Shares for the future: a top 3 stock with pristine finances

Doing things its own way has worked well for this company over the long term. Analyst Richard Beddard believes the share price will be revived once it’s obvious to other investors they are cheap.

25th October 2024 15:30

by Richard Beddard from interactive investor

Last year, I gave Thorpe (F W) (LSE:TFW) a perfect score in every category except for the share price. Since then, nothing about the business has changed my mind, but the market it is listed on is under a cloud

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Scoring FW Thorpe: big is beautiful

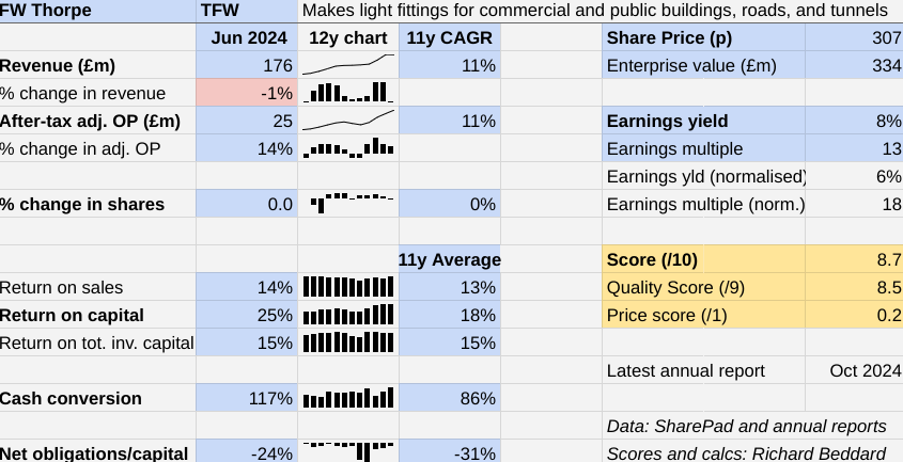

Revenue for the year to June 2024 declined for only the second time in the last 12 years. Like the previous time, the hit was less than 1%. Adjusted profit increased 14%.

The Past (dependable) [3]

- Profitable growth: 11% revenue and profit CAGR [1]

- Strong finances: Net cash [1]

- Through thick and thin: Lowest return on capital (RoC) 14% (2014, 2019, 2020) [1]

At one of the company’s Dutch businesses, Lightronics, a manufacturer of outdoor lighting and streetlights, everything “seemed to line up perfectly”.

At the mothership, Thorlux, revenue was “broadly level”, but some of the company’s smaller subsidiaries are struggling to profit.

In 2014, TRT’s revenue declined 15% and the subsidiary made a loss.

FW Thorpe has appointed a new sales director at TRT, overhauled the sales team, and tasked the business, which specialises in lighting for roads and tunnels, with increasing sales of streetlights to local councils.

A recent venture, FW Thorpe’s 50% investment in Ratio, a Dutch maker of EV chargers, is bringing the technology to the UK. So far it has “struggled to make a good contribution”.

- Stockwatch: is the rally in this litigation play justified?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

FW Thorpe says the commercial i07 charging bollard, which incorporates Ratio EV charging in a Thorlux lighting bollard, has started to sell in “much larger numbers”.

We need not be alarmed by one year of stalled revenue growth. Demand naturally ebbs and flows with economic activity and public spending. In 2022 and 2023, revenue grew at twice TFW’s 11-year Compound Annual Growth Rate (CAGR).

Meanwhile, the company says its larger businesses had stable leadership and good order books at the start of the current financial year.

Smaller ones that are underperforming have new leaders and plans to grow.

The Present (distinctive) [3]

- Discernible business: Vertically integrated manufacturer of commercial lighting systems [1]

- With experienced people: Very experienced [1]

- That creates value for customers: Lowest lifetime cost of ownership [1]

FW Thorpe makes commercial lighting systems. The annual report highlights a 10-year partnership with West Midlands Trains and Network Rail that has modernised the lighting at 145 stations and supplied the new University Station in Birmingham.

Its biggest business by far is the original one, Thorlux, which was founded in 1936. Next in the pecking order are two Dutch lighting companies, Lightronics and Famostar, and Zemper, which is Spanish.

The group earns just over half its revenue in the UK, and most of the rest in Europe, principally the Netherlands and Germany, where it owns a distributor and installer of Thorlux products.

It is vertically integrated, manufacturing the luminaires that house LED bulbs and the circuitry and software that controls them. It also operates its own delivery fleet.

