Shares for the future: a test-case for essentialism

This essentialist hunts for shares good enough to buy and hold indefinitely, at a reasonable price.

3rd July 2020 13:30

by Richard Beddard from interactive investor

This essentialist hunts for shares good enough to buy and hold indefinitely, at a reasonable price.

You can’t do everything. That’s the essential point of “Essentialism” by Greg McKeown, a book I’m reading. At least that’s the point so far. I’m 21% of the way through, according to my e-reader, but given the subject matter I’d be surprised if the message gets any more elaborate.

The essentials of essentialism

So far, I’ve had a lucky pandemic but, along with everyone else, I have put up with the restrictions that have prevented us doing a lot of things. Now they are being withdrawn I’m sure I’m not alone in wondering whether we would be better off continuing to abstain from some of them. Membership reminders lie on my desk while I ponder whether to renew them, and this year’s holiday is in the balance. Maybe we will stay at home and do the gardening and DIY projects we missed out on as we worked through the ‘lockdown’.

Life is about making choices, the book says, and, if you choose everything, you do it all badly. This is particularly true of information. By submitting ourselves to the tyranny of rolling news and the Twitter/Facebook/Instagram “feed”, a ceaseless torrent of other people’s messages, we’re squeezing out our capacity to think for ourselves. I’ve ‘muted’ most of the people and organisations I follow. It sounds rude, but actually it means I’ve prevented them from interrupting me all the time. Instead, I visit their feeds every now and then, like I might call or visit a friend.

The book is preaching to somebody who long ago converted to essentialism, but still sometimes tries to do everything. A description of the “core mind-set of an essentialist” reminds me of how I was thinking when I invented the Decision Engine, my method of scoring and ranking shares.

There are three “realities” that an essentialist embraces:

Choice

The first is choice. Without choice, McKeown says, there is no point in talking about options (which he calls trade-offs).

While this is a somewhat obvious point, it is far from conventional wisdom in stock market investing, because the widely held notion that “you cannot beat the market” implies any choice apart from buying the index is fruitless. Stock pickers believe the opposite, that our decisions will improve our returns.

Noise

The second is the prevalence of noise. Almost everything, McKeown says, is noise, and that is the justification of spending time and effort figuring out the things that are important.

The Decision Engine protects me from stuff that doesn’t matter and encourages me to work out what does: what companies do, the challenges they face, how they will make more money, whether we will all benefit, and whether the shares are a reasonable price. The noise is everything else: perturbations in profit and cashflow, rises and falls in share prices, whether others are buying or selling, and people’s hopes and fears about the economy, for example.

Trade-offs

When we choose to do something, we choose not to do everything else. Once we accept the reality of trade-offs, McKeown says, we stop asking “How can I make it all work?” and ask “Which problem do I want to solve?”

I decline to solve many problems, principally whether the next move in a company’s share price or UK GDP is up or down, the targets of much financial punditry. I’m liberated to solve one problem, which is finding shares in companies that are good enough to buy and hold indefinitely, at a reasonable price. These companies will adapt to their changing circumstances, if they have resilient strategies.

Corporate essentialism

McKeown draws inspiration from corporate strategy, citing everybody’s favourite case-study Southwest Airlines (NYSE:LUV), the original low-cost airline. Southwest’s founder, Herb Kelleher, is something of a legend, so I won’t recount the story, it’s repeated all over the Internet and in many good books on investment and strategy, for example in “Intelligent Fanatics”, a book that examines the strategies of some enduringly profitable businesses.

McKeown’s point is that Kelleher made many choices. His strategy was pretty much defined by what his company did not do - fly to all points, serve meals, allocate seats, and so on. McKeown quotes Kelleher:

“You have to look at every opportunity and say, “Well, no... I’m sorry. We’re not going to do a thousand different things that really won’t contribute much to the end result we are trying to achieve.””

Lack of essentialism explains the relatively low score I gave Portmeirion (LSE:PMP) two weeks ago. The company, famous for its beautiful pottery, has in recent years become a manufacturer of other kinds of tableware, cookware, scented candles and reed diffusers. Its experience in the pandemic manufacturing hand sanitiser at its candle factory has inspired it to launch a range of perfumed hand cleansing-soaps. The company is trying to grow outside its major markets in the UK, the US and South Korea, but that is causing problems in South Korea, where foreign distributors have flooded the market disrupting Portmeirion’s trade with its exclusive distributor there, a very good customer.

The company’s focus seems to be shifting from design to acquisition and sales through proliferating channels including, of course, the Internet. Sometimes I think Portmeirion is trying to do everything.

