Shares for the future: the best stock on my subs’ bench so far

After deciding to remove some stocks from his Decision Engine, analyst Richard Beddard is looking for replacements. Could this company be the one?

15th November 2024 15:11

by Richard Beddard from interactive investor

This week, I’m introducing another potential candidate for the Decision Engine, selected because it has grown dependably, and I think it may be distinctive and directed.

Instead of adding candidates immediately to the Decision Engine, I’m adding them to a different list. Let us call it the subs’ bench.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

I can mull them over and, when it is time to retire a low-scoring member of the Decision Engine, I’ll be able to pick from a handful of promising substitutes.

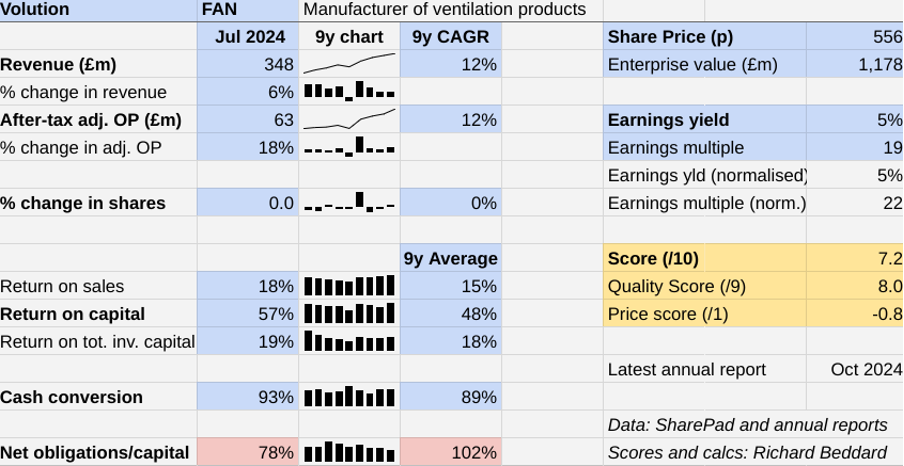

Scoring Volution: high returns

Volution Group (LSE:FAN) manufactures ventilation products for homes, offices, hospitals and shops. Fans, in other words, and whole-house ventilation systems.

The Past (dependable) [2.5]

- Profitable growth: 12% CAGR in revenue and profit [1]

- Strong finances: Strong cash flow, substantial obligations [0.5]

- Through thick and thin: Lowest RoC 34% in 2020 [1]

Since it listed on the stock market in 2014, Volution has grown revenue and adjusted profit at a compound annual growth rate of 12%.

Profit margins are more than adequate and Volution’s businesses generate about 50% return on capital in a typical year.

However, they are almost entirely financed by external capital. Net obligations (including leases) at the end of the financial year in July 2024 were 78% of operating capital.

That is the lowest level of indebtedness since 2015, but still above my 50% benchmark.

No doubt Volution believes that it can afford the interest on these obligations because of its dependable profits and strong cash flows. Cash returns after capital expenditure are typically 90% of adjusted profit.

- Stockwatch: possible bid target and hedge against IHT

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

That is a reasonable assessment. For a manufacturer, Volution does not require much capital. Its debt to capital ratio is not just high because of its financial obligations, but because I’m comparing it to something small.

That low capital requirement may stem from the fact that Volution is mainly an assembler. It makes the cases and fills them with components often made elsewhere, usually to its own specification.

If we think about debt in terms of how long it might take to repay it, it takes on a different complexion.

Volution could probably save up enough cash to outweigh all its financial obligations in a couple of years if it were to direct free cash flow into the bank.

In the decade since Volution floated it has spent much of it on acquisitions, instead.

The Present (distinctive) [3]

- Discernible business: Manufacture of ventilation systems [1]

- With experienced people: Experienced chief executive [1]

- That creates value for customers: Quality, availability, sustainability [1]

Better ventilation means healthier air indoors. Volution mostly improves the air in our homes, but the commercial market, places such as shops and offices, contributed a little over 20% of revenue in 2024.

Public awareness of the importance of indoor air quality increased during the Covid pandemic. Tightening regulations and the prosecution of public and private landlords for failing to prevent condensation and mould means Volution is benefiting from an “acute focus” on poorly ventilated homes (aka sick building syndrome).

Regulations to improve energy efficiency and reduce emissions from buildings are also boosting demand for ventilation systems that expel stale air but not heat in winter, and help cool houses in summer.

Volution differentiates itself by making quieter, more automated and more environmentally sustainable products, and by providing services to larger contractors, such as site surveys.

