Shares for the future: a high-profile firm worth your vote?

Richard Beddard nails his colours to the mast on a fascinating but speculative small-cap eyeing a return to growth in profit and revenue.

6th December 2024 11:20

by Richard Beddard from interactive investor

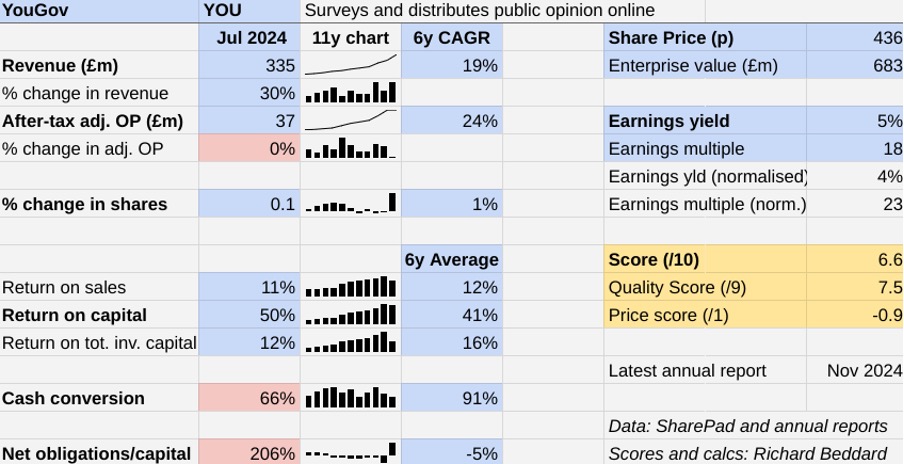

When YouGov (LSE:YOU) announced in June that profit might be lower in the year to July 2024 than it was in the previous year, it was such a shock it prompted me to re-score the business.

Now we have the annual report, we know more. In fact, YouGov made about as much profit as it did in 2023, despite growing revenue by 30%.

- Invest with ii: Top UK Shares | Free Regular Investing | Open an investment Account

Scoring YouGov: garbage in, garbage out

This was not a good result.

Most of the revenue growth was due to a large acquisition. The 3% underlying revenue growth YouGov achieved slightly underperformed a depressed market.

Companies reined in spending on market research due to unstable business conditions and, it seems, because of a loss in confidence in market research.

Profit was flat because costs increased, as YouGov invested in people and technology to deliver a new strategic plan.

The Past (dependable) [2.5]

- Profitable growth: Blah [1]

- Strong finances: Significant borrowings, strong cash flow generally [0.5]

- Through thick and thin: Lowest RoC [1]

The flat profit figure is heavily adjusted.

YouGov began to shut down less profitable activities and activities in less-significant territories, which will ultimately reduce its global workforce by 7%. The associated costs have been ignored in the adjusted figures, as have the costs of integrating three acquisitions unaffected by the cuts.

On an underlying basis, YouGov remained highly profitable, although the cash cost of the restructuring is deducted from cash flow, which is why cash flow decreased as a proportion of adjusted profit.

The company thinks it is righting itself, anticipating a return to growth in profit and revenue in the year to July 2025.

Meanwhile, acquisitions have indebted YouGov.

Net financial obligations including leases are double operating capital. Even though YouGov employs relatively modest amounts of capital, theoretically it would take the company six years to repay all of the obligations if it continued to earn 2024’s probably depressed free cash flow.

The Present (distinctive) [3]

- Discernable business: Proprietary online panel-based market research [1]

- With experienced people: Blah [1]

- That creates value for customers: Faster, better predictions [1]

Since 2020, YouGov has surveyed people’s opinions and attitudes online. It made its name in political polling, and it has also made money asking people about products, brands and consumer trends.

These surveys help inform marketing, advertising, strategy and product development. Companies use market research to give them insight into markets, and to see how they are doing.

Market researchers win if their predictions are more accurate than rivals’, and if they can be delivered faster. YouGov says its data is perceived as a “gold standard”. Its speed enabled it to supply up-to-the-minute political polling to the press, which explains the growth of the business and its reputation.

Although it has a market share of less than 1%, it is one of the world’s top 20 market research firms.

Internet polling gave YouGov the speed advantage, because everyone else was using telephones. Statistical methods overcame objections that YouGov’s panel is not randomly selected from a representative population, but self-selected when we sign-up on its website.

