Shares for the future: is this transformational deal a winner?

This company is probably a good long-term investment and is one that analyst Richard Beddard likes. But it is somewhat speculative and the acquisition raises questions about the past and the future.

21st June 2024 15:02

by Richard Beddard from interactive investor

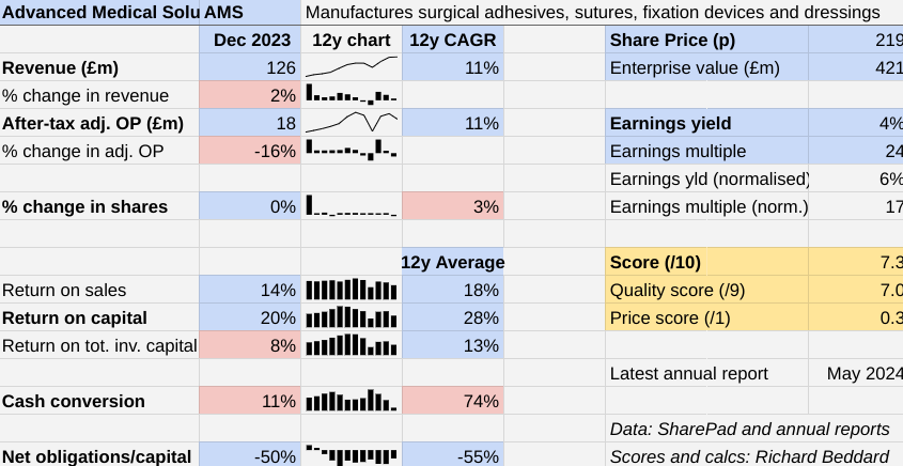

In 2023, Advanced Medical Solutions Group (LSE:AMS) achieved a sub-par performance, judging by every financial metric I track.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Top UK Shares

Scoring AMS: a big transformation

Disruption as AMS reconfigured US distribution may be over, but a transformational acquisition raises questions about the past and the future.

The Past (dependable) [2.5]

- Profitable growth: Double digit revenue and profit CAGR [1]

- Strong finances: Going into debt, declining cash conversion [0.5]

- Through thick and thin: Lowest Return on Capital ex. pandemic: 20% (2024) [1]

The manufacturer of sutures, surgical glues and dressings believes new distribution agreements in the US, AMS’ biggest market for LiquiBand, its biggest brand, will accelerate growth. In 2023, though, the company restructured its US distribution and distributors that would no longer be selling LiquiBand destocked. Revenue fell.

Growth in LiquiBand sales outside the US more than made up for the reduction in sales in the US, and revenue in the Surgical division grew modestly. It was the company’s smaller Woundcare division that contracted, limiting revenue growth to just 2%.

Adjusted after-tax profit declined 16% mainly due to the loss of royalty income from Organogenesis, a maker of dressings under a patent licensed from AMS. Coverage by US healthcare payers (the government and insurance companies) has been withdrawn for the product.

AMS has previously disclosed the Organogenesis royalty was worth about £4 million a year and predicted a £2 million hit in 2023, so there may be another £2 million hit in 2024, after which the company expects revenue to be minimal until the patent expires in 2026.

Cash conversion declined as AMS maintained investment in product development and capital expenditure, and restocked to improve customer service levels.

- Sector Screener: don’t chase exciting stocks, buy these instead

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

These investments should pay off, but the capitalisation of over £6 million of development costs, compared to only £1 million of amortisation, means more than a net £5 million of costs have not been expensed during the year.

It is normal accounting practice to spread these costs out, but in trusting the profit figure, we are trusting that management has got its forecasts and sums right.

Despite the drains on AMS’s finances and an acquisition during the year, its strong net cash position eroded only slightly because of high interest rates. That will change imminently, should a large acquisition announced after the year end completes as expected.

After a strong start to 2024, with a new product, LIQUIFIX, launching in the US and distribution sorted out, AMS thinks it is “primed” for double-digit revenue growth in 2024.

The newly restructured Woundcare division remains a problem though. In addition to a likely further £2 million reduction in royalties in 2024, the company reports pressure from low-cost competitors.

