Shares for the future: a mid-ranking stock at an inflection point

After falling by two-thirds since its peak at the end of 2021, columnist Richard Beddard believes this £250 million company is now good value. But there’s lots going on here, and plenty for investors to consider.

23rd February 2024 15:01

by Richard Beddard from interactive investor

Now fully moved into its purpose-built headquarters, Treatt (LSE:TET) must deliver on its promise. Rather unsettlingly though, the management team that built this stepping stone to a more prosperous future has moved on.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Scoring Treatt: Inflection point

The Past (dependable) [2]

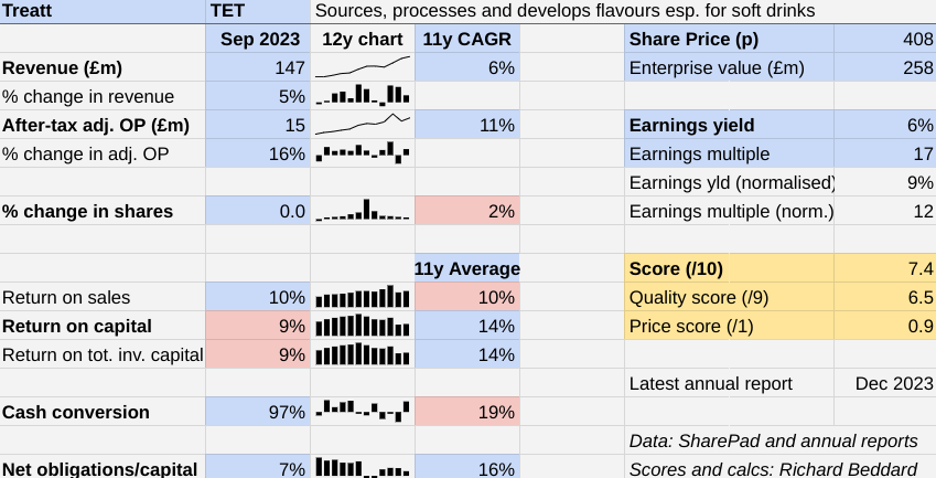

- Profitable growth: 11% compound annual growth rate (CAGR) in profit [1]

- Strong finances: Modest debt, but volatile cash flow [0.5]

- Through thick and thin: Lowest Return on Capital 9% (2022 and 2023) [0.5]

Treatt extracts natural flavours and aromas from fruit, vegetables, herbs, spices and flowers and sells these ingredients to international flavour houses and multinational beverage companies.

In terms of growth, Treatt’s 5% increase in revenue and 16% increase in adjusted profit in the year to September 2023 was true to form. Revenue was in line with the historical growth rate and profit growth was slightly above trend.

The profit figure is achieved by adjusting out the cost of redundancies due to the relocation, which involved a 14% reduction in staff, and costs incurred while the company was running two sites at once.

Return on capital at 9% is not only poor for Treatt, though, it is lower than I would expect any good business to achieve.

Although profit increased last year, operating capital, the denominator of the return on capital calculation, has increased by much more in recent years.

Operating capital is a measure of the money required to run the business. It has increased by £64 million since 2020, when it was £94 million.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Stockwatch: another share ‘pops’ but is it one to chase or ignore?

Most of the increase is due to £58 million of capital expenditure, money spent extending Treatt’s factory in Florida and building its new Headquarters in Bury St Edmunds.

The good news is capital expenditure normalised in 2023 at less than £6 million, still high by historical standards, but not unprecedented before 2020.

All this investment is one reason Treatt’s average cash conversion of 19% is so poor. Another is the company’s policy of holding high levels of stock to ensure it can supply customers.

As Treatt grows, it must add to this stock, which gobbles up ever more capital. In recent years, this has been exacerbated by supply shortages associated with the pandemic.

According to data provider SharePad, the value of stock in the last decade varied between 30% and 40% of revenue, but it almost reached 50% in 2022.

More good news. In 2023, the company earned more cash than it ever has from its operations, which reduced the ratio to 42%. The bad news: that is still high by historical standards.

