Shares for the future: a business I love is in great shape

It’s one of the biggest companies he covers and it continues to impress him, but there’s a niggling issue. Find out how analyst Richard Beddard scores these shares.

24th May 2024 15:29

by Richard Beddard from interactive investor

After the go-go pandemic years when lots of us became fitness fanatics, and a slow-slow 2022, when shipping delays and shortages increased costs, Garmin Ltd (NYSE:GRMN) says normality returned in the year to December 2023.

- Invest with ii: US Earnings Season | Buying US Shares in UK ISA | Cashback Offers

Scoring Garmin: back to normal

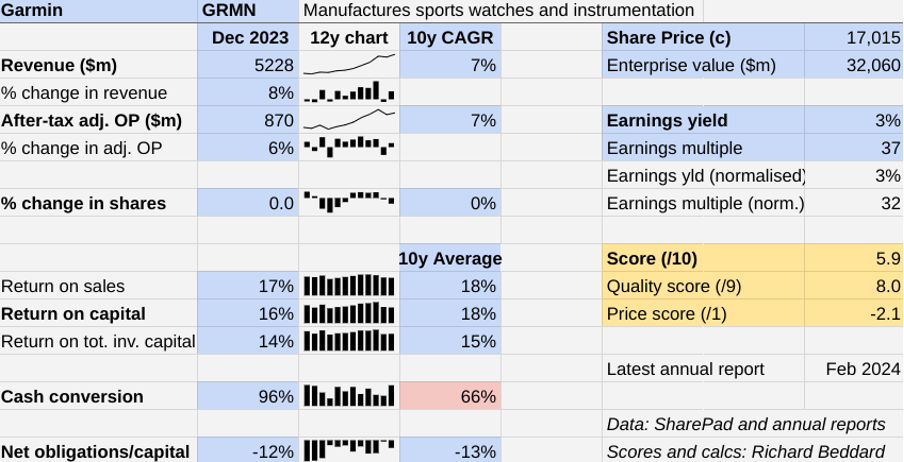

Normal looks good to me. Revenue increased 8%, just above Garmin’s long-term growth rate, and after-tax adjusted profit increased 6%, just below it.

Return on capital was a little below its long-term average but still in the high teens, and cash conversion improved as the company reduced the prior year’s stockpile.

The Past (dependable) [3]

- Profitable growth: 7% CAGR, revenue and profit [1]

- Strong finances: Negative net financial obligations [1]

- Through thick and thin: Lowest return on capital 15% (2015) [1]

The only red flag in my dashboard is average cash conversion, impacted somewhat by pandemic stockpiling, but also the ongoing capital expenditure required for a growing manufacturing business and share based payments which I deduct from cash flow.

Share-based payments gobbled up more than 7% of operating cash flow in 2023, but this may be a good thing as the payments are shared widely among employees.

Source: Garmin annual report 2023.

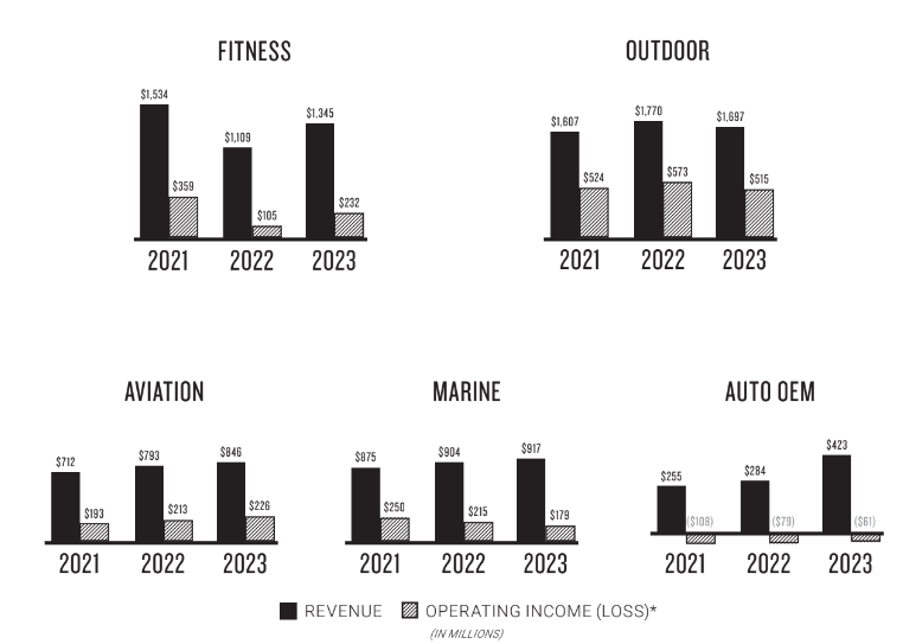

Growth in revenue and profit came from the smallest four of Garmin’s five divisions: Aviation, Marine (helped by the acquisition of JL Audio), Auto OEM, and Fitness.

