Shares for the future: this profit machine must grow faster

A reliable profit generator, this company scores full marks for its business, quality and experience, but analyst Richard Beddard isn’t entirely happy. Here’s why.

8th November 2024 15:33

by Richard Beddard from interactive investor

This year’s James Halstead (LSE:JHD) annual report opens with the heartfelt obituary of Geoffrey Halstead, grandson of the founder. He died in August,

James Halstead was originally a textile manufacturer, but Geoffrey Halstead nurtured Polyflor, the vinyl flooring part of the business.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

As Polyflor grew in significance, he oversaw the divestment of other businesses and soon after the turn of the millennium, it was entirely focused on vinyl flooring.

The man who succeeded him as chair in 2017, signed off his final annual report this year. In Anthony Wild’s 23 years as non-executive board member, the company grew revenue by nearly 300% and profit by more than 500%.

Scoring James Halstead: former glories

In terms of revenue growth, it has been a game of two halves though.

The Past (dependable) [2.5]

- Profitable growth: Very profitable, little growth [0.5]

- Strong finances: Net cash, cash generative [1]

- Through thick and thin: Lowest Return on Capital 31% in 2020 [1]

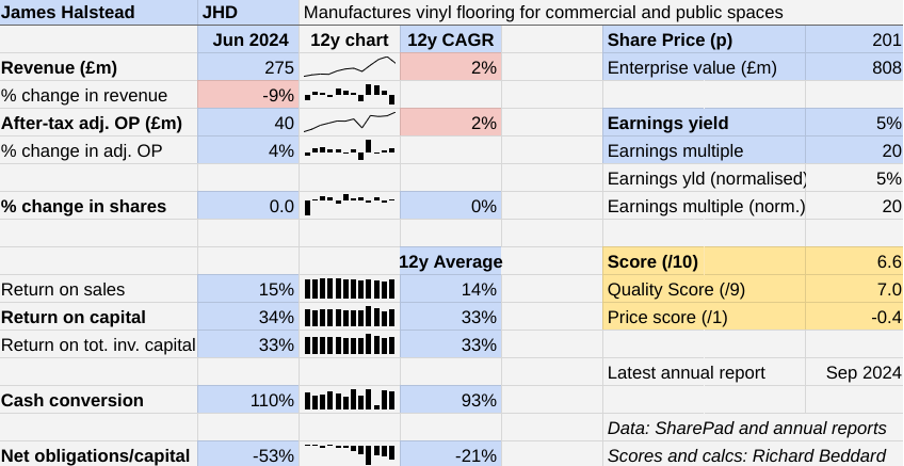

My spreadsheet going back 12 years shows the second half. And while every other aspect of James Halstead’s finances is impressive, the growth rate is very modest.

For the year to June 2024, James Halstead posted a 9% revenue decline. It reported weak demand in the UK and Europe, its biggest markets, due to lower construction activity and deferred spending due to high inflation and the energy crisis. Cash strapped flooring distributors in the UK reduced stock to control costs.

The surge in revenue growth post-pandemic has largely been reversed, and James Halstead’s long-term compound annual growth rate (CAGR) remains about 2%.

Profit increased because of price increases. Lower shipping rates at the start of the financial year also helped, although these have risen again due to further disruption to trade routes. The company also says it ran its plants for longer hours, increasing volumes and boosting efficiency.

- Share Sleuth: performance over 15 years, and a share sale

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

While growth is reliably low, the business churns out profit very reliably.

Return on capital has hardly varied over the past 12 years, despite the ructions we have experienced. The 34% return on capital achieved in 2024 is typical, even though it is only a few points higher than the low point experienced during the first year of the pandemic. Then James Halstead earned a 31% return on capital.

That profit, I should say, is unadulterated by adjustments. It is almost matched by cash flow. In other words, we can have a lot of confidence in the numbers.

The Present (distinctive) [3]

- Discernible business: Specialist manufacturer of vinyl flooring [1]

- With experienced people: Very [1]

- That creates value for customers: Quality, availability [1]

James Halstead makes sheet vinyl flooring in the UK. It also sells luxury vinyl tile, some made here and some sourced from China and Taiwan. It sells worldwide, but its biggest market is its home market (UK, 40% of revenue in 2024), followed by Europe and Scandinavia (36% of revenue).

Mostly you will walk on Polyflor in the corridors of buildings such as schools, hospitals and shops, where sheet vinyl is valued because it is hygienic, durable and easy to clean.

But among the big name projects James Halstead namechecks in this year’s annual report is the Star of the Seas, a mega cruise ship being built in Finland for Royal Caribbean. It also floored corporate headquarters, a five-star resort, and a university campus in places as far flung as Namibia and Ukraine.

Vinyl flooring is made from PVC, which James Halstead buys from large European petrochemical companies, in the main.

Because PVC is derived from oil, many environmentalists dislike it. James Halstead is at pains to point out its durability and recyclability, though. It is a by-product of oil, so it can be described as a sustainable material at least for as long as petrol is produced.

