Shares for the future: my view of Bunzl after share price crash

A rare profit warning from the FTSE 100 distribution giant has caused analyst Richard Beddard to rerun the numbers. Here’s how he scores the business now.

17th April 2025 14:34

by Richard Beddard from interactive investor

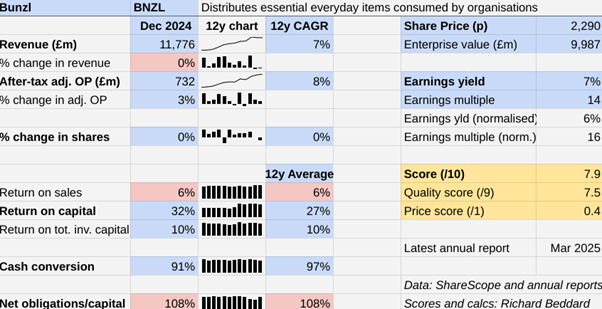

Despite a record amount spent on acquisitions, distributor Bunzl (LSE:BNZL)’s results for the year to December 2024 were sub-par.

Bunzl tends to have good years and not bad years, like 2024. Over the long term that amounts to a decent track record. A trading update on Wednesday has muddied the waters though.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Scoring Bunzl: Old faithful chokes

Revenue was flat in 2024, and adjusted profit grew 3%, although the company reported 3% revenue growth at constant exchange rates and 7% growth in company adjusted profit, also at constant exchange rates.

The Past (dependable) [2.5]

- Profitable growth: Mid to high single digit CAGRs [1]

- Strong finances: Strong cashflow, high debt to capital [0.5]

- Through thick and thin: Lowest Return on Capital (RoC): 21% in 2018 [1]

Revenue from Bunzl’s established operations contracted, especially in North America, where demand from grocers and retailers was weak.

This contraction was outweighed by the contribution of 13 new acquisitions. Bunzl remained highly profitable and cash generative.

The ratios highlighted in pink, are features of the business rather than things we should necessarily worry about. An after-tax profit margin of 6% reflects the fact that Bunzl distributes low value items in high volumes.

The stability of revenue and profit allows Bunzl to borrow to fund acquisitions, which explains why financial obligations are so high relative to operating capital.

Both profit margins and the debt to capital ratio are bang on their historical averages, and at levels the company has thrived on for decades.

Instead of running down debt, Bunzl chose to increase the dividend and buy back shares in 2024, as it often does. It has increased the dividend every year for 32 consecutive years.

- ii view: profit warning plunges Bunzl shares to 4-year low

- Stockwatch: let’s see how tariff chaos affects company profits

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Wednesday’s trading update set a sombre tone for 2025. Bunzl suspended its share buyback programme to keep debt at the lower end of the range it deems optimal and still fund acquisitions.

It anticipated moderate revenue growth at constant exchange rates in 2025 and a reduction in operating profit margin of at least 0.3% below the 8.3% it achieved in 2024.

It looks like the best we should hope for is another not bad year, in which revenue growth is sufficient to counteract the attrition in margin and produce a flattish year for profit.

As Bunzl has already found though, 2025 is shaping up to be a very unpredictable year.

The Present (distinctive) [3]

- Discernible business: Leading distributor of everyday essentials [1]

- With experienced people: Yes [1]

- That creates value for customers: Saves them money, helps them meet environmental targets [1]

Bunzl distributes essential products that companies and organisations like hospitals and schools use in their day-to-day operations. These products, like packaging, cleaning equipment and toilet paper are not for resale.

It aims to be a ‘one stop shop’, taking care of critical but routine supplies. It saves customers money by consolidating their orders, sourcing in large volumes and holding stock for them. It helps them improve their environmental credentials by sourcing more sustainable consumables.

Bunzl can do this well because it is big and efficient. It employs over 25,000 people in more than 30 countries and earned nearly £12 billion revenue in 2024.

Much of the growth has come from a disciplined acquisition program. Since 2004 it has acquired 205 similar but smaller distributors.

The £883 million it spent on acquisitions in 2024 was a record, primarily because one of them was unusually big.

Nisbets, a UK distributor of catering equipment with operations in Ireland, Northern Europe and Austria accounted for more than half of the total, although its annual revenue is little more than 4% of Bunzl’s total revenue in 2024.

Most of Bunzl’s acquisitions form part of what chief executive Frank van Zanten calls a “string of pearls”: Small regional distributors that grow Bunzl in tiny increments. None of the twelve other acquisitions in 2024 brought Bunzl more than £50 million in annual revenue. Their annual revenues were between 0.1% and 0.4% of Bunzl’s total.

- Investing through the storm: Q&A with ii experts on market volatility

- Heavyweight investors switch from US stocks to gold and cash

The most significant of the pearls may be Panmark of Finland. Bunzl describes it as an anchor acquisition. It is Bunzl’s first in Finland and through it the company will get to know other distributors there, ultimately acquiring some of them.

Panmark supplies the cleaning and hygiene, healthcare, foodservice and safety markets, all markets Bunzl serves in other territories, so it is a promising base to build on.

Illustrating Bunzl’s diversity, its other acquisitions were in Brazil, Canada, France, the Netherlands, Spain, and Western Australia.

In addition to the markets served by Nisbets and Panmark, it acquired businesses that supply packaging products, orthopaedic medical implants and materials, mobility aids and clinical furniture.

This acquisition strategy is over two decades old. Frank van Zanten inherited it when he became chief executive in 2016, and he was already steeped in it. The family business he ran, a Dutch distributor, joined Bunzl in 1994.

