Shares for the future: a stock catapulted into the buy zone

A recent event sent this company surging to third place in Richard Beddard’s Decision Engine, but it’s meant our columnist has had to rethink his scoring.

28th June 2024 15:01

by Richard Beddard from interactive investor

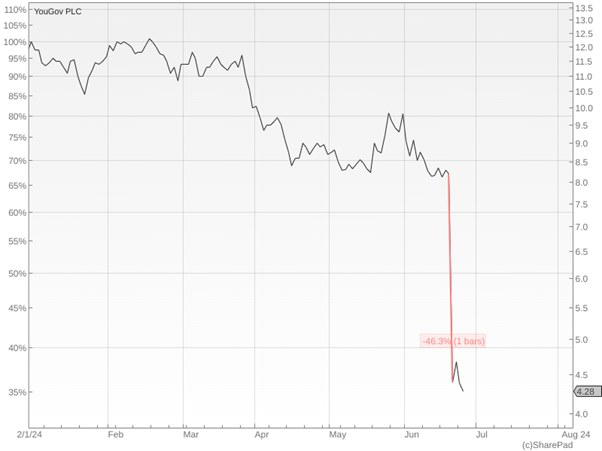

The reason market researcher YouGov (LSE:YOU) has not troubled the top half of the Decision Engine table vanished on 20 June when a profit warning nearly halved the company’s share price.

Source: SharePad

Since the half-year results announced in March (for the six months to January), YouGov had experienced lower sales bookings than anticipated.

It expects full-year revenue to be in the region of £325 million, still nearly £70 million more than the £258 million it earned in the year to July 2023. That is an increase of about 21%.

But YouGov anticipates adjusted operating profit will fall to between £41 million and £44 million, compared to just over £48 million in 2023 (potentially a fall of about 12%).

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Top Investment Funds

The company says it invested heavily in the expectation of an acceleration in growth that did not fully materialise.

A purpose of the Decision Engine is to separate thinking from trading by premeditating trades. The crash in the share price has elevated my score for YouGov to 8.8, catapulting it to third place in the Decision Engine - well into the ‘buy zone’.

Apparently, the Decision Engine’s verdict that the share was overpriced was justified, but there is something unnerving about YouGov’s trading update that makes me wonder whether I have scored the quality of the business too highly.

That means I need to have a rethink, to prevent myself from automatically buying the shares on my next monthly trade in the Share Sleuth portfolio.

Less profitable custom research, and the newest part of the business Consumer Panel Services, which also uses the expertise of YouGov consultants, have performed well enough.

The company is experiencing declines in “fast-turnaround research” - based on data products customers can interrogate themselves. This business is YouGov’s largest, and it is very profitable. It has for a long time been a strategic focus because of its scalability and because it is used by market researchers at large companies who might otherwise conduct their own research.

YouGov is responding by investing even more in its data products and its sales operation, and incorporating more artificial intelligence. What it has not given investors, is an inkling as to why demand for data products is in decline and why its recent investment has not generated traction.

I worry the rest of the industry may be catching up with YouGov which was digital and cultivated its own consumer panels pretty much from its foundation in 2000. Online tools integrated with YouGov’s own panels, is, I believe, the core of its competitive advantage.

I also wonder whether the company’s newfound enthusiasm for incorporating proliferating additional data sources like purchase data, banking data, and peoples’ streaming histories, is an admission that consumer panels are not as important as they used to be.

Until we know more, we should probably be circumspect. My scores determine the ideal holding size of a share, and a score of 8.8 means a substantial holding of 7.7% of the total value of a portfolio.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Stockwatch: this share price plunge is overdone

As so often happens, the profit warning comes at a time of other changes at YouGov. In addition to the acquisition, which has put the company into the red, its founder Stephan Shakespeare has stepped back to a non-executive role (chairman) and a seasoned executive has left the business for personal reasons.

Mr Shakespeare is mentoring the new chief executive, Steve Hatch, though. And Alex Macintosh, chief financial officer since 2017, has been at YouGov since 2007.

You can see how I scored YouGov last February in this article.

This is how I score it now:

The Past (dependable) [3]

- Profitable growth: 5-year compound annual growth rates: 17% (revenue), 27% (profit) [1]

- Strong finances: Net cash (will be weaker in 2024) [1]

- Through thick and thin: Lowest 5-year Return on Capital (RoC): 32% (2019) [1]

The Present (distinctive) [2.5]

- Discernible business: Data/online first market research [1]

- With experienced people: Still experience on the board [1]

- That creates value for customers: Fast turnaround not as unique as it was? [0.5]

The Future (directed) [2]

- Addressing challenges: Technology, new data sources [0.5]

- With coherent actions: Disappointing initial returns from focus on enterprise sales and self-service product improvement [0.5]

- That reward all stakeholders fairly: Yes, but I would like more data [1]

A reduction by one point, reduces YouGov’s score to 7.8 (it currently scores +0.3 for price). That is still in the ‘buy zone’, but the share is now ranked 8.

