Shares for the future: my biggest company and another new stock

Analyst Richard Beddard assesses the health of the largest stock in his Decision Engine, and names the share that will replace James Cropper.

14th March 2025 15:12

by Richard Beddard from interactive investor

Normally a steady grower, in the year to December 2024 Garmin Ltd (NYSE:GRMN) produced the kind of performance improvement I can only wish the Garmin Forerunner watch I wear would tell me I am making.

- Learn with ii: Top ISA Funds | How to build a FTSE Tracker ISA Portfolio | Income ISA Portfolio

Scoring Garmin: growth across all divisions

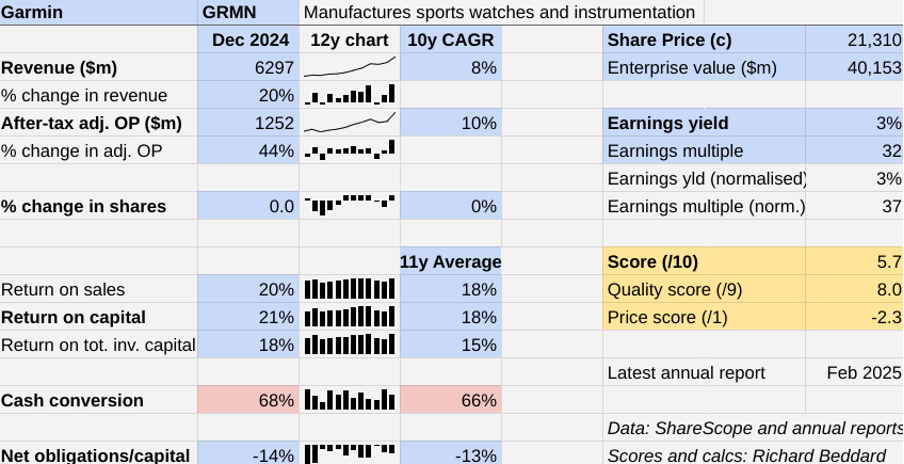

Garmin grew revenue by 20%, more than double its Compound Annual Growth Rate (CAGR) over the last 12 years. It grew adjusted profit 44%, more than four times its profit CAGR.

The Past (dependable) [3]

- Profitable growth: Profit has grown at 10% CAGR [1]

- Strong finances: More cash than financial obligations [1]

- Through thick and thin: Lowest Return on Capital 15% in 2015 [1]

The company has had more cash than financial obligations on its balance sheet at the end of each of the last 12 financial years.

The only blemish in its financial track record is slightly underwhelming cash conversion, which is explained by heavy investment in research and development and capital expenditure. This is the price of being a leading manufacturer of sophisticated technology.

Garmin anticipates $6.8 billion (£5.2 billion) revenue in 2025, 8% more than it achieved in 2024. A forecast 25% operating margin implies profit growth of 7%.

The Present (distinctive) [3]

- Discernible business: Manufacturer of location-enabled electronics [1]

- With experienced people: Very experienced board [1]

- That creates value for customers: Specialist functionality, reliability [1]

Although most of us know Garmin as a fitness watch maker and some of us may remember its previous heyday before Google Maps as a major satnav brand, it is much more than a manufacturer of fitness watches.

Founded by Gary Burrell and Min Kao (“Gar” and “Min”) in 1989 with a mission to popularise the Global Positioning System (GPS) and “change the world”, Garmin’s first products were navigation devices for planes and boats.

