Shares for the future: a FTSE 250 stock at a low price

Certain issues have weighed on this company’s score, but there are reasons to believe it remains a good long-term investment. Analyst Richard Beddard explains why.

24th January 2025 14:56

by Richard Beddard from interactive investor

In 2023’s annual report Victrex (LSE:VCT)’s chief executive Jakob Sigurdsson described the year as “one of the toughest periods on record for the entire chemical industry”.

Things got tougher for the polymer manufacturer in the year to September 2024 as it added another insipid result to a series going back six years.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Victrex says it has stayed the course after a troublesome period and is poised for recovery. But there are still milestones to hit if it is to achieve its growth targets.

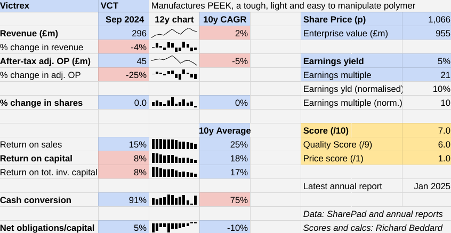

Scoring Victrex: VCT

Revenue from the Medical division declined 19% in the first half of the year to September 2024 due to destocking. Customers, who typically make implants such as spinal cages, had stockpiled PEEK polymer during earlier shortages and ran these stocks down rather than buy more from Victrex.

Victrex also reduced production volumes to shrink its own PEEK stockpile, which it had grown to ensure supply while it upgraded its UK facility, an investment programme it completed in the first half of the year.

Although total revenue declined by 4%, the lower proportion of high-margin medical sales, and the impact of high fixed costs, had a disproportionate impact on after-tax adjusted operating profit, which declined 25%

The Past (dependable) [1.5]

- Profitable growth: The business has contracted [0]

- Strong finances: Low financial obligations, decent cash flow [1]

- Through thick and thin: Lowest Return on Capital 8% in 2024 [0.5]

Reported profit was below adjusted profit. The company chooses to adjust out the cost of introducing a new Enterprise Resource Planning (ERP) software system, which has been in development since 2022 and may well be live now.

Victrex’s long-term track record does not make easy reading. Revenue growth has been sluggish and sporadic. Adjusted profit is less than half its 2018 peak.

If sustained, Victrex’s after-tax adjusted return on capital of 8% in 2024 is barely adequate (unadjusted it was 6%).

So far, investment has delivered a much larger capital base, but not growth.

- 14 stocks expected to move sharply after posting results

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Victrex believes profitability will improve from 2025. It should achieve at least mid-single digit volume and revenue growth over the next four years now that demand has normalised, as its “mega-programmes” finally deliver meaningful revenue, a new factory in China ramps up production, and higher value medical products make a bigger contribution.

Already decent cash flow should improve as capital expenditure falls now that its two big investment programmes are complete, and inventory reduces further.

This is predicated on an improvement, or at least not a worsening, of the global economy on which Victrex’s largely industrial markets depend.

The Present (distinctive) [2.5]

- Discernible business: Only specialist manufacturer of PEEK [1]

- With experienced people: Experienced chief executive yet to deliver [0.5]

- That creates value for customers: Unique materials, manufacturing know-how [1]

Victrex is the only specialist manufacturer of PEEK, a strong, light, hard-wearing polymer often used in place of metal. Aeroplane and car components made from PEEK improve performance and reduce emissions. Medical implants made from PEEK improve patient outcomes by fusing effectively with bone.

Victrex’s PEEK is stiffer and stronger but less flexible than the PEEK made by a handful of rival European and Chinese chemical companies. This is because Victex uses different raw materials and patented processes.

The company makes more varieties of PEEK than competitors, including carbon-fibre composites, in greater volumes than the rest of the industry combined.

It invests about 5% of revenue in research and development to stay ahead, broadening its portfolio of PEEK polymers and developing parts that hasten the adoption of PEEK in new markets.

Polymer and Parts has been the company’s strategy since before chief executive Jakob Siggurdson joined in 2017. But it is taking much longer than the company anticipated to deliver and, I suspect, has drained the company’s resources more than expected.

The Future (directed) [2]

- Addressing challenges:Cyclical markets, commoditisation [0.5]

- With coherent actions: Innovation, investment in capacity [0.5]

- That reward all stakeholders fairly: Investment led, employee friendly [1]

Victrex mostly makes money from resin sales into cyclical industrial, transport, electronics, and energy markets. 18% of revenue and 33% of gross profit comes from the more reliable medical market.

A decade ago, the company decided to grow its addressable market by finding new applications for PEEK. It targeted “mega-programmes”, new product families capable of achieving peak annual revenue of more than £50 million each.

The mega-programmes have not gained much traction. In 2024, they contributed just £10 million in revenue, 3% of the total.

PEEK vies with metals, ceramics and other high-level polymers, all with different characteristics.

Since regulators and major manufacturers tend to be risk averse, getting them to approve and adopt a new material is a lengthy process.

Innovation and advances in manufacturing techniques can also increase competition from other materials. For example, the development of 3D-printed porous titanium spinal implants has taken market share in the US back from PEEK.

Porosity is significant because it enables bone to fuse with the implant, making it stronger.

Victrex achieved US Food and Drug Administration (FDA) approval for 3D-printed porous PEEK spinal cages in 2024, but the fate of its manufacturing partner, Bond3D, illustrates the commercial risks involved in bringing new products to market.

- 19 UK stocks on list of conviction ‘buy’ ideas for 2025

- Stockwatch: why I’m upgrading this small-cap share

Bond3D, a company in which Vectrex held a 24.5% stake, went bust during the year after Victrex and other investors refused to stump up more cash to keep it going.

Victrex is now working with Demcon, a metal and glass 3D-printing company that acquired Bond3D for a nominal sum.