The Present (distinctive) [2.5]

- Discernible business: Sources and processes flavours [1]

- With experienced people: Much change at the top [0.5]

- That creates value for customers: Expertise. Trendy flavours [1]

Treatt sits between growers and processors on one side and flavour houses and fast-moving consumer goods companies on the other. It buys fruit and other raw materials, processes them into flavours, mainly for beverages, and ships them around the world from factories in the UK and Florida.

Its customers are multinational brands and the flavour houses that supply them, which can also be very big businesses. By-products of distillation have their uses too. For example, they are processed into citrus scents for cleaning products.

Treatt’s biggest market by far is the US, where it earned 42% of total revenue in 2023. By contrast, in the UK Treatt earned only 6% of revenue.

For more than a decade the company was run by Daemmon Reeve, who started his career as a laboratory assistant at Treatt and became chief executive in 2012.

He championed an employee-first innovation strategy with the aim of inventing new and more profitable flavours. This vision would only be fully realised after Treatt moved into its new headquarters, which it has in stages over the last couple of years.

Surprisingly, Mr Reeve retired in December just as this once in a generational investment was completed, and a year after the company’s long standing chief financial officer stepped down.

Now, Ryan Govender is running the business. He became interim chief executive in January after a year as chief financial officer. Previously he has held various finance roles at Associated British Foods subsidiaries.

Alison Sleight, Govender’s number two in the finance department has stepped up to be interim chief financial officer, although she is not a board member. She has been with Treatt since 2019.

Chair Vijay Thakrar is also a relatively new replacement for a long-term appointee. He joined as non-executive director in 2020 and became chairman in January 2023.

The Future (directed) [2]

- Addressing challenges:Commodification, powerful customers [0.5]

- With coherent actions: Collaboration, innovation (? low R&D) [0.5]

- That reward all stakeholders fairly: [1]

With the headquarters complete, the company’s focus is shifting from investment to innovation and sales.

New modern laboratories should enable Treatt scientists and technicians to collaborate with customers to innovate tastier flavours, and its modern factory will be more efficient.

In financial terms, Treatt should be able to manufacture higher margin products more cheaply, improving profitability and cash flow. This should lift return on capital back into double figures.

The company’s strategy for some time has been to drive the innovation of flavours for beverages that are growing in popularity such as health and energy drinks, ready-to-drink iced tea and cold-brew coffee.

Its newest flavour, coffee, has made a very good start. Revenue increased from £1 million to £5 million in 2023, accounting for much of Treatt’s growth.

Coffee is one of the C’s in Treatt’s “7C” growth strategy. Which puts Culture first and then targets in no particular order, Consumer trends, Treattzest premium Citrus extracts, Coffee, Chinese beverage brands, utilising its enlarged Capacity, and keeping a grip on Costs.

Treatt’s priorities could change though. Mostly, the company produces natural additives, but it has a longstanding line of synthetic flavourings made in partnership with a chemical company. In last year’s annual report, the company highlighted synthetic products to improve the flavour of plant-based meat.

Revenues from synthetics declined in 2023, partly because of reduced demand for alternative proteins, and Treatt now includes synthetics along with most of the commodity citrus extracts and aromas, and other herb and spice extracts, as “heritage” products.

It still intends to grow this category, which earns the majority of revenue, but the focus of innovation will be on premium categories such as tea, fruit and veg, and newer markets like coffee.

- Stockwatch: what price might bidders pay for Currys shares?

- Insider: director picks up this small-cap share on the cheap

Innovation requires research and development (R&D), and Treatt’s promise to treble R&D spend over the five years following 2022 has got off to an unconvincing start. The pledge was not repeated in this year’s annual report, and the company spent less on R&D in 2023 than it did in 2022, just over 1% of revenue.

Another concern is Treatt’s big customers, many of which also make flavours. 31% of revenue comes from the company’s top five customers and more than 10% of revenue from its largest customer.