Garmin’s biggest division, Outdoor, did not fully recover from a 27% decline in the first quarter of 2023 as the buzz around big adventure watch launches the previous year died down.

Among the plethora of products launched by the division in 2024 was the Descent G2 Solar - Ocean edition, a dive watch made with recycled ocean-bound plastics and the eTrex Solar, a handheld GPS capable of “infinite battery life”.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Shares for the future: evaluating a complicated FTSE 100 business

The Auto OEM division supplies original equipment manufacturers i.e. vehicle manufacturers and their suppliers.

Garmin has been investing for over a decade in designing and producing car infotainment systems and domain controllers that manage vehicle electronics. It is BMW’s lead supplier and also counts Yamaha Motorsports and Honda motorcycles as customers, but it has yet to make a profit. Sales, though, particularly of BMW-bound domain controllers are ramping up.

Prospects for 2024 look good. First-quarter revenues grew strongly compared to the same quarter last year in the Fitness and Outdoor divisions due to high demand for wearable technology. Propitiously, the strong growth in Auto OEM persisted too.

Garmin anticipates $5.75 billion revenue in 2024, which is 10% more than it achieved in 2023.

The Present (distinctive) [3]

- Discernible business: Vertically integrated manufacturer of specialised wearables and instrumentation [1]

- With experienced people: Very experienced [1]

- That creates value for customers: Functionality, reliability [1]

Garmin was founded in 1989 by two electrical engineers, Gary Burrell and Min Kao (“Gar” and “Min”) with a mission to “popularise GPS and change the world”.

GPS is the Global Positioning System, embedded in its first products and most of the subsequent ones.

Today, the company is probably best known as a fitness and adventure watch brand, but its first products were navigation devices for planes and boats. It also makes specialised wearables and navigation devices for off-grid adventurers, sports equipment such as bike computers and golfing aids, sophisticated instrumentation for aircraft and boats, and electronic systems for cars, trucks and motorcycles.

The diversity means it has no direct competitors, although its individual divisions face stiff competition. Estimates of Apple Watch sales, for example, suggest that Apple’s single product line earns more revenue than the whole of Garmin.

- How to invest ahead of the general election

- Dramatic turnaround and upgrades inflate this industry giant

Garmin’s products are different though. Apple makes watches for everyone. Garmin makes watches for runners, triathletes, for divers, mountaineers and numerous other niches.

Because Garmin was one of the first companies to commercialise GPS after the US government declassified the technology, and its founders were engineers, it designed and manufactured its own products.

The company says it still seeks to limit its dependence on third parties throughout the process of designing, manufacturing and distributing products because its know-how makes it more efficient, speeds up development time, and gives it full control over quality.

This policy has been consistently applied under the leadership of Min Kao, who is executive chair, and chief executive Cliff Pemble, who was one of the company’s first employees. He joined Garmin in its first year, 1989, as a software developer and succeeded Min Kao as chief executive in 2013.

The Future (directed) [2]

- Addressing challenges:Dependence on Taiwan [0.5]

- With coherent actions: Diversifying production locations? [0.5]

- That reward all stakeholders fairly: Employee friendly, customer friendly [1]

Garmin’s commitment to investment is visible in its research and development spend, which was 17% of revenue in 2023, a rate consistent with recent years. It has over 1,900 patents (last year it had over 1,800).

It is also demonstrated by its commitment to the Auto OEM segment despite a decade of losses. The higher sales trend is encouraging because it means Garmin should make more efficient use of the manufacturing capacity it has built and the intellectual property it has created.

Although the company has production facilities scattered across Taiwan, North America, the UK, China and Europe, most of Garmin’s biggest product lines are manufactured in Taiwan, which reportedly accounts for 90% of production.

Since Taiwan is a geopolitical hotspot, this represents a considerable risk. I do not know what Garmin is doing about it, and I wonder if its loyalty to Taiwan stems from its co-founder and executive chair Min Kao, who is Taiwanese-American, and the benefits of concentrating its volume manufacturing facilities near each other.