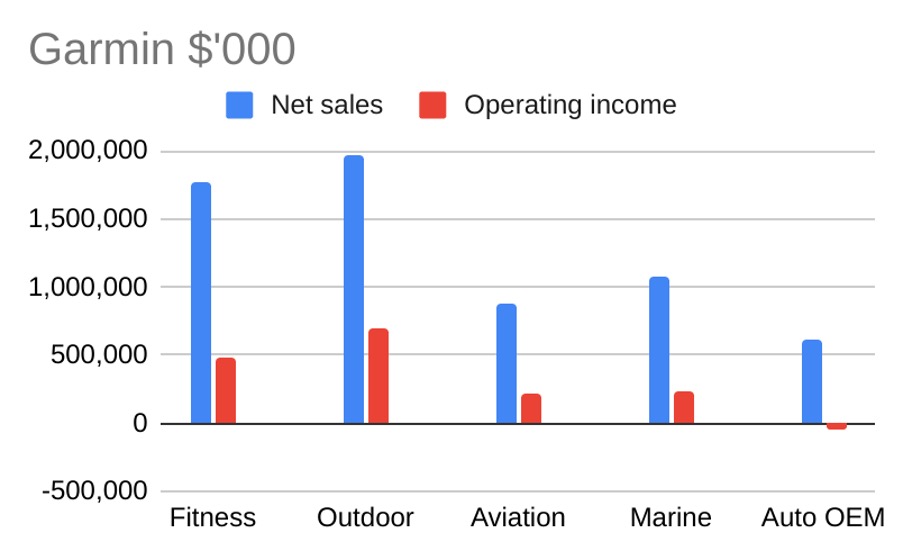

The aviation and marine divisions have grown into big businesses, with revenues of around $1 billion each.

The aviation division makes integrated flight decks and individual display, navigation, communication, weather and safety components and systems. It sells them to plane manufacturers such as Cessna and Embraer, and to distributors for retrofitting.

- The Income Investor: why I’m still a buyer despite dividend cut

- 10 shares to give you a £10,000 annual income in 2025

The marine division makes chartplotters (essentially satnavs for boats), fish finders, angling sonar, and trolling motors, which propel boats at slow speeds when, for example, they are fishing.

Recently, Garmin has bolstered the marine division with acquisitions: JL Audio, which makes speakers and amplifiers, and Lumishore, which makes LED lighting, as it seeks to integrate systems “throughout the boat”.

Garmin today has five divisions all of which are growing revenue, and four of which are highly profitable.

Its biggest and most profitable division is Outdoor, which makes specialised equipment and rugged watches. It earned revenue of nearly $2 billion in 2024 and operating profit of $703 million (44% of total operating profit).

Some of Garmin’s premium outdoor watches can operate almost indefinitely on solar power, measure things most of us do not need to measure (like altitude and depth), and send out distress signals from anywhere on the planet (which Garmin relays to emergency services).

The division also makes handheld GPS devices, satnavs, dash cams and audio systems for car and truck drivers and motorcyclists, satellite communicators, dive computers, dog tracking collars, and golf launch monitors (that record and analyse a golfer’s swing).

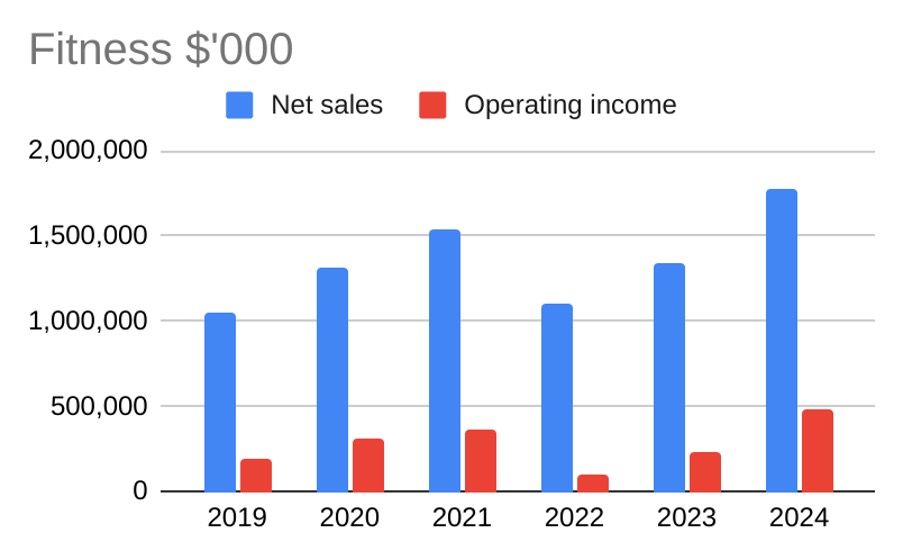

Over the last six years, the fastest-growing division in terms of profit has been Fitness, as more and more of us use these devices to measure our performance, plan and follow routes, and train, and monitor fitness trends. It has grown profit at a 17% CAGR since 2019:

The Fitness segment has not grown linearly, due to the pandemic. In 2020 and 2021, demand skyrocketed as many of us developed a sudden interest in running watches and bike computers. I was one of Garmin’s new recruits. Father Christmas delivered my Forerunner in 2020.