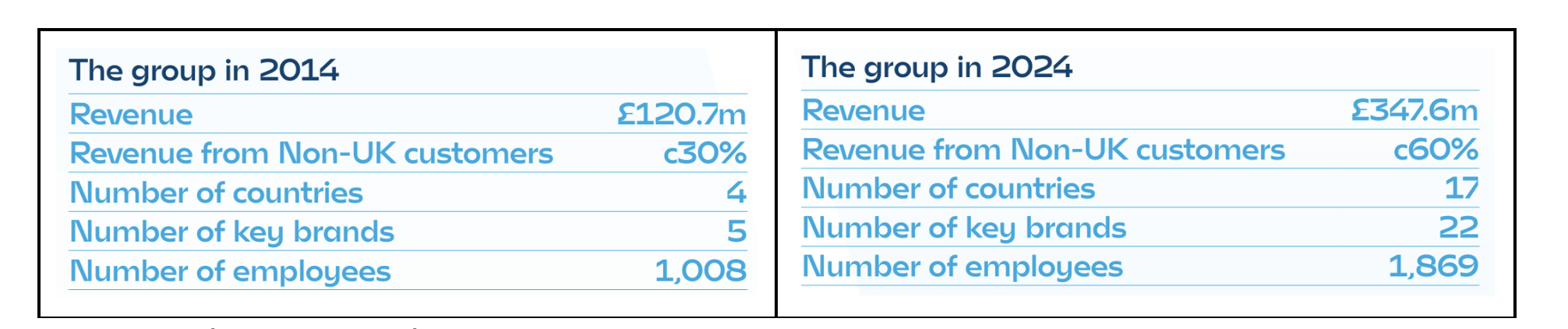

During the decade since it floated, the company has diversified geographically, doubling revenue from overseas from 30% to 60% as it has acquired businesses in Europe and Australasia.

Source: Volution annual report 2024

Chief executive Ronnie George has guided this transformation. Formerly the managing director of Vent-Axia, one of the company’s UK subsidiaries, he led a management buyout in 2012.

The Future (directed) [2.5]

- Addressing challenges:Growth, competition [1]

- With coherent actions: Innovation, acquisitions (sometimes large) [0.5]

- That reward all stakeholders fairly: Employee/customer-centric vibe [1]

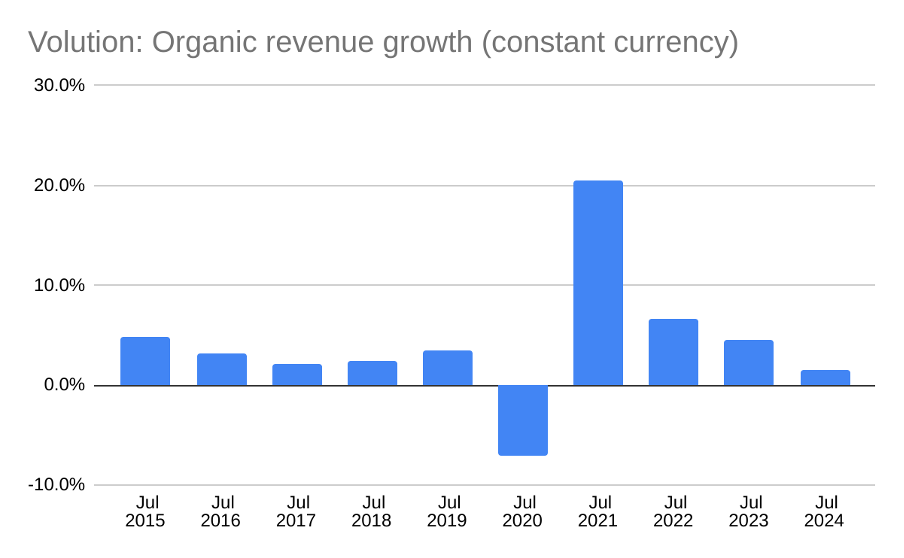

House building and construction activity is sensitive to economic conditions, yet revenue has declined only once since the company floated. That was in the year to July 2020, when the onset of the Covid pandemic shut the economy.

While construction is a cyclical activity, acquisitive growth is not masking underlying instability in the business. Excluding the pandemic years, Volution has achieved modest but steady organic growth:

Source: Volution annual reports

The average growth rate of 4.1% at constant currency (3.9% reported) is within Volution’s current “expected range” of 3-5% organic growth.

The company says that it earns more than two-thirds of revenue in the refurbishment market, and that has contributed decisively to its resilience. Less than a third of revenue, by contrast, was from new builds.

As Volution gets bigger though, it needs to make bigger acquisitions to keep the inorganic element of growth climbing near the historic rate.

The company recognises the consequences of bungling a larger acquisition is greater than bungling a small one, but post-year end it made its biggest so far.

- What is tipped to be the best asset class of 2025?

- The Income Investor: dividend stocks still appeal after Budget

The target is Fantech, operating in Australia and New Zealand. The deal is not yet done, because it is being scrutinised by antitrust authorities. The price is £144 million, roughly double 2024 cash flow (after capital expenditure).

