Shares for the future: a new top 10 stock

After being rescored following recent results, this company has raced 19 places up the list of 40 stocks compiled by analyst Richard Beddard. Here’s what his Decision Engine looks like now.

6th September 2024 15:04

by Richard Beddard from interactive investor

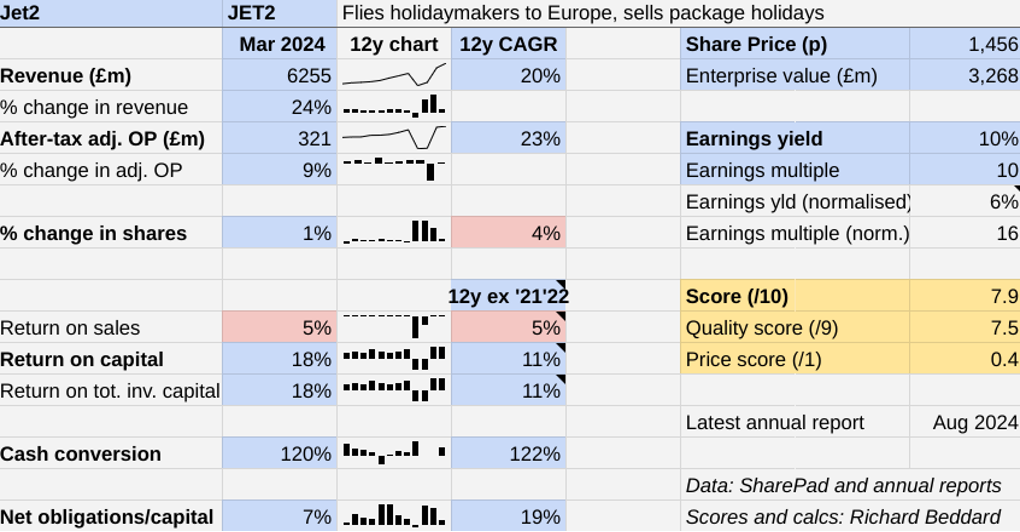

After a remarkable recovery from the pandemic in 2023, package tour operator and leisure airline Jet2 Ordinary Shares (LSE:JET2) achieved another strong set of results in the year to March 2024.

Revenue grew 24%, and adjusted after-tax operating profit grew 9%.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Scoring Jet2: building resilience

The airline has only recently celebrated its 21st birthday. The more profitable package holiday arm, Jet2holidays, is not yet 18.

The Past (dependable) [2.5]

- Profitable growth: 20% plus CAGR in revenue and profit [1]

- Strong finances: Modest net financial obligations [1]

- Through thick and thin: Lowest RoC (ex. Pandemic) 8% [0.5]

Yet over the last 12 years Jet2 has increased revenue at a Compound Annual Growth rate (CAGR) of 20% and profit at a CAGR of 24%. It is a £6 billion revenue business.

Because its customers pay for flights and holidays in advance, Jet2 typically earns more in cash flow than it does in profit.

Although it cannot rely on the customer’s money for investment (it will be used up in flying the flights), at the end of the financial year £1.3 billion of the £3.2 billion cash on its balance sheet was its own, as opposed to customer deposits.

Strong finances are essential if the company is to continue to finance the modernisation and expansion of its fleet and other investments critical to growth and efficiency.

It is also necessary to survive the occasional shock. Jet2’s policy is to maintain a cash buffer of between £600 and £700 million of “own money”, which is almost as much cash as flowed out of Jet2 in the crisis year of 2021.

- Share Sleuth: how I decided to make this double trade

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

I use a firm’s average return on capital over a representative period as a proxy for the returns a firm might earn in a typical future year.

But Jet2 made heavy losses during the pandemic years. The impact on airlines was so extreme that, I think, including the loss-making years of 2021 and 2022 distorts the averages and risks underestimating Jet2’s potential.

Excluding those years, Jet2’s normalised return on capital is 11%, although it was much higher in 2023 and 2024, when it achieved 18% return on capital.

Even though Jet2’s lowest non-pandemic Return on Capital in the last twelve years was a modest 8%, this 11% average may still underestimate Jet2’s potential.

It may be a better company now, than it was.

The Present (distinctive) [3]

- Discernable business: Family friendly package holidays [1]

- With experienced people: Founder still owns 17%, experienced execs [1]

- That creates value for customers: A friction-free holiday [1]

Jet2 is probably a better business since the pre-pandemic years partly because a greater proportion of revenue (81% in 2024) comes from package holidays, which are more profitable than tickets on their own.

It is also selling a lot more of them, having become the UK’s biggest operator, as judged by the number of passengers its ATOL licence permits.

It lived by its own high-minded values during the pandemic, retaining most of its staff and topping up the government’s furlough payments. This was costly, but it meant it was in a better position than many rivals to respond to the chaotic conditions of 2022 when airports reopened.

