Shares for the future: analysing a new company for my top 40

This highly regarded business is being considered for columnist Richard Beddard’s Decision Engine, but does it make the grade? Here’s his score out of 10 and final verdict.

28th March 2024 14:42

by Richard Beddard from interactive investor

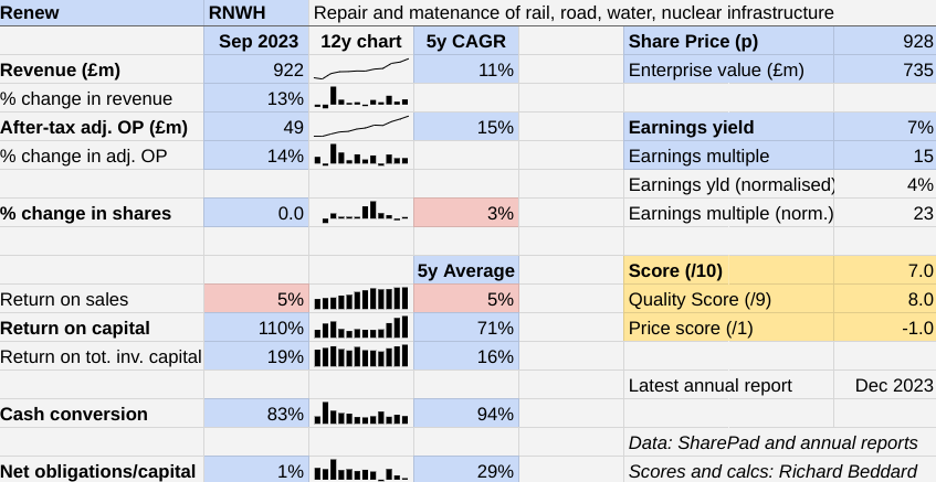

Today I am scoring Renew Holdings (LSE:RNWH) for the first time. Not only is the company new to me, but it is in an unfamiliar sector, so the score is provisional.

There is a general perception that our infrastructure is falling apart, which probably means lots of repair and maintenance work. Renew seems to have found a way of making good profits from it.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Renew is an engineering contractor. It mends and maintains UK infrastructure: railways, roads, water, and nuclear power.

Scoring Renew: repairing our infrastructure

Renew came to my attention because it has a distinguished record of profitability and growth. The only pink flags in the numbers are a sizable increase in the share count in 2018 and 2019 and a typical post-tax profit margin (return on sales in the table below) of only 5%.

The profit margin has been remarkably stable though, given recent materials and labour cost inflation. Repair and maintenance contracts tend to be short-term in nature, giving the company the ability to adjust pricing.

The Past (dependable) [3]

- Profitable growth: Double-digit profit and revenue growth [1]

- Strong finances: No bank debt at year end, modest lease obligations [1]

- Through thick and thin: Lowest ROTIC 13% (2020) [1]

Renew is highly profitable. It earned a 19% Return on Total Invested Capital (ROTIC) in 2024, 3% above the five-year average.

I have chosen to focus on ROTIC rather than Return on Operating Capital (ROC), because the ratio includes the cost of acquisitions. Renew has spent a large portion of free cash flow on acquisitions over the years, suggesting much of its growth has been acquisitive, and its strategy requires it to go on acquiring more businesses.

I have averaged the figures over just five years because I am not very confident in their comparability before then.

One of the surprising things about Renew, and one of the reasons it is so profitable, is it employs very little tangible capital (property and plant) and much of that capital is in the form of leased assets.

This makes the calculation of ratios like debt to capital and ROC very sensitive to operating lease accounting, which changed in 2020 when companies were required to recognise them as a form of debt. Before 2019, we must adjust the figures ourselves, and my way is fairly rudimentary.

2019 is also the year after Renew changed shape. In 2018 it divested itself of Forefront, a failed acquisition in a new sector - gas infrastructure and mains installation. By acquiring QTX, still its biggest acquisition, the company doubled down on its biggest market - Rail.

The QTS acquisition explains the increase in Renew’s share count. To fund it, the company issued more shares.

Renew usually issues a trading statement for the first half of its financial year in April. The mood music at January’s Annual General Meeting (AGM) was positive.

