Shares for the future: stuck in a technological arms race

This company changed forever in 2021 and is currently fighting to stay relevant. Now run by a former Google managing director, analyst Richard Beddard gives his take on prospects.

7th February 2025 15:05

by Richard Beddard from interactive investor

RWS Holdings (LSE:RWS) translates and localises content for 83 of the top 100 multinational brands. It is in a technological arms race to stay relevant.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Scoring RWS: disrupting itself

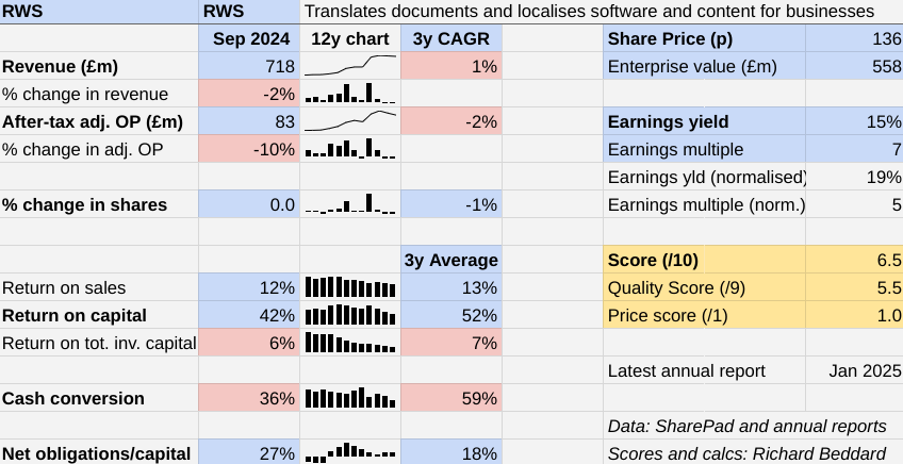

Latest results bear the scars of a company transforming itself. In the year to September 2024, revenue declined slightly, adjusted profit declined 10%, and return on capital and cash conversion were sub-par.

The Past (dependable) [2]

- Profitable growth: Stalled growth [0.5]

- Strong finances: Modest obligations, weakened cash conversion [0.5]

- Through thick and thin: Lowest RoC 42% (2024) [1]

Over the past three years, revenue and profit at RWS have not grown. The company still generates high returns on capital (RoC), but it is considerably less profitable than it was a decade before.

Cash flow has declined in comparison to adjusted profit over the past four years.

This is because the profit measure excludes exceptional costs related to integrating and rationalising subsidiaries. Since these costs should not recur, excluding them may give us a better impression of RWS’ profitability.

The other major drag on cash flow is capital expenditure. This has increased due to investment in RWS’ technology platform, now machine translation is integral to translation and localisation services. The requirement to improve it is unlikely to go away, but the company does expect capital expenditure to moderate somewhat.

Normally I judge performance over a decade or so, but the rapid growth and strong profitability of the 2010s is not very relevant because RWS changed forever in 2021.

The Present (distinctive) [1.5]

- Discernible business: Hybrid (human/machine) provider of language services [0.5]

- With experienced people: No [0]

- That creates value for customers: Quality, privacy [1]

Perhaps in time we will look back on 2021 as the year RWS began its transformation from a translation company that uses technology to a technology company that does translation. That was the year when RWS acquired SDL.

Up until 2021, RWS had enjoyed a long period of sustained growth translating patents and intellectual property for multinational companies in a rapidly globalising economy. During the second half of the 2010’s growth accelerated as it acquired translation companies across a wide range of industries.

RWS had long used technology to manage the translation process, check for errors and even produce drafts. But its translators were its competitive advantage. They are not only linguists but have specialist industry knowledge. RWS employs 1,800 language specialists and draws on a pool of tens of thousands of freelancers.

Since acquiring SDL, the balance has begun to shift more decisively towards technology. The company has developed a slew of solutions from “high touch” specialised services such as RWS’ traditional IP services to Language Weaver, its machine translation platform, which provides instant translation with minimal or no human involvement.

- 10 shares to give you a £10,000 annual income in 2025

- AIM performance since boom year: winners and a lot of losers

- The stocks behind FTSE 100’s latest record rally

Language Weaver is integrated with Trados, RWS’ computer-assisted translation software, and its network of linguists in its Language eXperience Delivery (LXD) platform, which the company describes as a common supply chain for all its language services. SDL, which acquired Trados in 2005 and Language Weaver in 2010, developed the two key technology components of LXD earlier.

The new RWS also offers technology services. The most notable may be TrainAI. TrainAI collects and processes data for its customers’ AI systems and evaluates and tests those systems. Although RWS says this is a growth opportunity, the market is currently much smaller than the massive language services market.

Today, 55% of content translated by RWS is initially translated by Language Weaver, and 25% of revenue comes from “AI-related” products and services.

Somewhat disconcertingly, this transformation has not been the project of a settled board. The company’s former chief executive Ian El-Mokadem joined just a month before the acquisition of SDL was announced in 2020 and departed this January.

Perhaps reflecting what RWS is becoming, his replacement is Benjamin Faes, who made his name at Google and other technology companies.

Chief financial officer Candida Davies joined RWS a little over two years ago.

The Future (directed) [2]

- Addressing challenges:Technology disruption (LLMs?), complexity [0.5]

- With coherent actions: Technology investment, business transformation, acquisitions [0.5]

- That reward all stakeholders fairly: Customer NPS +48, Staff voluntary attrition 10% [1]

New solutions like Evolve, for enterprises, and HAI, for smaller businesses, insert humans into multi-stage translation processes also including machines.