It also burnished its reputation for good customer service by refunding cancelled flights promptly.

TUI AG (XETRA:TUI1) is the UK’s second-biggest package tour operator but it is much more diversified than Jet2, which flies almost exclusively to the Mediterranean and European cities.

Online travel agents such as listed firm On The Beach Group (LSE:OTB) combine, sometimes not altogether coherently, with low-cost airlines like Ryanair to provide package holidays.

But Jet2 is unique in integrating package tours so tightly with a scheduled airline. It flies its holidaymakers from its own airport slots in its own planes, giving it more control of the product.

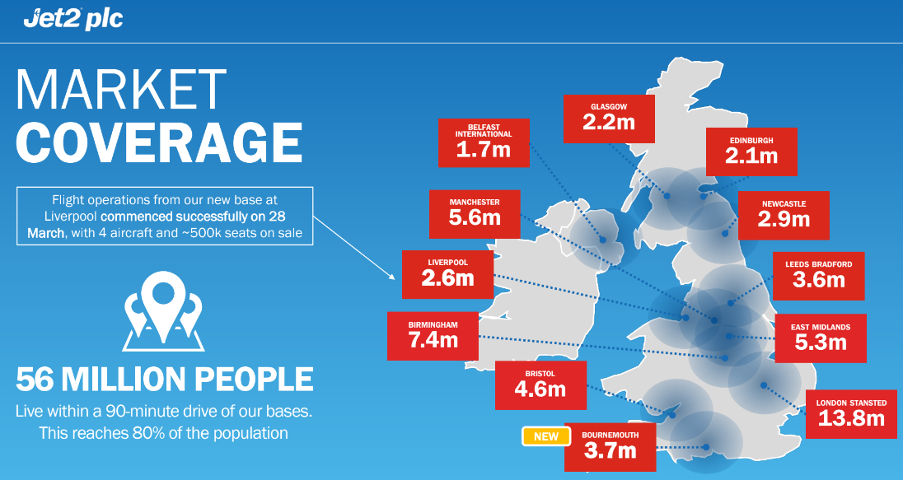

The company’s ethos is built around the notion that a family holiday should be hassle free, so it ensures its planes fly at convenient times, provides generous baggage allowances and offers flights from 11, soon to be 12, regional destinations.

Source: full-year results presentation 2024. The 12th base, Bournemouth, will be operational from February 2025.

It is the quality of the experience that brings people back. Jet2 says 60% of package holiday customers and 54% of flight-only customers have travelled before in the previous 25 months.

Control over the product goes beyond owning the planes.

It starts with booking. Almost 80% of bookings are through the company’s own channels, its website, app, and contact centre. Its apps are rated 4.7/5 on Google and 4.8/5 on Apple.

At seven of its 11 UK bases Jet2 does its own ground handling. It operates engineering facilities, and employs over 1,200 in resort-helpers

In October 2023, Jet2 opened its Retail Operations Centre, an industry first. The centre stocks and distributes drinks, ambient food, fragrances and beauty products for passengers.

- 24 UK stocks to benefit from buoyant economy

- Stockwatch: a FTSE 100 share worth owning for near 10% yield

Jet2 has bought a stake in a waste-to-fuels plant, Fulcrum NorthPoint, which will supply it with its first dribbles of Sustainable Aviation Fuel (SAF).

Founder Philip Meeson stepped down in 2023, but Stephen Heapy, chief executive, and Gary Brown, chief financial officer, have more than a decade’s experience each as board members. Heapy joined in 2009 as managing director of Jet2holidays and chief operating officer of Jet2, He became chief executive in 2020.

The customer focus is apparent to anyone reading the annual report, but there is external validation too. The UK Customer Satisfaction Index (UKCSI) ranks Jet2 fourth out of 275 large UK firms. The company routinely wins the plaudits of Which?

The Future (directed) [2]

- Addressing challenges: Climate change [0.5]

- With coherent actions: Investment in fuel efficiency and new fuels [0.5]

- That reward all stakeholders fairly: “People, service, profit” mantra [1]

Rather like Games Workshop Group (LSE:GAW) (scored last week), I think Jet2 resolves challenges by internalising them. Let down by a company that vets new airside staff in 2022, it took on the job itself.

This self-sufficiency, Jet2 calls it resilience, is the basis of its customer appeal, and its ability to respond to crises like the pandemic and wildfires so efficiently.

According to the latest ATOL statistics, Jet2 is licensed to carry 6.7 million package holiday passengers or 21% of the total for the top 250 licence holders. This compares to Tui (18%), We Love Holidays (12%), and Booking.com, easyJet Holidays and On The Beach (all on 7%).

Jet2 should be able to grow its share of a slowly growing market, but for one risk that cannot be internalised: climate change.

First, it must reduce emissions principally related to burning jet fuel because aviation is a significant contributor to climate change.