Others have adopted online polling, but YouGov says “it works tirelessly to remain the biggest, most representative, and most connected proprietary panel in the market”.

- Share Sleuth: tweaks to two shares I’ve held for over a decade

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

It may well be the best online pollster because it has been doing it longest, and it has amassed a huge panel. In July it had 29 million registered members, 62% of them active in the previous 12 months.

In support of its accuracy, YouGov cites an authoritative but old (2016) study from the Pew Research Center. It found YouGov consistently outperformed online competitor samples.

For a more recent view, it points us to 538, a data journalism site founded by Nate Silver, a famous statistician, and now owned by ABC News. It ranks YouGov equal first out of hundreds of pollsters based on accuracy and transparency.

YouGov also claims to have an unparalleled record in predicting UK elections, including correctly calling 92% of seats in this year’s election, a better result than any other pollster.

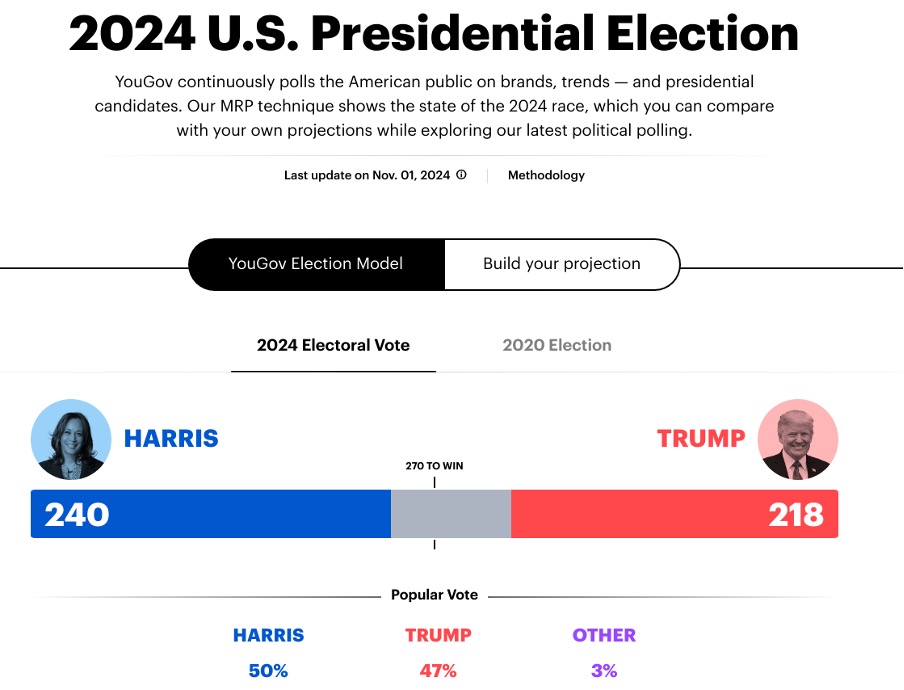

I wonder though, if the company’s high profile is currently working against it. Along with the rest of the polling industry YouGov was embarrassed by the recent US presidential election.

What might have been. Four days before the US election, YouGov’s election model predicted a win for Kamala Harris (Source: YouGov).

As every investor knows, when it comes to the future nobody is infallible.

The Future (directed) [2]

- Addressing challenges:Loss of focus, panel fraud, technological disruption [0.5]

- With coherent actions: Rationalisation, investment in data and AI [0.5]

- That reward all stakeholders fairly: Social purpose, employees? [1]

While YouGov earns most of its revenue doing market research, it earns much more profit when customers use data products to do their own market research. As a result profit growth has outpaced revenue growth over the long term.

But over the last two years heavy investment in data products, and the loss in confidence of customers has reversed that trend in recent years. While revenue from data products grew modestly in 2024, adjusted operating profit declined 22.5%.

The question taxing investors is whether this reversal is temporary, as marketers rein in budgets due to economic uncertainty and experiment with cheaper but less reliable surveys. Perhaps, though, YouGov has lost some of its speed and accuracy advantage.

Meanwhile, as market researchers continue to squeeze every last insight from their data, the cost of maintaining quality data and improving predictions is increasing.

YouGov is using machine learning to catch suspicious survey responses and it is also using artificial intelligence (AI) to make it easier to query the data.

In 2024 it launched its first client-facing AI product, YouGov AI Qualitative Explorer, which uses Natural Language Processing (NLP) to interrogate unstructured data.

