Shares for the future: FTSE 100 quality does not come cheap

One of the biggest companies he covers is under the spotlight this week, and columnist Richard Beddard admits the shares are no bargain. However, he rates them highly and thinks they’re probably a good long-term investment.

3rd May 2024 15:36

by Richard Beddard from interactive investor

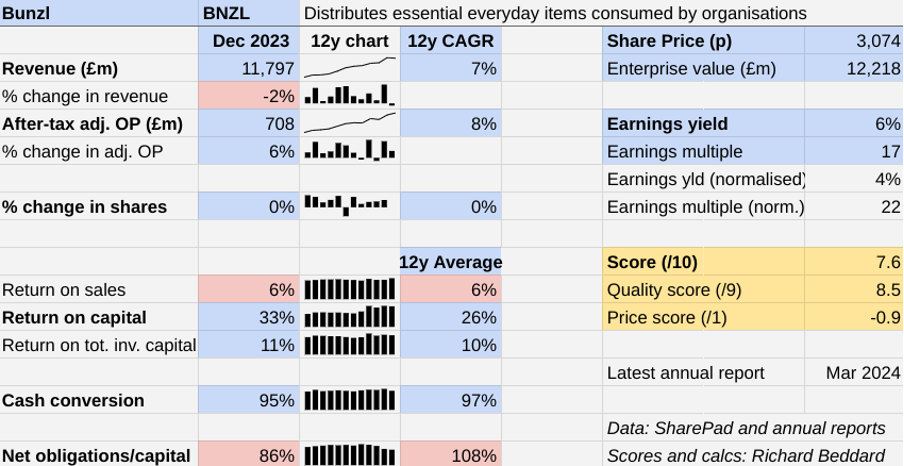

In the year to December 2023, Bunzl (LSE:BNZL)’s revenue declined for the first time since 2004, when it shaped itself into a distributor focused on the distribution of essential items used by businesses every day.

These are not items for resale. They are packaging, cleaning products, toilet paper, hard hats, boots, gloves, and healthcare equipment, for example.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Scoring Bunzl: self-funded growth

I doubt we have much to be concerned about. Revenue fell by only 2% in 2023, and in 2022 Bunzl grew strongly by 17%, almost twice its long-term growth rate.

At constant exchange rates and excluding the disposal of a business, revenue declined by 0.4%.

The Past (dependable) [2.5]

- Profitable growth: Yes, high single-digit long-term growth [1]

- Strong finances: High debt to capital, but consistent cash flow [0.5]

- Through thick and thin: Worst ROCE in 12 years: 20% in 2012 [1]

Return on capital remained above the levels the company achieved before the pandemic and Bunzl grew adjusted profit by 6%.

The immediate challenge facing Bunzl is falling prices in its large US food service operation, which it is often contractually obliged to pass on, price competition, and a reduction in takeaways after the pandemic, which has reduced demand for packaging.

Bunzl’s safety businesses are also experiencing the last bit of normalisation after a period of excess demand for personal protective equipment (PPE) due to the pandemic.

And sales volumes to US retailers have fallen, reducing revenue, as Bunzl focuses on its most profitable customers.

Bunzl is mostly funded by debt and operating lease obligations, which allows it to acquire more subsidiaries.

Although debt is risky, the company's extremely consistent performance justifies it. In other words, it has easily been able to afford the interest payments.

Revenue in the first quarter of the new financial year (January to March 2024) fell further, by 5.9% due to continuing issues in the US and adverse exchange rate movements.

Operating profit margins were strong though, and Bunzl still expects to grow slightly this year at constant exchange rates due to the acquisitions it has already completed.

Investors can be sniffy about acquisitive growth, but where it is self-funded in smaller complementary businesses with a manageable amount of debt, I do not see the problem.

The Present (distinctive) [3]

- Discernible business: Scale distributor of business essentials [1]

- With experienced people: Yes, CEO of eight years joined in 1994 [1]

- That creates value for customers: Service, expertise, range [1]

Bunzl is the largest value-added distributor in the markets it serves. It employs nearly 25,000 people in 33 countries.

The company is integral to customers' operations, stocking items and delivering them as they need them. Its product range is so wide and many of its customers so big, it can often fill a truck for a single delivery, which is efficient.

As the biggest customer of its many suppliers, it has clout sourcing products.

It has grown by acquiring 214 local and regional distributors since 2004, plugging them into its efficient supply chain and IT systems, and consolidating warehouses.

The courtship of rivals can take many years, but advantages accrue to acquired businesses and their customers including international knowledge, support on sustainability, digital innovation, cross-selling opportunities and cheaper purchasing.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Stockwatch: a FTSE 100 share in the early stages of a bull market

A case study in the annual report demonstrates that Bunzl does not just distribute cleaning products to one of its UK customers. It also provides carbon reporting, product information on sustainability, recycling opportunities and its own-brand chemically compliant and eco-friendly Cleanline Eco range.

Unlike small distributors, once developed, Bunzl can defray the cost of product development, IT systems, and digital sales tools over many subsidiaries.

Owners are attracted to sell their businesses to Bunzl because they are encouraged to stay on and retain considerable autonomy as managing directors.

Although Bunzl operations span the globe, its biggest markets are in North America and Europe. As a collection of local and regional businesses they, in the main, source products locally. These attributes insulate Bunzl somewhat from geopolitical risk.

The Future (directed) [3]

- Addressing challenges:Competition, climate change [1]

- With coherent actions: Acquisitions, innovation, services [1]

- That reward all stakeholders fairly: Scale benefits customers, employees [1]

Bunzl is expanding nearly everywhere, but particularly in countries where it has low market share. This is relatively easy because its biggest markets by market share are fairly small, like the Netherlands, Denmark and the UK.

