Shares for the future: still enthusiastic about this top 10 stock

This company’s shares currently trade at a fraction of their post-Covid peak, but they’re cheap and remain one of analyst Richard Beddard’s most highly rated shares.

20th December 2024 15:01

by Richard Beddard from interactive investor

Long-time shareholders in Focusrite (LSE:TUNE) have experienced severe whiplash since 2021.

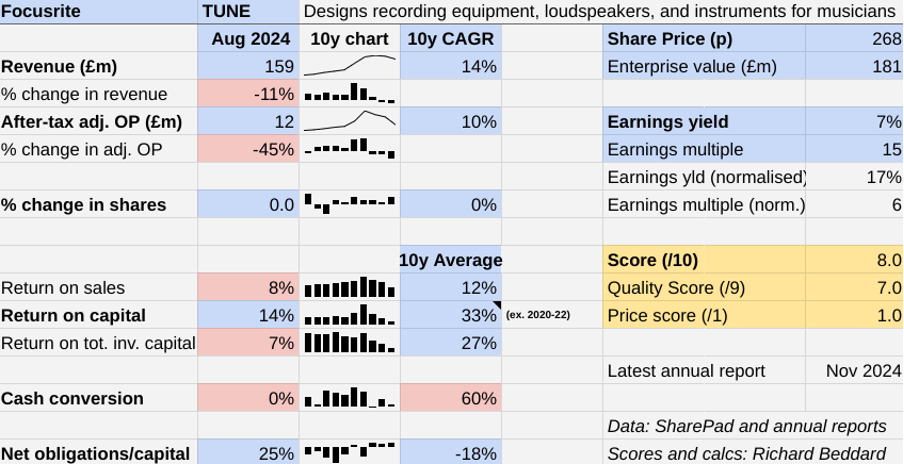

That year, after-tax adjusted profit reached its all-time high and the company’s return on capital was over 100%. Three years later, profit has fallen by more than 50%, near to levels last seen in 2019.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Heavy investment in acquisitions and new products mean Focusrite’s capital base has expanded. Return on capital (ROC) in 2024 was 14%, the lowest level of profitability Focusrite has achieved since it floated in 2014.

Comparing the company’s performance in 2024 to recent years, though, is misleading. The pandemic heightened demand for its biggest products to levels we are unlikely to see again.

Comparing Focusrite to the years before the pandemic is also of limited use, because it has been transformed by acquisitions since then.

Tricky.

Scoring Focusrite: where’s the growth?

Despite the acquisitions, Focusrite’s main brand remains the eponymous Focusrite range of digital interfaces. These devices, including its biggest product, Scarlett, connect instruments to computers so musicians can record and edit music.

Revenue from Focusrite fell by about 30% in the year to August 2024. Revenue from Sequential, a maker of high-end synthesisers acquired in 2021, fell by a similar proportion.

Other parts of the business grew or are treading water, but they were unable to make good these declines, and overall revenue fell 11% in 2024.

The Past (dependable) [2]

- Profitable growth: Long-term growth, medium-term contraction [0.5]

- Strong finances: Weak cash flow recently [0.5]

- Through thick and thin: Lowest Return on Capital 14% (2024) [1]

In more straightened times fewer musicians are stumping up for expensive high-end synthesisers, and the Focusrite brand is suffering the mother of all pandemic hangovers.

Having splurged on kit to keep themselves occupied during the pandemic, musicians are less keen to buy it now. Compounding the problem, Focusrite’s resellers and retailers had stocked up to meet the pandemic demand. Ever since, they have been running down stock in preference to buying more from Focusrite.

The launch of the fourth generation of Scarlett to acclaim early in the financial year ought to have boosted profit more than it did, but the industry-wide slump in demand caught Focusrite out.

It had high inventories of the earlier model 3 to sell, which it discounted. Although product registrations held up, many of them were for the older, cheaper model.

- Two stocks backed for more success in 2025

- Stockwatch: is this a transformative deal for UK small-cap?