Market researchers are using generative artificial intelligence to manufacture data from small samples so they can impute more reliable attitudes and opinions, ask questions that were not asked when collecting the data, and make use of historical data to ask new questions of former panellists.

The danger is that problems in the original data are magnified. Kantar, a rival, is piloting synthetic data with customers, but admits there is a lot of work to do before it has a robust solution.

- Is it time to come out of cash? And what to buy now

- Stockwatch: time to buy this ex-FTSE 100 fallen star?

YouGov took a step towards synthetic data when it acquired Yabble in 2024. Yabble is a small artificial intelligence firm focused on market research. It was already helping YouGov to improve the usability of its data products.

YouGov says Yabble is a pioneer in synthetic data, but it is still working out how to use it.

Picking winners when an industry is being disrupted by technology is perilous. But if synthetic data is the next big step forward in market research and data quality is paramount, YouGov may be in a strong position.

That said, competing data sets are proliferating in the servers of social media and search sites such as Meta and Google, who are the leaders in artificial intelligence, and the outcome of the US election was more successfully predicted by a different process: predictive markets.

YouGov’s biggest acquisition by far during the year was a diversification. CPS, a source of customer purchase data. This will help YouGov serve consumer goods companies better.

It may be that in the future asking people their opinions is regarded as a rather quaint way to find out what we think.

That would be a shame, because corporate control of personal data is increasingly contentious, and the way in which YouGov collects it has the virtue of transparency.

Its panellists willingly give up their data, either because they want their voice to be heard, or because they value the vouchers they receive as rewards, or both.

Many insights from this data are publicly available on its website.

The price (discounted?) [-0.9]

- No. A share price of 436p values the enterprise at about £683 million, 23 times normalised profit.

I think YouGov is a fascinating but somewhat speculative investment.

A score of 6.6 out of 10 implies it may be a good long-term investment.

It is ranked 25 out of 40 shares in my Decision Engine.

22 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Tristel (LSE:TSTL) and Focusrite (LSE:TUNE) have published annual reports and are due to be re-scored.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Supplies kitchens to small builders | 8.8 | ||

4 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

5 | Manufactures computers, battery packs, radios. Distributes components | 8.5 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.3 | ||

8 | Manufacturer of scientific equipment for industry and academia | 8.0 | ||

9 | Whiz bang manufacturer of automated machine tools and robots | 7.7 | ||

10 | Manufactures filters and filtration systems for fluids and molten metals | 7.7 | ||

11 | Flies holidaymakers to Europe, sells package holidays | 7.6 | ||

12 | Sells hardware and software to businesses and the public sector | 7.5 | ||

13 | Designs recording equipment, loudspeakers, and instruments for musicians | 7.5 | ||

14 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

15 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.5 | ||

16 | Manufactures/retails Warhammer models, licences stories/characters | 7.4 | ||

17 | Sources, processes and develops flavours esp. for soft drinks | 7.3 | ||

18 | Distributes essential everyday items consumed by organisations | 7.1 | ||

19 | Sells promotional materials like branded mugs and tee shirts direct | 7.1 | ||

20 | Translates documents and localises software and content for businesses | 7.0 | ||

21 | Manufactures natural animal feed additives | 7.0 | ||

22 | Manufactures vinyl flooring for commercial and public spaces | 7.0 | ||

23 | Online retailer of domestic appliances and TVs | 6.9 | ||

24 | Online marketplace for motor vehicles | 6.8 | ||

25 | YouGov | Surveys and distributes public opinion online | 6.6 | |

26 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.6 | ||

27 | Operates tenpin bowling and indoor crazy golf centres | 6.4 | ||

28 | Manufactures military technology, does research and consultancy | 6.4 | ||

29 | Acquires and operates small scientific instrument manufacturers | 6.3 | ||

30 | Retails clothes and homewares | 6.2 | ||

31 | Supplies vehicle tracking systems to small fleets and insurers | 6.1 | ||

32 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.8 | ||

33 | Publishes books, and digital collections for academics and professionals | 5.8 | ||

34 | Manufactures disinfectants for simple medical instruments and surfaces | 5.8 | ||

35 | Manufactures sports watches and instrumentation | 5.5 | ||

36 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 4.9 | ||

38 | Runs a network of self-employed lawyers | 4.6 | ||

39 | Develops and manufactures hygiene, baby, and beauty brands | 4.4 | ||

40 | Manufactures specialist paper, packaging and high-tech materials | 3.8 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports.

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.