Shares for the future: upgrade thrusts this stock into my top 10

A more generous score has put this company among the heavy hitters in analyst Richard Beddard’s list of Decision Engine stocks.

21st March 2025 15:02

by Richard Beddard from interactive investor

Next month, Ben Stocks, Porvair (LSE:PRV)’s chief executive of 27 years, will retire. Earlier this month, the filtration company posted a set of results typical of the past two decades of Stocks’ leadership. That is a good thing.

- Learn with ii: What is Bed & ISA? | What is the ISA Deadline? | How many ISAs can I have?

Scoring Porvair: reliable growth

Revenue and profit grew 9% in the year to November 2024 and return on capital (RoC) was 24%, very close to Porvair’s 12-year average rates of growth and profitability.

The Past (dependable) [3]

- Profitable growth: 10%-ish revenue and profit CAGR [1]

- Strong finances: Modest financial obligations [1]

- Through thick and thin: Lowest RoC: 18% in 2020 [1]

Cash conversion remained strong. Despite cash outflows due to acquisitions, record capital expenditure and the dividend, net financial obligations were near historical lows at the year end, in comparison to capital employed.

I think of Porvair as a stalwart, capable of steady growth under its own steam.

As is often the case, business was brisk in some markets (aerospace and petrochemicals in 2024), while others (laboratories and industrial) took a breather.

The company is optimistic about 2025 and beyond. Indeed, the outgoing chief executive has no doubt the best is yet to come.

The Present (distinctive) [2.5]

- Discernible business: Specialist manufacturer of filters [1]

- With experienced people: New chief executive starts in April [0.5]

- That creates value for customers: Reduces costs, contamination and pollution [1]

Porvair makes most of its money from filters. They protect equipment from contaminants in liquids and gases and reduce waste, pollution and impurities.

Filters are specifically designed to fit into equipment. Either they must be replaced according to regular schedules, or they can be used only once.

Porvair’s biggest division, Aerospace and Industrial, was responsible for 44% of revenue in 2024. Its filters are specified in most commercial aircraft, where they can be found in fuel tanks, hydraulic and cooling systems. They are specified in the LEAP aero engine programme and Blue Origin space rockets

Other major markets included the nuclear, petrochemical and microelectronics industries.

The company owns Selee, which is the mainstay of the Metal Melt Quality division. This segment is responsible for 23% of revenue. It makes filters used in aluminium cast houses.

- Trading Strategies: recession risk brings buying opportunities

- Sector Screener: an underperforming sector to buy for long term

The repeat business from these customers depends to an extent on how busy they are, but demand is fairly consistent because, while factories are operating and planes are flying, filters will be used up.

Porvair also owes its stability to its broad customer base. It supplies 4,000 products to over 15,000 customers. These are long-standing relationships, because the capital equipment in which the filters fit have long lifecycles.

A third subsidiary, the Laboratory division, supplies filters and consumables used in the preparation of samples, water analysers, robotic sample handlers and consumables. It brings in 33% of revenue, and the company says it is the largest and most innovative supplier of equipment for the measurement of inorganic contaminants in water.

For the past 20 years, chief executive Ben Stocks has focused the business on these activities. It has grown by developing new products and buying like-firms.

He is retiring at this year’s annual general meeting, having participated in the most orderly of successions. He gave a year’s notice. His replacement Hooman Caman Javvi, who has just spent two years as chief operating officer of engineer Hill & Smith, joined Porvair in January.

The Future (directed) [2.5]

- Addressing challenges:Decarbonisation, tariffs [0.5]

- With coherent actions: Buy and build [1]

- That reward all stakeholders fairly: Low and stable staff attrition [1]

One of Porvair’s success stories is Selee. This business has long been more cyclical and less profitable than the other divisions.

Now a combination of high demand for aluminium, which makes heavy electric vehicles lighter, and investment in new patented filters has driven profit margins at Selee. For now, they rival the rest of the business.

This result is particularly impressive, considering that revenue at Selee fell in 2024 after three boom years. The company also bore the cost of putting right damage wrought by Hurricane Helene to its plant in Hendersonville, North Carolina (it is negotiating with insurers).

It also shows how the business model can adapt. It will need to in years to come as industrial processes and powertrains change.

Revenue from industries processing and using traditional hydrocarbons will probably fall, although in the meantime Porvair has a role to play in making them cleaner. Potential future fuels such as sustainable aviation fuel (SAF) made from vegetable oil, and hydrogen, require filtration too.

