Shares for the future: this FTSE 100 stock owns its market

Few companies can boast the level of market dominance enjoyed by this blue-chip, whose innovation and strategy are impressive. Analyst Richard Beddard gives his opinion on this popular business.

26th July 2024 15:02

by Richard Beddard from interactive investor

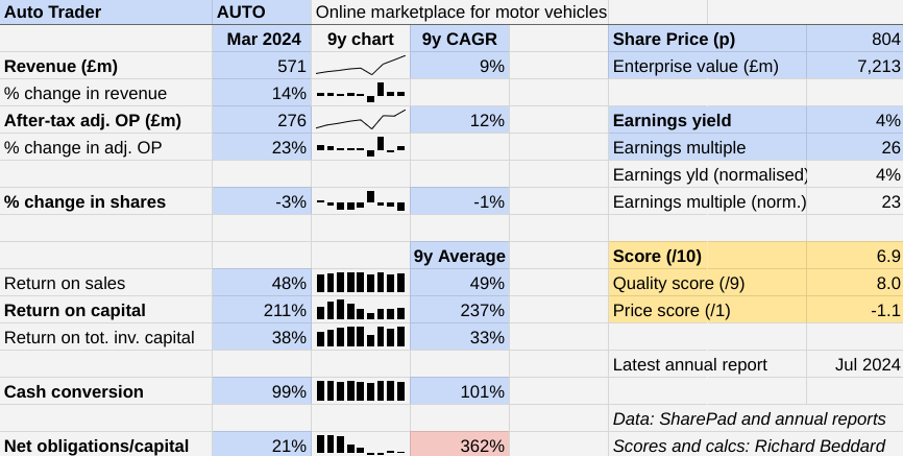

Judging by the year to March 2024, used car marketplace Auto Trader Group (LSE:AUTO)’s engine is still purring.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Scoring Auto Trader: like bees to a honeypot

The Past (dependable) [3]

- Profitable growth: Revenue compound annual growth rate (CAGR) 9% [1]

- Strong finances: Low borrowings, probably temporary [1]

- Through thick and thin: Lowest (return on capital employed) ROCE 97% (2021) [1]

Revenue and profit grew faster than their respective compound annual growth rates of 9% and 12% since the company floated in 2015, in a year that used car transactions increased 6%, according to the DVLA.

Typically strong cash flow allowed Auto Trader to pay down some of the money it borrowed to fund the acquisition of van-leasing marketplace Autorama in 2022.

Mostly though, Auto Trader dished the cash back out to shareholders in dividends and share buybacks.

The company anticipates growth through price increases, the sale of more data products, and more advertisements on Auto Trader in the current financial year. It also expects Autorama’s losses to diminish. In 2024, it lost £9 million, £2 million less than the previous year.

The Present (distinctive) [3]

- Discernible business: Famous used car marketplace is #1 in UK [1]

- With experienced people: Nathan Coe, chief executive since 2017, joined in 2007 [1]

- That creates value for customers: Draws customers to retailers like bees to a honeypot [1]

Auto Trader’s brand recognition is a big asset, it says 89% of us recognise the brand when prompted. According to Comscore, it accounts for 75% of minutes spent on online auto classified sites. Auto Trader says eight out of 10 car buyers use Auto Trader for some aspect of their purchase, and two-thirds of car buyers only use Auto Trader.

These eyeballs attract retailers (dealerships) to the platform, who pay subscriptions to advertise, and purchase additional products to boost or improve their advertisements.

The retailers offer a vast range of vehicles for sale. It is a self-reinforcing cycle that started nearly 50 years ago when Auto Trader published its first classified magazine, and continued when it built its first website in 1996 and then its data platform about 10 years ago.

Buyers get choice, trust and simplicity through retailer reviews, information about vehicle history and specification, finance options, and the ability to reserve a car online.

Auto Trader published its last magazine in 2013 and floated two years later. Post-IPO it became more profitable as it shrugged off the last remnants of the magazine business.

- Shares for the future: are more thrilling gains just a fantasy?

