Shares for the future: my final scores of 2024

After making changes to his Decision Engine this year, analyst Richard Beddard reveals the 23 shares he believes are currently good value.

27th December 2024 15:02

by Richard Beddard from interactive investor

Happy Christmas!

As I write, it is not yet holiday time for me. It is Thursday 19 December, and I am powering down the Decision Engine, all the research that flows into it and the investment decisions and writing that flows out, so I can celebrate and do a bit of DIY (I am not thrilled about the DIY but needs must).

I treasure this power-down routine, because it enables me to stop feeding the engine with new research and give it the once-over.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Decision Engine 101: one number to rule them all

My investment philosophy is long term. It is “To invest in businesses I can trust to make money through thick and thin for everyone.”

Over the years these firms should:

1) Grow revenue, profit, and cashflow without borrowing heavily or issuing more shares

2) Adapt to changing circumstances

3) Delight employees, customers, suppliers and other stakeholders

I target shares like this because it helps me avoid hyperactive trading. By dint of being worthwhile and reliable, these businesses are most likely to sustain my interest for many years.

To help me decide which businesses I can trust, I score nine qualities.

Each quality receives a score of 0 (which means I do not think the business has the quality I am looking for), 0.5 (which means I am on the fence), or 1 (which means I am confident the business has the quality).

There is also a price score, which is calculated using a formula (see the technical note at the end of this article). Shares that have a low price relative to their earning power receive a positive score (up to 1) but shares that have a high price have a low score (down to -3).

The mash-up of quality and price scores gives a total score out of 10, one number that represents relative value. In theory, a share with a high score is better value if held for the long term than a share with a low score.

If you are wondering how this works in practice, here is a recent example. I score a company and publish it on interactive investor platform nearly every week. You will find an up-to-date list of Decision Engine shares near the end of this article, and nearly all of my articles.

A new scoring system

The Decision Engine started 2024 with a new scoring system, redesigned at the tail-end of 2023 with the help of readers. The old system required me to think about many of the same things as the new one, but not in a coherent enough way.

Most importantly, the old system muddled a company's business model, how it makes money and its strategy, how it is adapting to challenges to make more money.

I felt that I was scoring lists of qualities without connecting them and properly considering whether a business was moving in the right direction.

The qualities I score now are organised under three headings pertaining to the past, present and future. They score to what extent a company...

- Has a dependable financial track record, demonstrating it knows how to profit under its own steam

- Operates a distinctive business model run by experienced people that adds value

- Is directed by a fair and coherent strategy that addresses the biggest challenges it faces

It has taken all year to re-score each company in the Decision Engine because, generally, I only score shares once a year after the publication of the annual report.

The new system forces me to be more realistic. If a company’s strategy is not building on strengths and plugging weaknesses in its business model, I must admit I do not know, or doubt, whether it is going in the right direction and give it a lower score.

Admitting we don’t know is uncomfortable, but it is better than being overconfident.

Uncertainty, both my greater appreciation of it, and my impression that, due to pandemic, lockdowns, wars, shortages, and inflation, there is more of it around, have led to another change. This time in the Decision Engine process.

Mid-term re-scores

The qualities I score should be long-lived. The Decision Engine values stable finances, management teams that have many years of experience, and strategies that will deliver returns over the long term.

I re-score these qualities after a company has published its annual report because that is the one document in which companies are compelled to tell us about the risks they face and the strategies they are employing.

When I designed the first version of the Decision Engine nearly 10 years ago, I did not expect to re-score shares in between annual reports. There have, over the years, been a few times when I have lost faith in companies and I have removed them until their next annual report gave me the opportunity to score them again.

But uncertainty, and my appreciation of it, have increased. As the number of shares going to the naughty step grew, the Decision Engine began to look a bit dysfunctional.

In May, I cracked and re-scored RWS Holdings (LSE:RWS).

RWS is a translation company, with an illustrious past and an uncertain future, which seemed to have reached a critical point in its history. Its chief executive resigned after only three years.

The unexpected resignation crystallised my concerns about the challenges the chief executive had been brought in to resolve: integrating the businesses and technologies RWS had acquired.

RWS was the first of five companies that I re-scored mid-term in 2024.

While I hate re-scoring shares mid-term, it is often an admission that I failed to score the company properly in the first place, it is better to admit failures than ignore them.

2025

I hope these changes are all that is required. In 2025 I will simply crank out the research, adjust the scores, and make trades.

That’s the dream.

Next year my focus may be on improving how I gather research.

I have asked artificial intelligence to extract information from annual reports, using it as a fuzzy search engine (one that, for example, understands that profitability and return on capital can be the same thing). I have also asked it to tell me about unfamiliar industries and the positions of companies within them.

- FTSE 100’s best and worst shares of 2024

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

I have had some success, but mostly AI has frustrated me. The effort of checking its voluminous output is greater than finding things out using old-school methods.

AI is improving though, and as many of the companies I follow seem to understand, we probably need to grow with it.

