Shares for the future: evaluating a complicated FTSE 100 business

It was plain sailing at this popular company until a few years ago, but it has weathered the storm and is on a roll again. Columnist Richard Beddard has another look under the bonnet to decide if it’s time to buy.

17th May 2024 15:42

by Richard Beddard from interactive investor

Last year I complained that Next (LSE:NXT)had no strategy, but I am returning to the UK retail giant this year in a spirit of humility. It may have been that Next is so complicated, I could not work out the strategy.

I am in good company. In his introduction to the annual report, the company's chief executive says: “With so much to explain, articulating how we plan to take the Group forward in a concise and simple way has been demanding.”

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

He gave himself 70 pages, I have little more than 1,000 words...

Scoring Next: calmer waters?

In this year’s annual report, Next describes the years to 2017 as “plain sailing”, and 2017 as the year its formula stopped working.

That growth formula was more products, more high street retail space, and more catalogue and subsequently online customers.

Then online began to gobble high street sales.

Veteran followers of Next will remember the projections it published quantifying the decline in revenues and profitability for the retail estate. In fact, revenues have held up a bit better than expected and Next successfully reduced costs, keeping shops profitable, albeit not quite as profitable.

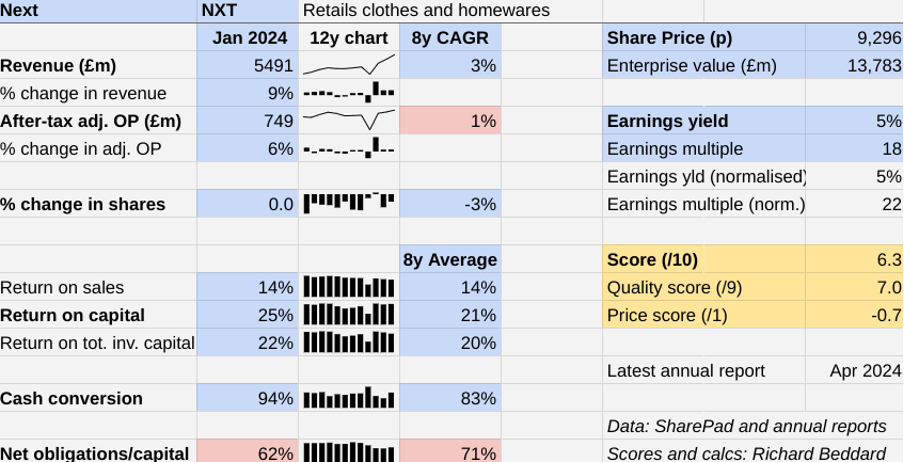

Profits have grown, but only at a Compound Annual Growth Rate (CAGR) of 1% since 2016.

The Past (dependable) [2]

- Profitable growth: 8-year profit growth only 1% CAGR [0.5]

- Strong finances: Debt to capital more than 50% [0.5]

- Through thick and thin: Lowest return on capital 12% in 2021 [1]

Next says it weathered the storm well, and I agree. It has largely maintained return on capital, cash generation has been strong, and it has reduced its indebtedness somewhat.

It thinks it will not have to refinance an upcoming bond in 2025 if high interest rates prevail then, which is reassuring.

Maybe Next is finding a route to growth too.

The company is on something of a roll. Revenue is 29% higher than it was for the year to January 2020, the last year before the pandemic, and adjusted profit after tax is 15% higher.

The company anticipates profit before tax will be 4.5% higher in 2025 than it was in the year to January 2024. Maybe calmer waters lie ahead, once again.

The Present (distinctive) [3]

- Discernible business: Vertically integrated UK fashion brand [1]

- With experienced people: Very experienced [1]

- That creates value for customers: Choice, value, service, credit [1]

Next as it is today, is the creation of Lord Wolfson of Aspley Guise, its chief executive of more than 20 years. He guided the business through nearly two decades of plain sailing, though he says it did not feel it was easy at the time, and he guided it through the subsequent storm.

Sometimes it has seemed the strategy is all at sea, but Next has more than stayed afloat.

The company is a reassuringly mid-market fashion retailer that nods to the latest trends and designs stylish but also practical clothes, mostly for adults in their twenties, thirties and forties. It also sells homeware and beauty products.

I think the brand has aged well, which probably has something to do with the name, and how well managed the business is. Its stores always look clean, sharp and full. Its annual reports are famous for the level of detail they provide, and the business is notorious for its financial acuity.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Next does better than expected in Q1

Creatively, the company is led “from the ground up”, by small teams of designers, buyers, merchandisers, and product technologists. But it is commercial from the top down.

For example, the company has ramped up spending on software and automation across the business, but Lord Wolfson says the company’s purpose is not excellent code or warehousing. The work of engineers and developers must achieve at least one of sales growth, improved customer service, or lower costs.

This culture probably extends throughout the business. Lord Wolfson says Next has taken its American chairman’s experience of developing ‘ordinary folks’ who go on to achieve extraordinary things. It prefers to promote from within, including a number of board members.

One of them, Amanda James, the company’s chief financial officer of nine years, is leaving in 2024. She joined Next 29 years ago. Her replacement is Jonathan Blanchard of Reiss, one of Next’s acquisitions.

The Future (directed) [2]

- Addressing challenges:Maturity of Next in UK, complexity [0.5]

- With coherent actions: Overseas sales, inventing and enabling other brands [0.5]

- That reward all stakeholders fairly: Special culture. How serious is it about sustainability? [1]

The NEXT Brand, which adorns the 75,000 products designed in-house, is described as the jewel in the crown. The annual report does not tell us how much revenue or profit Next makes from it, or whether it is growing.

