Shares for the future: a mid-table stock with long-term potential

An incredible recovery from the pandemic has seen this well-run small company win big orders and the share price hit a record high. Analyst Richard Beddard explains why he likes the business.

9th August 2024 15:00

by Richard Beddard from interactive investor

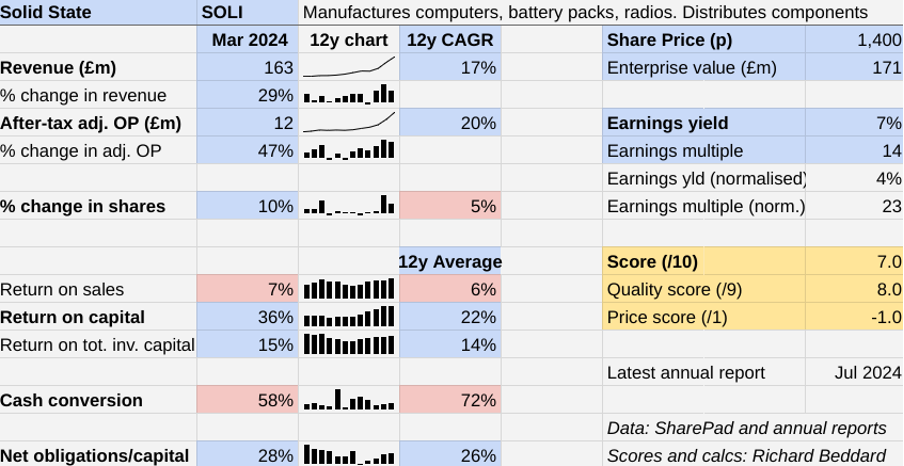

Although you would not notice from the headline results, the year to March 2024 marked the end of a pandemic boom for Solid State (LSE:SOLI).

Between 2020 and 2023, customers stocked up on electronic components and systems, but in 2024, the de-stocking began, reducing revenues in Solid State’s Components division.

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

It goes almost unnoticed because Solid State’s Systems division, the business that assembles battery packs, rugged computer systems and communications equipment, for example, delivered a huge order from the NATO Support and Procurement Agency (NSP).

NATO wanted radio communications gear pronto.

Scoring Solid State: war dividend

The order, which brought in about a fifth of Solid State’s total revenue, was worth £33 million and increased the Systems division’s revenue by 80%.

Components supplies electronic parts to manufacturers of defence, industrial, transport and medical equipment. Its revenue contracted 13% and it eked out a minuscule adjusted operating profit.

The Past (dependable) [3]

- Profitable growth: Double-digit revenue and profit growth [1]

- Strong finances: Modest financial obligations [1]

- Through thick and thin: Lowest return on capital 13% (2016) [1]

The Systems division is invariably the most profitable, and in 2024 it earned substantially more revenue than the Components division, so it was a bonanza year.

Group revenue increased 29%, adjusted after tax operating profit increased 47%, operating profit margins were 1% above the long-term average and return on capital was well above average at 36%.

Cash returns were only 58% of profit though. A strong end to the year meant that Solid State funded a working capital outflow of £5.6 million due to products delivered but not yet paid for. Much of that cash has been received in the first quarter of 2025.

Solid State also invested, improving its UK battery facility, enhancing its test and measurement capabilities and rolling out a software system in its Components division. The cost of investment is deducted in full from cash flow, but it has less impact on profit because it is depreciated over a number of years.

The bonanza is not going to continue. In 2025, revenue will contract.

De-stocking continues in the Components division, but it should turn around now it has closed down an inefficient and recently acquired production line in the US and as it wins new orders.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Share Sleuth: why I’ve halved my largest position

The Systems division will experience a hangover, though. Solid State anticipates significant growth in defence business in the medium term, but the amount of communications equipment delivered in 2024 is too hard an act to follow in 2025.

The company expects to achieve £142.6 million revenue in 2025, 13% below 2024 but 13% higher than in 2023, and 112% higher than in the year to March 2020.

Probably because of contraction in the more profitable Systems division and recovery in the less profitable Components division, Solid State anticipates a bigger fall in adjusted pre-tax profit of 33%.

This would still be more than double the profit Solid State achieved in 2020.

The Present (distinctive) [2.5]

- Discernible business: Technology for harsh environments [0.5]

- With experienced people: Very experienced board [1]

- That creates value for customers: Know-how, trust, reliability [1]

For a long time, Solid State has specialised in providing technology for harsh environments. Supplying this technology requires specialist accreditations, either because, like lithium in batteries, it is hazardous, or because the technology will handle sensitive information. Sometimes multiple accreditations are required, which limits competition.

The Systems division focuses on rugged computer systems, vision systems, custom battery packs, and radio communications systems. This year’s annual report highlights marine computing systems, drones, and rail transportation systems, which require all of the System division’s main technologies.

The Components division distributes franchised brands and Solid State’s own brands. It also provides services like sourcing and stocking obsolete components.

Solid State says distributing components as well as assembling them into bespoke products gives the company greater market knowledge, and more ways to service customers.

The customers are often the biggest manufacturers, companies such as BAE Systems (LSE:BA.), Airbus SE (EURONEXT:AIR), Honeywell International Inc (NASDAQ:HON) and Siemens AG (XETRA:SIE), who, Solid State says, prefer to work with suppliers they know well.

- Massive UK tax grab would be biggest of its kind in Europe

- Is this new type of ISA the one for you?

- Prospects for IHT under new Labour government

There are at least two reasons to believe Solid State is a good supplier. The first is that it was able to supply during the pandemic, sometimes paying in advance to secure stock for customers, who often paid in advance too. The second is the experience of the board, especially Gary Marsh, who joined the company in 1986 and became managing director in 2002.