Reassuringly for a company so big, Bunzl says its acquisition database continues to grow and it is still finding opportunities in highly penetrated markets.

In February 2024, Bunzl acquired Pamark, an “anchor” acquisition in Finland, which will also extend its reach across Scandinavia. Its operations span many of Bunzl’s product categories; cleaning and hygiene, healthcare, foodservice, and safety products.

Safety First, a distributor of PPE acquired in 2023 at a cost of £22 million, was Bunzl’s first acquisition in Poland.

Bunzl acquired Nisbets, a distributor of catering equipment in the UK, Northern Europe and Australasia earlier this year. It also acquired 17 businesses in 2023, too many to mention individually. As usual, the acquisitions show the diverse range of product categories Bunzl stocks.

- UK interest rate outlook: will Bank of England cut first?

- Lloyds Bank and Aviva part of FTSE 100’s £9bn dividend windfall

It made the most acquisitions (four) in Canada, spent the most money in Brazil (on three acquisitions). In terms of product category, six of the acquisitions supply cleaning and hygiene products, four supply safety and personal protective equipment (PPE), and two each supply packaging, and asset protection (like signposts and bollards).

Bunzl’s biggest acquisition, though, was in healthcare, a Brazilian supplier of surgical and medical equipment at a cost of £42 million. Three other acquisitions cost more than £30 million, two of them Brazilian (safety, cleaning and hygiene) and one of them German (workwear and PPE).

The biggest product category remains packaging (29% of total sales), where the industry is under pressure to reduce single use plastics (about 15% of sales) and the carbon footprint of products.

The transition to more sustainable products gives Bunzl the opportunity to increase profit margins. Alternative packaging materials are more expensive, and Bunzl can add value by developing and sourcing them, and helping customers work out which to buy.

Much of this development activity is focused on Bunzl’s own brands, which bring in about 25% of revenue, and give the company more control over pricing and profit margins.

I like Bunzl. For all its scale it is a relatively straightforward business, and it communicates well in the annual report.

But I cannot justify the differential between long standing chief executive Frank Van Zanten’s pay, and the median UK employee.

The chief executive’s total remuneration of £6.3 million was 213 times the median UK employee’s total remuneration of £29,468.

Median pay is much the same at Macfarlane, a much smaller UK protective packaging distributor, but about £5,000 less than median UK pay.

- Four AIM shares that are potential bid targets

- Wild’s Winter Portfolios 2023-24: record year for reliable shares

High executive pay is not just a Bunzl issue. Since Bunzl gives a good account of its culture I have turned a blind eye to it.

As a huge employer, there are many opportunities for employees to climb the career ladder and the company is in the process of certifying subsidiaries as “Great Places to Work”. Employee case studies in the annual report lend credence to this claim.

Voluntary employee turnover is 15%, which is another way of saying employees stay for six or seven years indicating a degree of contentment.

The price (discounted?) [-0.9]

- No. A share price of £30.74 values the enterprise at about £12.1 billion, 22 times normalised profit.

A score of 7.6 out of 10 indicates Bunzl is probably a good long-term investment.

It is ranked 13 out of 40 shares in my Decision Engine.

21 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report. Scores change daily due to price changes.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

4imprint Group (LSE:FOUR), Next (LSE:NXT) and Judges Scientific (LSE:JDG) have all published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

0 | Company | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.3 | |

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | |

3 | Supplies kitchens to small builders | 8.6 | |

4 | Translates documents and localises software and content for businesses | 8.5 | |

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | |

6 | Manufacturer of scientific equipment for industry and academia | 8.4 | |

7 | Manufactures filters and filtration systems for fluids and molten metals | 8.4 | |

8 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 8.2 | |

9 | Distributor of protective packaging | 8.1 | |

10 | Manufactures/retails Warhammer models, licences stories/characters | 7.8 | |

11 | Manufactures natural animal feed additives | 7.8 | |

12 | Imports and distributes timber and timber products | 7.8 | |

13 | Bunzl | Distributes essential everyday items consumed by organisations | 7.6 |

14 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.6 | |

15 | Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

16 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.4 | |

17 | Online retailer of domestic appliances and TVs | 7.4 | |

18 | Whiz bang manufacturer of automated machine tools and robots | 7.3 | |

19 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | |

20 | Sells hardware and software to businesses and the public sector | 7.2 | |

21 | Makes marketing and fraud prevention software, sells it as a service | 7.0 | |

22 | Supplies vehicle tracking systems to small fleets and insurers | 6.9 | |

23 | Online marketplace for motor vehicles | 6.9 | |

24 | Manufactures vinyl flooring for commercial and public spaces | 6.5 | |

25 | Manufactures specialist paper, packaging and high-tech materials | 6.4 | |

26 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.4 | |

27 | Operates tenpin bowling and indoor crazy golf centres | 6.3 | |

28 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 6.2 | |

29 | Manufactures military technology, does research and consultancy | 6.2 | |

30 | Flies holidaymakers to Europe, sells package holidays | 6.1 | |

31 | Surveys and distributes public opinion online | 6.1 | |

32 | Sells promotional materials like branded mugs and tee shirts direct | 6.1 | |

33 | Publishes books, and digital collections for academics and professionals | 5.8 | |

34 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | |

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.4 | |

36 | Manufactures sports watches and instrumentation | 5.4 | |

37 | Supplies software and services to the transport industry | 5.3 | |

38 | Acquires and operates small scientific instrument manufacturers | 4.8 | |

39 | Retails clothes and homewares | 4.6 | |

40 | Runs a network of self-employed lawyers | 4.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Bunzl and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.