Shares to buy, hold or sell

12th April 2016 12:07

by Rebecca Jones from interactive investor

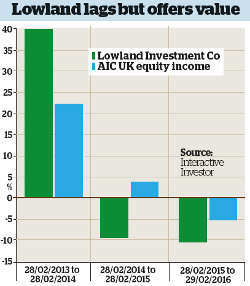

shares have been on the slide over the past two years as lead manager James Henderson's highly contrarian style has fallen out of favour. Core holdings in oil, gas and industrial companies have weighed particularly heavily on the portfolio.

However, co-manager Laura Foll says she and Henderson have no plans to change tack. Instead, they have used market weakness to add to their positions. With a yield of just over 2.5%, the trust is a bold pick for value-conscious income seekers.

Buy: Shoe Zone

Foll and Henderson originally bought into discount UK shoe retailer at the company's IPO in May 2014 for 160p, convinced by the company's long-term growth plan.

The company is often found in "secondary" properties in parts of town usually occupied by other discount retailers such as Poundland and Lidl, often attracting cash-paying customers. As a result, its store costs are low and cash flows high, making its shares attractive.

"The firm is very good at negotiating rents down, it has been closing some of its loss-making stores and it has grown successfully online, which is surprising, given how cheap those shoes are."

In January the company announced a final dividend of 6.5p a share, pushing total dividends for the financial year up to 9.7p alongside a special dividend of 6p a share. Foll and Henderson are confident the firm can continue to deliver this level of income every year.

Foll says: "This year Shoezone will yield around 8%, which is very attractive, and we think the special dividend will be recurring. It finished the year with a strong net-cash balance sheet, and it doesn't need quite as much cash as it ended up with. We think it can keep doing that every year."

Hold: Senior

Foll has chosen aerospace and auto components manufacturer as her "hold". The firm is a longstanding investment for the trust - Henderson originally purchased it for about 30p a share in 2009.

The firm is now trading at around 215p (as at 1 March). It is Lowland's second-largest holding, accounting for 3% of its portfolio.

Foll says: "The company had a tough year in 2015, but we feel the share price derating has been overdone. There have been some earnings downgrades, but it's still making a 13-14% operating margin and it's still very cash-generative - yet it is de-rated to about 11 times earnings."

Foll adds that Senior's exposure to the oil and gas industry has not helped it and may continue to weigh heavily while the oil price remains low. However, she says the firm's interests in civil aerospace - which she believes is a solid growth area - should help it pull through.

The manager says the trust's position has not been added to since 2011, and that she and Henderson have been trimming it regularly since.

But there are no plans to cut further at the current price. She explains that shares are "attractively valued at this level".

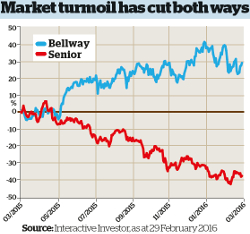

Sell: Bellway

Foll and Henderson are becoming increasingly sceptical about housebuilders. Medium-sized housebuilders such as and have seen their shares soar: Bellway's share price rose by more than 270% over the five years to 1 March.

They have also seemingly been impervious to the turmoil seen in the wider UK market. Over the year to 1 March, for example, Bellway shares rose by 25%, while the FTSE 250 index shed 4% and the lost 11%.

Accordingly, the valuations of these firms has shot up - in Bellway's case to around two times book value - which is, in Foll's opinion, too much, despite what seem like fairly benign operating conditions.

She says: "The environment for housebuilders is really positive at the moment: costs are low, they're returning a lot of cash to shareholders and the government is being supportive, so it's a great backdrop.

"However, we are concerned about whether that can last, which is what the company seems to be assuming in its estimates." She adds that she and Henderson felt shares were "priced for perfection", so they sold out.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.