Shares for the future: are more thrilling gains just a fantasy?

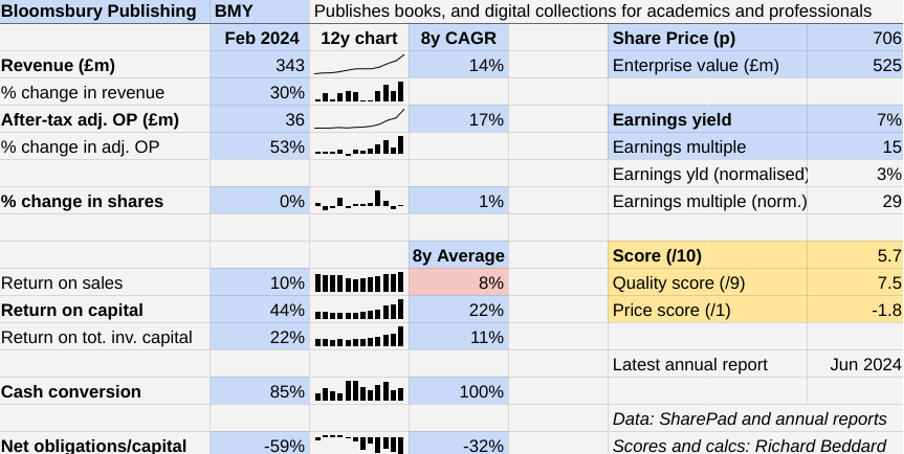

This half-a-billion-pound company is up 50% in 2024 already and at a record high. Analyst Richard Beddard reveals whether he still think it’s a good long-term investment.

19th July 2024 14:51

by Richard Beddard from interactive investor

Bloomsbury Publishing (LSE:BMY)’s mission is to publish works of excellence and originality. In the year to February 2024, it produced results of excellence too.

They will not be repeated in 2025. The publisher will likely record its first decline in revenue since 2008, but that is because of how good 2024 was - not how bad 2025 may be.

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

Scoring Bloomsbury: publishing phenomenon

This was the year Bloomsbury dubbed its most-popular author a “publishing phenomenon”.

The Past (dependable) [3]

- Profitable growth: Double digit revenue and profit CAGRs [1]

- Strong finances: Net cash [1]

- Through thick and thin: Lowest RoC 11% (2017) [1]

In January 2024, just before the financial year end, the company published Crescent City: House of Flame and Shadow by Sarah J. Maas. Her 23rd book immediately became a global no.1 bestseller and already lofty sales of her titles jumped 161%.

It was almost certainly the most significant factor in a record set of results. Revenue grew 30%, profit grew 54% and Return on Capital (RoC) was double its eight-year average at 44%.

At the Annual General Meeting earlier this week, the company confirmed it was performing in-line with analyst forecasts for revenue and profit in the financial year ending in February 2025, when no new Sarah J. Maas titles are anticipated. The bad news is the forecasts are lower.

Bloomsbury (£m) | 2023 | 2023 | 2025 (f) |

Revenue | 246.1 | 342.7 | 319.3 |

Revenue growth | 39% | -7% | |

Revenue growth since '23 | 30% | ||

Adj. PBT | 31.1 | 48.7 | 37.6 |

Adj. PBT growth | 57% | -23% | |

Adj. PBT growth since '23 | 21% | ||

Adj. PBT margin | 13% | 14% | 12% |

Source: Bloomsbury trading update 16 July 2024.

The good news is they still imply significant growth absent the distorting effect of a new Sarah J. Maas title. If it achieves them, Bloomsbury will have grown revenue 30% and adjusted profit before tax 21% in the two years since 2023.

One thing to note though. The company’s financial position was out of date before the annual report was published. In May, after the year-end, it acquired Rowman & Littlefield’s academic imprints and titles, borrowing £35 million to part fund the £65 million transaction.

Even though it is Bloomsbury’s biggest acquisition to date, the debt is unlikely to be troublesome given the company’s big net-cash position before the acquisition and generally strong cash flows.

The Present (distinctive) [3]

- Discernible business: Consumer and academic publisher of excellent and original works [1]

- With experienced people: CEO Nigel Newton has led the firm for 38 years [1]

- That creates value for customers: Entertainment and information [1]

Bloomsbury is the only major UK publisher to publish consumer and academic titles. It owns the English language rights to the Harry Potter series outside the US and the rights to the works of Sarah J. Maas, an author at the vanguard of a new subgenre: “romantasy”, since Bloomsbury published her first book 14 years ago.

These two franchises are hugely profitable and the reason why Bloomsbury is most closely associated with its Children’s Trade book publishing division, although the books appeal to adults too.