The Present (distinctive) [2.5]

- Discernible business: Own-brand and contract manufacturer [0.5]

- With experienced people: Yes [1]

- That creates value for customers: Differentiated products [1]

AMS makes tissue healing and wound care products for hospitals. The Surgical division makes branded surgical glues, implants, and sutures. The Woundcare division makes dressings.

AMS has its own brand of dressings, ActivHeal, but mostly it manufactures them under contract and it avoids selling ActivHeal in the same markets as its own customers.

The biggest brand in either portfolio is LiquiBand, a surgical glue system that has achieved a 15% compound annual growth rate in revenue over the past 10 years. The company also makes RESORBA collagen-based surgical implants and synthetic bone substitutes, a product category that has also grown strongly.

AMS acquired RESORBA in 2011, but prior to 2019 the business grew mostly organically, by innovating new products and selling them in more markets around the world.

It has focused on versions of LiquiBand that meet particular needs: LiquiBand Rapid, a quick drying adhesive, LiquiBand XL for closing large wounds, and LiquiBandFIX8 for fixing hernia mesh.

- Stockwatch: this 9% dividend yield may not be available for long

- Election manifestos 2024: the impact on your personal finances

LiqiuBandFIX8 is soon to be launched in the US as LIQUIFIX. It uses adhesive to fix mesh to the abdominal wall during hernia surgery. The company says it is a novel technology that minimises pain and complications by doing away with staples and tacks.

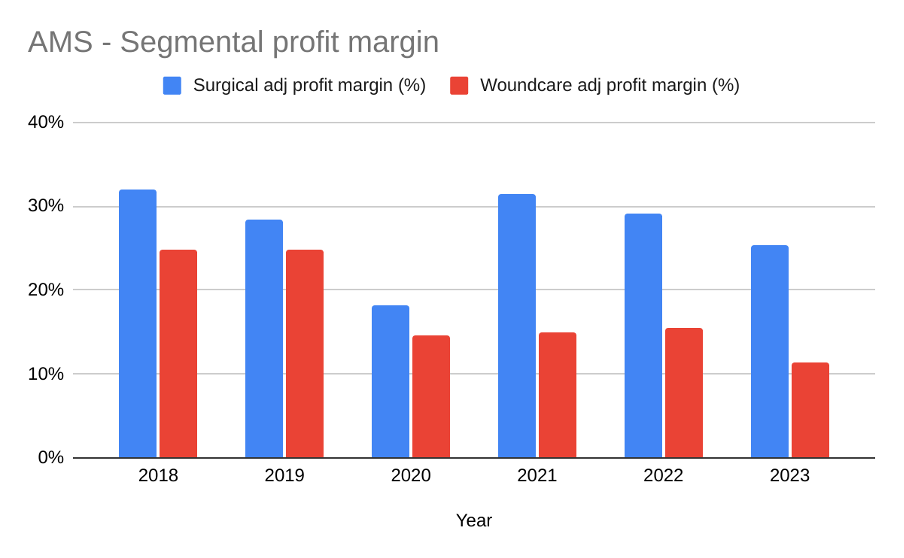

AMS’s success with its own brands makes me wonder about the contract manufacturing business in the Woundcare division, where profit margin has been declining and AMS does not want to compete with its own customers.

Since 2019, AMS has also acquired six businesses. It is in the throws of acquiring a seventh. To my mind these acquisitions have yet to prove themselves.

The executives leading the business have experience on their side, though. Chief executive Chris Meridith joined as group commercial director in 2005 and became chief executive in 2011. Eddie Johnson, joined in 2011 and became chief financial officer in 2019.

The Future (directed) [2]

- Addressing challenges:Competition, falling Woundcare profitability [0.5]

- With coherent actions: Innovation, are acquisitions paying off? [0.5]

- That reward all stakeholders fairly: Engaged employees [1]

AMS faces competitive risks because it is up against the brands of firms such as Johnson & Johnson (NYSE:JNJ), Smith & Nephew (LSE:SN.), and 3M Co (NYSE:MMM), and from customers because cost-conscious governments and insurance companies decide which treatments they are prepared to pay for through a process known as reimbursement.