The Decision Engine would have us invest a more modest 5.7% of the total value of our portfolios in the share.

Porvair

Porvair (LSE:PRV)’s chief executive has announced he is stepping down. Ben Stocks has led the manufacturer of filters and laboratory equipment since 1998. For nearly 20 years now the company has followed the same disciplined acquisition strategy.

My expectation is that a successfully entrenched strategy can survive a change in management and that is my experience at, for example, fitted kitchen supplier Howden Joinery Group (LSE:HWDN), which did not miss a beat when its founder retired in 2018.

Victrex (LSE:VCT) and XP Power Ltd (LSE:XPP) have faltered though, after their very experienced chief executives left. Unlike Howdens, these two businesses had embarked on new strategies in the years leading up to their retirement.

Victrex shifted from making polymer materials to forming or part-forming them into parts. XP Power started acquiring manufacturers of high power and high voltage converters to add to its own range of low power converters.

Porvair is like Howdens, there has been no perceptible change in strategy. However, Ben Stocks follows the retirement of the company’s long-standing chief financial officer in 2021. Until we know who will succeed him, I have decided to reduce the share’s score for management experience to 0.5.

The Present (distinctive) [3]

- Discernible business: Manufactures specialist filters [1]

- With experienced people: Longstanding chief executive is retiring [0.5]

- That creates value for customers: Filters reduce costs and pollution [1]

Porvair’s other scores remain unchanged except for the price score which changes all the time.

It scores 7.4 out of 10 (the price score is -0.6), ranking Porvair 16th in the Decision Engine table. The ideal holding size is 4.8%.

20 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Anpario (LSE:ANP), Bloomsbury Publishing (LSE:BMY), and Oxford Instruments (LSE:OXIG) have all published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” next to its name in the table. I am phasing this practice out in favour of re-evaluating shares when I feel I need to. However, two companies, Oxford Instruments and PZ Cussons (LSE:PZC), remain stuck in the old system.

- Election manifestos 2024: the impact on your personal finances

- Stockwatch: why I think these two shares are good value

In the case of Oxford Instruments, I am wary of the new chief executive and want to read his first annual report. It has been published and I will re-score the share in July.

We will have to wait longer for PZ Cussons’ re-evaluation. To my embarrassment I failed to acknowledge the currency risk that has caused the company so many problems this year. It has resulted in a change in strategy that also needs to be evaluated.

The company reports its full-year results for the just concluded in September. I will re-evaluate it when it publishes its annual report in November.

For the time being I have frozen trading in these two shares.

Company | * | Description | Score | |

1 | Manufactures tableware for restaurants and eateries | 9.8 | ||

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | ||

3 | Supplies kitchens to small builders | 8.6 | ||

4 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

5 | Distributor of protective packaging | 8.3 | ||

6 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.1 | ||

7 | ? | Manufacturer of scientific equipment for industry and academia | 8.0 | |

8 | * | Surveys and distributes public opinion online | 7.8 | |

9 | Imports and distributes timber and timber products | 7.8 | ||

10 | Whiz bang manufacturer of automated machine tools and robots | 7.7 | ||

11 | Distributes essential everyday items consumed by organisations | 7.7 | ||

12 | Manufactures/retails Warhammer models, licences stories/characters | 7.6 | ||

13 | ? | Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

14 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

15 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.4 | ||

16 | * | Manufactures filters and filtration systems for fluids and molten metals | 7.4 | |

17 | Sources, processes and develops flavours esp. for soft drinks | 7.4 | ||

18 | Online retailer of domestic appliances and TVs | 7.3 | ||

19 | Translates documents and localises software and content for businesses | 7.0 | ||

20 | Manufactures natural animal feed additives | 7.0 | ||

21 | Manufactures vinyl flooring for commercial and public spaces | 6.8 | ||

22 | Sells promotional materials like branded mugs and tee shirts direct | 6.8 | ||

23 | Supplies vehicle tracking systems to small fleets and insurers | 6.6 | ||

24 | Operates tenpin bowling and indoor crazy golf centres | 6.6 | ||

25 | Sells hardware and software to businesses and the public sector | 6.5 | ||

26 | Flies holidaymakers to Europe, sells package holidays | 6.5 | ||

27 | Makes marketing and fraud prevention software, sells it as a service | 6.5 | ||

28 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.4 | ||

29 | Manufactures specialist paper, packaging and high-tech materials | 6.4 | ||

30 | Online marketplace for motor vehicles | 6.3 | ||

31 | Retails clothes and homewares | 6.3 | ||

32 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.2 | ||

33 | Acquires and operates small scientific instrument manufacturers | 6.1 | ||

34 | Manufactures military technology, does research and consultancy | 6.1 | ||

35 | Manufactures sports watches and instrumentation | 6.0 | ||

36 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.6 | ||

37 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | ||

38 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

39 | Publishes books, and digital collections for academics and professionals | 5.4 | ||

40 | Runs a network of self-employed lawyers | 4.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click on the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Porvair and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.