Its success in discovering and promoting these authors, other famous names, and in building a third profit engine in academic publishing, has been achieved entirely under the leadership of chief executive Nigel Newton. He founded the business in 1986.

- Stockwatch: this FTSE 100 share’s 4-year bull run can continue

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

The Academic and Professional division has grown by acquisition over the last two decades. The jewel in its crown is Bloomsbury Digital Resources, which was born in 2016.

These are digital collections of books, journals, video and other materials, in the perhaps underserved arts, humanities and social sciences. They are sold to academic institutions and libraries.

The Future (directed) [1.5]

- Addressing challenges:Winner takes all book market book market[0.5]

- With coherent actions: Diversification, acquisitions [0.5]

- That reward all stakeholders fairly: Could explain itself better to shareholders [0.5]

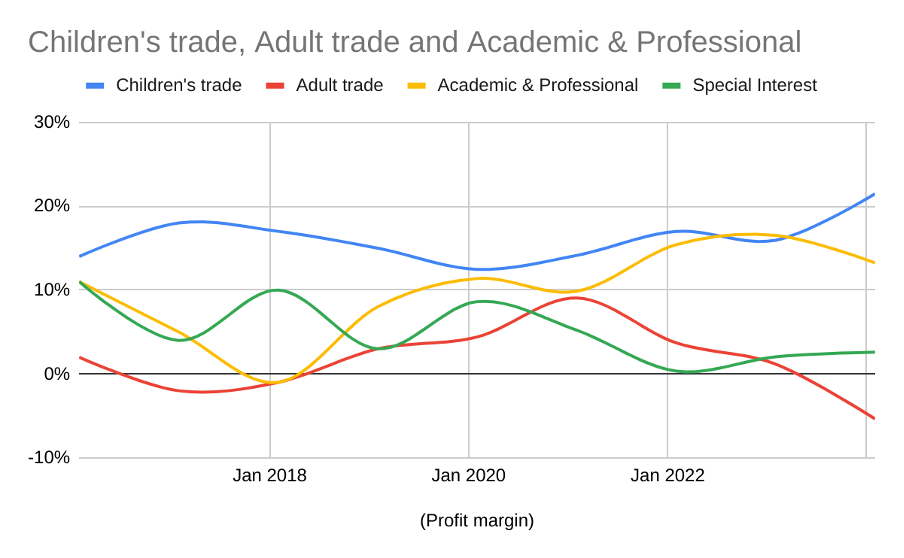

Bloomsbury reports revenue across four divisions: Children’s Trade, Adult Trade, which together encompass consumer books, and Academic & Professional and Special Interest.

The Sarah J. Maas effect on 2024’s results is illustrated by comparing the revenue and profit share of the Children’s Trade division. It contributed 41% of revenue in 2023, and 56% in 2024. The profit differential is even greater. In 2023, Children’s Trade contributed 56% of adjusted profit. In 2024 its share was a towering 86%.

This dependence is unnerving. It is prudent to assume now Bloomsbury has stopped reporting its growth every year that the fantastically profitable Harry Potter franchise is mature. And although Sarah J. Maas is contracted to write six more books, Bloomsbury needs to find new blockbuster novelists if it is to grow as fast as it has done in the past.

Without them Bloomsbury’s Children’s division might look like its Adult Trade division. Although it has many famous award-winning authors, the company’s third-biggest division by revenue often earns profit margins in the low single digits (red line). In some years it loses money.

There is serendipity in discovering new authors. Bloomsbury cannot have imagined how much money JK Rowling or Sarah J. Maas would make the company when it signed up their first books, but the more you recruit the luckier you get.

The interface between publisher and authors is Bloomsbury’s staff, and the company says it is working hard to be the best publisher to work for in terms of training, promotion, inclusiveness, benefits and flexible working arrangements. Its high production and design values and the opportunity to do genuinely interesting work must help it recruit editors (and authors) too.

It doesn’t divulge the employee engagement or retention statistics that might confirm its credentials, but median pay and benefits of nearly £42,000 suggests a career at Bloomsbury can be reasonably lucrative. In addition, all employees received a one off-payment of £1,250 because of the exceptional profits this year.

Since Bloomsbury bills the Academic & Professional division as a stable counterweight to the volatile consumer publishing divisions, it is surprising that divisional revenue declined 7% and profit declined 25% in 2024. Even Bloomsbury Digital Resources, which grew revenue from £6.3 million in 2019 to 26.7 million in 2024, only grew 2%.

- Sector Screener: two consumer stocks tipped to extend rally

- Proof that professional investors are shifting cash to UK shares

The company explains 2024 compares unfavourably with 2023 due to a one-off splurge on academic publications during the Covid period when US higher education institutions were flush with cash from additional government funding. But that feels like only half an explanation.