This puts FW Thorpe in control of costs and quality, which along with its strong financial position and reputation for lifetime support gives customers confidence in the supply of spares and services.

Its ability to survey, design, install and commission systems enables FW Thorpe to hold on to business in the sometimes nervy period between specification and installation. This period can last months, when contractors can be tempted to swap in cheaper components.

The big selling point of LED lights and smart controls is their efficiency, which lowers running costs and helps customers meet environmental goals.

For the first time in 2024, FW Thorpe has used wood instead of aluminium in some products: the Arden emergency light and the Oaken street light.

Wood is a renewable resource and requires less energy to manufacture. It also requires less tooling, which means FW Thorpe can make components in small batches and carry less stock.

FW Thorpe’s commitment to reduce waste and improve serviceability and recyclability is not a box-ticking exercise, it is central to its mission to offer the lowest long-term cost of ownership.

Thorlux even makes its own packaging from recycled materials. The initiative also reduces storage space, fire risk and material cost.

By installing solar panels and using electric vehicles (EVs), the company is ahead of its emission reduction targets, and FW Thorpe offsets remaining emissions by planting trees on its own land. It has been planting since 2009, and carbon neutral since 2012.

Since the retirement of chair, joint chief executive and grandson of the founder Andrew Thorpe in 2017, the company has been led by two men.

Mike Allcock joined as an apprentice 40 years ago and was chair and joint chief executive until earlier this year.

Craig Muncaster has been finance director since 2010, and became the other joint chief executive when Andrew Thorpe resigned.

Allcock retired from the executive board earlier this year, remaining as non-executive chair. Muncaster is now both chief executive and finance director.

Not for the first time, the board has an unconventional complexion. But as it has shrunk, FW Thorpe has strengthened the management of its subsidiaries

- Sector Screener: the FTSE 100 mining stocks with long-term appeal

- Owning Microsoft over Nvidia, and backing Diageo to recover

I take the view that FW Thorpe does a lot of things its own way, and over the long term this has worked well.

It is easy to imagine that a more decentralised structure provides opportunities for employees and makes the subsidiaries more entrepreneurial.

The founding family still wields much influence.

James Thorpe, joint MD of Thorlux, is the second executive on the board and brothers Andrew and Ian Thorpe (a former MD of Thorlux) are non-executives. Each holds more than a 20% stake.

Although such a concentration of ownership could cause concern, the Thorpe family have been excellent stewards.

The Future (directed) [2.5]

- Addressing challenges:Growth, competition [1]

- With coherent actions: Acquisitions, innovation [1]

- That reward all stakeholders fairly: Long-term ethos, but 46% of shares not in public hands [0.5]

I once fretted that demand for LED lighting might fall once the more than decade-long transition from incandescent lighting in factories, shops, offices and public buildings peaked, which it has.

But there was no need. LED lighting is more capable than it used to be, giving customers reasons to upgrade existing systems.

And although lighting systems have a lifespan of 10 years or more, early adopters are already replacing them.

FW Thorpe has taken advantage of the opportunities that the transition to LED lighting has given to innovate new more capable systems, and by acquiring companies in Europe.

Chief among innovations is SmartScan, a wireless management system that monitors, controls and tests lighting systems. It configures lighting based on movement and time of day, and offers additional features such as air quality sensing, adjustment of colour temperature and emissions reporting.

Recent developments include SmartScan Analytics, which tells users why an installation is using more power: more footfall, for example, rising electricity costs, or a diminished contribution from locally installed solar panels.

To grow in Europe and gain new capabilities, the company has acquired businesses. A Return on Total Invested Capital of 15% implies they have not come at an unacceptable cost.

In 2024, it stepped off the acquisition trail to focus on consolidation. FW Thorpe is introducing Thorlux industrial lighting products in the Netherlands and France, and introducing Famostar and Zemper products outside their home markets of the Netherlands and Spain

- Stockwatch: time to take profits after 600% gain?

- Insider: buying a winter winner plus big sales in the FTSE 250

Lightroncs will sell Oaken, TRT's wood-topped streetlight, in the Netherlands.

Famostar, acquired in 2018 and Zemper, acquired in 2022, make emergency lighting systems, which has become something of a specialty within FW Thorpe.

Along with UK architectural emergency lighting subsidiary Philip Payne (acquired in the 1990s), and Thorlux’s emergency lighting products, they contribute 38% of total revenue.

