Shares for the future: two new ideas for my stock list

Two underperforming companies are getting the chop, so analyst Richard Beddard is holding a beauty parade to identify exciting candidates. The first two companies are nothing like the old ones.

1st November 2024 15:00

by Richard Beddard from interactive investor

Today I am departing from the standard format, the appraisal of a single company, to weigh up replacement candidates for Cropper (James) (LSE:CRPR) and PZ Cussons (LSE:PZC) in the Decision Engine.

These two companies are propping up the bottom of the table. To improve the Decision Engine, I am on the lookout for shares that ought to be better long-term investments.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

The first two companies in the beauty parade are nothing like James Cropper, the fading paper-making business, manufacturer of advanced materials and would-be enabler of the hydrogen economy I lost confidence in. And they are not much like beleaguered soap maker PZ Cussons either.

They are retailers. Market-leading retailers in fact. And one or both of them might join Next (LSE:NXT) in the Decision Engine.

A word of warning. The statistical snapshots I provide for each of these companies look identical to the snapshots for companies I have fully evaluated.

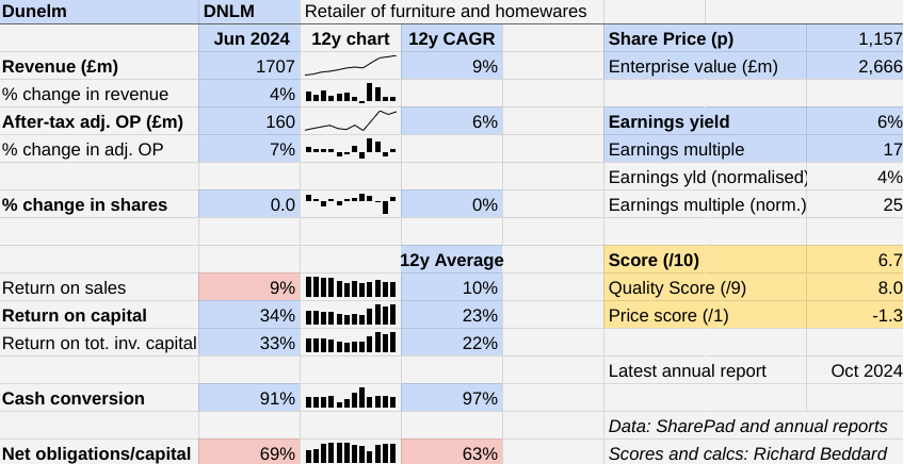

In most respects they are, but I have not evaluated each individual quality criterion (dependable, distinctive, and directed) for Dunelm Group (LSE:DNLM) and Pets at Home Group (LSE:PETS).

I have not studied their business models or strategies in detail. I have given them an impressionistic score so that I can compare them with each other.

I have, however, a firm grip of the numbers.

First up: Dunelm

It is not often I go through the last 13 annual reports of a business, picking out the salient figures, and find so little to quibble about.

You are probably aware that Dunelm sells furniture and homewares from stores mostly on retail parks and in shopping centres.

You may not be aware that the company’s accounts are almost completely unencumbered by adjustments, or accounting complications such as acquisitions and defined benefit pension schemes.

The results bear comparison to Next, another stalwart retailer and one of Dunelm’s smaller competitors in the furniture and homewares market.

Both companies have achieved average returns on capital of over 20% and almost as impressive returns in cash terms as profit. But Dunelm has achieved more growth.

Mostly, of course, Next sells clothes. It is a business that has alternately delighted and frustrated me due to the many ways it has sought to grow, without actually growing much.

Dunelm is a much simpler business. It has a 7.7% share of the UK furniture and homewares market, and it thinks it can reach 10% in the medium term by designing and selling better products to more people.

Many of these products are own-brands, which differentiates the business, and in some of its biggest-earning product categories such as curtains and blinds, it makes them too.

Except for its largest competitor, Ikea, and online-only retailers, Dunelm's rivals tend to be less-focused department stores and supermarkets, and much smaller independents.

The company has made a relatively late but successful transition to online retailing. Digital sales have risen from 7% of the total in 2016, the year before it bought Worldstores out of administration and repurposed its online systems and fleet of delivery vehicles, to 37%.

Dunelm has been evolving for 45 years, so it would be bad luck if my interest is piqued at the precise moment when it runs out of steam.

The biggest fly in the ointment might be the share price, which values Dunelm at a reasonable 17 times adjusted profit in 2024, but a heady 25 times normalised profit.

Normalised profit is the profit Dunelm would have earned in 2024 if it had earned its average return on capital of 23% instead of the 34% return on capital it actually earned.

Profitability has been elevated since the pandemic, and I do not know if this is permanent. Consequently, it is safer to assume that the future will more likely resemble a typical year than the latest one.

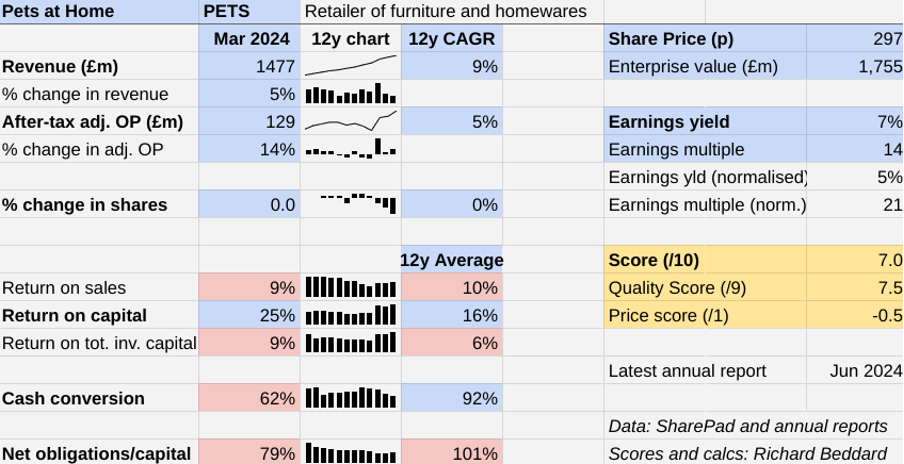

Next up: Pets at Home

If you think Dunelm has a big market share, you should take a look at Pets at Home.