- Stockwatch: what I’d do with BT and Vodafone shares

Subsequently, it has grown revenue and profit as it has invested in the marketplace and data platform based on the proprietary information it collects and augmented by other sources.

This data forms the heart of services that it sells back to retailers to improve their advertisements, uses in tools and guides for customers, and in publicity materials and briefings for the government.

Chief executive Nathan Coe has been involved since the magazine days. He joined Auto Trader in 2007 to help it develop into an online marketplace and was appointed to the top job in 2017.

It is a pretty stable business because retailers still need to sell cars in recessions. Demand for used cars holds up better than more expensive new cars, and if retailers drop their prices this does not directly impact Auto Trader’s main source of revenue, subscriptions.

In extreme years though, such as the pandemic, retailers will cut spending. In February 2021, Auto Trader felt it necessary to waive fees and extend payment terms to support the industry. Profit declined by nearly 40% that year and return on capital halved to a still majestic 97%.

The Future (directed) [2]

- Addressing challenges:Manufacturers selling direct, complexity [0.5]

- With coherent actions: Data products, Retail services, Leasing [0.5]

- That reward all stakeholders fairly: Employee friendly. Excellent annual report [1]

Auto Trader believes the drivers of its future performance are likely to be “reasonably consistent”. Aside from a growing automotive market, those drivers are mostly the company’s to lose: its dominant market position, its culture of innovation, and a strategy focused on selling more data products and bringing more of the car sale online.

The data product suite is branded Auto Trader Connect. It consists of three products. “Retail Essentials” launched in April 2022 is a taxonomy that makes it easier for retailers to list cars and synchronise their data with Auto Trader’s. “Valuations” launched in April 2023 and gives retailers access to specification and condition-adjusted valuations, enabling them to price products better. “Trended Valuations” and “Enhanced Retail Check” was launched in April this year. It tells retailers how vehicle prices have changed over the last six months, and provides forecasts, to help them decide what to stock.

The company says more than 75% of retailers use Retail Essentials and Valuations, and over half the increase in Average Revenue per Retailer in 2024 was due to the Valuations product.

To bring more of the car-buying journey online, Auto Trader has been trialling a service called DealBuilder, which partners with third parties to provide part-exchange and finance. It also enables car buyers to reserve cars online.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Trading Strategies: a FTSE 100 company with solid fundamentals

As a trial, it has yet to prove itself and the company has to be careful not to tread on its customers’ toes. For example, it will not offer finance to a car buyer from its panel of brokers if the advertiser has its own finance partner. However, it says the trial included 1,100 retailers (less than 10% of the total on Auto Trader) and it has monetised “a small cohort” of customers by charging a 0.25% transaction fee.

Another area of potential growth is new cars, but it is quite a complicated story. New cars contribute a modest proportion of advertising revenue from about 2,100 retailers. This has been augmented by the acquisition of Autorama, but growth in revenue has also been held back by a shortage of supply since the pandemic.

How new cars are being sold is also changing.

Brands from Audi to Volvo have or are changing the terms under which they distribute new cars through retailers from a franchise model to an agency model. Instead of the retailer owning the stock and negotiating with the car buyer, the manufacturer retains ownership and sets the price. The retailer becomes a service provider, supporting the sale in showrooms and during test drives for a fee.

The transition is an attempt by some manufacturers to improve their profitability and bring them closer to customers. The process is piecemeal, often starting with electric vehicles (EVs), and some brands are recanting. Reportedly, Jaguar Land Rover is one.

The immediate threat is modest, since Auto Trader is mostly about used cars and it has launched an advertising product for manufacturers operating an agency-only model in the UK. At the end of the financial year, it had nine manufacturers on board, which brought in about 3% of revenue.

If most manufacturers end up operating agency models, though, it would consolidate Auto Trader’s new car customer base, and maybe weaken retailers from which Auto Trader derives 85% of revenue. I am using a lot of “ifs” and “maybes”, but weaker retailers might not be good news for the used car business.