To grow, Bloomsbury Academic needs more content, which it has principally achieved through a successful acquisition strategy.

The publisher says its latest acquisition, Rowman & Littlefield, will double the size of the US Academic business, the world’s biggest academic market, improving its humanities and social sciences collections and helping it to build newer subject areas such as business and psychology.

Due to the acquisition, Bloomsbury has raised its revenue growth target for Bloomsbury Digital Resources to £41 million in 2028 (just over 50% from 2024).

One more potential risk is the adoption of Open Access, a system by which publishers receive a fee for publishing publicly funded scholarly work from its funders instead of the exclusivity of copyright. This means articles can be copied and distributed freely, and policymakers are considering adopting it across the board in Bloomsbury’s biggest markets.

The extent of Bloomsbury’s dependence on publicly funded content is not spelled out in the annual report, but unless publishers adapt, the acceleration of Open Access could reduce the profitability of academic publishing and the quantity of publications if funding is restricted.

Bloomsbury is an Open Access publisher. It includes Open Access content in its proprietary collections, and it is piloting a system that enables customers, libraries, to collectively fund Open Access collections through subscriptions.

The price (discounted?) [-1.8]

- No. A share price of 706p values the enterprise at about £525 million, 29 times normalised profit.

Normalised profit is the profit Bloomsbury would have earned if it had achieved its average return on capital of 22% not the 44% it actually achieved in 2024. This is prudent, because 2024 was exceptional.

A score of 5.7 out of 10 indicates Bloomsbury may be a good long-term investment.

A high price relative to normalised profit and my uncertainty about the future reduce its appeal though.

Bloomsbury is ranked 34 out of 40 shares in my Decision Engine.

20 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Auto Trader Group (LSE:AUTO), Marks Electrical Group Ordinary Shares (LSE:MRK), and Solid State (LSE:SOLI) have all published annual reports and are due to be re-scored.

I have moved PZ Cussons (LSE:PZC) to the bottom of the table pending the publication of its annual report in September. The collapse in the value of the Nigerian currency and the impact on the company’s finances and strategy mean I no longer have faith in the score.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.8 | ||

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | ||

3 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

4 | Supplies kitchens to small builders | 8.4 | ||

5 | Distributor of protective packaging | 8.3 | ||

6 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.8 | ||

7 | Whiz bang manufacturer of automated machine tools and robots | 7.8 | ||

8 | Imports and distributes timber and timber products | 7.7 | ||

9 | Manufactures/retails Warhammer models, licences stories/characters | 7.7 | ||

10 | Manufactures filters and filtration systems for fluids and molten metals | 7.5 | ||

11 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

12 | Distributes essential everyday items consumed by organisations | 7.5 | ||

13 | Online retailer of domestic appliances and TVs | 7.4 | ||

14 | Surveys and distributes public opinion online | 7.3 | ||

15 | Manufacturer of scientific equipment for industry and academia | 7.3 | ||

16 | Sources, processes and develops flavours esp. for soft drinks | 7.3 | ||

17 | Sells hardware and software to businesses and the public sector | 7.1 | ||

18 | Translates documents and localises software and content for businesses | 7.0 | ||

19 | Manufactures natural animal feed additives | 7.0 | ||

20 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.0 | ||

21 | Manufactures vinyl flooring for commercial and public spaces | 6.7 | ||

22 | Sells promotional materials like branded mugs and tee shirts direct | 6.7 | ||

23 | Retails clothes and homewares | 6.6 | ||

24 | Supplies vehicle tracking systems to small fleets and insurers | 6.6 | ||

25 | Operates tenpin bowling and indoor crazy golf centres | 6.6 | ||

26 | Manufactures specialist paper, packaging and high-tech materials | 6.5 | ||

27 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.4 | ||

28 | Online marketplace for motor vehicles | 6.3 | ||

29 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.2 | ||

30 | Flies holidaymakers to Europe, sells package holidays | 6.0 | ||

31 | Makes marketing and fraud prevention software, sells it as a service | 5.9 | ||

32 | Manufactures sports watches and instrumentation | 5.9 | ||

33 | Manufactures military technology, does research and consultancy | 5.9 | ||

34 | Bloomsbury Publishing | Publishes books, and digital collections for academics and professionals | 5.7 | |

35 | Acquires and operates small scientific instrument manufacturers | 5.7 | ||

36 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.6 | ||

37 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

38 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | ||

39 | Runs a network of self-employed lawyers | 4.5 | ||

v Frozen v | ||||

? | Develops and manufactures hygiene, baby, and beauty brands | 7.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Bloomsbury and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.