Decision Engine

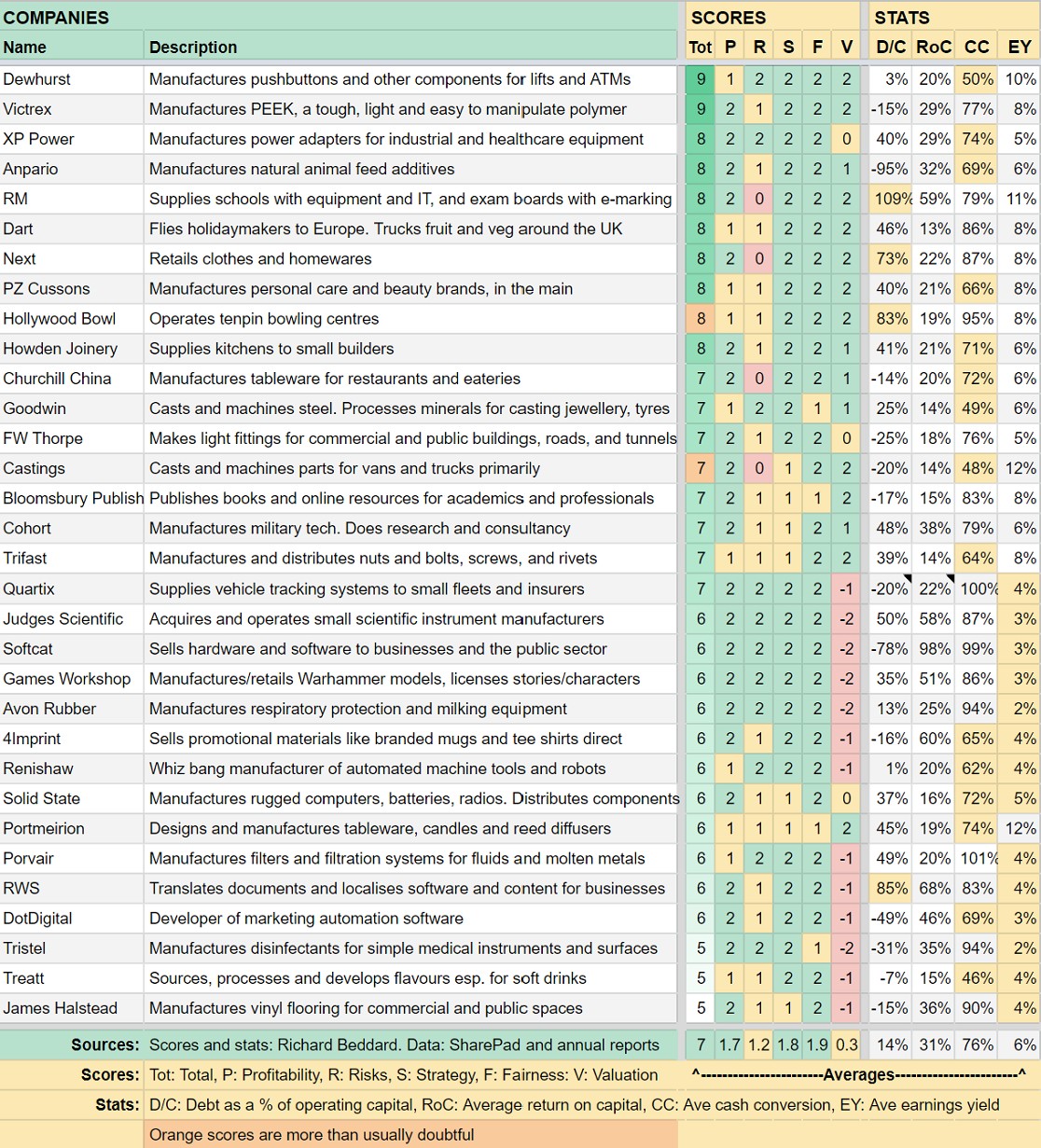

This month, Portmeirion is ranked 26 out of 32 shares. Most of the shares in the list should make good long-term investments, but the higher the score (in the “Tot” column), the more confident I am.

Will XP Power fall foul of Sino-US rift?

A reader has emailed a warning about XP Power (LSE:XPP), which manufactures power converters in China and Vietnam, mostly for European and American manufacturers of industrial and medical machinery.

