Shares for the future: most high-scoring stocks since January

29th October 2021 14:56

by Richard Beddard from interactive investor

Our companies analyst reveals his updated list of top shares, which includes more high-scoring companies than at any time in the past nine months. But Richard is uncertain about one former favourite.

My worries last month about high share prices and consequently the low scores of shares ranked by my Decision Engine have been realised by a sell-off of sorts. Prices have come down, and so more Decision Engine shares appear to be attractively valued.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Generally, I consider shares on a score of 7 or more out of 9 to be good value and 5 to 7 out of nine to be probably worth holding for the long-term. These are arbitrary guidelines, determined by experience.

- Read more Richard Beddard articles here

- Wild’s Winter Portfolios 2021: winners revealed

- Check out our award-winning stocks and shares ISA

This month, 14 shares score 7 or more out of 9 including some names, like Quartix (LSE:QTX), that have not been this attractively priced for quite some time. Last month, the number was 11. The previous month it was 10.

0 | Company | Description | Score |

1 | Manufactures military technology, does research and consultancy | 8 | |

2 | Manufactures pushbuttons and other components for lifts and ATMs | 8 | |

3 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 8 | |

4 | Imports and distributes timber and timber products | 8 | |

5 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 7 | |

6 | Manufactures power adapters for industrial and healthcare equipment | 7 | |

7 | Supplies kitchens to small builders | 7 | |

8 | Designs and manufactures tableware, candles and reed diffusers | 7 | |

9 | Publishes books and online resources for academics and professionals | 7 | |

10 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7 | |

11 | Retails clothes and homewares | 7 | |

12 | Manuf's rugged computers, battery packs, radios. Distributes electronics | 7 | |

13 | Manufactures personal care and beauty brands | 7 | |

14 | Supplies vehicle tracking systems to small fleets and insurers | 7 | |

15 | Acquires and operates small scientific instrument manufacturers | 6 | |

16 | Manufactures/retails Warhammer models, licenses stories/characters | 6 | |

17 | Manufactures filters and filtration systems for fluids and molten metals | 6 | |

18 | Distributes essential everyday items consumed by organisations | 6 | |

19 | Manufactures specialist paper, packaging and high-tech materials | 6 | |

20 | Manufactures natural animal feed additives | 6 | |

21 | Supplies schools with equipment and IT, and exam boards with e-marking | 6 | |

22 | Manufactures tableware for restaurants and eateries | 6 | |

23 | Manufactures and distributes fasteners and other low cost components | 6 | |

24 | Whiz bang manufacturer of automated machine tools and robots | 6 | |

25 | Manufactures vinyl flooring for commercial and public spaces | 6 | |

26 | Translates documents and localises software and content for businesses | 6 | |

27 | Supplies software and services to the transport industry | 5 | |

28 | Sells promotional materials like branded mugs and tee shirts direct | 5 | |

29 | Manufactures respiratory protection equipment and body armour | 5 | |

30 | Develops and integrates Customer Data Platforms | 5 | |

31 | Manufactures disinfectants for simple medical instruments and surfaces | 5 | |

32 | Sources, processes and develops flavours esp. for soft drinks | 5 | |

33 | Sells hardware and software to businesses and the public sector | 5 | |

34 | Designs recording equipment, loudspeakers, and instruments for musicians | 5 | |

35 | Develops marketing automation software | 5 | |

36 | Casts and machines parts for vans and trucks, primarily | 5 | |

37 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 5 | |

38 | Operates tenpin bowling and indoor crazy golf centres | 5 | |

39 | Manufactures connectivity components and power cord | 4 | |

40 | Flies holidaymakers to Europe, sells package holidays | 4 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with an asterisk* score less than 5 out of 6 for Profitability, Risks and Strategy. They are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

As always, the shares are scored using five factors, profitability, risks, strategy, fairness and price.

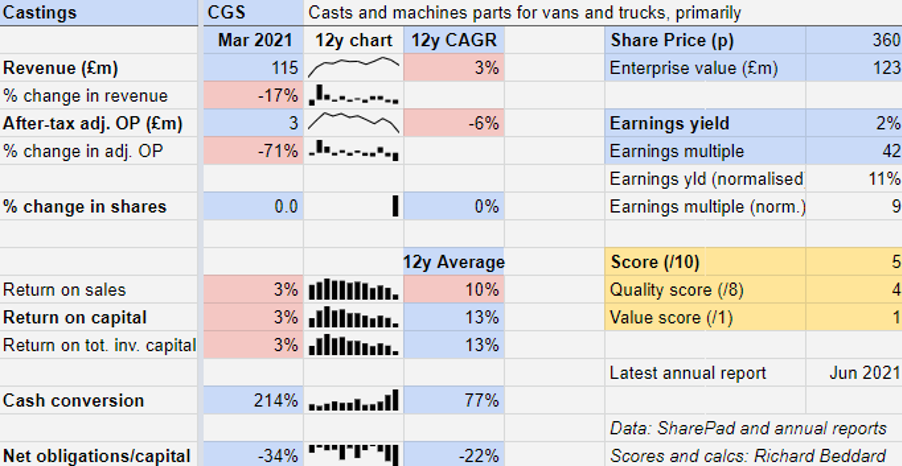

Scoring Castings

I have been putting off scoring Castings (LSE:CGS) because I am resigned to the fact that much as I respect the company for its financial prudence, clean accounts and sheer staying power, there are equally compelling reasons to be wary of the share.