The company co-founded Recoflor, a UK vinyl take-back scheme, and this year started a similar scheme in Australia.

- Trump victorious: these UK stocks are also big winners

- What ‘unpleasant shock’ means for world’s biggest drug company

It describes its business as simple, to sell vinyl flooring to distributors and “understand, motivate and cajole” them to service end users and contractors. It does this through a global salesforce that provides technical and design support, and brings custom to its distributors.

This year, James Halstead increased the number of presentation stands it installed for distributors of Colonia, commercial grade flooring that is also sold into the residential market. It also offered end customers cash back to drive them away from competitor ranges and distributors’ own products.

This article started with an obituary of the company’s life president Geoffrey Halstead, and the retirement of its chair. But it was his grandfather who liked to say: “Quality is when the customer comes back, not the product.”

In a sense, everything is changing now.

Mark Halstead, Geoffrey’s son and chief executive since 2002 will become executive chair at the forthcoming AGM. Gordon Oliver, finance director since 1999, and group financial controller before that, is the new chief executive. And David Drillingcourt, who joined as an accountant in 1996 and has served as finance director of Polyflor, company secretary, and corporate development director, is the new finance director.

So, in another sense, a continuity candidate has been installed in every position and, probably, nothing has changed.

The Future (directed) [1.5]

- Addressing challenges:Growth, sustainability [0.5]

- With coherent actions: More of the same [0.5]

- That reward all stakeholders fairly: Could be more forthcoming [0.5]

Following a lull due to shortages of parts and labour, James Halstead has stepped up investment in its UK plants to improve operating and energy efficiency, but the company says little else about strategy leaving me to conclude it is “more of the same”.

There are risks. James Halstead’s sluggish record of growth suggests it may have reached a limit.

I wonder whether James Halstead already has a strong market position at home, and the further from home it sells, the less competitive it is. The sheet vinyl it manufactures here can be expensive to ship.

Secondarily perhaps, it is a one-product company, and that product is derived from oil. Alternative polymer feedstocks are available, James Halstead says, but they require more energy to manufacture.

Its policy is to be more efficient and make the case for vinyl, a case that seems reasonable to me.

The price (discounted?) [-0.4]

- No. A share price of 201p values the enterprise at about £808 million, 20 times normalised profit.

A score of 6.6 out of 10 implies James Halstead, while a decent business, is pretty average in terms of Decision Engine shares for its long-term investment potential.

It is ranked 30 out of 40 shares.

22 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Supplies kitchens to small builders | 8.7 | ||

4 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

5 | Distributor of protective packaging | 8.4 | ||

6 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.0 | ||

7 | Manufacturer of scientific equipment for industry and academia | 8.0 | ||

8 | Flies holidaymakers to Europe, sells package holidays | 7.8 | ||

9 | Whiz bang manufacturer of automated machine tools and robots | 7.7 | ||

10 | Manufactures/retails Warhammer models, licences stories/characters | 7.7 | ||

11 | Manufactures filters and filtration systems for fluids and molten metals | 7.7 | ||

12 | Surveys and distributes public opinion online | 7.6 | ||

13 | Manufactures computers, battery packs, radios. Distributes components | 7.5 | ||

14 | Designs recording equipment, loudspeakers, and instruments for musicians | 7.5 | ||

15 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

16 | Manufactures military technology, does research and consultancy | 7.4 | ||

17 | Distributes essential everyday items consumed by organisations | 7.3 | ||

18 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | ||

19 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.1 | ||

20 | Sells promotional materials like branded mugs and tee shirts direct | 7.1 | ||

21 | Translates documents and localises software and content for businesses | 7.0 | ||

22 | Manufactures natural animal feed additives | 7.0 | ||

23 | Sells hardware and software to businesses and the public sector | 6.8 | ||

24 | Online marketplace for motor vehicles | 6.8 | ||

25 | Online retailer of domestic appliances and TVs | 6.7 | ||

26 | Operates tenpin bowling and indoor crazy golf centres | 6.6 | ||

27 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.3 | ||

28 | Supplies vehicle tracking systems to small fleets and insurers | 6.2 | ||

29 | Retails clothes and homewares | 6.2 | ||

30 | James Halstead | Manufactures vinyl flooring for commercial and public spaces | 6.1 | |

31 | Acquires and operates small scientific instrument manufacturers | 6.0 | ||

32 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 6.0 | ||

33 | Publishes books, and digital collections for academics and professionals | 5.7 | ||

34 | Manufactures sports watches and instrumentation | 5.6 | ||

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | ||

36 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 5.0 | ||

38 | Runs a network of self-employed lawyers | 4.6 | ||

39 | Develops and manufactures hygiene, baby, and beauty brands | 4.4 | ||

40 | Manufactures specialist paper, packaging and high-tech materials | 3.7 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.