Shares for the future: this new stock wins a place in my list

After deciding to jettison four companies from his Decision Engine, analyst Richard Beddard names one of the replacements which he thinks is a good long-term investment.

28th February 2025 15:03

by Richard Beddard from interactive investor

Last November, I introduced Dunelm Group (LSE:DNLM) as a potential replacement for Next (LSE:NXT), the token retailer in my Decision Engine.

Now I have decided to score it, to see if it deserves a place.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Scoring Dunelm: specialist with scale advantage

Homeware and furniture retailer Dunelm published its results for the half year to December 2024 earlier this month. Pre-tax profit was flat, reflecting low consumer confidence and cost inflation.

The company does not expect much of an improvement in the second half of the year, foreseeing flat revenue and a modest increase in profit for the year to June 2025.

The Past (dependable) [2.5]

- Profitable growth: Single-digit revenue and profit growth [0.5]

- Strong finances: Strong cash flow, affordable obligations [1]

- Through thick and thin: Lowest return on capital 14% in 2018 [1]

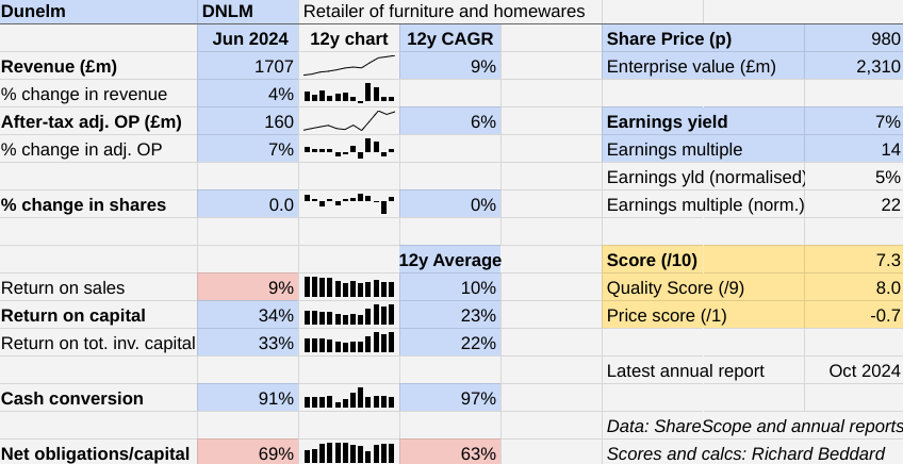

However, Dunelm is a strong performer over the longer term. The table shows the state of play at the end of the year to June 2024.

Revenue has grown at a compound annual growth rate (CAGR) of 9% over the past year. Profit growth has lagged it slightly because for much of the past decade, Dunelm did not grow profit.

It is tempting to conclude that the pandemic accelerated growth. We did spend more on our homes when we were trapped in them, but I doubt this is the only factor. The uptick in growth began before the pandemic started, and while revenue has flatlined, it has not subsided after it.

- Trading Strategies: a FTSE 100 cyclical share to tuck away

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

I think the coincidental development of Dunelm’s online capabilities has brought it new customers and engaged existing customers more.

While net financial obligations are above 50% of operating capital, which is usually a no-no, they are roughly equivalent to two years of cash flow after capital expenditure.

Dunelm can afford these financial commitments. In December and June, the company had no bank debt. The obligations are capitalised lease obligations, often the unavoidable cost of operating stores in shopping centres and retail parks.

Rather than offset its obligation to pay rent with a large cash surplus, the company has routinely chosen to pay shareholders special dividends. The latest will be paid in April.

The Present (distinctive) [3]

- Discernible business: UK’s biggest furniture and homeware retailer [1]

- With experienced people: Adderley family interest [1]

- That creates value for customers: Quality, choice, value [1]

Dunelm traces its origins back to a curtain stall run by Bill and Jean Adderley at a market in Leicester 45 years ago. They opened their first store 40 years ago, but it was under the management of their son, Sir Will Adderley, in the 1990s that the store expansion really got under way.