When I scored Castings last year, the shares were cheap relative to normalised profit but, apart from price, I did not score Castings highly in any category. Nothing really has changed.

Short-term prospects good

The company makes good money most of the time, but profitability has been in decline for years, a trend that accelerated due to the pandemic and will no doubt improve after it, at least for as long as there is pent-up demand for heavy commercial vehicles.

Past performance is not a guide to future performance

After that, though, I wonder if the pattern of declining returns will reassert itself.

Castings casts, machines, and assembles parts for truck manufacturers in the main. Its speciality, the activity it has done since it commissioned its first foundry in Walsall in 1835, is casting. This business is very profitable and highly skilled.

In response to demands from its main customer Scania, in 1996 Castings acquired CNC Speedwell, a machine shop. Before then truck manufacturers often bought raw castings from Castings and machined them in their own factories.

In ridding themselves of the cost and hassle, truck manufacturers saddled Castings and other suppliers with it, and the company has often struggled to profit from machining. In recent years losses at CNC Speedwell have dragged on the group’s profit.

In the short term there is a positive story to tell. The company believes CNC Speedwell would have returned to profit in 2021 had it not been for the pandemic and there is high demand for trucks (though the high cost of steel scrap, energy, and transportation is a problem).

With prudent finances and a big cash surplus Castings has weathered the pandemic well.

Long-term prospects uncertain

Over the long term, there is more uncertainty for a variety of reasons.

The first is Castings’ failure to profit reliably from machining. A knowledgeable correspondent tells me casting is an art and Castings is very good at it. Perhaps this explains its profitability.

Machining these days is computer controlled, and the way to get an edge is to invest in the latest machines, which is a bit of an arms race that may be benefitting the machine manufacturers more than the users.

It seems as though Castings views machining as a service it must offer customers otherwise it might lose their casting business, which tells us something about the power dynamic in the relationship between customer and supplier.

However, Castings says its willingness to manufacture small batches using high-tech machinery has won it work rivals just do not want to do.

- Bill Ackman: an industry as certain as food and oxygen

- Bill Ackman: hot sectors and the economy in 2022

- Bill Ackman: why I've bet $100 billion on this event

Over 70% of sales are earned from four truck manufacturers. The good news here is that the number has gone up from three, as Daimler (XETRA:DAI) has joined Scania, Volvo (OMX:VOLV B) and DAF as one of Castings’ major customers over the last decade.

All four of these companies are headquartered in the EU (although much of Daimler’s business comes from its US subsidiary Detroit Diesel). That may put some of Castings’ long-standing relationships at greater risk in the event of trade frictions now that we have left the EU.

The parts required by commercial vehicles are also likely to change as the industry adopts electric powertrains, which will use fewer, lighter components probably made from aluminium.

Castings makes about a third of its revenue from engine components, and some of this will be jeopardised if manufacturers’ ambitions to switch substantially to electric powertrains over the next decade or two come true. If they choose hydrogen instead, as some are planning to, the risk may be lower.

Castings hopes to pick up business as it seeks to provide more of the components in trucks and if other foundries and machine shops leave the shrinking market for iron parts. But it is also seeking to partner with or acquire a business that can manufacture aluminium parts.

Trinity of risks

This trinity of risks, the inability (so far) to profit reliably from machining, the concentration of customers, and the possibility that Castings might have to acquire wholly new capabilities to prosper as the amount of iron in commercial vehicles shrinks, takes the edge of the investment for me.

Does the business make good money? [1]

+ Cash conversion has improved

? Return on capital on declining trend

? Average profit margin is modest

What could stop it growing profitably? [1]

? Failure to turn CNC Speedwell into a profit centre

? Loss of a major customer

? Electrification of commercial vehicles

How does its strategy address the risks? [1]

? Company has not explained how it can profit from machining

? Seeks to increase contribution to major customers’ platforms

? Considering acquiring aluminium capability for EV part production

Will we all benefit? [1]

+ Highly trained and experienced workforce

? Experienced management may be be stuck in a rut

? Communications with shareholders could provide more detail

Is the share price low relative to profit? [1]

? Yes. Profit in 2021 was depressed by the pandemic. A share price of 360p values the enterprise at £123 million, less than 10 times normalised profit.

A score of five out of nine means Castings may be a good long-term investment but I am uncertain.

The company’s short-term prospects are probably good, but it is the long term I am interested in.

Maybe it is time to drop Castings from the Decision Engine, to open up a slot for company that has a less cloudy future.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.