The Present (distinctive) [3]

- Discernible business: Focus on non-discretionary maintenance and repair [1]

- With experienced people: CEO Paul Scott has 22 years of service [1]

- That creates value for customers: Expert provision of services [1]

QTS gives us a flavour of what Renew does. It pins soil and rocks to embankments to stop them falling on railway lines, it manages vegetation, puts up fences, rents out specialist plant, clears and maintains drains, and trains the engineers of other companies.

Most of Renew's businesses have similar capabilities. In nuclear, it works on decontamination and decommissioning programmes.

Perhaps the key attraction is these things must be done if the economy is to work, even if the government and private companies are short of money. In difficult economic times, maintenance and repair becomes a priority over new infrastructure (like the cancelled HS2 project).

It is labour, rather than capital-intensive business. Renew makes much of its directly employed workforce, which means expertise is trained and retained in-house.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Shares for the future: the best strategy for my pension savings

In the Annual Report and Accounts 2023, Renew said it employs 4,361 people and its claim that they are well trained and well remunerated seems credible.

The company’s education programmes resulted in 22,665 days of training in 2023, more than five for each employee. Median pay is about £38,000, which is a price worth paying to avoid volatility in subcontractor pricing. Renew regards its specialist workforce as a competitive advantage.

Recent acquisitions show the company’s strategic direction. Barring the failed foray into gas and the acquisition of Clarke Telecom, Renew has focused investment on the rail, water, road and nuclear markets.

Some of the acquisitions have been bundled up with other companies in the group (its most recent, TIS, was acquired by Shepley, Renew’s existing nuclear subsidiary, for example, and AMCO and Giffen are AmcoGiffen now), but each subsidiary is allowed to operate autonomously under a common set of standards.

Renew’s recent acquisitions

Year | Company | Cost | Principal market |

2023 | TIS | £4.7 million | Nuclear |

2023 | ENISCA | £14.6 million | Water |

2021 | J Browne | £41.5 million | Water |

2021 | REL | £3.6 million | Rail |

2020 | Carnell | £43.7 million | Road |

2018 | QTS | £80 million | Rail |

2016 | Giffen | £7.2 million | Rail |

2014 | Clarke Telecom | £17.1 million | Wireless telecoms |

2014 | Forefront | £14.8 million | Gas |

2013 | Lewis Civil Engineering | £8.2 million | Water |

2011 | AMCO | £27.1 million | Rail |

Less than 10% of revenue and only 2% of adjusted operating profit comes from specialist building, a long-established business called Walter Lilly which refurbishes posh residential and culturally important buildings, and builds scientific facilities. It has a different business model that relies on subcontractors, and it earns lower profit margins than the much larger engineering services business.

Unfortunately, Renew does not disclose how much it earns from each engineering services market, but it surely earns most from Rail, historically the largest and the focus of its biggest acquisition. That implies National Rail, described in the annual report as a significant customer, is also its biggest customer, responsible for 43% of revenue. Other customers, like water companies, are big too but none of them bring in more than 10% of revenue.

Paul Scott, CEO since 2016, has sharpened the focus on engineering services. An engineer with 22 years’ service under his belt, he oversaw the disposal of Forefront, the gas company, so he knows what a bad acquisition looks like.

He has also presided over a number of acquisitions, and so far they have performed well.

The Future (directed) [2]

- Addressing challenges:Large customers, and projects [0.5]

- With coherent actions: Diversification through acquisition [0.5]

- That reward all stakeholders fairly: Trained and motivated workforce [1]

The loss of a large customer is a risk, but in mitigation Renew is contracted under long-term “framework” agreements. This means it is a pre-approved supplier, which makes it easy for Renew to win new business and give the company the opportunity to develop strong customer relationships.

This is achieved through innovative and well-paid employees. The 2023 annual report highlights Renew’s bespoke road rail plant (which can be driven on road and rail) for working on the railways, and SafetyCam, a safety system that protects road workers from dangerous drivers.

Acquisitive growth in other important markets like Water and Road also reduces large customer risk. Growth in all markets allows it to extend its reach regionally and gives Renew more capabilities to offer customers.

