Shares for the future: a high-quality firm like no other

This company with impeccable numbers has internalised risk by inventing an industry and developing the capabilities to deliver almost all of it, writes analyst Richard Beddard.

30th August 2024 15:03

by Richard Beddard from interactive investor

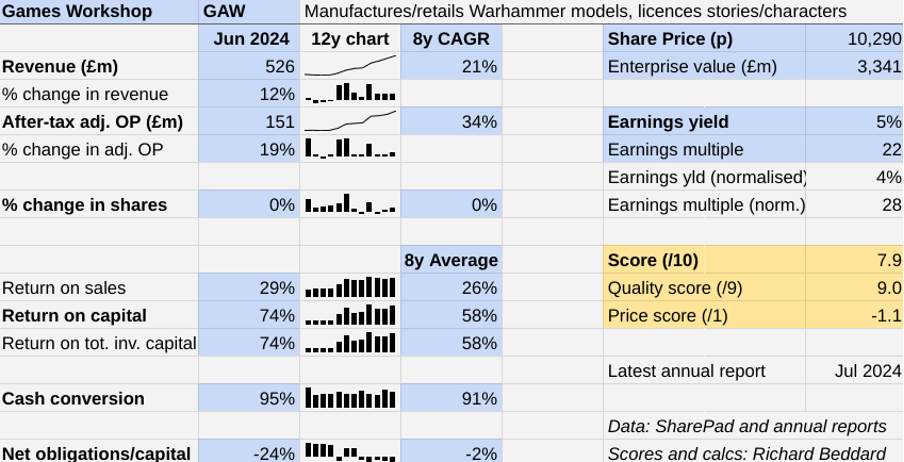

Once again I am staring at Games Workshop Group (LSE:GAW)’s numbers and shaking my head. Among the quality companies I follow, there is nothing quite like them.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Scoring Games Workshop: an industry in a company

The Past (dependable) [3]

- Profitable growth: 21% revenue, 34% profit CAGRs [1]

- Strong finances: Net cash [1]

- Through thick and thin: Lowest RoC 37% (2016) [1]

The table calculates averages and growth rates for the last eight years, which takes us back to 2016. That was Kevin Rountree’s first full year as chief executive.

It was also the year profit margin, return on capital and revenue growth, all started to lift off.

Before 2016, Games Workshop was a decent business, but it was not growing convincingly. Subsequently, revenue has grown at a compound annual growth rate (CAGR) of 21% and adjusted profit has grown at 34% CAGR.

In the year to June 2024, Games Workshop achieved double-digit growth again, while earning higher than average return on capital.

This was no surprise, in fact it might have been a slight disappointment.

Games Workshop launched the latest edition of its most popular tabletop wargame, Warhammer 40,000, at the beginning of the financial year. Historically, these releases drive increased sales of model soldiers.

Recent editions of Warhammer 40,000 have been launched at three-year intervals. The previous two launches in the financial years of 2018 and 2021 not only propelled Games Workshop to peak profitability (62% and 78% Return on Capital respectively), they also drove peak revenue growth (40% and 37%).

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- The 20 most-popular dividend shares among UK fund managers

2024 looked a lot like those earlier Warhammer 40,000 launch years in terms of Return on Capital (74%), but revenue growth was a more modest 12%.

The company says it will be a fair challenge to grow in 2025, following the best Warhammer 40,000 launch on record, but that is the plan.

I am not alarmed by sub-par growth in 2024 and cautious words about growth in 2025. Games Workshop grew 12% in 2022, after the launch of the last edition of Warhammer 40,000, and 16% in 2019, after the launch of the one before that.

Companies, even Games Workshop, have better years and worse years and a period of more modest growth, if that is what we are facing, would not make it a bad long-term investment.

The company’s impeccable numbers extend to the balance sheet and cash flow statements. In a typical year, Games Workshop converts more than 90% of profit to cash, and for the past five years the year end cash balance has exceeded the value of all Games Workshop’s financial obligations.

The Present (distinctive) [3]

- Discernable business: Owner and maker of Warhammer [1]

- With experienced people: Chief executive since 2015 is a lifer [1]

- That creates value for customers: Multi-faceted life-long hobby [1]

Games Workshop makes and sells science fiction and fantasy-themed miniatures based on the Warhammer 40,000 and Warhammer Age of Sigmar fictional universes.