The Future (directed) [2]

- Addressing challenges:Tariffs, challenges in large markets [0.5]

- With coherent actions: Acquisitions, own brands [0.5]

- That reward all stakeholders fairly: Employees agree Bunzl is a great place to work. [1]

Bunzl may be in a good position to ride out a trade war even though 56% of its revenue comes from North America, which has introduced tariffs. That is because the main target of those tariffs currently is China, and Bunzl only sources about 10% of revenue there.

It sources locally because the goods it distributes are bulky and low in value, making them expensive to transport.

When Donald Trump’s first administration introduced tariffs in 2018 and 2019, Bunzl renegotiated prices with suppliers and passed on inflationary costs to customers, who cannot really do without everyday essentials.

But economic uncertainty is reducing demand in North America, and exacerbating existing challenges in the grocery and foodservice market. Globally, these are Bunzl’s biggest markets, each responsible for more than a quarter of revenue.

- Six ways to take the fear out of investing

- Investing through the storm: Q&A with ii experts on market volatility

In pursuit of higher margins, Bunzl has invested in developing and promoting its own foodservice brands, for example in sustainable food packaging. This strategic shift has reduced volumes in North America, at least temporarily.

The company’s response is to double down by introducing more own brand products, whilst simultaneously making management changes in North America, and cutting unspecified costs.

Bunzl’s principal growth strategy remains acquisitions. It is favouring the safety, cleaning and hygiene, and healthcare markets, where it sees the greatest potential for growth. Collectively these markets are responsible for about a third of revenue.

The opportunities are more limited in grocery and foodservice, and it no longer considers retail a growth market.

In theory, the bigger Bunzl gets, the better it gets. Each acquisition has the potential to improve the business by bringing it new customers, new products, new employees, and new capabilities.

Bunzl improves the efficiency of the acquisitions by plugging them into its well-developed systems and consolidating warehouses and upgrading them with robotics.

One of Nisbets' attractions was “excellent” digital capabilities. It also has own-brands, which now account for 28% of Bunzl revenue.

Bunzl does not report employee attrition or retention rates, however it surveys employees to achieve Great Place to Work certification. According to the 2024 survey, 73% of the 81% of employees agreed Bunzl is a great place to work.

The price (discounted?) [0.4]

- Yes. A share price of £22.90 values the enterprise at about £10 billion, 16 times normalised profit.

The share price fell 25% on the Wednesday of Bunzl’s warning to close at the level reported in this article.

A score of 7.9 implies Bunzl is a good long-term investment.

It is ranked 14 out of 40 shares in my Decision Engine.

29 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Macfarlane, 4Imprint, and Judges Scientific have all published annual reports and are due to be re-scored.

I have reduced the score of 4Imprint by a point in response to the new US tariffs because the direct seller of promotional goods sources 60% of its revenue in China and earns 98% of revenue in North America.

This decision will be reviewed when I score 4 Imprint next month.

company | * | description | score | |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.9 | ||

4 | Supplies kitchens to small builders | 8.8 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Distributor of protective packaging | 8.5 | ||

7 | Whiz bang manufacturer of automated machine tools and robots | 8.4 | ||

8 | Manufacturer of scientific equipment for industry and academia | 8.3 | ||

9 | Manufactures computers, battery packs, radios. Distributes components | 8.3 | ||

10 | Repair and maintenance of rail, road, water, nuclear infrastructure | 8.2 | ||

11 | Flies holidaymakers to Europe, sells package holidays | 8.2 | ||

12 | * | Sells promotional materials like branded mugs and tee shirts direct | 8.1 | |

13 | Designs recording equipment, loudspeakers, and instruments for musicians | 8.0 | ||

14 | Bunzl | Distributes essential everyday items consumed by organisations | 7.9 | |

15 | Surveys and distributes public opinion online | 7.9 | ||

16 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.7 | ||

17 | Manufactures vinyl flooring for commercial and public spaces | 7.7 | ||

18 | Operates tenpin bowling and indoor crazy golf centres | 7.6 | ||

19 | Manufactures filters and laboratory equipment | 7.6 | ||

20 | Sells hardware and software to businesses and the public sector | 7.5 | ||

21 | Retailer of furniture and homewares | 7.4 | ||

22 | Manufactures/retails Warhammer models, licences stories/characters | 7.4 | ||

23 | Manufacturer of ventilation products | 7.4 | ||

24 | Acquires and operates small scientific instrument manufacturers | 7.2 | ||

25 | Supplies vehicle tracking systems to small fleets and insurers | 7.1 | ||

26 | Online marketplace for motor vehicles | 7.1 | ||

27 | Sources, processes and develops flavours esp. for soft drinks | 7.0 | ||

28 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.0 | ||

29 | Supplies software and services to the transport industry | 7.0 | ||

30 | Manufactures natural animal feed additives | 6.9 | ||

31 | Provides automated marketing software as a service | 6.7 | ||

32 | Online retailer of domestic appliances and TVs | 6.7 | ||

33 | Translates documents and localises software and content for businesses | 6.5 | ||

34 | Publishes books, and digital collections for academics and professionals | 6.4 | ||

35 | Manufactures sports watches and instrumentation | 5.8 | ||

36 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.8 | ||

37 | Manufactures military technology, does research and consultancy | 5.7 | ||

38 | Manufactures disinfectants for simple medical instruments and surfaces | 5.6 | ||

39 | Makes marketing and fraud prevention software, sells it as a service | 5.6 | ||

40 | Runs a network of self-employed lawyers | 4.9 |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Bunzl and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.