Shares for the future: this top 10 company is undervalued

This business remains impressively profitable and believes AI is an opportunity rather than a threat. Columnist Richard Beddard explains why it could be even bigger, more efficient, and more profitable.

9th February 2024 15:20

by Richard Beddard from interactive investor

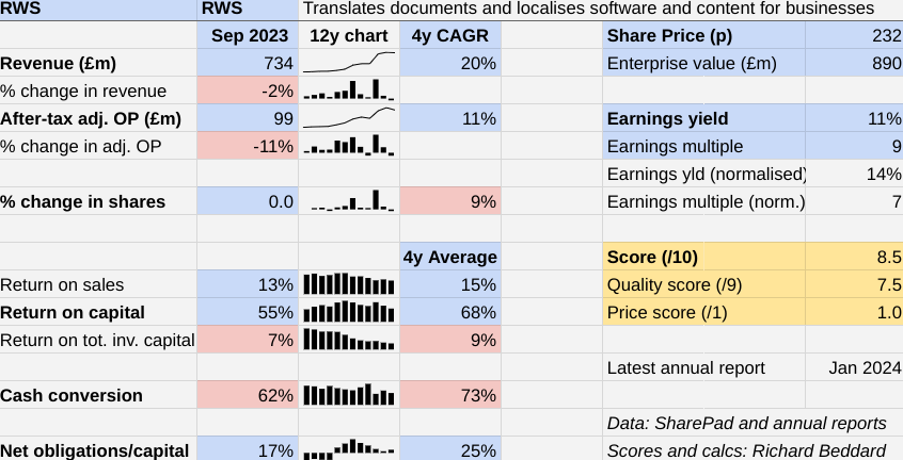

Scoring RWS Holdings (LSE:RWS) a year ago, my main concern was the potential impact of artificial intelligence (AI) on the translation company’s business model.

A reader emailed to say I should be more concerned about the challenges of integrating businesses acquired in recent years.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

I think they are right.

RWS has amassed considerable expertise in machine translation and AI as it has bulked up to become one of the world’s biggest language service providers. But it has also turned into a complex business.

The good news is the company is addressing its organisational challenges. The not so good news is this muddies the accounting.

Scoring RWS: All change please

The Past (dependable) [3]

- Profitable growth: Average return on capital 68% [1]

- Strong finances: Debt to capital 17%, below average [1]

- Through thick and thin: Lowest return on capital 55% (2023), 42% on a less adjusted basis [1]

RWS says challenging economic conditions were responsible for a 2% decline in revenue in the year to September 2023. Adjusted profit fell 11%.

Last year, I used a long-term average to judge the underlying performance of the company, but when a business has changed as much as RWS the distant past is less relevant.

This year, I have focused on the last four years, 2020 to 2023, a period in which acquisition activity peaked and the effort to integrate the businesses and technologies RWS had acquired intensified.

Although the adjusted figures for the four-year period are less good than the years before, RWS remains impressively profitable:

The adjustments are large, though; large enough to wipe out profit entirely if we add the costs RWS thinks we should ignore back into the profit calculation.

Mostly, these costs do not relate to money that actually flowed out of the business during the year. They were caused by reductions in the book value of intangible assets acquired by RWS in previous years, and have little bearing on ongoing profitability.

Other costs did involve outflows of money during the year. Principally these were “transformation” and “restructuring” costs associated with making people redundant, and welding disparate teams, processes and IT systems together.

RWS says these are transitory costs, so they obscure the underlying profitability of the business. But there is a lot of change going on so a lot of transformation might be required.

I do not know if ignoring these costs is a good idea, but we can see how much it matters by adding them back. Adjusted profit growth since 2020 falls from 11% to 5% and average return on capital drops to 59%. Average cash conversion increases to 86%.

These are not bad figures and, other things being equal, profit growth will improve if the costs are transitory, and the efficiencies promised by the transformation programmes are realised.

However, factor in the original cost of all RWS’ acquisitions and the returns look less good. RWS’ Return on Total invested capital is only 7%.

This means RWS may have overpaid for some of its past acquisitions, which would be a concern if the company gears up for more big deals.

The Present (distinctive) [2.5]

- Discernible business: Hybrid man/machine translation at scale [1]

- With experienced people: Board experience mixed, attrition falling [0.5]

- That creates value for customers: Efficiency, trust, lower costs? [1]

RWS’ heritage is in patent and intellectual property (IP) translation, a highly profitable niche that still earned the company 14% of revenue in 2023.

More recent acquisitions took it into other technical markets. They are Life Sciences, RWS translates pharmaceutical trials for example, and financial and legal services. Together these businesses brought in 22% of revenue in 2023.

The company’s biggest division (45% of revenue) localises content for businesses and organisations, including websites, video, and eLearning, and labels data for customers’ artificial intelligence applications to process and learn from.

Two-thirds of all this activity passes through LXD, a hybrid production platform that uses machine translation in combination with 1,750 in-house specialists and 35,000 freelance translators.

A fourth division offers clients the technologies underlying LXD, principally Language Weaver, RWS’ machine translation platform, as well as other translation productivity and content management tools.

As a result of all this activity, RWS’ capabilities are changing. Its specialist translators are still important, but they are increasingly helped by technology, which has become something the company does not just use, but sells. Software generates 19% of revenue.

From 1995, when he led a management buyout, until he stepped down as chairman in 2023, Andrew Brode guided the company as it evolved. He may still be a significant influence, as a non-executive director and the company’s biggest shareholder.

The executives charged with integrating the businesses into something more coherent, are fairly new to RWS. Chief executive Ian El-Mokadem joined in 2021, and chief financial officer Candida Davies joined in 2022.