Focusrite says it is inherently cash generative, but that has not been my impression since the pandemic.

In cash terms, Focusrite barely broke even in 2024 when £15.7 million of capital expenditure all but wiped out £15.8 million of operating cash flow.

Laudably, much of the capital expenditure was the capitalised cost of developing new products, which will underpin future growth if the products succeed in the market.

Focusrite is circumspect about its immediate prospects, though. While the industry is stabilising, economic and geopolitical instability is putting pressure on consumer spending, and costs.

The Present (distinctive) [3]

- Discernible business: Leading audio brands [1]

- With experienced people: Founder still on board, CEO is experienced [1]

- That creates value for customers: Quality, support, ease of use [1]

Focusrite designs equipment for musicians, podcasters and broadcasters.

The Focusrite brand is the mainstay of the Content Creation division. Scarlett is sold worldwide and probably has a market share of more than 30%.

Other brands make synthesisers, grooveboxes and monitor speakers, which are used in home and professional recording studios.

The smaller Audio Reproduction division is Martin Audio, which Focusrite acquired in 2019. Martin Audio makes sound systems comprising loudspeakers and amplifiers for concerts, festivals, and venues such as churches and clubs. This business struggled during the pandemic when gatherings were forbidden, but is growing again now.

The company’s most recent acquisitions, costing just £3 million in total, add “immersive sound” technologies to Martin Audio’s stable.

Focusrite has built its prosperity on removing the barriers to creativity by making its equipment easy to use and providing high levels of support. It outsources much of its manufacturing to contract manufacturers, principally in China.

The Content Creation division supplies distributors and retailers, and sells direct to musicians and podcasters, but the Audio Reproduction division has a different set of customers. Rental and installation companies buy the sound systems, and work with systems integrators to install them.

For most of its 35-year history, the company’s founder Phil Dudderidge ran the business. Still a 33% shareholder, he stepped down as an executive in 2022 but remains as non-executive chair.

Tim Carroll has been chief executive since 2017.

The Future (directed) [2]

- Addressing challenges:Brand maturity, China dependency [0.5]

- With coherent actions: Product development, acquisitions [0.5]

- That reward all stakeholders fairly: run by enthusiasts, NPS scores [1]

Focusrite is a conundrum. Despite the collapse in profit since 2021, it has grown revenue and profit at double-digit compound annual growth rates (CAGR) since it floated in 2014.

It would be very easy to write off the pandemic boom and subsequent bust by assuming that Focusrite will pick up where it left off in 2019.

But the company is a much more complex business than it was.

No doubt part of its motivation for acquiring businesses was the maturity of the Focusrite brand. Scarlett has been a market leader for the past 12 years, and it is not expected to significantly increase Scarlett's market share.

Two data points this year cast doubt on the value of the acquisition strategy though. The first is the £5 million impairment of Sequential's intangible asset value, one of its acquisitions.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Insider: heavy buying after big falls at two FTSE 350 stocks

The company no longer expects to earn as much profit from Sequential as it anticipated when it acquired the business (and another brand Oberheim, which it subsequently acquired and folded into Sequential).

Since the intangible assets are the capitalised cost of the acquisitions, essentially it overpaid.

The company’s ROTIC (Return on Total Invested Capital) might be telling us the same thing. This compares profit to capital invested in the business including the value of acquired intangible assets at their original purchase cost. ROTIC was 7% in 2024, which is not adequate to justify the purchase cost.

Instincts are treacherous, but my instinct is that 2024 is a bad year, and 2025 may be no better, but if we are patient, profit will improve - taking ROTIC with it.

Not only is Focusrite a different business to the business that started 2019, it is operating in a different economic environment.

When the world was more peaceful, manufacturing in China was advantageous because Focusrite’s long-standing relationships with manufacturers provided high-quality products at low cost.

That is less obvious today, as the war in the Ukraine and the Middle East disrupts the global economy, increasing manufacturing and shipping costs, and the new US administration brings with it the prospect tariffs on Chinese goods.

