Shares for the future: why this firm just became my second favourite

This company flourished during the pandemic years and has done well enough since for it to shoot up eight places in analyst Richard Beddard’s rankings.

16th August 2024 14:56

by Richard Beddard from interactive investor

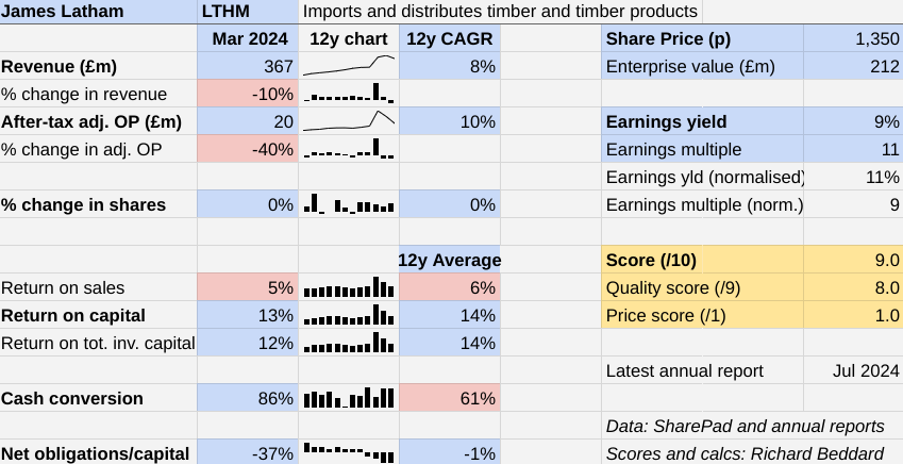

Having reported a 10% fall in revenue and a 40% fall in profit with little immediate sign of improvement, you would have to have confidence in the long-term prospects of timber distributor Latham (James) (LSE:LTHM) to advocate holding the shares.

That is the position I am in, as I score James Latham this year.

Scoring Lathams: taking the long view

If it was not obvious from soaring revenue and profit in 2022 and still elevated numbers in 2023, Lathams made it clear in its annual reports that it was enjoying an exceptional period of demand and soaring prices due to timber shortages.

The shortages were the result of elevated demand as the economy emerged from the pandemic, and constricted supply as the war in Ukraine disrupted a supply chain already struggling to get back up to speed.

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

A different geopolitical crisis, conflict in the Middle East, is disrupting shipping again, but trading returned to normality during the year. James Latham posted much more typical results.

The Past (dependable) [2.5]

- Profitable growth: 10% compound annual growth rate (CAGR) profit growth over 12 years [1]

- Strong finances: Net cash [1]

- Through thick and thin: Lowest return on capital (RoC) 8% (2013) [0.5]

Inflation and low consumer confidence has tempered orders from timber merchants and manufacturers are impacted by reduced construction activity. More jittery customers are using cheaper materials and buying them on demand rather than in anticipation of work.

Low demand for timber in Europe encouraged European suppliers to swamp the UK market. For the first time since the pandemic, Lathams’ average selling price fell (by 3.4%).

Notably, Lathams did not adjust out the cost of implementing a new IT system from its results as many companies would.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Sector Screener: rate cuts a catalyst for two FTSE 100 stocks

The silver lining is that Lathams is still prospering. The company’s after-tax profit margin only fell to 5%, 1% below the 12-year average and the level it typically achieved before 2021. After-tax return on capital was also close to the average at 13%.

Revenue was 47% higher than it was in 2020, and after tax adjusted operating profit was 37% higher.

Cash conversion was unusually strong for the second year running as the company needed less stock.

Due to the profit and cash windfalls, Lathams is in an even stronger financial position than it was in 2020, with more cash on the balance sheet than financial obligations. Its modest defined benefit pension scheme is in surplus, and the company will not have to pay any money into it until at least 2026, the date of the next triennial pension review.

The weak trading conditions of the second half of 2024 have continued into the first half of 2025, but Lathams anticipates a pick-up in demand and reversion to a more profitable sales mix later in the year.

This translates into a small increase in revenue and a small decline in profit in 2025 according to the company’s house broker.