The miniatures are painted by hobbyists. They often use them in tabletop wargames played in accordance with rulebooks created and updated by Games Workshop.

Although it is a niche hobby, it is a sizeable niche. Games Workshop’s three factories in Nottingham churned out 40 million plastic sprues in 2024 (sprues are the plastic frames holding model components). The company earned over £500 million, mostly in the US and Europe.

The hobby has long-term appeal. Warhammer 40,000 is a science fiction themed universe originally launched as a game in the late 1980s, and now in its 10th edition. Its sibling, Warhammer Age of Sigmar replaced the original Warhammer Fantasy Battle game, which dates back to the early 1980s.

Although Games Workshop stopped producing Warhammer Fantasy Battle in 2015 when it introduced Warhammer Age of Sigmar, it pleased old-school gamers in 2024 by rebooting the original as Warhammer: The Old World.

This intellectual property extends beyond game editions to hundreds of novels, more than 500 editions of the Warhammermagazine White Dwarf, and daily video content published on Games Workshop’s Warhammer Community website and YouTube. These activities promote the hobby, which is also showcased on the Warhammer e-commerce site, in more than 500 company-run hobby stores and thousands of independent hobby stores.

In 2021, Games Workshop launched Warhammer+, a monthly subscription that grew 30% to 176,000 subscribers in 2024. Subscribers receive a free and exclusive miniature every year, the opportunity to buy another, and original video content.

In addition to this “core” revenue Games Workshop also has a healthy sideline licensing Warhammer stories and characters to companies that make video games. This activity earned it 6% of revenue, and because of the low costs associated, 13% of profit in 2024.

- Downbeat Nvidia reaction fails to cloud AI outlook

- Insider: bosses back up targets with own purchases

There are few unique businesses listed in London, but I think Games Workshop is one of them. It has unique intellectual property, which it defends vigorously, and that means there is no direct competition.

Other companies make tabletop wargaming miniatures based on historical or imaginary worlds but they are tiny in comparison.

Games Workshop benefits from economies of scale: its massive design, manufacturing, publishing, distribution and retail capabilities. It also benefits from network effects. The more people that play the games and upload content to social media, the easier it is for people new to the hobby to join in.

Two men have dominated the company's history. Tom Kirby joined as general manager in 1986, led it through a management buyout in 1991, and floated it in 1994. An executive director until 2014, he retired as non-executive chair in 2017.

Kevin Rountree joined in 1998 as assistant group accountant, and became chief executive in 2015.

Chief financial officer Rachel Tongue is standing down. Her replacement is Liz Harrison, who joined Games Workshop as a finance manager in 2000.

The Future (directed) [3]

- Addressing challenges:Has internalised most challenges [1]

- With coherent actions: Focuses on what it controls [1]

- That reward all stakeholders fairly: Long-term ethos, employee focused [1]

Games Workshop has internalised risk by inventing an industry and developing the capabilities to deliver almost all of it itself.

The company is highly integrated. It manufactures its own plastic and resin models. It controls distribution (not always to its own satisfaction) through three main hubs in Nottingham, Memphis and Sydney, although a hub in Asia is outsourced. It operates its own book publishing imprint, Black Library, and publishes its own magazine. It operates 550 stores and sells online through its own site.

The main risk, as the company says every year, is mismanagement. Outgoing chair John Brewis says: “if it was easy, everybody would be doing it”.

Games Workshop’s approach is to focus on the many things in its control, and ride out the things that are not.

One of the current focuses, and risks, is IT. The company’s creaking systems have disrupted orders and fulfilment, and a project to upgrade them is taking longer than expected. The company has increased IT spend from 3% to 5% of core revenue and anticipates that it will be three to five years before the work is done.

Games Workshop can be so internally focused partly because Warhammer is such an important part of so many people’s lives that their spending is quite resilient. Mostly though it is because it has a winning formula and will not be distracted from following it.

It has not always been that way. I think under Tom Kirby, we saw what could go wrong. More than two decades ago the company was granted the licence to make Lord of the Rings miniatures and games by the film company that made the famous Lord of the Rings trilogy.