Focusrite says it is working with its Chinese manufacturing partners to dual source production in China and a mix of other countries.

Currently Martin Audio products are manufactured in China and the UK, and Sequential’s are manufactured in China and the US. Focusrite says it is confident it will achieve a second source for its biggest product line (presumably Scarlett) in Malaysia.

How readily Focusrite could transfer more production to these sites if trade becomes less free remains to be seen.

- Stockwatch: a cheap way to secure Aviva’s 8% yield?

- Shares for the future: an uncommonly profitable company

What a difference a year makes. When I reviewed Focusrite last time, I was more positive about it. My whiplash moment happened mid-year, when the drip-drip of profit warnings made me circumspect.

One thing has not changed though, and over the long term this may be the most important thing. Focusrite still portrays itself as a company of enthusiasts designing equipment for enthusiasts.

It publishes Net Promoter Scores (NPS) to back its people-focused assertions up. Net promoter scores are based on one-question surveys that ask whether an individual would recommend the company to a friend or colleague.

Positive is good, negative is bad. The range is -100 to 100. Focusrite's employees give it a score of 33. Its customers give it a score of 70.

You can buy Focusrite Scarlett on Amazon for £165. 43,970 customer reviews give it 4.7/5.

The price (discounted?) [1]

- Yes. A share price of 268p values the enterprise at about £181 million, 6 times normalised profit.

A score of 8 implies Focusrite is a good long-term investment.

It is ranked 8 out of 40 shares in my Decision Engine.

21 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Supplies kitchens to small builders | 8.8 | ||

4 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

5 | Manufactures computers, battery packs, radios. Distributes components | 8.4 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.4 | ||

8 | Focusrite | Designs recording equipment, loudspeakers, and instruments for musicians | 8.0 | |

9 | Manufacturer of scientific equipment for industry and academia | 7.9 | ||

10 | Sells hardware and software to businesses and the public sector | 7.7 | ||

11 | Flies holidaymakers to Europe, sells package holidays | 7.6 | ||

12 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.6 | ||

13 | Manufactures filters and filtration systems for fluids and molten metals | 7.5 | ||

14 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

15 | Manufactures/retails Warhammer models, licences stories/characters | 7.5 | ||

16 | Whiz bang manufacturer of automated machine tools and robots | 7.4 | ||

17 | Sells promotional materials like branded mugs and tee shirts direct | 7.2 | ||

18 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | ||

19 | Distributes essential everyday items consumed by organisations | 7.2 | ||

20 | Manufactures vinyl flooring for commercial and public spaces | 7.1 | ||

21 | Translates documents and localises software and content for businesses | 7.0 | ||

22 | Manufactures natural animal feed additives | 6.9 | ||

23 | Online marketplace for motor vehicles | 6.9 | ||

24 | Online retailer of domestic appliances and TVs | 6.9 | ||

25 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.8 | ||

26 | Surveys and distributes public opinion online | 6.5 | ||

27 | Operates tenpin bowling and indoor crazy golf centres | 6.4 | ||

28 | Supplies vehicle tracking systems to small fleets and insurers | 6.4 | ||

29 | Retails clothes and homewares | 6.3 | ||

30 | Acquires and operates small scientific instrument manufacturers | 6.3 | ||

31 | Manufactures military technology, does research and consultancy | 6.1 | ||

32 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.9 | ||

33 | Publishes books, and digital collections for academics and professionals | 5.8 | ||

34 | Manufactures sports watches and instrumentation | 5.5 | ||

35 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

36 | Manufactures disinfectants for simple medical instruments and surfaces | 5.4 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 4.9 | ||

38 | Runs a network of self-employed lawyers | 4.7 | ||

39 | Develops and manufactures hygiene, baby, and beauty brands | 4.4 | ||

40 | Manufactures specialist paper, packaging and high-tech materials | 3.7 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Focusrite and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.