The average tenure of RWS’ top 30 clients is 17 years, evidence they trust RWS to localise their content and keep it secure.

The Future (directed) [2.0]

- Addressing challenges: Complexity, advancing technology [0.5]

- With coherent actions: Embrace tech, simplify systems, acquisitions? [1]

- That reward all stakeholders fairly: Loyal customers, not sure about staff [0.5]

Given RWS’ debatable performance as an acquirer, it was a relief last year when the company stated it would be making the most of the businesses it already owned and putting less emphasis on acquisitions.

It has made two small acquisitions since then, though. RWS acquired Propylon in July 2023, gaining new capabilities in content management, and ST Communications just after the financial year-end, enhancing its presence in Africa.

This January, RWS migrated its businesses onto a single collaboration platform. The first phase of a new Human Resources platform went live in December.

Integrating the group should make RWS more efficient, and to make it easier to bring future acquisitions on board.

RWS has also moved the specialist work of its IP translation team to LXD.

LXD enables the company to do more translation more efficiently. It is central to RWS’ ambitions because it should improve profit margins, which, along with the explosion of content worldwide, means RWS believes AI is an opportunity rather than a threat.

But LXD is a new platform at least to RWS. It is underpinned by technologies acquired principally with SDL in 2021, so the integrated growth strategy is unproven.

Success depends on pricing too. Technology like LXD is reducing the cost of translation per word, but this means customers expect to pay less. RWS must maintain prices sufficiently to ensure rising volumes and efficiency more than make up for deflation.

In providing translation and localisation, supplying the software for clients to translate their own content, and in training clients' AI to automate aspects of translation, RWS is covering all bases.

It does not know how the market will develop, but perhaps it is in a better position than most to find a way forward.

The price (discounted?) [1]

- Yes. A share price of 232p values the enterprise at about £890 million, 7 times normalised profit.

RWS’ instinct to simplify and put technology at the heart of its platform is a good one.

If we look through the fog, it is possible to imagine a bigger, more efficient, and more profitable RWS.

A score of 8.5 out of 10 indicates that RWS is probably a good long-term investment.

It is ranked 9 out of 40 stocks in my Decision Engine.

29 Shares for the future

Here is the ranked list of shares from the Decision Engine. I review the scores once a year, soon after each company has published its annual report. They change day to day due to changes in price.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

YouGov (LSE:YOU), Treatt (LSE:TET), Victrex (LSE:VCT) and Hollywood Bowl Group (LSE:BOWL) have all published annual reports and are due to be re-scored.

Quartix Technologies (LSE:QTX) is riding high in the list, but boardroom uncertainty may lead me to reduce my score when I next evaluate it. The latest currency devaluation in Nigeria has revealed that I did not properly understand the risks of investing in PZ Cussons (LSE:PZC) last time I scored it. I am also concerned that XP Power Ltd (LSE:XPP) has been unable to repair its finances rapidly after heavy investment and a fine stressed them.

While I do not know how I will score these shares when their time comes, downgrades are probable.

0 | Company | Description | Score |

1 | Supplies kitchens to small builders | 9 | |

2 | Manufactures tableware for restaurants and eateries | 9 | |

3 | Supplies vehicle tracking systems to small fleets and insurers | 9 | |

4 | Designs recording equipment, loudspeakers, and instruments for musicians | 9 | |

5 | Sources, processes and develops flavours esp. for soft drinks | 9 | |

6 | Distributor of protective packaging | 9 | |

7 | Manufacturer of scientific equipment for industry and academia | 9 | |

8 | Manufactures pushbuttons and other components for lifts and ATMs | 8 | |

9 | Translates documents and localises software and content for businesses | 8.5 | |

10 | Manufactures filters and filtration systems for fluids and molten metals | 8 | |

11 | Manufactures/retails Warhammer models, licenses stories/characters | 8 | |

12 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 8 | |

13 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8 | |

14 | Whiz bang manufacturer of automated machine tools and robots | 8 | |

15 | Imports and distributes timber and timber products | 8 | |

16 | Manufactures natural animal feed additives | 8 | |

17 | Manufactures power adapters for industrial and healthcare equipment | 8 | |

18 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 8 | |

19 | Sells hardware and software to businesses and the public sector | 8 | |

20 | Distributes essential everyday items consumed by organisations | 7 | |

21 | Develops and manufactures hygiene, baby, and beauty brands | 7 | |

22 | Online retailer of domestic appliances and TVs | 7 | |

23 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 7 | |

24 | Manufactures military technology, does research and consultancy | 7 | |

25 | Online marketplace for motor vehicles | 7 | |

26 | Makes marketing and fraud prevention software, sells it as a service | 7 | |

27 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 7 | |

28 | Manufactures vinyl flooring for commercial and public spaces | 7 | |

29 | Publishes books, and digital collections for academics and professionals | 7 | |

30 | Flies holidaymakers to Europe, sells package holidays | 6 | |

31 | Manufactures specialist paper, packaging and high-tech materials | 6 | |

32 | Sells promotional materials like branded mugs and tee shirts direct | 6 | |

33 | Manufactures sports watches and instrumentation | 6 | |

34 | Collects and analyses market research and opinion polls through online panels | 6 | |

35 | Operates tenpin bowling and indoor crazy golf centres | 6 | |

36 | Manufactures disinfectants for simple medical instruments and surfaces | 6 | |

37 | Supplies software and services to the transport industry | 5 | |

38 | Retails clothes and homewares | 5 | |

39 | Acquires and operates small scientific instrument manufacturers | 5 | |

40 | Runs a network of self-employed lawyers | 5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with an asterisk* are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns RWS and most of the shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.