Second, as we witness wildfires and water shortages, some of its destinations are becoming more inhospitable.

The problem is there is only so much a company can do.

Jet2 expects to receive 146 new A321neo aircraft between 2023 and 2035. This it says is the most flexible, fuel efficient and sustainable aircraft in its class.

It will use a 1% SAF blend at Stansted, Bristol and Malaga from Summer 2024, it is retrofitting some planes with winglets to make them more fuel efficient, and it has electrified 50% of ground handling equipment.

These measures can best be described as a well intentioned start. By 2035, Jet2 is targeting reductions in Scope 1 and 2 emissions (those it is directly responsible for) of 35%.

But SAF’s efficacy is disputed. It produces emissions when it is burnt, just like ordinary fuel, and in its production. There is not enough waste to supply the aviation industry, which means using crops like corn grown on land that might otherwise be used for growing food. There may not be enough land.

Long-term airlines are reliant on the advancement of unproven technologies, principally hydrogen to propel planes. There will be many hurdles to overcome.

Jet2’s mantra, “People, Service, Profits” reminds me of another uniquely self-sufficient businesses’ mantra: “Worthwhile for all concerned.”

That one belongs to Howden Joinery Group (LSE:HWDN), a kitchen supplier that over a similar time period to Jet2 has grown an even greater market share.

The stats bear out Jet2’s people focus. It has the highest rating on recruitment site Glassdoor of all its peers (4.0/5), and its chief executive has an 89% approval rate. Staff vote by not moving their feet, Jet2’s permanent colleague retention rate is 93%.

No doubt a 9% pay rise from March 2023 and a rise of 5.5% from March 2024 encouraged them to stay, along with the company’s popular ShareSave scheme which allows employees to buy shares at 20% discount.

The price (discounted?) [0.4]

- A little. A share price of £14.56 values the enterprise at about £3.3 billion, 16 times normalised profit.

A score of 7.9 implies Jet2 is a good long-term investment.

It is ranked ninth out of 40 shares in my Decision Engine.

20 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Cohort (LSE:CHRT), Goodwin (LSE:GDWN) and Cropper (James) (LSE:CRPR) have all published annual reports and are due to be re-scored.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.9 | ||

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | ||

3 | Imports and distributes timber and timber products | 9.0 | ||

4 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

5 | Distributor of protective packaging | 8.4 | ||

6 | Supplies kitchens to small builders | 8.3 | ||

7 | Whiz bang manufacturer of automated machine tools and robots | 8.2 | ||

8 | Manufactures/retails Warhammer models, licences stories/characters | 7.9 | ||

9 | Jet2 | Flies holidaymakers to Europe, sells package holidays | 7.9 | |

10 | Manufactures filters and filtration systems for fluids and molten metals | 7.9 | ||

11 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.9 | ||

12 | Manufacturer of scientific equipment for industry and academia | 7.8 | ||

13 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

14 | Surveys and distributes public opinion online | 7.3 | ||

15 | Sources, processes and develops flavours esp. for soft drinks | 7.3 | ||

16 | Sells hardware and software to businesses and the public sector | 7.2 | ||

17 | Distributes essential everyday items consumed by organisations | 7.1 | ||

18 | Manufactures computers, battery packs, radios. Distributes components | 7.0 | ||

19 | Translates documents and localises software and content for businesses | 7.0 | ||

20 | Manufactures natural animal feed additives | 7.0 | ||

21 | Sells promotional materials like branded mugs and tee shirts direct | 6.9 | ||

22 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 6.9 | ||

23 | Manufactures vinyl flooring for commercial and public spaces | 6.9 | ||

24 | Online marketplace for motor vehicles | 6.6 | ||

25 | Manufactures specialist paper, packaging and high-tech materials | 6.5 | ||

26 | Operates tenpin bowling and indoor crazy golf centres | 6.5 | ||

27 | Online retailer of domestic appliances and TVs | 6.5 | ||

28 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.4 | ||

29 | Retails clothes and homewares | 6.2 | ||

30 | Supplies vehicle tracking systems to small fleets and insurers | 6.1 | ||

31 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 6.0 | ||

32 | Manufactures sports watches and instrumentation | 5.8 | ||

33 | Acquires and operates small scientific instrument manufacturers | 5.8 | ||

34 | Publishes books, and digital collections for academics and professionals | 5.7 | ||

35 | Manufactures military technology, does research and consultancy | 5.6 | ||

36 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

37 | Manufactures disinfectants for simple medical instruments and surfaces | 5.4 | ||

38 | Makes marketing and fraud prevention software, sells it as a service | 4.9 | ||

39 | Runs a network of self-employed lawyers | 4.5 | ||

v Frozen v | ||||

? | Develops and manufactures hygiene, baby, and beauty brands | 7.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Jet2 and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.