Fantech brands would augment those of Volution’s three existing Australian subsidiaries, and catapult the region to prominence in the group. Including Fantech, the company reckons Australasia would contribute about 30% of revenue.

The company will bear scars from the acquisition for a few years. It will be more indebted and Return on Total Invested Capital (ROTIC), the measure I use to determine whether a good business is a good acquirer, will fall.

This is because ROTIC includes the value of the acquisition at cost in the denominator (capital), but it can take a few years for companies to integrate large acquisitions, and for the full benefit to be seen in the numerator (profit).

Investors rightly question whether “synergies” from large acquisitions will justify the cost. Often they do not. But Volution has been a good acquirer. ROTIC in 2024 was 19% after corporation tax at the standard rate, which is impressive. Even at its lowest point in 2020, Volution achieved 12% ROTIC.

I have invested in companies with seemingly high levels of financial obligations before, when they have simple, repeatable and highly profitable businesses.

Volution’s focus on one kind of product, increasingly required in most buildings, and its modest capital requirement, make me think it may be.

It is easy to imagine that as it gets bigger, Volution can source components more cheaply, increase the range of products it sells through its subsidiaries, and consolidate manufacturing and assembly sites.

Meanwhile, the company’s purpose to deliver healthy air sustainably is laudable and the headline figures show it is edging towards sustainability. The carbon intensity of Volution’s operations is considerably lower than it was in 2020, and 78% of the plastic it incorporates in products is recycled.

- Stockwatch: a tax warning for UK and US investors

- Share Sleuth: performance over 15 years, and a share sale

Since this year Volution conducted its first group-wide employee engagement survey, we have nothing much to compare it with. The company runs apprenticeship and management training schemes and seems to have good intentions.

A self-reported score of 74% would usually be considered good and is, as Volution says in so many words, something to build on.

However, over the last three years, when the company has performed well and often paid out close to the maximum bonus and long-term incentives, the gap between executive pay and median pay has widened.

In 2024, Ronnie George earned nearly 80 times median pay of about £26,000.

The price (discounted?) [-0.8]

- No. A share price of 556p values the enterprise at about £1.2 billion, 22 times normalised profit.

A provisional score of 7.2 means Volution may be a good long-term investment.

It is by a nose, the best of the subs picked so far:

Company | Description | Score |

Retailer of furniture and homewares | 6.8 | |

Volution | Manufacturer of ventilation products | 7.2 |

Retailer of pet products, and veterinary chain | 7.1 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Softcat (LSE:SCT) and YouGov (LSE:YOU) have published annual reports and are due to be re-scored.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Supplies kitchens to small builders | 8.8 | ||

4 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

5 | Distributor of protective packaging | 8.4 | ||

6 | Manufacturer of scientific equipment for industry and academia | 8.1 | ||

7 | Manufactures computers, battery packs, radios. Distributes components | 7.9 | ||

8 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.9 | ||

9 | Flies holidaymakers to Europe, sells package holidays | 7.7 | ||

10 | Whiz bang manufacturer of automated machine tools and robots | 7.7 | ||

11 | Manufactures/retails Warhammer models, licences stories/characters | 7.7 | ||

12 | Manufactures filters and filtration systems for fluids and molten metals | 7.6 | ||

13 | Designs recording equipment, loudspeakers, and instruments for musicians | 7.5 | ||

14 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

15 | Surveys and distributes public opinion online | 7.5 | ||

16 | Sources, processes and develops flavours esp. for soft drinks | 7.3 | ||

17 | Distributes essential everyday items consumed by organisations | 7.3 | ||

18 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.2 | ||

19 | Sells promotional materials like branded mugs and tee shirts direct | 7.1 | ||

20 | Manufactures military technology, does research and consultancy | 7.0 | ||

21 | Translates documents and localises software and content for businesses | 7.0 | ||

22 | Online marketplace for motor vehicles | 7.0 | ||

23 | Manufactures natural animal feed additives | 7.0 | ||

24 | Online retailer of domestic appliances and TVs | 6.9 | ||

25 | Sells hardware and software to businesses and the public sector | 6.9 | ||

26 | Operates tenpin bowling and indoor crazy golf centres | 6.6 | ||

27 | Manufactures vinyl flooring for commercial and public spaces | 6.5 | ||

28 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.4 | ||

29 | Retails clothes and homewares | 6.3 | ||

30 | Supplies vehicle tracking systems to small fleets and insurers | 6.3 | ||

31 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.9 | ||

32 | Acquires and operates small scientific instrument manufacturers | 5.9 | ||

33 | Publishes books, and digital collections for academics and professionals | 5.7 | ||

34 | Manufactures sports watches and instrumentation | 5.5 | ||

35 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

36 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 4.8 | ||

38 | Runs a network of self-employed lawyers | 4.5 | ||

39 | Develops and manufactures hygiene, baby, and beauty brands | 4.5 | ||

40 | Manufactures specialist paper, packaging and high-tech materials | 3.7 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.