Sir Will stepped down after a second stint as chief executive in 2015, but he remains an executive board member and owns or controls the majority of the Adderley family’s controlling 38% shareholding.

As a Dunelm lifer, the keeper of the company’s family culture, and a seasoned chief executive who has worked closely with his successors, he will be a key figure as Dunelm recruits and inducts a new chief executive to replace Nick Wilkinson, who is retiring.

Today Dunelm bills itself as “The Home of Homes”. It is the UK’s biggest furniture and homewares retailer. It operates 198 stores across the UK and Ireland, most of them incorporating coffee shops.

Rivals such as Ikea, Next, John Lewis and major supermarkets tend to be more diversified.

The Future (directed) [2.5]

- Addressing challenges:Distant possibility of saturation in UK [0.5]

- With coherent actions: More products, more stores, more online [1]

- That reward all stakeholders fairly: Employee friendly [1]

The company’s ethos is to “act like owners” by investing for the long term. Its strategy is to build on its scale and reputation by developing more and better products, increasing custom and operating efficiently.

Mostly, Dunelm sells its own brands, providing quality at all price points. Towels, for example, sell in nine “value tiers”, from £4 to £24.

The company controls product development through an in-house design team that works with long-term suppliers, famous designers, and intellectual property holders such as the Natural History Museum.

The aim is to make bold, long-lasting, sustainable products like its modular “Full Circle” Austin sofas. These can be taken apart for recycling when they die. The LED component of Dunelm’s Aurora lighting range can be replaced as easily as an incandescent bulb.

In some product categories, the company is taking control of the product further by vertically integrating manufacturing. In 2022 it acquired Sunflex, a manufacturer of curtain tracks, poles and blinds, and it is introducing shutters manufactured by Sunflex this year.

Dunelm is generating more custom by opening more stores, and by making incremental improvements to elements of its online proposition, principally search, personalisation, the promotion of trendy products, and its click and collect service.

There is room for improvement. Judging by Dunelm’s generally good Trustpilot reviews, click and collect is a source of customer dissatisfaction because sometimes the product is not there to collect.

Surprisingly too, there is no Dunelm app, although it is coming later this year.

Dunelm’s commitment to online shopping is less than a decade old, kicked off by the acquisition of Worldstores, an online retailer, out of administration in 2016. Over the following years, Dunelm repurposed Worldstore’s technology and delivery fleet to serve the group.

This enabled the impressive growth of online sales, which increased from 7% of total revenue to 37% of total revenue at the end of 2024. By my calculation, store revenue grew only 11% over the past eight years and its contribution has shrunk from 93% of total revenue to 63%.

While the market has grown, Dunelm’s growth has increased its market share, according to GlobalData, from 5.1% to 7.8% over five years, implying it is a formidable competitor.

- Stockwatch: is another retailer in takeover territory?

- Shares for the future: four stocks facing the axe from my top 40

Store growth of five to 10 new stores per year was augmented by the acquisition of Home Focus last November. Home Focus is a chain of small curtain, bedding and fabric stores in Ireland, Dunelm’s first outside the UK.

Dunelm is gradually introducing some of its own ranges into Home Focus bricks-and-mortar stores and online.

It is also being creative at home. The company opened its first store in inner London just before Christmas at Westfield Shopping Centre in Shepherd’s Bush. Like about half its openings these days, the new store has a smaller format than the ones we are used to in retail parks.

When companies experiment with smaller formats and overseas stores, they may be motivated by the prospect of diminishing returns from rolling out existing formats at home. If this is true, at least Dunelm is addressing the risk.

It reminds me of Howden Joinery Group (LSE:HWDN), which has a much larger share of an adjacent market. Howdens is in some ways the anti-Dunelm. To oversimplify, Dunelm supplies everything for the home minus the kitchen and bathroom units, Howdens supplies the cabinetry.