The ubiquitous pet shop chain contains within it a chain of veterinary practices structured as joint ventures with local vets.

It claims a 24% share of UK pet spending.

Yet despite that dominant market share, Pets at Home has achieved steady revenue growth and somewhat more shaky profit growth since it floated in 2014.

There is more red in my dashboard than there is for Dunelm. Generally, it is somewhat less profitable and somewhat more indebted, but the results are in the same ballpark.

Low return on total invested capital (ROTIC) suggests an acquisitive past. This is not true, and we can ignore the statistic.

Most of the goodwill on Pets at Home’s balance sheet was paid by KKR, Pets at Home’s private equity owner before it listed. KKR acquired Pets at Home in a leveraged buyout and, in this kind of transaction, the goodwill sits on the acquisition’s balance sheet. It is of no relevance to Pets at Home’s strategy now, which is mostly self-propelled.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Stockwatch: can this activist shareholder unlock value?

It is an interesting time for the veterinary industry. Large groups such as IVC Evidensia and CVS Group (LSE:CVSG) have rolled-up vet practices. This has given them power to set prices and influence the commercial decisions of vets. It has also invited the attention of regulators.

The sector is being investigated by the Companies and Markets Authority (CMA), which notes that chains own 60% of vet practices today.

Pets at Home is one of them, but it has a distinctive franchise business model that may insulate it from some of the CMA’s rulings. It has also jettisoned its specialist referral centres. Tight integration with referral centres is one of the CMA’s concerns.

The Pets at Home story is slightly more complicated than Dunelm’s, and the numbers are messier. There are many adjustments in the results, most recently relating to a new distribution centre.

The adjustments are not significant enough to change my impression of Pets at Home’s long-term profitability though, and although Pets at Home has also experienced a post-pandemic bump in profitability, the shares are a bit less pricey at 21 times normalised profit.

A reckoning

Combine the price scores for each share and my guesstimate scores for quality, and the two are almost neck and neck. Dunelm scores 6.7 and Pets at Home scores 7.

That may not be enough to make them immediately attractive for investment. I look for a score of 7 or more, but a margin of safety is required because there may well be overconfidence and risks not yet understood in these scores.

In a beauty parade tiebreak, I will always favour the better-looking business. If necessary, I would rather wait around for it to get cheaper, than wait around for the cheaper company to get better.

For now, Dunelm is top of the list of shares to score properly. But I want to run the numbers on more candidates before I commit to it.

22 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

James Halstead (LSE:JHD) has published its annual report and is due to be re-scored.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.7 | |

4 | Supplies kitchens to small builders | 8.6 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Manufactures computers, battery packs, radios. Distributes components | 8.0 | ||

8 | Flies holidaymakers to Europe, sells package holidays | 8.0 | ||

9 | Manufacturer of scientific equipment for industry and academia | 7.9 | ||

10 | Manufactures/retails Warhammer models, licences stories/characters | 7.7 | ||

11 | Manufactures military technology, does research and consultancy | 7.6 | ||

12 | Whiz bang manufacturer of automated machine tools and robots | 7.6 | ||

13 | Manufactures filters and filtration systems for fluids and molten metals | 7.6 | ||

14 | Designs recording equipment, loudspeakers, and instruments for musicians | 7.5 | ||

15 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

16 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.5 | ||

17 | Surveys and distributes public opinion online | 7.4 | ||

18 | Distributes essential everyday items consumed by organisations | 7.3 | ||

19 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | ||

20 | Translates documents and localises software and content for businesses | 7.0 | ||

21 | Manufactures natural animal feed additives | 7.0 | ||

22 | Sells promotional materials like branded mugs and tee shirts direct | 7.0 | ||

23 | Manufactures vinyl flooring for commercial and public spaces | 6.9 | ||

24 | Supplies vehicle tracking systems to small fleets and insurers | 6.9 | ||

25 | Online retailer of domestic appliances and TVs | 6.7 | ||

26 | Online marketplace for motor vehicles | 6.6 | ||

27 | Sells hardware and software to businesses and the public sector | 6.6 | ||

28 | Operates tenpin bowling and indoor crazy golf centres | 6.5 | ||

29 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.5 | ||

30 | Acquires and operates small scientific instrument manufacturers | 6.2 | ||

31 | Retails clothes and homewares | 6.2 | ||

32 | Manufactures sports watches and instrumentation | 5.9 | ||

33 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.9 | ||

34 | Manufactures disinfectants for simple medical instruments and surfaces | 5.7 | ||

35 | Publishes books, and digital collections for academics and professionals | 5.7 | ||

36 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 5.0 | ||

38 | Runs a network of self-employed lawyers | 4.8 | ||

39 | Develops and manufactures hygiene, baby, and beauty brands | 4.4 | ||

40 | Manufactures specialist paper, packaging and high-tech materials | 3.8 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.