All four companies contributed to the development of the company’s newly launched and improved Firefly emergency downlight, which is controlled by SmartScan.

This collaboration has reduced dependence on external suppliers, and shared the cost of hardware and software development, moulds and tooling.

I wish FW Thorpe published employee attrition or retention statistics, but I think they would be good. It promotes, from within, regards training as a strategic priority, and pays staff well. Median total remuneration was £48,000 in 2024.

This long-term ethos is also evident in the unprofitable subsidiaries FW Thorpe carries. The annual report says: “new projects and companies always seem to take longer to start and be harder to establish than one first believes”.

Given FW Thorpe’s pristine finances and strong performance, patience is probably a virtue.

The price (discounted?) [0.2]

- A little. A share price of 307p values the enterprise at about £334 million, 18 times normalised profit.

FW Thorpe has a score of 8.7 out of 10, which means it probably is a good long-term investment.

I write this though, when the Alternative Investment Market (AIM), on which FW Thorpe is listed, is under several clouds.

Institutional investors are reportedly shunning smaller illiquid UK companies and this coincides with speculation about the forthcoming Budget.

One mooted change, the reduction or removal of an inheritance tax break (Business Property Relief) enjoyed by AIM shares, may further reduce interest.

- The future of AIM: how the small-cap market can survive

- The funds most at risk of AIM stocks losing IHT relief

Tax breaks are a sideshow for me. FW Thorpe is worth more than its market valuation irrespective of them.

And interest in smaller companies is cyclical. It should revive, once it is obvious to other investors they are cheap.

But there is a potential wrinkle in my cosy scenario that I cannot completely discount.

If institutional indifference gets to the point that even AIM stalwarts question their listing, they might I suppose move to the main market, or delist.

Delisting is the nightmare scenario for private investors.

It is not trivial to do or, I think, likely. FW Thorpe’s history as a public company long predates AIM. It floated on the main market in 1969 and stayed there until it joined AIM in 2005.

But the fact that 46% of the shares are already not in public hands could make delisting easier, which is why FW Thorpe does not quite get a perfect score this year.

FW Thorpe is ranked 3 out of 40 shares in my Decision Engine.

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

James Halstead (LSE:JHD) has published its annual report and is due to be re-scored.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.7 | |

4 | Supplies kitchens to small builders | 8.5 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Surveys and distributes public opinion online | 8.1 | ||

8 | Manufacturer of scientific equipment for industry and academia | 8.0 | ||

9 | Flies holidaymakers to Europe, sells package holidays | 7.9 | ||

10 | Manufactures computers, battery packs, radios. Distributes components | 7.9 | ||

11 | Manufactures/retails Warhammer models, licences stories/characters | 7.6 | ||

12 | Whiz bang manufacturer of automated machine tools and robots | 7.6 | ||

13 | Manufactures military technology, does research and consultancy | 7.6 | ||

14 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.6 | ||

15 | Manufactures filters and filtration systems for fluids and molten metals | 7.5 | ||

16 | Designs recording equipment, loudspeakers, and instruments for musicians | 7.5 | ||

17 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

18 | Sells hardware and software to businesses and the public sector | 7.3 | ||

19 | Distributes essential everyday items consumed by organisations | 7.2 | ||

20 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | ||

21 | Translates documents and localises software and content for businesses | 7.0 | ||

22 | Manufactures natural animal feed additives | 7.0 | ||

23 | Sells promotional materials like branded mugs and tee shirts direct | 7.0 | ||

24 | Supplies vehicle tracking systems to small fleets and insurers | 6.9 | ||

25 | Manufactures vinyl flooring for commercial and public spaces | 6.7 | ||

26 | Online retailer of domestic appliances and TVs | 6.7 | ||

27 | Online marketplace for motor vehicles | 6.6 | ||

28 | Operates tenpin bowling and indoor crazy golf centres | 6.4 | ||

29 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.3 | ||

30 | Retails clothes and homewares | 6.2 | ||

31 | Acquires and operates small scientific instrument manufacturers | 6.1 | ||

32 | Manufactures sports watches and instrumentation | 6.0 | ||

33 | Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.9 | |

34 | Publishes books, and digital collections for academics and professionals | 5.8 | ||

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.6 | ||

36 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 4.9 | ||

38 | Runs a network of self-employed lawyers | 4.7 | ||

39 | Develops and manufactures hygiene, baby, and beauty brands | 4.4 | ||

40 | Manufactures specialist paper, packaging and high-tech materials | 3.7 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns FW Thorpe and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.