He has overseen the acquisition of 13 businesses since Solid State acquired Steatite that year, and two decades of growth.

He says the company’s 55 engineers help differentiate Solid State. They work with customers to choose components and design them into products. Of course, Solid State can also assemble them into products and sub-systems, if they wish.

The good news is that the engineers seem happy to work at Solid State. Employee retention was 92% in 2024.

The Future (directed) [2.5]

- Addressing challenges:Competition, complexity [0.5]

- With coherent actions: Self-similar acquisitions, broadening portfolio, own brands [1]

- That reward all stakeholders fairly: Employee focus, Sensible executive remuneration [1]

Graduate recruitment and developing career paths for employees is the first of four strategic pillars at Solid State. The others are straight out of the playbook for distributors and customisers.

The company is broadening its portfolio of components and systems built from common components, developing its own brands, and seeking to sell all this further afield.

To broaden the portfolio, it is signing up more franchise brands to distribute, especially in the US.

Defence revenue reached 44% of the total in 2024, and a planned investment in a new “Integrated Systems” business unit in Tewkesbury will help ensure defence revenue remains significant. This unit will assemble the more complex systems being demanded by defence customers.

To counterbalance the growing importance of defence revenue, Solid State is targeting medical equipment manufacturers, which have similar complex needs like accreditation, and requirements for “longstanding credibility”. Solid State earned 10% of revenue from medical customers in 2024.

Own-brand components tend to be more profitable than franchised brands, and so too are semi-custom systems like battery packs. These are products made from common components assembled in custom configurations, which are relatively easy to design and build.

- Stockwatch: has a ‘Minsky moment’ in stock markets been averted?

- Biggest FTSE 100 losers in awful August 2024

The result of these strategies, Solid State hopes, is an increase in operating profit margin from a currently, perhaps already elevated 10.4%, to 12% by 2030 (the figures do not tally with the figures in my table because I calculate all ratios after corporation tax of 25%).

As well as these organic strategies, Solid State can acquire brands, capabilities and geographical diversification. It is the product of 13 acquisitions since 2002 and, judging by its Return on Total Invested Capital (ROTIC) of 15%, these have been good investments.

Solid State says it focuses on similar businesses to itself, which has been a recipe for success. Not only has it grown profitably, it earned more revenue outside the UK than it did inside it for the first time in 2024.

I have deducted only half a point for complexity. As Solid State grows and seeks higher margins, the business is becoming more complex, exemplified by the requirement for a new business unit to integrate complex systems.

Its semi-custom assembly was once described to me as like building models from Lego, but if the models are becoming more complex, more can go wrong.

Recent acquisitions may also be misfiring in the US, which would help explain both a restructuring of the Components division there, its poor performance in 2024, and a strategic focus on finding new franchises to distribute.

Unfortunately, the annual report does not discuss the performance of the division at the operating level.

The price (discounted?) [-1]

- No. A share price of £14.00 values the enterprise at about £171 million, 23 times normalised profit.

A score of 7 out of 10 indicates that Solid State is probably a good long-term investment.

It is ranked 20 out of 40 shares in my Decision Engine.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.8 | ||

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | ||

3 | Supplies kitchens to small builders | 8.6 | ||

4 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

5 | Distributor of protective packaging | 8.3 | ||

6 | Whiz bang manufacturer of automated machine tools and robots | 8.1 | ||

7 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.9 | ||

8 | Manufactures filters and filtration systems for fluids and molten metals | 7.8 | ||

9 | Manufactures/retails Warhammer models, licences stories/characters | 7.8 | ||

10 | Imports and distributes timber and timber products | 7.7 | ||

11 | Manufacturer of scientific equipment for industry and academia | 7.7 | ||

12 | Distributes essential everyday items consumed by organisations | 7.5 | ||

13 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

14 | Sources, processes and develops flavours esp. for soft drinks | 7.3 | ||

15 | Sells hardware and software to businesses and the public sector | 7.2 | ||

16 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.0 | ||

17 | Translates documents and localises software and content for businesses | 7.0 | ||

18 | Manufactures natural animal feed additives | 7.0 | ||

19 | Online marketplace for motor vehicles | 7.0 | ||

20 | Solid State | Manufactures computers, battery packs, radios. Distributes components | 7.0 | |

21 | Sells promotional materials like branded mugs and tee shirts direct | 6.9 | ||

22 | Manufactures vinyl flooring for commercial and public spaces | 6.7 | ||

23 | Surveys and distributes public opinion online | 6.7 | ||

24 | Operates tenpin bowling and indoor crazy golf centres | 6.7 | ||

25 | Manufactures specialist paper, packaging and high-tech materials | 6.6 | ||

26 | Flies holidaymakers to Europe, sells package holidays | 6.5 | ||

27 | Retails clothes and homewares | 6.4 | ||

28 | Online retailer of domestic appliances and TVs | 6.4 | ||

29 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.4 | ||

30 | Manufactures sports watches and instrumentation | 5.9 | ||

31 | Acquires and operates small scientific instrument manufacturers | 5.9 | ||

32 | Publishes books, and digital collections for academics and professionals | 5.8 | ||

33 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.8 | ||

34 | Manufactures military technology, does research and consultancy | 5.8 | ||

35 | Supplies vehicle tracking systems to small fleets and insurers | 5.7 | ||

36 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 5.5 | ||

38 | Manufactures disinfectants for simple medical instruments and surfaces | 5.4 | ||

39 | Runs a network of self-employed lawyers | 4.5 | ||

v Frozen v | ||||

? | Develops and manufactures hygiene, baby, and beauty brands | 7.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Solid State and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.