He says geopolitical shenanigans between the USA and China are provoking a reversal of the offshoring trend, especially in industries deemed strategic, a trend exemplified in US sanctions on Huawei, a Chinese technology company. Some companies supplying Western markets are refusing to design components manufactured in China into their products, and perhaps other South-East Asian manufactures might also lose trade if they are perceived as being susceptible to Chinese influence.

XP Power has been transferring production from China to Vietnam, which shares a border with China, so I asked the company whether it might have to bring manufacturing closer to its big Western markets.

While some customers are declining to incorporate Chinese manufactured components into their designs, my impression is that it is not ready to reshore. Most of XP Power’s European and US customers are themselves manufacturing in Asia, and significant cost advantages remain (even for Chinese manufacturing, despite US tariffs).

This is a test-case for essentialism. I’ve noted the risk, but I trust XP Power, a company that adjusted its strategy to profit from globalisation, to adapt again, if necessary.

It’s either that, or become an expert in Sino-Vietnamese relations. Quite frankly, that’s an enticing prospect, which is why I must restrain myself!

How I scored each company

| Name | Description | Profile |

|---|---|---|

| 4Imprint | Sells promotional materials like branded mugs and tee shirts direct | https://bit.ly/swFOUR2020 |

| Anpario | Manufactures natural animal feed additives | https://bit.ly/swANP2020 |

| Avon Rubber | Manufactures respiratory protection and milking equipment | https://bit.ly/swBMY2020 |

| Bloomsbury Publishing | Publishes books and online resources for academics and professionals | http://bit.ly/swBMY2019 |

| Castings | Casts and machines parts for vans and trucks primarily | http://bit.ly/swCGS2019 |

| Churchill China | Manufactures tableware for restaurants and eateries | https://bit.ly/swCHH2020 |

| Cohort | Manufactures military tech. Does research and consultancy | http://bit.ly/swCHRT2019 |

| Dart | Flies holidaymakers to Europe. Trucks fruit and veg around the UK | http://bit.ly/swDTG2019 |

| Dewhurst | Manufactures pushbuttons and other components for lifts and ATMs | http://bit.ly/swDWHT2020 |

| DotDigital | Developer of marketing automation software | http://bit.ly/swDOTD2019 |

| FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | http://bit.ly/swTFW2019 |

| Games Workshop | Manufactures/retails Warhammer models, licenses stories/characters | http://bit.ly/swGAW2019 |

| Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | http://bit.ly/swGDWN2019 |

| Hollywood Bowl | Operates tenpin bowling centres | http://bit.ly/swBOWL2020 |

| Howden Joinery | Supplies kitchens to small builders | http://bit.ly/sw2020HWDN |

| James Halstead | Manufactures vinyl flooring for commercial and public spaces | http://bit.ly/swJHD2019 |

| Judges Scientific | Acquires and operates small scientific instrument manufacturers | https://bit.ly/swJDG2020 |

| Next | Retails clothes and homewares | https://bit.ly/swNXT2020 |

| Portmeirion | Designs and manufactures tableware, candles and reed diffusers | https://bit.ly/swPMP2020 |

| Porvair | Manufactures filters and filtration systems for fluids and molten metals | http://bit.ly/swPRV2019 |

| PZ Cussons | Manufactures personal care and beauty brands, in the main | http://bit.ly/swPZC2019 |

| Quartix | Supplies vehicle tracking systems to small fleets and insurers | https://bit.ly/swQTX2020 |

| Renishaw | Whiz bang manufacturer of automated machine tools and robots | http://bit.ly/swRSW2019 |

| RM | Supplies schools with equipment and IT, and exam boards with e-marking | http://bit.ly/swRM2020 |

| RWS | Translates documents and localises software and content for businesses | https://bit.ly/swRWS2020 |

| Softcat | Sells hardware and software to businesses and the public sector | http://bit.ly/swSCT2019 |

| Solid State | Manufactures rugged computers, batteries, radios. Distributes components | http://bit.ly/swSOLI2019 |

| Treatt | Sources, processes and develops flavours esp. for soft drinks | http://bit.ly/swTET2020 |

| Trifast | Manufactures and distributes nuts and bolts, screws, and rivets | http://bit.ly/swTRI2019 |

| Tristel | Manufactures disinfectants for simple medical instruments and surfaces | http://bit.ly/swTSTL2019 |

| Victrex | Manufactures PEEK, a tough, light and easy to manipulate polymer | http://bit.ly/swVCT2020 |

| XP Power | Manufactures power adapters for industrial and healthcare equipment | https://bit.ly/swXPP2020 |

Richard owns shares in XP Power, Portmeirion and many of the shares in the Decision Engine.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.