Nevertheless, Victrex believes momentum is finally building in the mega-programmes. It is targeting annual revenue of £10 million from each of four of the five mega-programmes by 2027.

Although £10 million is only a fifth of the minimum peak revenue the company anticipates from each programme, it is quadruple mega-programme revenue in 2024 (and equivalent to 14% of total revenue in 2024).

There are still milestones to achieve, and the means to achieve them are not always in the company’s own hands.

The company says customers manufacturing aerospace composites, one of the mega-programmes, are “closing in” on the deployment of new (and larger) components like engine housings and nacelles.

It anticipates growing revenue for its e-mobility mega-programme from the new 800v electric vehicle battery architecture. PEEK can be extruded on to battery wire to insulate it, a process that is less energy-intensive than ceramic coating. Also, having successfully introduced lightweight and quiet PEEK gears, Victrex is scaling down manufacturing in favour of supplying resin to gear manufacturers.

Magma m-pipe is a composite pipe made from carbon fibre and PEEK developed by TechnicFMC, an oil and gas services business, in partnership with Victrex. The technology is going through the final stages of an extended qualification phase, and commercialisation is dependent on TechnicFMC winning business, initially offshore Brazil.

Victrex says revenue from PEEK trauma plates, which are used to fix fractures in the US and Asia, is building from a 2024 base of about £1 million.

The fifth mega-programme is knee. Having secured regulatory approval in India, Victrex’s knee replacement programme may deliver revenue in 2025, but it is still at the clinical trial stage in the US and European Union. Victrex does not anticipate reaching the £10 million mark in the next three years.

- Where to invest in Q1 2025? Four experts have their say

- The only two assets pro investors are bullish on right now

Caution about Victrex’s prospects is probably warranted despite signs of progress, because it has failed to meet prior milestones.

Victrex’s Chinese plant commenced commercial production in 2024. The company already earns 15% of revenue in China, and its investment is intended to secure and grow this business because Chinese government policy mandates more domestic content in products manufactured there.

China is the world’s biggest electric vehicle (EV) maker, and Victrex also supplies COMAC, the state-owned aircraft manufacturer being touted as a rival to Airbus and Boeing.

While it remains to be seen whether these investments will finally bring rewards to shareholders, the company is a good employer.

Its claim that training, career opportunities and rewards drive high retention rates is borne out by the statistics. Victrex had an 8% voluntary turnover rate in 2024, which is typical of other years. Its employee survey finds 73% of employees are engaged.

The median employee in its highly skilled workforce earned total pay of £53,111 in 2024.

The price (discounted?) [1]

- Yes. A share price of £10.55 values the enterprise at about £955 million, 10 times normalised profit.

Victrex’s investment case is finely balanced. Its deteriorating results and slowness to develop the mega-programmes weighs on its score. However, the low share price may discount both a cyclical recovery and the possibility that the mega-programmes might finally be coming good.

A score of 7/10 implies Victrex is probably a good long-term investment, without being a ringing endorsement!

It is ranked 23 out of 40 shares in my Decision Engine.

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Hollywood Bowl Group (LSE:BOWL), Renew Holdings (LSE:RNWH) and RWS Holdings (LSE:RWS) have all published annual reports and are due to be re-scored.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Supplies kitchens to small builders | 8.9 | ||

4 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.7 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Manufactures computers, battery packs, radios. Distributes components | 8.3 | ||

8 | Designs recording equipment, loudspeakers, and instruments for musicians | 8.0 | ||

9 | Manufacturer of scientific equipment for industry and academia | 8.0 | ||

10 | Flies holidaymakers to Europe, sells package holidays | 7.9 | ||

11 | Sells hardware and software to businesses and the public sector | 7.8 | ||

12 | Whiz bang manufacturer of automated machine tools and robots | 7.5 | ||

13 | Manufactures/retails Warhammer models, licences stories/characters | 7.4 | ||

14 | Manufactures filters and filtration systems for fluids and molten metals | 7.4 | ||

15 | Operates tenpin bowling and indoor crazy golf centres | 7.4 | ||

16 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.3 | ||

17 | Distributes essential everyday items consumed by organisations | 7.3 | ||

18 | Surveys and distributes public opinion online | 7.1 | ||

19 | Manufactures vinyl flooring for commercial and public spaces | 7.1 | ||

20 | Online marketplace for motor vehicles | 7.0 | ||

21 | Repair and maintenance of rail, road, water, nuclear infrastructure | 7.0 | ||

22 | Translates documents and localises software and content for businesses | 7.0 | ||

23 | Victrex | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.0 | |

24 | Sells promotional materials like branded mugs and tee shirts direct | 6.9 | ||

25 | Online retailer of domestic appliances and TVs | 6.8 | ||

26 | Sources, processes and develops flavours esp. for soft drinks | 6.8 | ||

27 | Acquires and operates small scientific instrument manufacturers | 6.7 | ||

28 | Manufactures natural animal feed additives | 6.6 | ||

29 | Retails clothes and homewares | 6.5 | ||

30 | Publishes books, and digital collections for academics and professionals | 6.0 | ||

31 | Manufactures military technology, does research and consultancy | 5.9 | ||

32 | Supplies vehicle tracking systems to small fleets and insurers | 5.8 | ||

33 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.7 | ||

34 | Manufactures sports watches and instrumentation | 5.5 | ||

35 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

36 | Manufactures disinfectants for simple medical instruments and surfaces | 5.3 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 5.2 | ||

38 | Runs a network of self-employed lawyers | 4.8 | ||

39 | Develops and manufactures hygiene, baby, and beauty brands | 4.4 | ||

40 | Manufactures specialist paper, packaging and high-tech materials | 3.8 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports.

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price),

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Victrex and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine see Richard’s year end explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.