The acquisition of REL in 2021 added rail electrification to the range of services Renew offers, and enabled QTS, the company it folded REL into, and AmcoGiffen to win the Wales & Western Electrification and Plant frameworks. In 2023, AmcoGiffen and Carnell (AGC) together completed their first major National Highways barrier scheme, making AGC the second largest supplier of road restraint systems in the UK.

- How to build a £1 million pension and ISA portfolio

- Stockwatch: are interest rates really coming down soon?

These examples show the group can be more than the sum of its parts.

Renew also has a role in decarbonising the economy.

The electrification opportunity is significant because National Rail needs to electrify 13,000 single track kilometres if it is to decarbonise the railways by 2050. Though small, the acquisition of TIS doubles Renews nuclear manufacturing capability, potentially positioning it to work on new nuclear facilities.

Acquisitions can also be risky, especially if they are substantial. The company’s returns from its acquired businesses have been good though. Although it has tapped investors once for money in the past, its policy is to redeploy internally generated cash flows and pay down debt quickly post acquisitions.

Maybe this means it will live within its means in future.

The price (discounted?) [-1]

- No. A share price of 928p values the enterprise at about £735 million, 23 times normalised profit.

A score of 7 out of 10 indicates that Renew is probably a good long-term investment.

I like it but I am not planning to include it in the Decision Engine immediately. It is a candidate for inclusion, should I decide to remove one of the existing 40 members.

Were Renew included today, it would be ranked 23 (equal with Celebrus Technologies (LSE:CLBS)) out of 40 shares.

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report. The scores change daily due to price changes.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Bunzl (LSE:BNZL), Howden Joinery Group (LSE:HWDN), and XP Power Ltd (LSE:XPP) have all published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

0 | Company | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.4 | |

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | |

3 | Manufacturer of scientific equipment for industry and academia | 8.6 | |

4 | Translates documents and localises software and content for businesses | 8.5 | |

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | |

6 | Supplies kitchens to small builders | 8.5 | |

7 | Distributor of protective packaging | 8.4 | |

8 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 8.3 | |

9 | Manufactures filters and filtration systems for fluids and molten metals | 8.1 | |

10 | Manufactures/retails Warhammer models, licences stories/characters | 7.8 | |

11 | Manufactures natural animal feed additives | 7.8 | |

12 | Manufactures power adapters for industrial and healthcare equipment | 7.8 | |

13 | Imports and distributes timber and timber products | 7.8 | |

14 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.7 | |

15 | Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

16 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | |

17 | Sources, processes and develops flavours esp. for soft drinks | 7.4 | |

18 | Distributes essential everyday items consumed by organisations | 7.3 | |

19 | Online retailer of domestic appliances and TVs | 7.3 | |

20 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 7.3 | |

21 | Sells hardware and software to businesses and the public sector | 7.2 | |

22 | Whiz bang manufacturer of automated machine tools and robots | 7.2 | |

23 | Makes marketing and fraud prevention software, sells it as a service | 7.0 | |

24 | Manufactures military technology, does research and consultancy | 6.9 | |

25 | Online marketplace for motor vehicles | 6.9 | |

26 | Operates tenpin bowling and indoor crazy golf centres | 6.5 | |

27 | Manufactures specialist paper, packaging and high-tech materials | 6.5 | |

28 | Manufactures vinyl flooring for commercial and public spaces | 6.4 | |

29 | Supplies vehicle tracking systems to small fleets and insurers | 6.4 | |

30 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.3 | |

31 | Flies holidaymakers to Europe, sells package holidays | 6.1 | |

32 | Sells promotional materials like branded mugs and tee shirts direct | 6.1 | |

33 | Surveys and distributes public opinion online | 5.9 | |

34 | Publishes books, and digital collections for academics and professionals | 5.8 | |

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | |

36 | Manufactures sports watches and instrumentation | 5.4 | |

37 | Supplies software and services to the transport industry | 5.2 | |

38 | Acquires and operates small scientific instrument manufacturers | 4.8 | |

39 | Runs a network of self-employed lawyers | 4.6 | |

40 | Retails clothes and homewares | 4.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many of the shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.