Shares for the future: why I’m losing sleep over these stocks

One share is sent to the naughty step, and two more may join it, warns our companies analyst.

29th May 2020 15:42

by Richard Beddard from interactive investor

One share is sent to the naughty step, and two more may join it, warns our companies analyst. Find out who they are here and also what’s stopping him getting a good night’s sleep.

Next week I will conduct my annual appraisal of Churchill China (LSE:CHH). It is a somewhat daunting prospect: the first time since Covid-19 shut businesses down that I must evaluate a company that, I imagine, is barely trading and has only distant prospects of a return to normal. Churchill China makes tableware for the hospitality industry, the ‘eating out’ part of which has substantially shut down.

All but the most optimistic scenarios for Covid-19 require us, or at least anybody considered vulnerable, to keep a low profile indefinitely. If things go badly, restrictions will tighten again, if not nationally, then locally. And at some point, even companies with strong balance sheets who rely on people gathering will have to change radically to survive and ultimately prosper.

I have not read Churchill China’s annual report yet, and the numbers (for the year to December 2019) are untainted by the virus, but it seems likely I will reduce the company’s score. Churchill China faces new risks, which may require it to change strategy, and that could impact profitability for some time. Profitability, risks, and strategy are three of the five criteria I use to score a share.

This puts me in a pretty awkward situation. The fourth criteria is fairness. Most of the companies I score, Churchill China included, have the maximum score for fairness because they treat customers, staff, and shareholders well. If I had to choose shares using one criterion only, it would be fairness because these companies and their, relatively speaking, selfless managers and motivated workforces, have the greatest capability to adapt.

Shares that keep me awake at night

Reconciling these countervailing forces, and the additional complication of the fifth criterion, the market value of the shares, does not keep me awake at night. I go to sleep really easily.

This morning though, I woke up early, and when I rolled over to snatch another hour of sleep before the long commute downstairs to the office, thoughts about Churchill China and some other shares stymied me. Much as I love the company, that is not the way I want to start the day.

The discomfort of making decisions is one of the many reasons I only review companies once a year.

The most important reason is that I do not trust myself to make good decisions in the moment - as a pandemic is breaking for example. Limiting the amount of time I spend investigating each share also enables me to learn more about other companies and build more diverse portfolios.

Generally, the companies I choose to score are relatively stable, after all I picked them because they were profitable, I was comfortable with the risks, and they treated people fairly.

Hitherto events that might herald a big strategic shift have been rare and gradual and I have made a mental note to consider them when I next review the share.

The pandemic has increased this cognitive load, though, and I have started to note things to follow up in my Decision Engine spreadsheet. The result is that I am less confident in some of my scores than others.

