The share that will do well out of a hard Brexit

Valuation suggests traders anticipate a recovery. Our companies analyst thinks they are probably right.

4th October 2019 15:56

by Richard Beddard from interactive investor

Valuation suggests traders anticipate a recovery. Our companies analyst thinks they are probably right.

Goodwin (LSE:GDWN), Richard. Second good year on the trot. Revenue up a smidgen, profit up 24%. Looks like this one's working out...

Not so fast hot shot. Interpreting Goodwin's accounts this year is complicated by the introduction of IFRS 15...

What? Stop right there. IFRS 15?

It's a new International Reporting Standard governing the recognition of revenue. Generally companies account for a sale when they ship the goods or have provided the service, but the new rules sometimes means Goodwin will book revenue before it has actually shipped. Changing when a company can book revenue can have a big impact on its performance during a particular period.

The new standard means Goodwin reported substantially more revenue and cash flow than it would have in the year to April 2019. On a like-for-like basis (as if the new standard had not been introduced), revenue actually fell and profit increased substantially less than the company reported (pre-tax profit increased by about 11% like-for-like). The calculations were so complicated, Goodwin had to delay its results.

Oh blimey, so the sleeping giant has yet to awaken?

You could say that, if you consider how the company has performed recently. I would only describe it as adequately profitable. Under the new accounting standard, return on capital in 2019 was 11%. In 2018 and 2017, under the old standard, return on capital was in high single figures. Goodwin will be a fairly unexciting long-term investment if these figures are typical of the future. But Goodwin was much more profitable in the past, mainly due to its patented check valves used in oil pipelines, tankers, terminals and platforms.

You're not gambling on the oil price are you? Doesn't sound like you...

Well, a higher oil price would be good for Goodwin if it meant more investment in exploration and production, but the reason I am still following the company is that it has reduced its dependence on oil and gas.

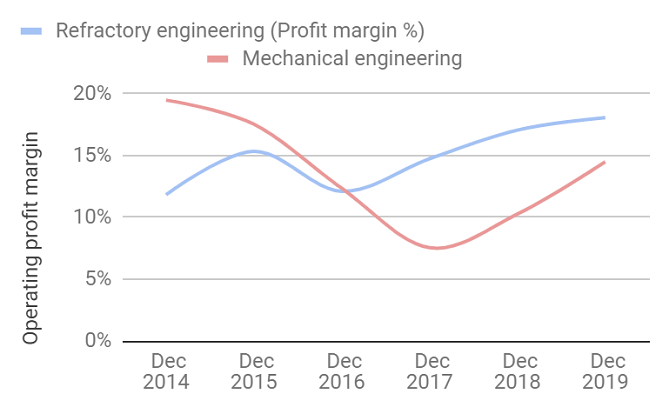

Aided by the closure of a major competitor, the other half of the Goodwin business, Refractory Engineering, which supplies consumables like casting powder to jewellery manufacturers and tyre makers, has gone from being the poor relation of the Mechanical Engineering division to a 50% partner in terms of profit, at least in 2018. In 2019 the pendulum swung back a bit as trade frictions reduced Chinese demand and the Refractory Engineering division's growth rate to single figures. But in terms of profit margins, Refractory Engineering retained its newfound supremacy. As you can see, things have improved in the Mechanical Engineering division too:

After the oil price crashed in 2015 Goodwin used the downtime in its foundry to increase capacity, enabling it to cast steel in even more gigantic sizes. The company has previously boasted that it is only one of a handful of companies worldwide that can cast this big. After two years of losses, the foundry, Goodwin Steel Castings, is back in profit and, the company says, in tandem with Goodwin International, the mechanical engineering division will never again be as dependent on the oil industry.

One of its new contracts is to supply radiation shielding vessels for the transportation of nuclear waste in the USA. Another is to supply the US nuclear submarine programme. In the annual report it says it is in a "unique global position", and that may be partly because of the USA's increasingly antagonistic trade policy, which may stymie potential competitors in the Far East.

Jam tomorrow then. Doesn't sound like you either!

Are you trolling me? Some jam today, and more jam tomorrow - judging by the confident statements the company's new chairman Tim Goodwin makes in the annual report. He's the son of the previous chairman John Goodwin, by the way.

- 10 quality income stocks with momentum

- A great alternative to 'perverse' company incentive plans

- Is Goodwin one of those rebound stories?

New orders won't make a difference to the accounts until the company delivers them (and they won't make any difference to cash flow until the company gets paid), but the most eye-catching statistic in the annual report is that Goodwin had won £93 million in new orders since April and the order book was worth £165 million in July, compared to £85 million a year earlier. That is why I think there will be more jam tomorrow.

