Shares for the future: a UK tech firm with an ace up its sleeve

This FTSE 250 company has invested heavily in recent years and is planning to spend more. It also has something that none of its UK peers have. Analyst Richard Beddard explains why it makes his top 20.

22nd November 2024 15:21

by Richard Beddard from interactive investor

Although we are warned not to judge a book by its cover, software reseller Softcat (LSE:SCT) is sending us one-word messages on the front of its annual reports.

In the past few years, it has chosen words that evoke its enduring culture: “Community”. “Together”. “Connect”, but the report for the year to July 2024 says “Evolve”.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Softcat is evolving in response to rapid technological change.

Scoring SCT: rapid technological change

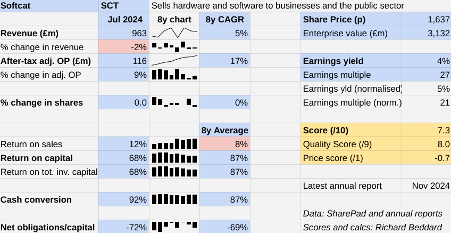

Since 2016, the first full year after Softcat’s flotation, adjusted profit has grown at a compound annual growth rate (CAGR) of 17% without recourse to acquisitions or debt.

The Past (dependable) [3]

- Profitable growth: Adjusted profit has grown at 17% CAGR [1]

- Strong finances: More cash than financial obligations at every year end [1]

- Through thick and thin: Worst year, 68% return on capital in 2024 [1]

Modest revenue growth over the long term and a decline in 2024 are not a cause for concern.

Accounting rules determining revenue changed in 2018 and they were reinterpreted in 2021, reducing revenue in those years.

The same rules require Softcat to account for software as an agent, receiving a commission on sales rather than recognising the full value of the sale in revenue.

This means hardware sales have a disproportionate impact. In a year like the one just past, when hardware revenue fell sharply but the rest of the business performed well, the overall impact was negative.

Softcat uses an alternative performance measure, Gross Invoiced Income (GII), to show how it is performing. This grosses up software sales so they are calculated on a similar basis to hardware. GII revenue increased by 11%.

- Why FTSE 250 is tipped to thrive in 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Over the past 10 years, Softcat says it has grown GII at a compound annual growth rate of 19%. Over the past five years the rate has slowed to 12%.

The company confirmed on Thursday that it is looking forward to double-digit growth in gross profit in 2025, and high single-digit growth in operating profit.

Perhaps that discrepancy is a result of investment.

Having invested heavily in recruitment in recent years, Softcat is planning major investment in its IT infrastructure.

That is the price of evolution...

The Present (distinctive) [3]

- Discernible business: Sells software and hardware at scale [1]

- With experienced people: Very experienced managers [1]

- That creates value for customers: Choice, expertise [1]

Softcat started as a catalogue reseller of software to small businesses in the early 1990s. Today it is the UK’s largest reseller.

It sells products from all the big vendors, such as Amazon, Apple, Google and Microsoft, and has partnerships with many more, from Acer to Zoom.

While its biggest customer segment is still small- and medium-sized businesses, Softcat earns almost as much GII from the public sector, and it has made inroads into larger enterprises too.

Scale means suppliers want Softcat to represent them, and that means it can give customers a broad range of IT to choose from.

More than 80% of the company’s employees deal with customers, and its founder Peter Kelly’s priority was to enable and motivate its biggest resource. His thinking was that if work was fun and employees were passionate, Softcat would sell more.

- Stockwatch: should you own Nvidia at an all-time high?

- Shares for the future: the best stock on my subs’ bench so far

To keep this culture alive, the company places great emphasis on internal events, including an annual charity ball, and an annual corporate gathering that most employees and many vendors attend. It also gives employees two days a year to volunteer or fundraise for charity.

It has preserved the culture by promoting from within. Softcat recruits for attitude straight from school and university and trains its account managers to follow through on their promises.

Long retired, Peter Kelly still has a 33% controlling interest and, breaking with corporate governance norms, the company has successively promoted chief executives to the chair’s role, starting with Kelly.

Graham Charlton has only just completed his first full year as chief executive, but he was formerly chief financial officer and his predecessor as chief executive, Graeme Watt, is now chair.

External awards recognise Softcat as a “Great Place To Work”, and the company’s own surveys show high levels of employee engagement (90% in 2024, 92% in 2023).

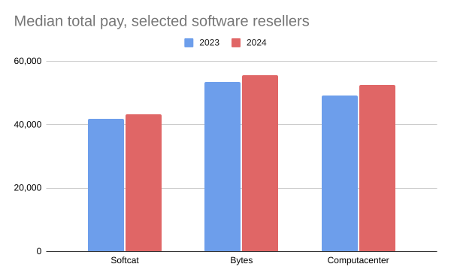

Perhaps the acid test of Softcat’s culture is that its employees are prepared to work for less pay than the employees of rivals.

This disparity may explain one other statistic. Despite being such a good place to work, people leave.

2023’s employee attrition rate was 15%, and although the company did not publish the attrition rate in this year’s annual report, my arithmetic suggests it was 11%.