Evolve, for example, is populated by linguists and industry specialists who fine-tune translations generated by RWS’ old school Neural Machine Translation (NMT) and a private Large Language Model, a type of artificial intelligence made famous by ChatGPT.

NMT is more accurate than LLMs but can be less fluent. Having human arbitrators, reassures customers and will hasten the adoption of AI, but like everybody else I wonder where this will end.

The frantic development of large public LLMs threatens to sweep established technologies before it, potentially commoditising many aspects of translation. RWS is betting on the convergence of NMT and LLMs, but in the brave new world we are rushing towards, it is not obvious who will emerge with competitive advantages: RWS, other translation companies developing AI technologies, or AI companies.

- Share Sleuth: three firms on the buy list. Here’s the one I chose

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Neither is it obvious how quickly things will change. Some translations are technical and very high stakes, and humans may be required for longer than we think.

For example, RWS says linguistic validation work is growing. Linguistic validation is the quality control of translated clinical drug trial outcomes. This relies on well-established and convoluted translation processes involving multiple human translators and patients to ensure the resulting documentation is not just accurate but conceptually equivalent across different cultures.

The acquisition of SDL, and RWS’ machine-first strategy shows it is tackling the threat of technological disruption head-on by becoming a disruptor, but this has come at a cost.

RWS is not yet generating sufficient returns to justify the cost of its many acquisitions. Return on Total Invested Capital is only 6%. The acquisitions have made the business more complex, which it is resolving through costly transformation programmes.

The disruption makes it a difficult company to evaluate. I simply do not know whether the investment and restructuring has been worth it, and what level of profitability we can expect from an industry that is fundamentally changing.

The price (discounted?) [1]

- Yes. A share price of 136p values the enterprise at about £558 million, five times normalised profit.

A score of 6.5 implies RWS may be a good long-term investment.

It is ranked 28 out of 40 shares in my Decision Engine.

22 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Renew Holdings (LSE:RNWH) has published its annual report and is due to be re-scored.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Supplies kitchens to small builders | 8.9 | ||

4 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.6 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Manufactures computers, battery packs, radios. Distributes components | 8.5 | ||

7 | Distributor of protective packaging | 8.4 | ||

8 | Repair and maintenance of rail, road, water, nuclear infrastructure | 8.1 | ||

9 | Manufacturer of scientific equipment for industry and academia | 8.0 | ||

10 | Designs recording equipment, loudspeakers, and instruments for musicians | 8.0 | ||

11 | Flies holidaymakers to Europe, sells package holidays | 7.8 | ||

12 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.6 | ||

13 | Operates tenpin bowling and indoor crazy golf centres | 7.5 | ||

14 | Sells hardware and software to businesses and the public sector | 7.4 | ||

15 | Manufactures/retails Warhammer models, licences stories/characters | 7.4 | ||

16 | Manufactures filters and filtration systems for fluids and molten metals | 7.4 | ||

17 | Manufactures vinyl flooring for commercial and public spaces | 7.3 | ||

18 | Distributes essential everyday items consumed by organisations | 7.3 | ||

19 | Whiz bang manufacturer of automated machine tools and robots | 7.2 | ||

20 | * | Surveys and distributes public opinion online | 7.1 | |

21 | Online marketplace for motor vehicles | 7.1 | ||

22 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.0 | ||

23 | Acquires and operates small scientific instrument manufacturers | 6.9 | ||

24 | Sources, processes and develops flavours esp. for soft drinks | 6.9 | ||

25 | Sells promotional materials like branded mugs and tee shirts direct | 6.8 | ||

26 | Online retailer of domestic appliances and TVs | 6.8 | ||

27 | Manufactures natural animal feed additives | 6.8 | ||

28 | RWS | Translates documents and localises software and content for businesses | 6.5 | |

29 | Retails clothes and homewares | 6.4 | ||

30 | Supplies vehicle tracking systems to small fleets and insurers | 6.2 | ||

31 | Publishes books, and digital collections for academics and professionals | 5.9 | ||

32 | Manufactures military technology, does research and consultancy | 5.8 | ||

33 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.8 | ||

34 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

35 | Manufactures sports watches and instrumentation | 5.5 | ||

36 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 5.4 | ||

38 | Runs a network of self-employed lawyers | 4.8 | ||

39 | Develops and manufactures hygiene, baby, and beauty brands | 4.5 | ||

40 | Manufactures specialist paper, packaging and high-tech materials | 3.8 |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Correction

To my embarrassment, I neglected to fill in the reasons for two of the summary scores I gave YouGov last December. The two scores were for “profitable growth” (1/1) and “experienced people” (1/1).

I noticed the omission when considering whether to reduce YouGov (LSE:YOU)’s score for “experienced people” when it announced earlier this week that Steve Hatch, chief executive of only 18 months, is leaving the business prematurely.

This is unsettling news, but the company simultaneously issued a trading update indicating the business may have stabilised.

For now, I have decided not to change the score. I will, though, take this opportunity to fill in the blanks I left. The company is drawing on board experience to fill Steve Hatch’s shoes while the company searches for a successor.

Co-founder Stephan Shakespeare has stepped down as chair to reprise his former role as chief executive. Chief financial officer Alex McIntosh has also had a long career at YouGov.

- With experienced people: Interim CEO is co-founder and major shareholder, experienced CFO [1]

I will also add some detail to the “profitable growth” score:

- Profitable growth: Double-digit revenue and profit CAGR [1]

The earlier descriptions read “Blah”, and “Blah”, which is highly regrettable.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns RWS and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.