Howdens has been experimenting with smaller formats and overseas stores for years. It seems to have made a success of smaller stores and its Irish expansion.

The numbers largely bear out Dunelm’s claim to have a superior culture, instilled by Sir Will. Employee retention in 2024 was 89%, up from 87% the previous year, which is impressive for a company that pays most of its staff by the hour.

Dunelm uses the employer Net Promoter Score (eNPS) method to measure employee engagement but does not disclose the actual score. While the eNPS has declined over the past two years, the company says it is above the sector average, and it is working to improve it.

Among the measures taken in 2024, Dunelm introduced a £10,000 life assurance package and added data literacy to its many training and development schemes.

Small things like this suggest to me a good company in a strong competitive position is trying to get better.

The price (discounted?) [-0.7]

- No. A share price of 980p values the enterprise at about £2.3 billion, 22 times normalised profit.

Normalised profit is the profit Dunelm would have earned had it earned its average return on capital of 23% in 2024 instead of the 34% it actually earned.

It may underestimate the value of the business if the recent uplift in profitability is not a flash in the pan.

A score of 7.3 implies Dunelm is a good long-term investment.

Although Next is probably on its way out of the Decision Engine, as I foreshadowed last week, I need to find a replacement for XP Power Ltd (LSE:XPP) sooner. I have replaced XP Power with Dunelm. The quest for replacements for the other at-risk shares continues...

Dunelm is ranked 19 out of 40 shares in the Decision Engine.

24 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Supplies kitchens to small builders | 8.8 | ||

4 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.7 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Manufactures computers, battery packs, radios. Distributes components | 8.4 | ||

8 | Manufacturer of scientific equipment for industry and academia | 8.2 | ||

9 | Repair and maintenance of rail, road, water, nuclear infrastructure | 8.2 | ||

10 | Flies holidaymakers to Europe, sells package holidays | 8.1 | ||

11 | Designs recording equipment, loudspeakers, and instruments for musicians | 8.0 | ||

12 | Whiz bang manufacturer of automated machine tools and robots | 8.0 | ||

13 | Manufactures vinyl flooring for commercial and public spaces | 7.6 | ||

14 | Operates tenpin bowling and indoor crazy golf centres | 7.5 | ||

15 | Sells hardware and software to businesses and the public sector | 7.5 | ||

16 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.5 | ||

17 | Distributes essential everyday items consumed by organisations | 7.5 | ||

18 | Manufactures/retails Warhammer models, licences stories/characters | 7.4 | ||

19 | Dunelm | Retailer of furniture and homewares | 7.3 | |

20 | Manufactures filters and filtration systems for fluids and molten metals | 7.3 | ||

21 | Online marketplace for motor vehicles | 7.1 | ||

22 | Sells promotional materials like branded mugs and tee shirts direct | 7.0 | ||

23 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.0 | ||

24 | Surveys and distributes public opinion online | 7.0 | ||

25 | Sources, processes and develops flavours esp. for soft drinks | 6.8 | ||

26 | Online retailer of domestic appliances and TVs | 6.8 | ||

27 | Manufactures natural animal feed additives | 6.7 | ||

28 | Supplies vehicle tracking systems to small fleets and insurers | 6.6 | ||

29 | Translates documents and localises software and content for businesses | 6.5 | ||

30 | Acquires and operates small scientific instrument manufacturers | 6.4 | ||

31 | Retails clothes and homewares | 6.3 | ||

32 | Manufactures military technology, does research and consultancy | 6.2 | ||

33 | Publishes books, and digital collections for academics and professionals | 6.0 | ||

34 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.8 | ||

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.6 | ||

36 | Manufactures sports watches and instrumentation | 5.5 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 5.2 | ||

38 | Runs a network of self-employed lawyers | 4.9 | ||

39 | Develops and manufactures hygiene, baby, and beauty brands | 4.4 | ||

40 | Manufactures specialist paper, packaging and high-tech materials | 3.8 |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.