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Treatt (LSE:TET) and Dewhurst Group (LSE:DWHT) have published annual reports. They are due to be rescored.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Supplies kitchens to small builders | 8.9 | ||

4 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.6 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Manufactures computers, battery packs, radios. Distributes components | 8.5 | ||

7 | Distributor of protective packaging | 8.4 | ||

8 | Manufacturer of scientific equipment for industry and academia | 8.0 | ||

9 | Designs recording equipment, loudspeakers, and instruments for musicians | 8.0 | ||

10 | Sells hardware and software to businesses and the public sector | 7.7 | ||

11 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.7 | ||

12 | Flies holidaymakers to Europe, sells package holidays | 7.7 | ||

13 | Whiz bang manufacturer of automated machine tools and robots | 7.5 | ||

14 | Manufactures/retails Warhammer models, licences stories/characters | 7.5 | ||

15 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

16 | Distributes essential everyday items consumed by organisations | 7.4 | ||

17 | Manufactures filters and filtration systems for fluids and molten metals | 7.4 | ||

18 | Sells promotional materials like branded mugs and tee shirts direct | 7.3 | ||

19 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | ||

20 | Manufactures vinyl flooring for commercial and public spaces | 7.1 | ||

21 | Translates documents and localises software and content for businesses | 7.0 | ||

22 | Online marketplace for motor vehicles | 7.0 | ||

23 | Manufactures natural animal feed additives | 7.0 | ||

24 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.9 | ||

25 | Online retailer of domestic appliances and TVs | 6.9 | ||

26 | Surveys and distributes public opinion online | 6.8 | ||

27 | Operates tenpin bowling and indoor crazy golf centres | 6.8 | ||

28 | Supplies vehicle tracking systems to small fleets and insurers | 6.6 | ||

29 | Retails clothes and homewares | 6.3 | ||

30 | Acquires and operates small scientific instrument manufacturers | 6.3 | ||

31 | Manufactures military technology, does research and consultancy | 6.1 | ||

32 | Publishes books, and digital collections for academics and professionals | 5.8 | ||

33 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.7 | ||

34 | Manufactures sports watches and instrumentation | 5.6 | ||

35 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

36 | Manufactures disinfectants for simple medical instruments and surfaces | 5.3 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 4.9 | ||

38 | Runs a network of self-employed lawyers | 4.7 | ||

39 | Develops and manufactures hygiene, baby, and beauty brands | 4.4 | ||

40 | Manufactures specialist paper, packaging and high-tech materials | 3.7 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Technical note: price score

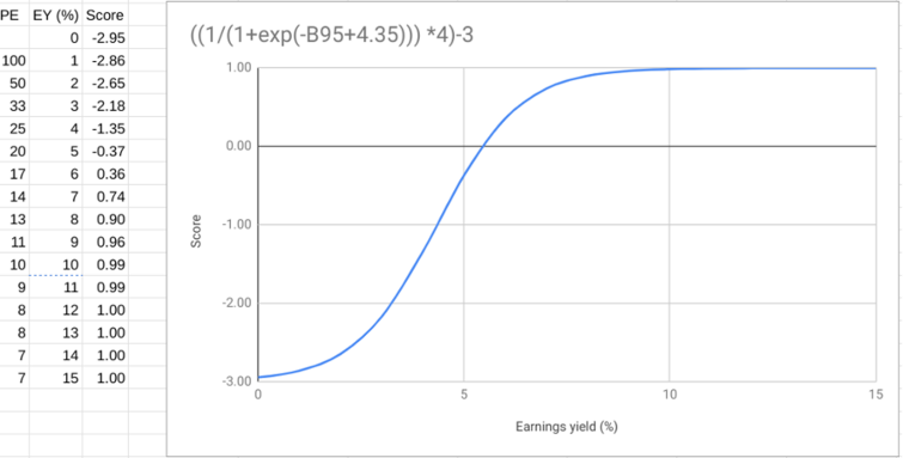

The price score uses a souped-up version of everybody’s favourite price/earnings (PE) ratio.

Unlike the other scores, it is calculated automatically every day using the previous day’s closing share prices.

My spreadsheet uses enterprise value (the value of equity and debt) instead of the more common market capitalisation (the value of equity) to put a price on the business.

It also normalises profit by determining how much the company would have earned if it had achieved an average return on the capital it employed in the last full financial year.

By dividing this average profit figure into price (enterprise value), we get a normalised earnings yield. We can translate it into a PE ratio using its reciprocal because the PE is simply price divided by profit.

The Decision Engine uses a sigmoid function to turn the earnings yield into a score. The sigmoid function produces an S-shaped curve, with the earnings yield on one axis, and the score on the other.

The table on the left of the chart shows the more common PE ratio for each earnings yield, and the score.

Any share with a PE of less than 10 (an earnings yield of more than 10%) is rewarded with a maximum price score of 1. Between a PE of 17 and a PE 20 (an earnings yield of 5) shares get a score of around 0. As the PE rises and the earnings yield falls, shares are penalised by up to a maximum of three points.

The highest possible score for a great business (maximum score 9) with a low share price (maximum score 1) is, therefore 10.

Generally, I consider a score of 7 or more to be good value, a score of between 5 and 7 to be fair value and scores of less than 5 to be poor value over the longterm.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.