When a customer took up its tea product in 2021, it nearly doubled Treatt’s revenue from the category to 11% of revenue, but the business has subsequently dwindled and today Treatt earns 5% of revenue from tea.

Large customers also have purchasing power, which may be showing up in slow payments and tying up Treatt’s capital further.

For most of the last decade payables, money owed to Treatt, were about 15% of revenue. That number began rising towards the end of the decade and has been above 20% in four of the last six years.

As if there was not enough pressure on Treatt’s cash flow, funding payables adds to it.

The price (discounted?) [0.9]

- Yes. A share price of 408p values the enterprise at £258 million, 12 times normalised profit.

I have re-scored Treatt at an inflection point. It has relocated to a much better facility but that has come at a considerable cost.

Much depends on the company making the most of these facilities.

The incomplete boardroom changes mean Treatt’s strategy may not be settled. The change of management has also allowed me to look at the business more dispassionately.

I was very impressed by the company’s former managers and their strategy to energise Treatt’s employees and build a new home for them. My approval may have blinded me to what may be quite a weak position in the market.

It is far too early to judge, of course, but I wonder if the new facilities have all the answers.

A score of 7.4 out of 10 indicates that Treatt probably is a good long-term investment.

It is ranked 22 out of 40 stocks in my Decision Engine.

26 Shares for the future

Here is the ranked list of shares from the Decision Engine. I review the scores once a year, soon after each company has published its annual report. The scores change day to day due to changes in price.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Victrex (LSE:VCT) and Hollywood Bowl Group (LSE:BOWL) have published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

0 | Company | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.5 | |

2 | Supplies kitchens to small builders | 9.3 | |

3 | Supplies vehicle tracking systems to small fleets and insurers | 9.1 | |

4 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | |

5 | Distributor of protective packaging | 8.7 | |

6 | Manufacturer of scientific equipment for industry and academia | 8.6 | |

7 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | |

8 | Translates documents and localises software and content for businesses | 8.5 | |

9 | Manufactures filters and filtration systems for fluids and molten metals | 8.4 | |

10 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.1 | |

11 | Manufactures/retails Warhammer models, licenses stories/characters | 8.0 | |

12 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 8.0 | |

13 | Sells hardware and software to businesses and the public sector | 7.7 | |

14 | Manufactures natural animal feed additives | 7.8 | |

15 | Manufactures power adapters for industrial and healthcare equipment | 7.8 | |

16 | Imports and distributes timber and timber products | 7.8 | |

17 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.7 | |

18 | Whiz bang manufacturer of automated machine tools and robots | 7.5 | |

19 | Manufactures military technology, does research and consultancy | 7.5 | |

20 | Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

21 | Online retailer of domestic appliances and TVs | 7.4 | |

22 | Treatt | Sources, processes and develops flavours esp. for soft drinks | 7.4 |

23 | Distributes essential everyday items consumed by organisations | 7.5 | |

24 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 7.4 | |

25 | Online marketplace for motor vehicles | 7.1 | |

26 | Makes marketing and fraud prevention software, sells it as a service | 7.0 | |

27 | Manufactures vinyl flooring for commercial and public spaces | 6.8 | |

28 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.8 | |

29 | Manufactures specialist paper, packaging and high-tech materials | 6.4 | |

30 | Sells promotional materials like branded mugs and tee shirts direct | 6.3 | |

31 | Manufactures sports watches and instrumentation | 6.3 | |

32 | Flies holidaymakers to Europe, sells package holidays | 6.3 | |

33 | Publishes books, and digital collections for academics and professionals | 6.1 | |

34 | Surveys and distributes public opinion online | 5.8 | |

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | |

36 | Operates tenpin bowling and indoor crazy golf centres | 5.5 | |

37 | Supplies software and services to the transport industry | 5.3 | |

38 | Retails clothes and homewares | 5.3 | |

39 | Runs a network of self-employed lawyers | 4.9 | |

40 | Acquires and operates small scientific instrument manufacturers | 4.9 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Treatt and many of the shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.