Shares for the future: a maximum score for quality

This UK company is the biggest of its kind in North America, and columnist Richard Beddard ranks it highly. But is it still a buy when you factor in price and valuation?

10th May 2024 15:00

by Richard Beddard from interactive investor

4imprint Group (LSE:FOUR) has been stealing market share for decades. Now it is the biggest North American distributor of promotional goods with 5% market share, it is no longer under the radar.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Scoring 4Imprint: big gets bigger

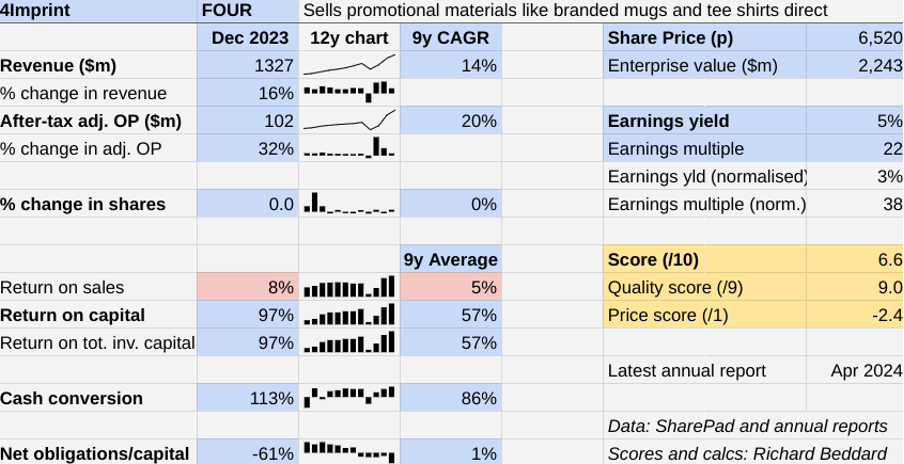

Barring the pandemic period, 4Imprint’s numbers just get better and better.

The Past (dependable) [3]

- Profitable growth: Double digit revenue and profit growth [1]

- Strong finances: Net cash [1]

- Through thick and thin: Average Return on Capital 57% [1]

Promotional goods are given away in workplaces and at events, so a sharp decline in revenue and sales when offices and expos were closed was inevitable.

Looking past the pandemic though, on every key measure 4Imprint is improving on its already impressive performance.

In the year to December 2023, the company grew revenue and profit faster than its double-digit nine-year compound annual growth rates (CAGRs).

Profit margin and return on capital were above their nine-year averages as well. So too was cash conversion and, almost inevitably, net obligations including lease obligations were not only negative, but at an all-time low.

No doubt 4Imprint is benefiting from a strong US economy, but there is more to it than that.

The Present (distinctive) [3]

- Discernible business: Biggest direct seller in biggest market [1]

- With experienced people: Extremely experienced [1]

- That creates value for customers: Range, value, speed, satisfaction [1]

4Imprint is a direct seller. It sits between suppliers (importers, manufacturers, and customisers) of promotional goods on one side, and marketeers working for companies on the other.

It takes orders from companies and organisations for clothing, mugs, stationery. and technology branded with the customers’ logos and messages, and channels them to its network of suppliers through an efficient IT platform and call centre.

4Imprint bills the orders but they are usually drop-shipped directly from supplier to customer, which means the company avoids the capital-intensive aspects of distribution: like warehousing and delivery.

Instead, it focuses on marketing, which has traditionally involved sending out “Blue Boxes” of samples and catalogues to potential customers and taking orders through the internet or by phone.

Historically, distributors of promotional goods relied on field sales forces, and some still do. 4Imprint was the first direct seller, an advantage that has also enabled it to become the biggest distributor in the US.

It has lowered the cost of reaching customers, while keeping the customer connection through its folksy ethos and customer service guarantees. These promise free artwork, free samples, and 100% satisfaction.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Share Sleuth: the new holding I’ve picked to reduce my cash pile

Demand for promotional goods is sensitive to activity levels in the North American economy, where 4Imprint earns 98% of revenue. However, even during the pandemic, the company eked out a tiny profit, and its future was never in doubt because of its policy of “typically” maintaining a positive cash position. This gives it the opportunity to invest through thick and thin and gain market share.

True to form, 4Imprint has gained market share since before the pandemic. The company’s revenue in North America has risen 54% since 2019 (from $839 million to $1.3 billion), but according to figures from industry body ASI, the market has only grown 1% ($25.8 billion to $26.1 billion).

That suggests 4Imprint’s market share has risen from just over 3% to about 5% in the last four years.

The company has grown under Kevin Lyons-Tarr. He joined 4Imprint in 1991 and has led the business since 2004, when it was part of a larger group of otherwise rather pedestrian promotional product distribution and manufacturing firms.

By 2015, the group had disposed of its other businesses and renamed itself 4Imprint, with Lyons-Tarr as chief executive. David Seekings, the company’s chief financial officer, has had a similar career trajectory. He joined as chief financial controller in 1996.

The Future (directed) [3]

- Addressing challenges:Growth, sustainability [1]

- With coherent actions: Own brands, TV advertising [1]

- That reward all stakeholders fairly: Employee/customer focused [1]

It is difficult to conjure competitive threats that would undermine 4Imprint.

