Shares for the future: a business priced for perfection

Its share price has remained in an uptrend for the past seven years, and analyst Richard Beddard still likes the company, but there’s a problem. Here’s how he scores this AIM 100 stock.

7th June 2024 14:58

by Richard Beddard from interactive investor

Judges Scientific presents investors with a problem: How much is it worth paying for a business that has grown so reliably for so long?

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

Scoring Judges Scientific: proper growth story

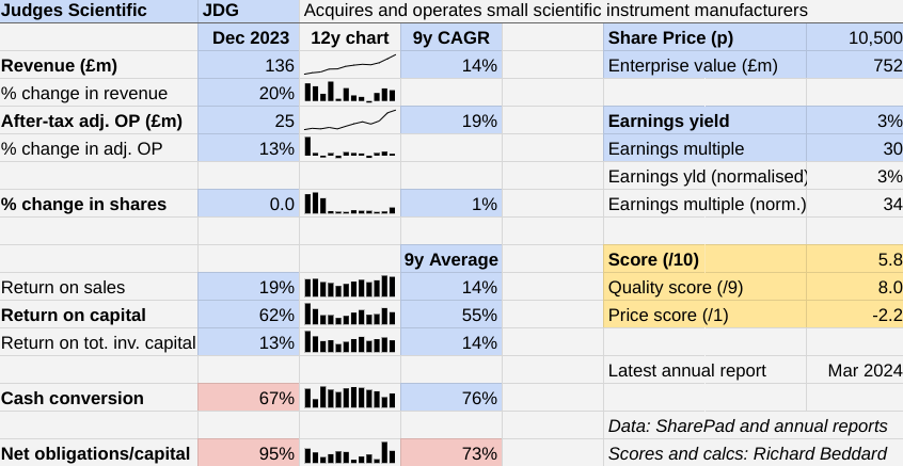

In the year to December 2023, Judges Scientific (LSE:JDG) increased revenue by 20%, higher than its impressive nine-year Compound Annual Growth Rate (CAGR) of 14%, and profit increased by 13%, lower than its even more impressive 19% CAGR.

The Past (dependable) [2.5]

- Profitable growth: Double-digit revenue and profit CAGR [1]

- Strong finances: Elevated financial obligations [0.5]

- Through thick and thin: Lowest return on capital 29% (2016) [1]

Return on capital was 62%, above its long-term average, demonstrating Judges Scientific’s operations generate an incredible amount of profit compared to the capital it must invest to stay in business.

The company did not overpay for the acquisitions either. Return on total invested capital (including acquisitions at cost) is 17%.

For the second year running, though, cash conversion was sub-par. This, the company explains, is because it still held higher stocks to mitigate component shortages.

A return to pre-pandemic levels of cash conversion is the goal.

Lower cash conversion and the final payment for the company’s biggest ever acquisition meant debt levels remained elevated.

It needs to reduce debt before it can swing whole-heartedly back on to the acquisition trail...

The Present (distinctive) [3]

- Discernible business: Acquirer of niche scientific instrument manufacturers [1]

- With experienced people: Founder-led board [1]

- That creates value for customers: Provides the workhorses of scientific research [1]

Judges Scientific acquires companies that make scientific equipment. These specialised machines occupy niches that are not always easy to expand, so the company also reinvests the copious returns from them in more acquisitions.

The acquisitions do not need to satisfy a similar scientific need or market, but they do need to be making equipment that has few or no direct competitors. These machines are the workhorses of scientific inquiry, used at universities and in industry around the world (11% of sales were earned in the UK).

Judges Scientific targets businesses that already earn strong profit margins, typically with an established manager ready to take over the running of the business from a retiring founder.

It buys firms using borrowed money, aiming to pay less than 6% interest, which compares extremely favourably to the much higher returns they generate. Then it encourages management to be entrepreneurial, using the international experience of other subsidiaries, to help them expand in new geographical markets.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- AIM stocks, elections and what to expect after 4 July

Once the debt has been repaid, Judges Scientific repeats the acquisition process.

Judges Scientific can buy companies cheaply in private markets because it has a reputation for straight dealing. It would rather walk away than beat sellers down on price once terms are agreed.

Particularly when acquisitions are too small to be of interest to private equity buyers, they can be uncontested.

Over the last 18 years, Judges Scientific has acquired 23 companies.

The Future (directed) [2.5]

- Addressing challenges:Growth [1]

- With coherent actions: Collaboration, bigger acquisitions [0.5]

- That reward all stakeholders fairly: Acquisitions flourish, so do shareholders [1]

Higher interest rates could make acquisitions less affordable, although that would not be the end of the story.

Judges Scientific reckons high interest rates would hurt private equity acquirers, aka the competition, more because they rely more heavily on debt. If they backed off, the market would be less competitive and sellers might lower their price expectations, making acquisitions more affordable.

In any case, the existing businesses do not require debt to earn handsome profits so the worst-case scenario is likely to be that acquisitions slow down for a while.

The same might be said of another potential risk factor. David Cicurel, Judges Scientific’s founder and principal dealmaker, is in his seventies, and although he has not indicated he plans to retire, it is evidently a possibility.