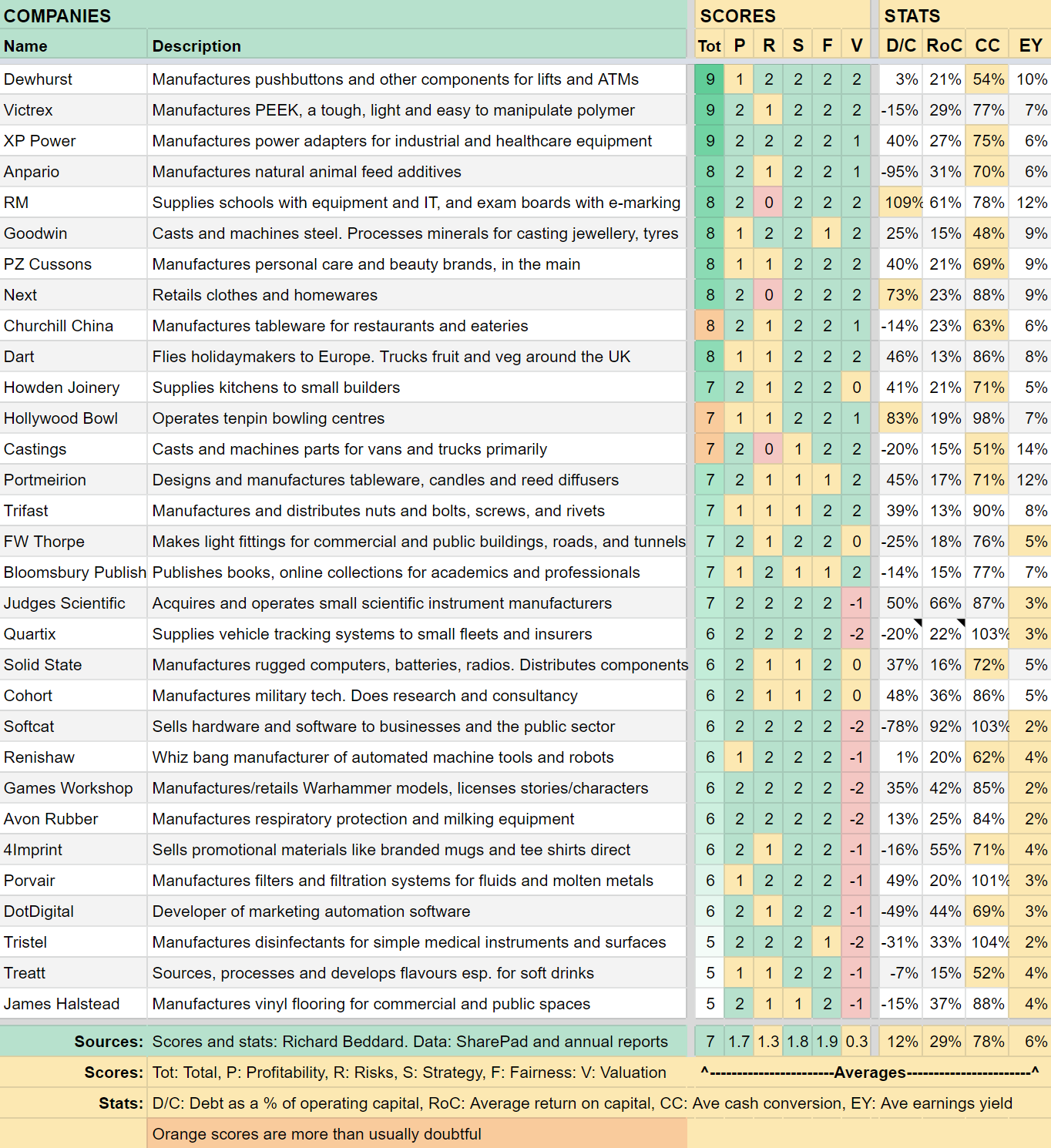

This is something I know that readers do not, so in pursuit of transparency I have decided to highlight the scores I feel most doubtful about in orange.

I must admit to feeling ambivalent about this innovation. Often the most profitable investments are the ones that conflict us. It is also confusing.

The scores I give companies are themselves confidence measures, and I am essentially overriding a score arrived at soberly during a systematic review, with half-formed thoughts of a feverish mind that has yet to fully come to terms with the new information it is trying to process!

Nevertheless, these doubts have proved sufficient to stop me trading these shares, a strategy known among investors as “sitting on your hands”, and I am unlikely to be liberated until I have scored them properly.

Hollywood Bowl

In addition to Churchill China (LSE:CHH), I have awarded the orange mark of doubt to Hollywood Bowl, a bowling alley chain.

By the conservative standards of my selections, it was one of three financially stretched companies in the list going into the pandemic and it will probably come out considerably more stretched (the other two companies are Next (LSE:NXT) and RM (LSE:RM.), which may join Hollywood Bowl (LSE:BOWL) on the naughty step). Like the company’s directors, I thought Hollywood Bowl could afford its debts, principally lease obligations, because it is a highly profitable business when it is open. That profitability is founded on a convincing strategy focused on prime locations, family friendly entertainment, and being a good tenant.

Hollywood Bowl has kept shareholders informed about its efforts to conserve and raise cash. It has been industrious too, raising money from investors in a placing, extending its borrowing facility and negotiating a relaxation in the terms of its bank lending, and (reportedly) negotiating a deferral of rental payments with landlords. It seems the company has the confidence of all its backers, but the pandemic has reminded me of two things that I find unsettling.

Although tenpin bowling is a relatively cheap form of family entertainment, Hollywood Bowl’s short history as a listed business means we have not seen how it performs in a recession, even a normal one, let alone one in which gatherings are restricted. I wonder whether, like many of the businesses I favour, the company should have eschewed all bank debt bearing in mind its large lease obligations. The prospect of higher debt may reduce my risk score.

Secondly, Hollywood Bowl’s directors are very well paid and, amid all the cost-cutting measures the company says it has taken, I see no mention that they have sacrificed an element of their pay. If this is true, it may prompt me to reduce the fairness score even though they are clearly working very hard.