In the longer term, I think mid to high single-digit percentage growth in revenue and profit is achievable, as it has been in the past.

Lathams is a very solid business, despite operating in a capricious market.

The Present (distinctive) [3]

- Discernible business: Established reputable timber distributor [1]

- With experienced people: Very experienced board [1]

- That creates value for customers: Right product at the right time [1]

To my mind, Lathams’ performance during the pandemic years demonstrates its strengths. While smaller, less established, financially weaker suppliers struggled to meet their customers’ needs, James Latham flourished.

As a cash buyer, and a significant customer of multiple suppliers, Lathams was probably high in their minds when it needed to source scarce timber. With large stocks and efficient systems, it was probably high in customers’ minds too.

The apparent weaknesses in Lathams’ long-term financial track record, typically a modest profit margin and modest cash conversion, are at worst features of the industry it is in.

The requirement to outlay ever more cash to fund warehouses and the stock that goes in them, and Lathams’ ability to do it while still rewarding shareholders, can be viewed as a competitive advantage. If rivals and new entrants are to grow, on the face of it they must match its spending.

Lathams is a 266-year-old UK importer and distributor of hardwoods, softwoods, and wood based panel products like chipboard, plywood, and fibreboard. It also supplies manufactured timber like door blanks, panels and engineered woods like Accoya and WoodEx.

It supplies timber from 16 depots, three of them at major ports, and nine of which operate 24 hours a day five days a week. By trunking timber between depots overnight, if necessary, Lathams says it can supply the right product at the right time from “huge” stocks nationwide.

The depots, run autonomously by experienced directors, serve a wide range of trade customers: joiners, timber merchants, kitchen and furniture manufacturers and shop-fitters for example.

- Trading Strategies: FTSE 100 volatility is a buying opportunity

- Inflation and three other threats to your long-term wealth

Lathams also courts the architects and designers that specify materials by contributing to their professional development. It also operates two specification showrooms in London and Manchester, and an online digital showroom.

During 2024, Lathams supplied HONEXT board, a certified carbon-negative brand, for exhibitions in the Fitzwilliam Museum in Cambridge after it had been specified by the project’s architect. Lathams had introduced the architect to the product.

As demonstrated by its profitability, James Latham is an efficient operation that benefits from very strong supplier and customer relationships. It would be a difficult business to build from scratch, but it has been built by nine generations of the Latham family. The family is still represented on the company’s board.

The combined experience of the four executive directors is 126 years!

The Future (directed) [2.5]

- Addressing challenges:Competition, limits to growth? [0.5]

- With coherent actions: Expanding warehouses and ranges [1]

- That reward all stakeholders fairly: Directors are shareholders, strong relationships [1]

Lathams’ house broker estimates the company’s market share is about 15%, which may put it in something of a sweet spot: large enough to benefit from scale, but small enough to grow without leaving the British Isles.

Although the company acquired an Irish subsidiary in 2019, that was its first investment overseas. Lathams’ strategy is focused on the UK and Ireland.

The risk report says the competitive threat is low, but this year’s results show the company is not immune. Customers switch products and suppliers to suit their budgets, and profitability has been impacted by dumping from European suppliers.

Climate change is an opportunity, though, as wood has more carbon-friendly credentials than some of the obvious alternatives such as concrete and steel. James Latham calculates a carbon score for all products, a UK first, it says, to help customers choose.

Generally, Lathams is doing what distributors do from its position of strength. It is increasing the product range and expanding warehouses in the quest for greater market share.

In 2024, Lathams increased the capacity of its depots in Dublin, Thurrock and Hemel Hempstead, although the expansion of Belfast is delayed while it searches for a new site.

In recent years the company has expanded the range to include natural acrylic stone, a blend of minerals, pigments bound in acrylic that can be cut and shaped like wood or thermoformed to make worktops. It also supplies malamines (like formica) and laminates.

The acquisition of Dresser Mouldings in 2019 enabled Lathams to dip its toe in manufacturing. The subsidiary is a small manufacturer of cladding and decorative mouldings, and the company says it may further develop its own range of processed timbers.