As the biggest and most efficient distributor of promotional goods in the US, 4Imprint benefits from the industry’s bifurcation between suppliers and distributors. The company is vigilant for competitors that threaten this set-up, but, it says, the industry is relatively stable.

Having long benefitted from the efficiency of direct selling, 4Imprint is now reaping the rewards of scale. Marketing is its biggest expense and it is earning more from each of its marketing bucks as it grows.

This is due to a change in emphasis just before the pandemic to TV advertising, and more recently, streaming TV.

The cost of TV advertising is too much for small businesses. Like its competitors, before 2018, 4Imprint was reliant on mailshots and Google advertising. These are more scalable forms of marketing.

- Shares for the future: FTSE 100 quality does not come cheap

- Stockwatch: one to buy if a bid approach fails

Now 4Imprint can afford TV advertising, and has channelled much of its offline and print marketing into it.

In 2023, 4Imprint reported that it was earning $8.30 per dollar spent on marketing, down slightly from 2022 when it earned $8.83, but still much higher than the previous best of $6.17.

The company has also developed its own brands in core categories such as drinkware and stationery to meet customer needs like sustainability. These cost it little more than unbranded “blanks”, but earn it almost as much as famous brands, which it also sells.

Another recent strategic initiative is vertical integration. Having developed its own in-house embroidery capability, last year 4Imprint acquired a tiny screen-printing operation near its headquarters in Oshkosh, Wisconsin.

Screen printing is the most common method of putting logos and messages on products, and 4Imprint may be more efficient bringing these elements in house.

To extract those efficiencies, you need scale. Like TV advertising, 4Imprint seems to be adjusting its strategy to its market leading status.

The price (discounted?) [-2.4]

- No. A share price of £65.20 values the enterprise at about $2.2 billion, 38 times normalised profit

I admire 4Imprint. The firm demonstrated its commitment to employees during the pandemic when it did not lay off any staff, rightly considering their salaries an investment in the post-pandemic recovery.

The smiling faces of employees adorn 4Imprint’s marketing materials. Apparently, the people of Oshkosh, Wisconsin, where most of its employees work, are famously friendly and down to earth.

The company does not disclose staff turnover rates or employee engagement stats in the annual report, which I would like, but the results speak for themselves.

- NatWest retail share offer latest

- The Income Investor: FTSE 100 retains income appeal despite record rally

Such is my confidence in 4Imprint, it gets a maximum score for quality. That is, it is dependable, distinctive and directed.

The only mote in my investor’s eye is price. Given the quality on offer a current year multiple of 22 times adjusted post tax operating profit seems undemanding. However, in 2023, 4Imprint earned a higher return on capital than ever.

I doubt that is sustainable through thick and thin. Using the nine-year average return on capital puts the company on a more demanding multiple of 38 times profit.

A score of 6.6 out of 10 indicates that 4Imprint may well be a good long-term investment.

It is ranked 23 out of 40 shares in my Decision Engine.

21 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Next (LSE:NXT) and Judges Scientific (LSE:JDG) have published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

0 | Company | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.4 | |

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | |

3 | Supplies kitchens to small builders | 8.5 | |

4 | Translates documents and localises software and content for businesses | 8.5 | |

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | |

6 | Manufactures filters and filtration systems for fluids and molten metals | 8.4 | |

7 | Distributor of protective packaging | 8.3 | |

8 | Manufacturer of scientific equipment for industry and academia | 8.3 | |

9 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 8.0 | |

10 | Manufactures/retails Warhammer models, licences stories/characters | 7.8 | |

11 | Manufactures natural animal feed additives | 7.8 | |

12 | Imports and distributes timber and timber products | 7.8 | |

13 | Distributes essential everyday items consumed by organisations | 7.5 | |

14 | Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

15 | Whiz bang manufacturer of automated machine tools and robots | 7.5 | |

16 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.4 | |

17 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.4 | |

18 | Online retailer of domestic appliances and TVs | 7.4 | |

19 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | |

20 | Sells hardware and software to businesses and the public sector | 7.0 | |

21 | Supplies vehicle tracking systems to small fleets and insurers | 7.0 | |

22 | Makes marketing and fraud prevention software, sells it as a service | 6.9 | |

23 | 4Imprint | Sells promotional materials like branded mugs and tee shirts direct | 6.6 |

24 | Online marketplace for motor vehicles | 6.6 | |

25 | Manufactures vinyl flooring for commercial and public spaces | 6.5 | |

26 | Operates tenpin bowling and indoor crazy golf centres | 6.3 | |

27 | Flies holidaymakers to Europe, sells package holidays | 6.3 | |

28 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.3 | |

29 | Manufactures specialist paper, packaging and high-tech materials | 6.2 | |

30 | Surveys and distributes public opinion online | 6.2 | |

31 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 6.0 | |

32 | Publishes books, and digital collections for academics and professionals | 5.9 | |

33 | Manufactures military technology, does research and consultancy | 5.7 | |

34 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | |

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | |

36 | Supplies software and services to the transport industry | 5.2 | |

37 | Manufactures sports watches and instrumentation | 5.1 | |

38 | Acquires and operates small scientific instrument manufacturers | 4.8 | |

39 | Retails clothes and homewares | 4.5 | |

40 | Runs a network of self-employed lawyers | 4.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns 4Imprint and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.