2022 was a hangover year, when we had new fitness watches, were not yet in the market for replacements, and shipping delays and shortages increased costs. Helped by the launch of the Forerunner 165 early in 2024, the growth trend has now fully reasserted itself.

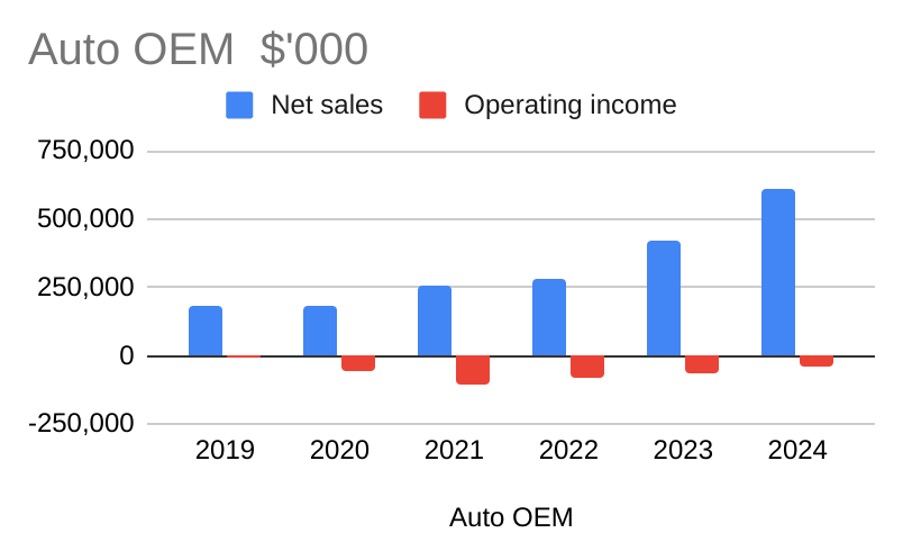

Another hallmark of Garmin is its ability to bear pain. Its fifth division, Auto OEM, has been losing money since at least 2018, which is the earliest year Garmin reported its performance.

The good news is revenue in this division is growing strongly, faster than at any other division, while losses have been shrinking since 2021:

The Auto OEM division supplies vehicle manufacturers and their suppliers with infotainment systems and domain controllers.

Domain controllers are computing units that manage in-cabin systems like displays, audio and navigation. Garmin is lead supplier to BMW, and as Garmin domain controllers have rolled out across BMW’s models, sales have ramped up.

Behind Garmin’s success is a huge commitment to product development. The company consistently reports research and development expenditure of 16 or 17% of revenue and claims over 1,000 patents.

It seeks to minimise dependence on third parties throughout the processes of design, manufacture and distribution because it believes the consequent know-how makes it more efficient, speeds up development time, and guarantees quality.

Two chief executives have turned Garmin into a $6 billion revenue company over the past 35 years. The incumbent, Cliff Premble, joined in 1989 as a software developer. He was one of the company’s first employees and took the top job in 2013.

The other was Min Kao, one of the founders. He is executive chair.

The Future (directed) [2]

- Addressing challenges:Volume manufacturing in Taiwan, maturing wearables market? [0.5]

- With coherent actions: Innovation [0.5]

- That reward all stakeholders fairly: Well-paid, motivated workforce [1]

Vertical integration is the company’s great strength. As well as retaining know-how in-house, it creates an abundance of opportunities for Garmin’s well-paid workforce.

It may also be a significant weakness.

Garmin’s volume manufacturing is done in its Taiwanese factories. Taiwan is a geopolitical hotspot. It is claimed by China and also a close commercial and military partner of the US. Garmin warns that deteriorating relations with China could severely disrupt its operations. The nightmare scenario is that China takes Taiwan by force, as it has threatened.

Garmin has manufacturing facilities to help with product development or manufacture lower volume products in other parts of the world, including Southampton in the UK (where it opened its first UK retail store in 2024). But it has not diversified its volume manufacturing footprint.

- What to expect from the 2025 Spring Statement

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

No doubt this is because relocating would be extraordinarily expensive and time-consuming to achieve. Garmin has a massive skilled workforce in Taiwan, and an established supply chain.