The company might be inching towards a more diversified manufacturing footprint, though. Reports in the Taiwanese press last month say Garmin is to build its first plant outside Taiwan but in Southeast Asia by 2026. The investment, it is said, will focus on auto products initially, but the intent is to diversify the production base and bring Garmin closer to some of its suppliers.

- Stockwatch: what now after ISA tip’s 70% profit in two months?

- Insider: boardroom buying at AIM company with royal approval

It would be wise, I think, if this were the first step in accelerating the growth of production capacity outside Taiwan.

Otherwise, Garmin’s future is probably largely in its own hands, and its innovative culture should persist.

Share based payments amounted to over $101 million in 2023. If these were mostly going into executives’ pockets it would be distressing. However, the board pocketed $10 million in stock awards in 2023, suggesting its largesse is targeted quite liberally.

This accords with the company’s policy, which is to pay people well to recruit and retain a high-quality workforce. Chief executive Cliff Pemble’s total remuneration in 2023 was just over $6.5 million, which sounds like a lot but is probably quite modest in comparison to peers.

It was 159 times the median total remuneration of Garmin’s global workforce, which also sounds like a lot. Many of its employees work in lower wage economies like Taiwan, Eastern Europe, and here in Southampton, though. Cliff Pemble’s pay was 58 times median US pay of just over $113,000.

The chief executive’s letter prefacing this year’s annual report speaks of his pride in the awards won by Garmin during the year, not least number two spot in Forbes’ list of “America's Best Large Employers”.

I spy a superior culture.

There is one additional risk. Garmin is incorporated in Switzerland and listed in New York. Currently it distributes its dividend from an accounting reserve, which means we do not have to pay withholding tax.

If the reserve runs out or the rules change, we will lose a portion of the annual dividend.

The price (discounted?) [-2.1]

- No. A share price of $170 values the enterprise at about $32 billion, 32 times normalised profit.

Beware, I am a Garmin fanboy. I love my Garmin Forerunner, and the business - except for the niggling issue of Taiwan.

A score of 5.9 out of 10 indicates Garmin is probably fairly valued.

It is ranked 34 out of 40 shares in my Decision Engine.

20 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Judges Scientific (LSE:JDG), Churchill China (LSE:CHH), and Advanced Medical Solutions Group (LSE:AMS) have all published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

Company | Description | Score |

Manufactures tableware for restaurants and eateries | 9.6 | |

Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | |

Translates documents and localises software and content for businesses | 8.5 | |

Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | |

Supplies kitchens to small builders | 8.5 | |

Distributor of protective packaging | 8.3 | |

Manufactures filters and filtration systems for fluids and molten metals | 8.3 | |

Manufacturer of scientific equipment for industry and academia | 8.2 | |

Manufactures/retails Warhammer models, licences stories/characters | 7.8 | |

Manufactures natural animal feed additives | 7.8 | |

Imports and distributes timber and timber products | 7.8 | |

Distributes essential everyday items consumed by organisations | 7.7 | |

Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.7 | |

Makes light fittings for commercial and public buildings, roads, and tunnels | 7.7 | |

Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

Online retailer of domestic appliances and TVs | 7.4 | |

Whiz bang manufacturer of automated machine tools and robots | 7.4 | |

Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.4 | |

Sources, processes and develops flavours esp. for soft drinks | 7.1 | |

Supplies vehicle tracking systems to small fleets and insurers | 7.0 | |

Sells hardware and software to businesses and the public sector | 6.8 | |

Online marketplace for motor vehicles | 6.7 | |

Sells promotional materials like branded mugs and tee shirts direct | 6.7 | |

Makes marketing and fraud prevention software, sells it as a service | 6.6 | |

Manufactures vinyl flooring for commercial and public spaces | 6.5 | |

Casts and machines steel. Processes minerals for casting jewellery, tyres | 6.5 | |

Operates tenpin bowling and indoor crazy golf centres | 6.4 | |

Flies holidaymakers to Europe, sells package holidays | 6.4 | |

Manufactures specialist paper, packaging and high-tech materials | 6.3 | |

Retails clothes and homewares | 6.2 | |

Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.2 | |

Surveys and distributes public opinion online | 6.1 | |

Manufactures military technology, does research and consultancy | 5.9 | |

Garmin | Manufactures sports watches and instrumentation | 5.9 |

Acquires and operates small scientific instrument manufacturers | 5.8 | |

Manufactures power adapters for industrial and healthcare equipment | 5.5 | |

Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | |

Publishes books, and digital collections for academics and professionals | 5.4 | |

Supplies software and services to the transport industry | 5.2 | |

Runs a network of self-employed lawyers | 4.4 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Garmin and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.