- Insider: bargain hunting at bombed-out AIM share

- Stockwatch: why this popular sector is not a one-way bet

Lathams’ is a very modest acquirer, but the company has the resources to grow its range and geographical presence this way too.

I believe part of the formula for success is an employee first culture, but the evidence is anecdotal because the company does not publish employee retention or engagement statistics.

In 2023, the company reported that a depot director had retired after 40 years. This year it name-checked two depot directors, Purfleet and Dublin, retiring after 45 years and 34 years respectively.

The annual report also lauds the company’s head of IT, for the integration of the new Enterprise Resource Planning (ERP) system. It was, “a smoother transition than anyone could have expected”.

Four Lathams are listed as substantial shareholders including chair Nick and executive director Piers. No doubt other family members are shareholders too.

I think it is a fair bet the family are at least as concerned for the long-term development of the company that bears their name as the rest of us.

The price (discounted?) [1]

- Yes. A share price of £13.50 values the enterprise at about £212 million, 11 times normalised profit.

A score of 9 out of 10 indicates Lathams is probably a good long-term investment.

It is ranked 2 out of 40 shares in my Decision Engine.

19 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Celebrus Technologies (LSE:CLBS), Games Workshop Group (LSE:GAW), and Jet2 Ordinary Shares (LSE:JET2) have all published annual reports and are due to be re-scored.

I have moved PZ Cussons (LSE:PZC) to the bottom of the table pending the publication of its annual report in September. The collapse in the value of the Nigerian currency and the impact on the company’s finances and strategy mean I no longer have faith in the score.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.8 | ||

2 | James Latham | Imports and distributes timber and timber products | 9.0 | |

3 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | ||

4 | Supplies kitchens to small builders | 8.6 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Whiz bang manufacturer of automated machine tools and robots | 8.0 | ||

8 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.9 | ||

9 | Manufactures filters and filtration systems for fluids and molten metals | 7.8 | ||

10 | Manufactures/retails Warhammer models, licences stories/characters | 7.7 | ||

11 | Manufacturer of scientific equipment for industry and academia | 7.7 | ||

12 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

13 | Distributes essential everyday items consumed by organisations | 7.5 | ||

14 | Sources, processes and develops flavours esp. for soft drinks | 7.3 | ||

15 | Sells hardware and software to businesses and the public sector | 7.2 | ||

16 | Translates documents and localises software and content for businesses | 7.0 | ||

17 | Manufactures natural animal feed additives | 7.0 | ||

18 | Online marketplace for motor vehicles | 7.0 | ||

19 | Manufactures computers, battery packs, radios. Distributes components | 7.0 | ||

20 | Sells promotional materials like branded mugs and tee shirts direct | 6.9 | ||

21 | Manufactures vinyl flooring for commercial and public spaces | 6.9 | ||

22 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 6.9 | ||

23 | Operates tenpin bowling and indoor crazy golf centres | 6.7 | ||

24 | Manufactures specialist paper, packaging and high-tech materials | 6.6 | ||

25 | Online retailer of domestic appliances and TVs | 6.5 | ||

26 | Surveys and distributes public opinion online | 6.5 | ||

27 | Flies holidaymakers to Europe, sells package holidays | 6.4 | ||

28 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.3 | ||

29 | Retails clothes and homewares | 6.3 | ||

30 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 6.2 | ||

31 | Manufactures sports watches and instrumentation | 5.9 | ||

32 | Acquires and operates small scientific instrument manufacturers | 5.9 | ||

33 | Supplies vehicle tracking systems to small fleets and insurers | 5.8 | ||

34 | Publishes books, and digital collections for academics and professionals | 5.8 | ||

35 | Manufactures military technology, does research and consultancy | 5.6 | ||

36 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

37 | Manufactures disinfectants for simple medical instruments and surfaces | 5.4 | ||

38 | Makes marketing and fraud prevention software, sells it as a service | 5.3 | ||

39 | Runs a network of self-employed lawyers | 4.5 | ||

v Frozen v | ||||

? | Develops and manufactures hygiene, baby, and beauty brands | 7.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns James Latham and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.