- The tax trap affecting 500,000 workers and how to beat it

- Lloyds Bank half-year results: steady rather than spectacular

Generally, Auto Trader is becoming more complex. Not only must it balance the needs of buyers and retailers to be a trusted marketplace with a huge choice, it must balance the interests of retailers and manufacturers, and its own offerings with retailers’.

As it becomes more involved in financing purchases in DealBuilder and leasing, the partners it is working with and the regulations it must obey are multiplying.

Set against the complexity is the company’s culture of innovation, which gives some confidence it will adapt.

Auto Trader seems intent on protecting its culture. This year, it introduced a staff share scheme that gives all staff an additional 10% of their salaries in shares every year, subject to a three-year vesting period.

Unsurprisingly perhaps, internal surveys show 97% of staff are proud to work for Auto Trader. Employee attrition is 11%, which the company says is low compared to peers. Employees rate it highly on recruitment site Glassdoor too. Its score is 4.5 out of 5.

The price (discounted?) [-1.1]

- No. A share price of 804p values the enterprise at just over £7 billion, 23 times normalised profit.

I think Auto Trader might find it more difficult to grow in future than it has in its first 10 years as a listed company. But a score of 6.9 out of 10 indicates that it may well be a good long-term investment.

It is ranked 21 out of 40 shares in my Decision Engine.

20 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Marks Electrical Group Ordinary Shares (LSE:MRK) and Solid State (LSE:SOLI) have published annual reports and are due to be re-scored.

I have moved PZ Cussons (LSE:PZC) to the bottom of the table pending the publication of its annual report in September. The collapse in the value of the Nigerian currency and the impact on the company’s finances and strategy mean I no longer have faith in the score.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.8 | ||

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | ||

3 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

4 | Supplies kitchens to small builders | 8.3 | ||

5 | Distributor of protective packaging | 8.3 | ||

6 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.9 | ||

7 | Whiz bang manufacturer of automated machine tools and robots | 7.9 | ||

8 | Manufactures/retails Warhammer models, licences stories/characters | 7.7 | ||

9 | Imports and distributes timber and timber products | 7.7 | ||

10 | Manufactures filters and filtration systems for fluids and molten metals | 7.5 | ||

11 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

12 | Surveys and distributes public opinion online | 7.5 | ||

13 | Distributes essential everyday items consumed by organisations | 7.4 | ||

14 | Manufacturer of scientific equipment for industry and academia | 7.4 | ||

15 | Online retailer of domestic appliances and TVs | 7.4 | ||

16 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | ||

17 | Sells hardware and software to businesses and the public sector | 7.1 | ||

18 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.0 | ||

19 | Translates documents and localises software and content for businesses | 7.0 | ||

20 | Manufactures natural animal feed additives | 7.0 | ||

21 | Auto Trader | Online marketplace for motor vehicles | 6.9 | |

22 | Manufactures vinyl flooring for commercial and public spaces | 6.8 | ||

23 | Retails clothes and homewares | 6.7 | ||

24 | Sells promotional materials like branded mugs and tee shirts direct | 6.7 | ||

25 | Operates tenpin bowling and indoor crazy golf centres | 6.5 | ||

26 | Supplies vehicle tracking systems to small fleets and insurers | 6.5 | ||

27 | Manufactures specialist paper, packaging and high-tech materials | 6.5 | ||

28 | Flies holidaymakers to Europe, sells package holidays | 6.5 | ||

29 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.4 | ||

30 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.2 | ||

31 | Makes marketing and fraud prevention software, sells it as a service | 5.9 | ||

32 | Manufactures sports watches and instrumentation | 5.9 | ||

33 | Manufactures military technology, does research and consultancy | 5.7 | ||

34 | Acquires and operates small scientific instrument manufacturers | 5.7 | ||

35 | Publishes books, and digital collections for academics and professionals | 5.6 | ||

36 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.5 | ||

37 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

38 | Manufactures disinfectants for simple medical instruments and surfaces | 5.4 | ||

39 | Runs a network of self-employed lawyers | 4.5 | ||

v Frozen v | ||||

? | Develops and manufactures hygiene, baby, and beauty brands | 7.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Auto Trader and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.