Judging by Next’s ambitions though, there is probably not much potential for the brand to grow in the UK where Next earns 84% of total revenue.

Instead, the company’s growth ambitions lie outside the UK or involve other brands.

Next is spending more marketing the NEXT Brand overseas, where the company says awareness is growing (but it is much less well known).

It is also banking on developing new brands, licensing third-party brands to develop, and Total Platform, which rents out Next’s retail infrastructure to other UK brands, which Next usually acquires or invests in.

With Total Platform, Next provides the website, the logistics and the credit facility, so the client brand can get on with sourcing products and marketing them. It earns a commission and also profits from the equity it has in the partner businesses.

The company is developing, licensing, or acquiring multiple brands a year. In the year to January 2024 Next launched Love & Roses, licensed nine brands, and added JoJo Maman Bébé, MADE, and Joules to Total Platform. It upped its stake in Reiss, also on Total Platform, and acquired 97% of FatFace, which joins the platform later this year.

There are elements of coherence in this plan. Total Platform is built on Next’s existing infrastructure. By putting more volume through its warehouses and IT infrastructure it should improve the efficiency of Next itself, as well as partners.

FatFace will be receiving a new Total Platform feature that allows “friction-free” re-export to the EU and other countries.

In Europe, Next cannot afford to build this infrastructure, so it uses online retailers and aggregators.

In Asia, Australia and North America it is too costly to ship products that have already been shipped from the Far East, so Next is seeking franchise and wholesale partners who will decide what to stock, receive shipments directly from the Far East, and set their own prices.

This means Next will be following different business models in different territories.

The complexity worries me. The company is already a vertically integrated UK retailer, an outsourcer of retail services to other UK brands, a serial acquirer, and an investor in other brands. Lest we forget it is also a credit company.

Running Next is a big job and Lord Wolfson has done well, but I still question the level of pay. His single figure of remuneration was £4.5 million in 2024. Apparently, this is sub-par for a FTSE 100 chief executive. It is, nevertheless 202 times the median employee’s total pay of £22,407.

The median employee works in a shop or a warehouse. In my hometown of Cambridge, Next’s neighbour is Marks & Spencer, where the median employee earns a similar amount.

On a relative basis, Next is not gouging its employees, but the disparity between top and bottom in retail is very unappealing.

I also wonder why sustainability is not listed as a principal risk, or mentioned outside the ESG section of the annual report.

The price (discounted?) [-0.7]

- No. A share price of £92.96 values the enterprise at about £13.8 billion, 22 times normalised profit.

Next appears to be growing again. Although the growth is modest, a 4% CAGR in adjusted profit over the last four years, it is only part of the story.

The company also returns substantial amounts to shareholders in terms of dividends and share buybacks, adding to their total return.

A score of 6.3 out of 10 indicates that Next is probably fairly valued.

It is ranked 29 out of 40 shares in my Decision Engine.

21 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Garmin Ltd (NYSE:GRMN), Judges Scientific (LSE:JDG), Churchill China (LSE:CHH) and Advanced Medical Solutions Group (LSE:AMS) have all published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

0 | Company | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.4 | |

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | |

3 | Translates documents and localises software and content for businesses | 8.5 | |

4 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | |

5 | Supplies kitchens to small builders | 8.4 | |

6 | Distributor of protective packaging | 8.3 | |

7 | Manufacturer of scientific equipment for industry and academia | 8.3 | |

8 | Manufactures filters and filtration systems for fluids and molten metals | 8.2 | |

9 | Manufactures natural animal feed additives | 7.8 | |

10 | Imports and distributes timber and timber products | 7.8 | |

11 | Manufactures/retails Warhammer models, licences stories/characters | 7.8 | |

12 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.7 | |

13 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.6 | |

14 | Distributes essential everyday items consumed by organisations | 7.6 | |

15 | Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

16 | Online retailer of domestic appliances and TVs | 7.5 | |

17 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.4 | |

18 | Whiz bang manufacturer of automated machine tools and robots | 7.4 | |

19 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | |

20 | Sells hardware and software to businesses and the public sector | 7.0 | |

21 | Supplies vehicle tracking systems to small fleets and insurers | 7.0 | |

22 | Sells promotional materials like branded mugs and tee shirts direct | 6.7 | |

23 | Makes marketing and fraud prevention software, sells it as a service | 6.6 | |

24 | Online marketplace for motor vehicles | 6.5 | |

25 | Manufactures vinyl flooring for commercial and public spaces | 6.5 | |

26 | Operates tenpin bowling and indoor crazy golf centres | 6.4 | |

27 | Flies holidaymakers to Europe, sells package holidays | 6.3 | |

28 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 6.3 | |

29 | Next | Retails clothes and homewares | 6.3 |

30 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.2 | |

31 | Manufactures specialist paper, packaging and high-tech materials | 6.1 | |

32 | Surveys and distributes public opinion online | 6.1 | |

33 | Manufactures military technology, does research and consultancy | 5.9 | |

34 | Manufactures sports watches and instrumentation | 5.9 | |

35 | Publishes books, and digital collections for academics and professionals | 5.6 | |

36 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | |

37 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | |

38 | Supplies software and services to the transport industry | 5.2 | |

39 | Acquires and operates small scientific instrument manufacturers | 4.7 | |

40 | Runs a network of self-employed lawyers | 4.4 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.