Castings

Castings (LSE:CGS), which makes parts for trucks, is in a much stronger financial position. Remarkably, it not only has no conventional borrowings, it has no operating lease obligations, and it is in the process of offloading its pension obligations to an insurance company.

I have no doubt Castings is prudently managed, but I notched up a new doubt when I noticed that profit in 2019 was no higher than it was on the eve of the financial crisis in 2008.

Historical growth is not something I think much about, trusting that a company’s strategy will produce growth in future, but I already had doubts about Castings’ strategy when I reviewed the company last year, and its strategy score may be reduced again when I conduct this year’s review in the autumn.

Castings’ cash cushion makes it a more comfortable proposition if the effects of the pandemic are prolonged. So does the fact that it is still operating, but I need to consider whether it is worth holding for the next 10 years, given it has not grown for the last 10.

Here are links to the most recent profiles of all the companies in the Decision Engine:

| Dewhurst | Manufactures pushbuttons and other components for lifts and ATMs | http://bit.ly/swDWHT2020 |

| XP Power | Manufactures power adapters for industrial and healthcare equipment | https://bit.ly/swXPP2020 |

| Victrex | Manufactures PEEK, a tough, light and easy to manipulate polymer | http://bit.ly/swVCT2020 |

| Churchill China | Manufactures tableware for restaurants and eateries | http://bit.ly/swCHH2019 |

| RM | Supplies schools with equipment and IT, and exam boards with e-marking | http://bit.ly/swRM2020 |

| Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | http://bit.ly/swGDWN2019 |

| Anpario | Manufactures natural animal feed additives | https://bit.ly/swANP2020 |

| PZ Cussons | Manufactures personal care and beauty brands, in the main | http://bit.ly/swPZC2019 |

| Next | Retails clothes and homewares | https://bit.ly/swNXT2020 |

| Dart | Flies holidaymakers to Europe. Trucks fruit and veg around the UK | http://bit.ly/swDTG2019 |

| Hollywood Bowl | Operates tenpin bowling centres | http://bit.ly/swBOWL2020 |

| Howden Joinery | Supplies kitchens to small builders | http://bit.ly/sw2020HWDN |

| Castings | Casts and machines parts for vans and trucks primarily | http://bit.ly/swCGS2019 |

| Portmeirion | Designs and manufactures tableware, candles and reed diffusers | http://bit.ly/swPMP2019 |

| Judges Scientific | Acquires and operates small scientific instrument manufacturers | https://bit.ly/swJDG2020 |

| Trifast | Manufactures and distributes nuts and bolts, screws, and rivets | http://bit.ly/swTRI2019 |

| FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | http://bit.ly/swTFW2019 |

| Solid State | Manufactures rugged computers, batteries, radios. Distributes components | http://bit.ly/swSOLI2019 |

| Cohort | Manufactures military tech. Does research and consultancy | http://bit.ly/swCHRT2019 |

| Bloomsbury Publishing | Publishes books, online collections for academics and professionals | http://bit.ly/swBMY2019 |

| Quartix | Supplies vehicle tracking systems to small fleets and insurers | https://bit.ly/swQTX2020 |

| Games Workshop | Manufactures/retails Warhammer models, licenses stories/characters | http://bit.ly/swGAW2019 |

| Softcat | Sells hardware and software to businesses and the public sector | http://bit.ly/swSCT2019 |

| Renishaw | Whiz bang manufacturer of automated machine tools and robots | http://bit.ly/swRSW2019 |

| Avon Rubber | Manufactures respiratory protection and milking equipment | http://bit.ly/swAVON2020 |

| 4Imprint | Sells promotional materials like branded mugs and tee shirts direct | https://bit.ly/swFOUR2020 |

| Porvair | Manufactures filters and filtration systems for fluids and molten metals | http://bit.ly/swPRV2019 |

| DotDigital | Developer of marketing automation software | http://bit.ly/swDOTD2019 |

| Tristel | Manufactures disinfectants for simple medical instruments and surfaces | http://bit.ly/swTSTL2019 |

| Treatt | Sources, processes and develops flavours esp. for soft drinks | http://bit.ly/swTET2020 |

| James Halstead | Manufactures vinyl flooring for commercial and public spaces | http://bit.ly/swJHD2019 |

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.