The Future (directed) [2]

- Addressing challenges:Technological change [0.5]

- With coherent actions: Recruiting, investing in platforms, adopting AI [0.5]

- That reward all stakeholders fairly: Employee and customer friendly [1]

The company’s strategy is to build on its culture. It is using its well-oiled sales machine to recruit more customers and sell more software to them.

This seems achievable since it estimates its share of the UK and Ireland market is still only 5%. This market is growing as companies and organisations seek to increase productivity through IT.

Softcat is also slowly growing its international footprint, by serving UK customers operating abroad from small overseas offices.

It has thrived because technological advances spur demand. The reseller has a small but important role in helping businesses and other organisations understand the options available to them, design and integrate systems, and save money.

These days, customers need more software and hardware to enable employees to work remotely, build data centres to host AI applications, and fend off AI enabled cyber-attacks.

Although it sells the same products and services as rivals, one ace up its sleeve is its status as the only UK reseller to have top-tier accreditation with AWS (Amazon) and Microsoft Azure, two of the big three cloud computing platforms.

- Stockwatch: a near 9% yield and capital prospects

- The AI boom’s new bottlenecks – and where you might find opportunities

New AI-enabled products require customers to upgrade their existing software and improve their data, which Softcat can help with.

In fact, it is leading the way. The company is upgrading and unifying its own IT systems to pave the way for AI.

Softcat plans to use data from its IT systems to improve the recommendations and support it gives customers. And it hopes to boost staff productivity by giving them Microsoft’s AI sidekick, Copilot.

It plans to unify and automate customer-facing platforms, allowing customers to manage products and services, and buy them.

Some of these investments, principally a new sales system, will cost a lot, and shareholders will be holding their breath. IT upgrades often disrupt businesses and cost more than expected. Softcat is expert, so reputationally and financially, it cannot afford to mess up.

In this year’s annual report Softcat elevated the severity of one risk. It is the risk that rapid technological change would change customer purchasing behaviour.

I am not so worried about business going to rivals. All resellers should be responding to change, and Softcat’s culture should keep it competitive as it has in the past.

But software automation, enabled by cloud hosting and AI, might diminish the role of the intermediary, and therefore the value of Softcat’s people-focused culture, if more customers choose to buy direct from vendors.

It is a long-term risk, but I do not think we can ignore it.

The price (discounted?) [-0.7]

- No. A share price of £16.37 values the enterprise at about £3.1 billion, 21 times normalised profit.

A score of 7.3 implies Softcat is a good long-term investment.

It is ranked 18 out of 40 shares in my Decision Engine.

24 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Last week, Solid State (LSE:SOLI) reported that orders representing a significant portion of revenue anticipated in the year to March 2025 had been paused. This may prompt me to re-evaluate the share’s score in a forthcoming article.

YouGov (LSE:YOU) has published its annual report and is due to be re-scored.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Manufactures computers, battery packs, radios. Distributes components | 9.0 | ||

4 | Supplies kitchens to small builders | 8.8 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.2 | ||

8 | Manufacturer of scientific equipment for industry and academia | 8.1 | ||

9 | Flies holidaymakers to Europe, sells package holidays | 7.9 | ||

10 | Surveys and distributes public opinion online | 7.8 | ||

11 | Whiz bang manufacturer of automated machine tools and robots | 7.7 | ||

12 | Manufactures/retails Warhammer models, licences stories/characters | 7.7 | ||

13 | Manufactures filters and filtration systems for fluids and molten metals | 7.7 | ||

14 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.6 | ||

15 | Designs recording equipment, loudspeakers, and instruments for musicians | 7.5 | ||

16 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

17 | Sources, processes and develops flavours esp. for soft drinks | 7.4 | ||

18 | Softcat | Sells hardware and software to businesses and the public sector | 7.3 | |

19 | Manufactures military technology, does research and consultancy | 7.3 | ||

20 | Distributes essential everyday items consumed by organisations | 7.3 | ||

21 | Sells promotional materials like branded mugs and tee shirts direct | 7.1 | ||

22 | Translates documents and localises software and content for businesses | 7.0 | ||

23 | Manufactures natural animal feed additives | 7.0 | ||

24 | Online marketplace for motor vehicles | 7.0 | ||

25 | Online retailer of domestic appliances and TVs | 6.9 | ||

26 | Manufactures vinyl flooring for commercial and public spaces | 6.9 | ||

27 | Operates tenpin bowling and indoor crazy golf centres | 6.6 | ||

28 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.5 | ||

29 | Retails clothes and homewares | 6.4 | ||

30 | Acquires and operates small scientific instrument manufacturers | 6.1 | ||

31 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 6.0 | ||

32 | Supplies vehicle tracking systems to small fleets and insurers | 5.9 | ||

33 | Publishes books, and digital collections for academics and professionals | 5.9 | ||

34 | Manufactures sports watches and instrumentation | 5.6 | ||

35 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

36 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 4.9 | ||

38 | Runs a network of self-employed lawyers | 4.5 | ||

39 | Develops and manufactures hygiene, baby, and beauty brands | 4.5 | ||

40 | Manufactures specialist paper, packaging and high-tech materials | 3.7 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.