The board has grown in experience with the addition of two executives. Mark Lavelle, chief operating officer since 2017, and Dr Tim Prestidge, group business development director since 2023, both came from serial acquirer Halma.

They’re currently focused on getting the most out of existing subsidiaries, but their experience of acquisitions must also be useful.

Last year, I was spooked by the size of the GeoTek acquisition, £80 million was more than five times that year’s cash flow, and more than the cost of all Judges Scientifics’ previous acquisitions put together.

Big acquisitions tend to be more expensive, because they are often contested. Judges Scientific did not stray out of its self-imposed valuation range (3 to 7 times EBIT (Earnings Before Interest and Tax) when it bought GeoTek, but it touched the top of the range.

- Share Sleuth: the stock I’ve sold after a roller-coaster ride

- Six FTSE 100 giants to pay £10 billion dividends in June

This may be a sign of things to come. As the company grows, it needs to make bigger acquisitions to maintain the growth rate. If they are more expensive, the acquisition model becomes less profitable.

Still-acquisitive Halma, though, earns 10 times the revenue Judges Scientific does and still seems to be making acquisitions work.

GeoTek also pushed other boundaries, raising the group to a new level of indebtedness, and exposed it to more complexity.

GeoTek manufactures instruments that analyse geographical cores. Like most of Judges’ smaller subsidiaries, it supplies universities as well as industry. But much of the industrial demand comes from oil and gas exploration companies.

There are two obvious complexities: oil and gas are cyclical industries and governments are trying to get us to use less of these fossil fuels. There is a third complexity too. As well as selling equipment, GeoTek leases it to customers, provides services to oil and gas companies, and conducts lucrative but irregular coring expeditions under contract. These are business models the mothership is less familiar with.

The company’s risk report contains the rather stark warning that tensions between the West and China “may well degenerate into open conflict”. It earns about 14% of revenue in China and Hong Kong, but of course the impact of such a conflict would be felt everywhere.

The price (discounted?) [-2.2]

- No. A share price of £105.00 values the enterprise at about £752 million, 34 times normalised profit.

I like Judges Scientific. The firms it acquires flourish. We know this because the group has grown so profitably, and it has never closed a business.

The directors’ pay is modest by the standards of some of the companies I follow, and although their share options are valuable, that is because the company has done extremely well.

Judges Scientific makes equipment that helps scientists do important work. It wants its employees to be proud to work for it and encourages them to think long term. David Cicurel owns nearly 11% of the firm.

The main hole in the investment case is the share price...

A score of 5.8 out of 10 indicates that Judges Scientific is priced for near perfection.

It is ranked 36 out of 40 shares in my Decision Engine.

19 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Churchill China (LSE:CHH), Advanced Medical Solutions Group (LSE:AMS), and Anpario (LSE:ANP) have all published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.8 | ||

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | ||

3 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

4 | Supplies kitchens to small builders | 8.4 | ||

5 | Distributor of protective packaging | 8.3 | ||

6 | Manufacturer of scientific equipment for industry and academia | 8.2 | ||

7 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.9 | ||

8 | Manufactures filters and filtration systems for fluids and molten metals | 7.8 | ||

9 | Distributes essential everyday items consumed by organisations | 7.8 | ||

10 | Manufactures/retails Warhammer models, licences stories/characters | 7.8 | ||

11 | Manufactures natural animal feed additives | 7.8 | ||

12 | Imports and distributes timber and timber products | 7.8 | ||

13 | Develops and manufactures hygiene, baby, and beauty brands | 7.5 | ||

14 | Whiz bang manufacturer of automated machine tools and robots | 7.5 | ||

15 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.4 | ||

16 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.4 | ||

17 | Online retailer of domestic appliances and TVs | 7.4 | ||

18 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | ||

19 | Translates documents and localises software and content for businesses | 7.0 | ||

20 | Sells hardware and software to businesses and the public sector | 6.9 | ||

21 | Makes marketing and fraud prevention software, sells it as a service | 6.7 | ||

22 | Manufactures vinyl flooring for commercial and public spaces | 6.7 | ||

23 | Sells promotional materials like branded mugs and tee shirts direct | 6.7 | ||

24 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 6.7 | ||

25 | Operates tenpin bowling and indoor crazy golf centres | 6.5 | ||

26 | Supplies vehicle tracking systems to small fleets and insurers | 6.5 | ||

27 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.4 | ||

28 | Flies holidaymakers to Europe, sells package holidays | 6.4 | ||

29 | Manufactures specialist paper, packaging and high-tech materials | 6.4 | ||

30 | Retails clothes and homewares | 6.2 | ||

31 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.2 | ||

32 | Online marketplace for motor vehicles | 6.2 | ||

33 | Surveys and distributes public opinion online | 6.1 | ||

34 | Manufactures sports watches and instrumentation | 6.0 | ||

35 | Manufactures military technology, does research and consultancy | 5.9 | ||

36 | Judges Scientific | Acquires and operates small scientific instrument manufacturers | 5.8 | |

37 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | ||

38 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

39 | Publishes books, and digital collections for academics and professionals | 5.5 | ||

40 | Runs a network of self-employed lawyers | 4.4 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click on the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.