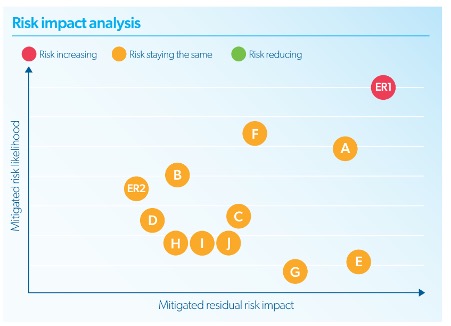

Companies often include a risk analysis in their annual reports. Porvair is noteworthy because an Emerging Risk (ER1) has gone straight in at number 1, so to speak.

It is both the most likely and most impactful risk.

That risk is tariffs.

Porvair earned about 90% of revenue outside the UK in 2024, principally in the US (40%), which has famously embraced tariffs as a means of gaining economic and geopolitical advantage, continental Europe (28%) and Asia (16%).

Although Porvair has plants in the US, Europe and China. it seems it will rely on efficient manufacturing, superior products, switching costs (like the requirement to accredit new products) and its reputation to keep customers loyal.

Porvair’s Return on Total Invested Capital (ROTIC) of 10% suggests the company has paid a full-ish price for acquisitions over the years, but it has also shown it can reinvest those returns and grow.

- What to expect from the 2025 Spring Statement

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Looking back, chief executive Ben Stocks in 2024’s annual report wrote proudly of the company’s long-term performance while the share count grew less than 1% a year.

He might also have added that it has grown while using less and less leverage. His focus on sustainable growth gives me confidence in the future. I hope Hooman Caman Javvi will buy and build on that legacy.

Nestling among Porvair’s self-selected key performance metrics is the voluntary quit ratio, which it measures at a plant level in addition to employee satisfaction. It counts the number of resignations as a percentage of the average number of employees in each plant.

Porvair’s voluntary quit ratio in 2024 was 8.2%, so 91.8% of employees chose not to quit in 2024. I think that also bodes well.

The price (discounted?) [0.2]

- Perhaps a little. A share price of 656p values the enterprise at about £316 million, 18 times normalised profit.

A score of 8.2 implies Porvair is a good long-term investment.

It is ranked 9 out of 40 shares in my Decision Engine.

27 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Quartix Technologies (LSE:QTX) has published its annual report and is due to be re-scored.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Supplies kitchens to small builders | 9.1 | ||

3 | Imports and distributes timber and timber products | 9.0 | ||

4 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.9 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Manufacturer of scientific equipment for industry and academia | 8.2 | ||

8 | Repair and maintenance of rail, road, water, nuclear infrastructure | 8.2 | ||

9 | Porvair | Manufactures filters and laboratory equipment | 8.2 | |

10 | Whiz bang manufacturer of automated machine tools and robots | 8.1 | ||

11 | Flies holidaymakers to Europe, sells package holidays | 8.0 | ||

12 | Designs recording equipment, loudspeakers, and instruments for musicians | 8.0 | ||

13 | Sells promotional materials like branded mugs and tee shirts direct | 8.0 | ||

14 | Distributes essential everyday items consumed by organisations | 7.9 | ||

15 | Manufactures computers, battery packs, radios. Distributes components | 7.7 | ||

16 | Operates tenpin bowling and indoor crazy golf centres | 7.7 | ||

17 | Manufactures vinyl flooring for commercial and public spaces | 7.6 | ||

18 | Surveys and distributes public opinion online | 7.5 | ||

19 | Retailer of furniture and homewares | 7.5 | ||

20 | Manufactures/retails Warhammer models, licences stories/characters | 7.4 | ||

21 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.4 | ||

22 | Sells hardware and software to businesses and the public sector | 7.4 | ||

23 | Online marketplace for motor vehicles | 7.3 | ||

24 | Manufacturer of ventilation products | 7.0 | ||

25 | Acquires and operates small scientific instrument manufacturers | 7.0 | ||

26 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.0 | ||

27 | Supplies software and services to the transport industry | 7.0 | ||

28 | Sources, processes and develops flavours esp. for soft drinks | 6.9 | ||

29 | Manufactures natural animal feed additives | 6.8 | ||

30 | Online retailer of domestic appliances and TVs | 6.7 | ||

31 | Translates documents and localises software and content for businesses | 6.5 | ||

32 | Publishes books, and digital collections for academics and professionals | 6.5 | ||

33 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.9 | ||

34 | Manufactures military technology, does research and consultancy | 5.8 | ||

35 | Manufactures sports watches and instrumentation | 5.7 | ||

36 | Manufactures disinfectants for simple medical instruments and surfaces | 5.7 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 5.6 | ||

38 | Supplies vehicle tracking systems to small fleets and insurers | 5.6 | ||

39 | Runs a network of self-employed lawyers | 4.8 | ||

40 | Develops and manufactures hygiene, baby, and beauty brands | 4.4 |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Porvair and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.