000. In the past, when it has neared this target, it has increased it, but we cannot rely on this forever. Eventually, the UK will be saturated.

In 2025, the company anticipates opening 20 new UK depots, down from the 30 or so it has opened in recent years. Andrew Livingstone says we should not read anything into the lower rate. Howdens wants more depots in London, and locations are harder to find, as are prime locations on industrial estates generally.

If Howdens continues at this rate, it will reach 1,000 in 2031, and if that is the limit, growth will be harder to achieve.

The company is over halfway through revamping its existing estate, so depots make more effective use of space. Every year it introduces new products, recently extending its range of higher-priced kitchens and entering the fitted bedroom market.

Once the UK roll-out runs out of steam, the main prospect for growth is France, where the company operates 65 depots clustered around Paris, Lyon and Marseilles, and the Republic of Ireland, where it operates 13 near Dublin and Cork.

- Stockwatch: let’s see how tariff chaos affects company profits

- ‘Cockroach shares’ the pros are backing to survive market turmoil

The clustering strategy enables Howden to concentrate its marketing locally, use word of mouth, and build out its distribution network.

Howdens opened three new depots in Ireland in 2024 and plans to open five more in 2025. Potentially, it is on its way to 40.

Aspirations for France are much greater, 250 depots, but Howdens opened no new depots there in 2024 and it is not planning to open any in 2025.

This is a hiatus. Howdens doubled the size of its French estate between 2021 and 2023 and experienced growing pains. A key issue is the lack of experienced personnel, so it has beefed up management, and sent people out from the UK to help with training and focus the business on same depot growth.

The roll-out will resume as “the talent pool grows” and sales per depot reach the right level, which could happen as soon as next year. Breakeven may also be reached in the next year or two. Whether these depots can be as profitable as their UK counterparts remains to be seen.

Howdens’ far-sighted founding principle that it should be worthwhile for all concerned has stood the test of time.

The company’s highly incentivised structure extends down through the business, which motivates depot managers to be entrepreneurial and bestows free shares on all staff.

Median pay including bonuses, and a generous pension scheme, was over £40,000 in 2024. Eleven per cent of UK employees started as apprentices.

Its two factories at Howden and Runcorn were certified carbon neutral in 2021.

The price (discounted?) [0.8]

- Yes. A share price of 693p values the enterprise at about £4.2 billion, 13 times normalised profit.

A score of 8.8, although down from 9.3 last time, implies Howdens is a good long-term investment.

It is ranked 5 out of 40 shares in my Decision Engine.

29 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Judges Scientific (LSE:JDG) has published its annual report and is due to be re-scored.

0 | company | * | description | score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Makes light fittings for commercial and public buildings, roads, and tunnels | 9.0 | ||

4 | Sells promotional materials like branded mugs and tee shirts direct | 8.9 | ||

5 | Howden Joinery | Supplies kitchens to small builders | 8.8 | |

6 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

7 | Distributor of protective packaging | 8.5 | ||

8 | Manufacturer of scientific equipment for industry and academia | 8.4 | ||

9 | Whiz bang manufacturer of automated machine tools and robots | 8.4 | ||

10 | Repair and maintenance of rail, road, water, nuclear infrastructure | 8.3 | ||

11 | Manufactures computers, battery packs, radios. Distributes components | 8.3 | ||

12 | Flies holidaymakers to Europe, sells package holidays | 8.3 | ||

13 | Distributes essential everyday items consumed by organisations | 8.2 | ||

14 | Manufactures filters and laboratory equipment | 8.2 | ||

15 | Designs recording equipment, loudspeakers, and instruments for musicians | 8.0 | ||

16 | Surveys and distributes public opinion online | 7.9 | ||

17 | Manufactures vinyl flooring for commercial and public spaces | 7.9 | ||

18 | Operates tenpin bowling and indoor crazy golf centres | 7.7 | ||

19 | Retailer of furniture and homewares | 7.7 | ||

20 | Manufacturer of ventilation products | 7.6 | ||

21 | Sells hardware and software to businesses and the public sector | 7.6 | ||

22 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.6 | ||

23 | Manufactures/retails Warhammer models, licences stories/characters | 7.5 | ||

24 | Online marketplace for motor vehicles | 7.4 | ||

25 | Acquires and operates small scientific instrument manufacturers | 7.1 | ||

26 | Provides automated marketing software as a service | 7.1 | ||

27 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.0 | ||

28 | Supplies software and services to the transport industry | 7.0 | ||

29 | Sources, processes and develops flavours esp. for soft drinks | 7.0 | ||

30 | Manufactures natural animal feed additives | 6.9 | ||

31 | Online retailer of domestic appliances and TVs | 6.7 | ||

32 | Supplies vehicle tracking systems to small fleets and insurers | 6.7 | ||

33 | Publishes books, and digital collections for academics and professionals | 6.6 | ||

34 | Translates documents and localises software and content for businesses | 6.5 | ||

35 | Manufactures disinfectants for simple medical instruments and surfaces | 6.5 | ||

36 | Manufactures sports watches and instrumentation | 6.1 | ||

37 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.9 | ||

38 | Manufactures military technology, does research and consultancy | 5.9 | ||

39 | Makes marketing and fraud prevention software, sells it as a service | 5.6 | ||

40 | Runs a network of self-employed lawyers | 4.9 |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Howdens and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.