The chairman says there are more contracts to come, and maybe ailing EASAT will make a contribution in 2020. This year the subsidiary, which makes radar antennas, lost money due to customer delays, but the company says it is shipping now.

Hmmm, Jam today and more Jam tomorrow, sounds tasty, shall we run it through the Decision Engine?

Here goes...

Does Goodwin make good money?

Just about. It has really been testing my lower limits in terms of return on capital, and heavy investment is recent years means average cash conversion is only about 55%. Profitability may improve as volumes increase improving the foundry's efficiency and cashflow may improve because the company is restricting investment (including acquisitions) to 55% of profit.

Score: 1

What could prevent it from growing profitably?

Although it is more diverse now, many of Goodwin's businesses are sensitive to economic turbulence, as shown by the impact of the slowdown in China on Refractory Engineering.

As 3D printing technology improves it could replace casting for the mass production of jewellery, which could impact the Refractory Engineering business.

Score: 2

How will it overcome these challenges?

Patient capital, if I might use a slightly tarnished term. The Goodwin family are firmly in control (see below). They have largely maintained investment to emerge from recession stronger. Weaker competitors have folded. I believe Goodwin has unrivalled expertise, and it is uniquely placed to build on it as skills are passed down through the generations.

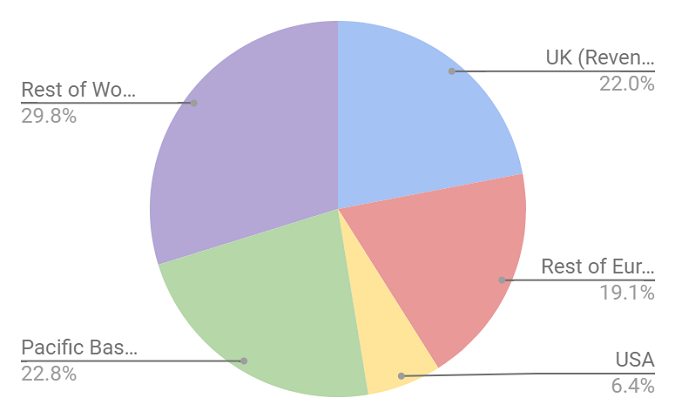

For a relatively small engineering business Goodwin is very diversified, both in terms of the markets it serves, and the places it operates. Less than 25% of revenue is from companies headquartered in Europe, but generally, even for these companies it supplies projects outside the EU.

Goodwin thinks it would do well out of a hard Brexit, believing the subsequent devaluation of the pound would outweigh the negative impact of tariffs. Much of its European revenue (just under 20% of the total) is exported to countries outside Europe for companies headquartered in the EU, and increasingly it is looking to the USA.

The technological threat to the Refractory Engineering division is a distant probability, and since Goodwin supplies consumables for 3D printers and the printers themselves it may be in a good position to adapt to the changing requirements of the industry.

Score: 2

Will we all benefit?

Goodwin has a unique, self-reliant culture. Online reviews by staff are favourable and the company runs a large four-year apprentice scheme.

The fifth generation of the Goodwin family, chairman John, and managing director Richard, retired from the board in April but family control has, if anything, increased. Three of John and Richard's sons have taken the top jobs, one as chairman, and the other two as managing directors of Goodwin's two divisions, Mechanical Engineering and Refractory Engineering. The fourth son is an executive director. Combined, the family owns more than 50% of the shares and John and Richard still sit on the audit committee.

There is little doubt the sixth generation of Goodwins plans to hand on a thriving business to the seventh (although I don't know if a seventh even exists yet!) and, given the already impressive experience of the younger family members, still guided by the older ones, they probably will.

But a Long Term Incentive Plan (LTIP), now concluded, that transferred 0.85% of the firm to each of the directors of the company, shook my faith in the firm's previously unblemished record of even-handedness to shareholders.

The justification for the extraordinary level of remuneration that resulted was the effort required to reposition the company, not just in terms of reconfiguring the foundry, but winning accreditations to supply new customers, particularly in the USA, and then winning their business. This work appears to be bearing fruit in terms of new contracts, but it has yet to turn to jam.

While no new LTIP is being considered or proposed, and executive pay is otherwise relatively modest, the opacity and manipulability of the LTIP, and the fact that the family could just vote through another one in future, means I do not feel I can give Goodwin a maximum score of 2 for fairness. In many respects, though, I think it deserves it.

Score: 1

Are the shares cheap?

A share price of £33 values the enterprise at about 19 times adjusted profit, which suggests traders are anticipating a recovery. They are probably right.

Score: 1.2

A score of 7.2 out of 10 is good enough to recommend Goodwin for the long-term.

Richard owns shares in Goodwin.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.