Customers also band together in buying groups to negotiate better deals with suppliers, which can result in them opting for cheaper and more generic products.

Profit margins in 2020 fell across both divisions due to Covid-19, which delayed medical procedures.

Otherwise, the Surgical segment’s profit margin has been high but volatile. In 2019 and 2023, demand flagged in the US, although the decline in 2023 was partly self-inflicted due to de-stocking by ex-distributors.

By appointing exclusive US distributors for LiquiBand and new acquisition Connexicon, which also makes surgical glues, AMS expects the distributors to work harder to market the products. It has also established a direct sales operation to service markets they do not reach.

The trend of declining profit margin in the Woundcare segment may be more enduring, though.

AMS has little to say about what it is doing to turn things around in the annual report, which might explain the recent focus of its acquisition activity: Connexicon in 2023 and Peters Surgical, announced in March 2024, have both joined the Surgical division.

- Nvidia now world’s biggest public company after passing Microsoft

- City analyst explains L&G ‘buy’ rating

Connexicon currently makes a tiny contribution to profit and its products cannot yet be sold in the US, although approval is expected this year. The cost, though, has added intangible assets to the balance sheet.

Tiny contributions to profit (or small losses), is typical of the six acquisitions AMS has made since 2019 at the time of acquisition. Sometimes the company has acquired promising technologies it expects to bring to a wider market. Sometimes it has acquired capabilities that will make manufacturing and distribution more efficient.

Seal-G MIST, acquired with Sealantis in 2019, meets an unmet clinical need for a gastrointestinal surgical sealant, for example, but it is still in “soft launch”. The company is gathering data required to commercialise the product.

Bringing products to market takes time, so perhaps we need to be patient. But low returns from acquisitions and their cost have depressed the company’s Return on Total Invested Capital (ROTIC) to a modest 8%.

Perhaps that is why AMS’s next acquisition is different from those that have gone before. It is much larger, and it is, at least, somewhat profitable.

In March, AMS announced the impending acquisition of Peters Surgical. The combination, AMS thinks, will be a “powerhouse”.

Peters Surgical is a manufacturer and distributor of surgical products based in France. Principally it manufactures and distributes sutures and haemostatic clips and clamps (which clamp blood vessels during surgery).

I think this merger is mainly about efficiency. A bigger business ought to be able to develop, manufacture and distribute products more efficiently.

Although Peters Surgical does bring AMS more products to sell and beefs up its direct sales force in Europe, sutures are not a particularly fast-growing part of AMS’s portfolio.

The soon to be subsidiary is not much smaller than AMS’s Surgical division and the company will pay up to €141 million for it, perhaps six times a typical year’s free cash flow for AMS.

It will be funded by the eradication of its net cash position and a new debt facility, which the company expects to pay down over time.

The debt will add a modest risk to the balance sheet and time will tell if AMS can combine the businesses and make them worth more than the sum of their parts.

AMS also acquired SyntaColl in March at a cost of €1 million. Its small size probably makes it a footnote.

Big acquisitions are risky because they can be expensive and difficult to integrate, but AMS has a strong culture. It wants “a world where the outcome of every patient can benefit from our products and a company where every employee feels invested and valued.”

The vision is borne out by the stats. Employee attrition is 12%, implying the average length of service is over eight years.

Employee engagement is 83%, and the company says: “We are particularly proud to maintain the engagement level [down 1% year on year] given some difficult messages we have delivered to employees about company performance.”

The price (discounted?) [0.3]

- Yes. A share price of 219p values the enterprise at about £421 million, 17 times normalised profit.

A score of 7 out of 10 indicates that AMS is probably a good long-term investment, although it is somewhat speculative.

I like AMS, but I do not like big “transformational” acquisitions such as Peters Surgical. It makes me doubt the future because the business has changed perhaps radically. It also means I doubt the past because I believed AMS did not need to transform. Maybe it did.

It is ranked 17 out of 40 shares in my Decision Engine (as of last week, see note in Shares for the future section, below).

Shares for the future

There is no Decision Engine table this week, as I have taken a week off. This article was prepared in advance and last week’s table at the end of the profile on Churchill China (LSE:CHH) reflected AMS’s new score.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Advanced Medical Solutions and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.