The risk to this huge asset makes scoring Garmin very difficult. Rival fitness watch manufacturers are either Chinese or, like Apple, dependent on Chinese manufacturing, and share many of the same risks.

However, Garmin demonstrates how almost any investment in businesses that make technology could be derailed by geopolitical events, which are escalating in frequency and severity.

Other risks seem small, because Garmin controls what it can control.

The acceleration of Garmin’s growth in recent years has been driven by demand for wearables.

Reportedly Apple dominates smartwatch shipments but comparing the Apple Watch or even a Fitbit to a Garmin watch is like comparing a Swiss Army Knife to a hunting knife or fishing knife or a butcher’s cleaver. Garmin’s large range is made up of products individually optimised for runners, triathletes, mountaineers, divers, polar explorers, and golfers, and extends way beyond wearables.

There is also competition from Chinese manufacturers like Huawei and Xiaomi, but Garmin’s commitment to innovation reassures me that it will continue to make competitive products.

Demand for wearables will moderate eventually, as they become commonplace, but Garmin will surely continue to improve how we use technology to help us move and improve, as it has in the past.

The price (discounted?) [-2.3]

- No. A share price of $230 values the enterprise at about $40 billion, 37 times normalised profit.

A score of 5.7 implies Garmin may be a good long-term investment, but it is probably fairly priced. I like everything about it except its exposure to the rivalry between China and the US and its high share price.

It is ranked 37 out of 40 shares in my Decision Engine.

26 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

I have replaced the 40th-ranked share prior to this update, Cropper (James) (LSE:CRPR), with Volution Group (LSE:FAN), which is ranked 20. I scored James Cropper last October and Volution last November.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Supplies kitchens to small builders | 9.1 | ||

3 | Imports and distributes timber and timber products | 9.0 | ||

4 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.7 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Manufacturer of scientific equipment for industry and academia | 8.3 | ||

8 | Repair and maintenance of rail, road, water, nuclear infrastructure | 8.3 | ||

9 | Whiz bang manufacturer of automated machine tools and robots | 8.2 | ||

10 | Flies holidaymakers to Europe, sells package holidays | 8.0 | ||

11 | Designs recording equipment, loudspeakers, and instruments for musicians | 8.0 | ||

12 | Distributes essential everyday items consumed by organisations | 7.9 | ||

13 | Manufactures computers, battery packs, radios. Distributes components | 7.7 | ||

14 | Sells hardware and software to businesses and the public sector | 7.7 | ||

15 | Manufactures vinyl flooring for commercial and public spaces | 7.7 | ||

16 | Operates tenpin bowling and indoor crazy golf centres | 7.7 | ||

17 | Surveys and distributes public opinion online | 7.6 | ||

18 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.6 | ||

19 | Manufactures filters and filtration systems for fluids and molten metals | 7.5 | ||

20 | Manufacturer of ventilation products | 7.5 | ||

21 | Manufactures/retails Warhammer models, licences stories/characters | 7.4 | ||

22 | Retailer of furniture and homewares | 7.4 | ||

23 | Online marketplace for motor vehicles | 7.3 | ||

24 | Sells promotional materials like branded mugs and tee shirts direct | 7.2 | ||

25 | Supplies software and services to the transport industry | 7.0 | ||

26 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.0 | ||

27 | Acquires and operates small scientific instrument manufacturers | 6.9 | ||

28 | Sources, processes and develops flavours esp. for soft drinks | 6.9 | ||

29 | Manufactures natural animal feed additives | 6.9 | ||

30 | Online retailer of domestic appliances and TVs | 6.8 | ||

31 | Publishes books, and digital collections for academics and professionals | 6.6 | ||

32 | Translates documents and localises software and content for businesses | 6.5 | ||

33 | Supplies vehicle tracking systems to small fleets and insurers | 6.2 | ||

34 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.8 | ||

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.8 | ||

36 | Manufactures military technology, does research and consultancy | 5.8 | ||

37 | Garmin | Manufactures sports watches and instrumentation | 5.7 | |

38 | Makes marketing and fraud prevention software, sells it as a service | 5.4 | ||

39 | Runs a network of self-employed lawyers | 4.8 | ||

40 | Develops and manufactures hygiene, baby, and beauty brands | 4.4 |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports.

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Garmin and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.