The popularity of the films drove demand for the miniatures and expansion at Games Workshop, but it also deflected management’s attention from its own intellectual property and once the films were mostly memories, the company was left with three underperforming ranges.

A prolonged period of cost cutting and restructuring followed, much of it necessary, but the Games Workshop’s creativity was channelled into making more and more expensive models.

They were highly profitable but appealed to a small subset of the community. The pendulum had swung. Having expanded aggressively with intellectual property it did not control, Games Workshop became very cautious with the intellectual property it did control. This alienated many of its customers.

One of Kevin Rountree’s first acts as chief executive was the introduction of starter kits, models and paints at relatively low price points. Game rules were refreshed and published for free, and Games Workshop re-engaged with its community online.

The company has also become more open and pro-activity about sharing its intellectual property.

Licensing revenue still mostly comes from video game partnerships, but that could change if Games Workshop agrees creative guidelines currently under discussion with Amazon Studios, the film and TV production arm of Amazon.com Inc (NASDAQ:AMZN).

Up for grabs are the exclusive rights to produce films and television series set in the Warhammer 40,000 universe, and the option for equivalent rights to the Warhammer Fantasy universe. We will know whether Amazon gets them in December.

The price (discounted?) [-1.1]

- No. A share price of £102.90 values the enterprise at about £3.3 billion, 28 times normalised profit.

A score of 7.9 implies Games Workshop is a good long-term investment.

It is ranked 8 out of 40 shares in my Decision Engine.

18 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Cohort (LSE:CHRT), Goodwin (LSE:GDWN), Cropper (James) (LSE:CRPR) and Jet2 Ordinary Shares (LSE:JET2) have all published annual reports and are due to be re-scored.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.8 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | ||

4 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

5 | Distributor of protective packaging | 8.4 | ||

6 | Supplies kitchens to small builders | 8.4 | ||

7 | Whiz bang manufacturer of automated machine tools and robots | 8.0 | ||

8 | Games Workshop | Manufactures/retails Warhammer models, licences stories/characters | 7.9 | |

9 | Manufactures filters and filtration systems for fluids and molten metals | 7.9 | ||

10 | Manufacturer of scientific equipment for industry and academia | 7.8 | ||

11 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.7 | ||

12 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

13 | Distributes essential everyday items consumed by organisations | 7.2 | ||

14 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | ||

15 | Sells hardware and software to businesses and the public sector | 7.2 | ||

16 | Manufactures computers, battery packs, radios. Distributes components | 7.1 | ||

17 | Translates documents and localises software and content for businesses | 7.0 | ||

18 | Manufactures natural animal feed additives | 7.0 | ||

19 | Sells promotional materials like branded mugs and tee shirts direct | 6.9 | ||

20 | Surveys and distributes public opinion online | 6.9 | ||

21 | Manufactures vinyl flooring for commercial and public spaces | 6.9 | ||

22 | Online marketplace for motor vehicles | 6.7 | ||

23 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 6.7 | ||

24 | Manufactures specialist paper, packaging and high-tech materials | 6.5 | ||

25 | Operates tenpin bowling and indoor crazy golf centres | 6.5 | ||

26 | Online retailer of domestic appliances and TVs | 6.4 | ||

27 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.4 | ||

28 | Retails clothes and homewares | 6.2 | ||

29 | Flies holidaymakers to Europe, sells package holidays | 6.0 | ||

30 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 6.0 | ||

31 | Supplies vehicle tracking systems to small fleets and insurers | 5.8 | ||

32 | Acquires and operates small scientific instrument manufacturers | 5.8 | ||

33 | Manufactures sports watches and instrumentation | 5.8 | ||

34 | Publishes books, and digital collections for academics and professionals | 5.6 | ||

35 | Manufactures military technology, does research and consultancy | 5.5 | ||

36 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

37 | Manufactures disinfectants for simple medical instruments and surfaces | 5.4 | ||

38 | Makes marketing and fraud prevention software, sells it as a service | 4.9 | ||

39 | Runs a network of self-employed lawyers | 4.5 | ||

v Frozen v | ||||

? | Develops and manufactures hygiene, baby, and beauty brands | 7.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Games Workshop and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.