Share trades that could have won you back a fortune

Some of the biggest rallies occur during bear markets, and some stocks have doubled in a few days.

25th March 2020 13:01

by Graeme Evans from interactive investor

Some of the biggest rallies occur during bear markets, and some stocks have doubled in a few days.

Venturing back into these bombed-out markets isn't for the faint-hearted, but for those that did towards the end of last week there have been some stunning gains in many stocks.

Heavyweights Royal Dutch Shell (LSE:RDSB) and BP (LSE:BP.), for example, are up by around 50% over the past week after Covid-19 market panic was curbed by vast global stimulus measures, most notably progress on Donald Trump's US$2 trillion package of support for the US economy.

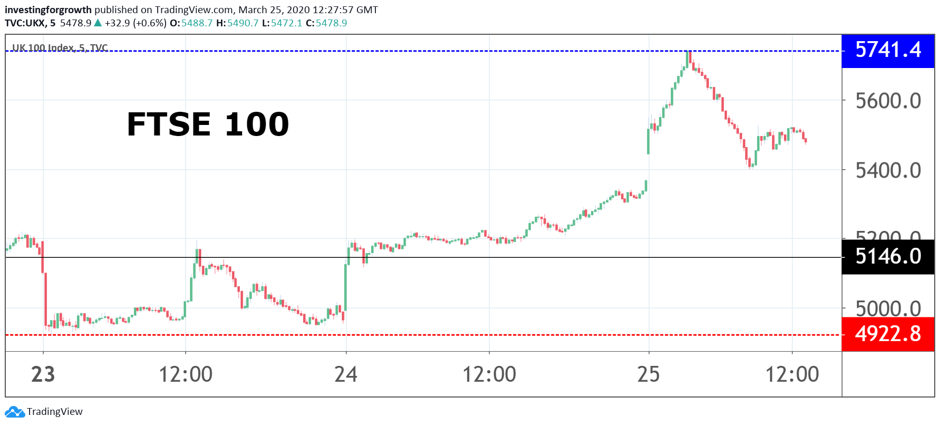

The US news fuelled the biggest rise in the FTSE 100 index since the financial crisis, with the top-flight up 6% in the first hour of trading today. The S&P 500 closed 9.3% higher last night, alongside an 11% rise for the Dow Jones Industrial Average in the best session since 1933!

Source: TradingView Past performance is not a guide to future performance

Other recovery plays in London since last Wednesday night include cruise ship operator Carnival, with a rise of 86% after another 8% gain in early trading today. Highly rated retail chain JD Sports Fashion (LSE:JD.) is up 73%, ahead of a gain of 43% for Premier Inn owner Whitbread (LSE:WTB).

Longer-term investors are still sitting on big losses, of course, with BP (LSE:BP.) and Shell (LSE:RDSB)down 25% on where they were in mid-February and the FTSE 100 index only back to where it was two weeks ago. It's also worth remembering that every bear market sees these kinds of rallies at some point.

But for those looking for positives, the VIX index of implied volatility is now at its lowest in 11 days, and some City analysts are talking about markets being close to “peak uncertainty”.

As cases of Covid-19 are still accelerating in Europe and the US, it certainly doesn't feel like we're over the worst, or that Trump's pledge to get Americans back to work by Easter is remotely achievable.

But China went from normal activity to massive disruption and close to full recovery in the space eight weeks. And now there's the hope offered by a US stimulus package equivalent to around 10% of GDP, and reportedly bigger than the combined spending on defence, scientific research, highway construction and other discretionary projects.

Analysts at UBS said today:

“We think the actions of monetary and fiscal policymakers should help us prevent a global financial crisis style credit crunch.”

They added: “Encouragingly, recent new lows in stocks have been accompanied by either sideways or even lower volatility, indicating markets are starting to become more comfortable with the potential range of outcomes we face.

“These gains could be consolidated if we see more good news that containment measures are starting to rein in the spread of the virus.”

All this would be undone, of course, if the economic impact of Covid-19 is larger than forecast, or if the virus re-emerges in China. UBS's central scenario is for new cases in Europe and the US to peak by mid-April, allowing the most severe restrictions to be lifted from mid-May.

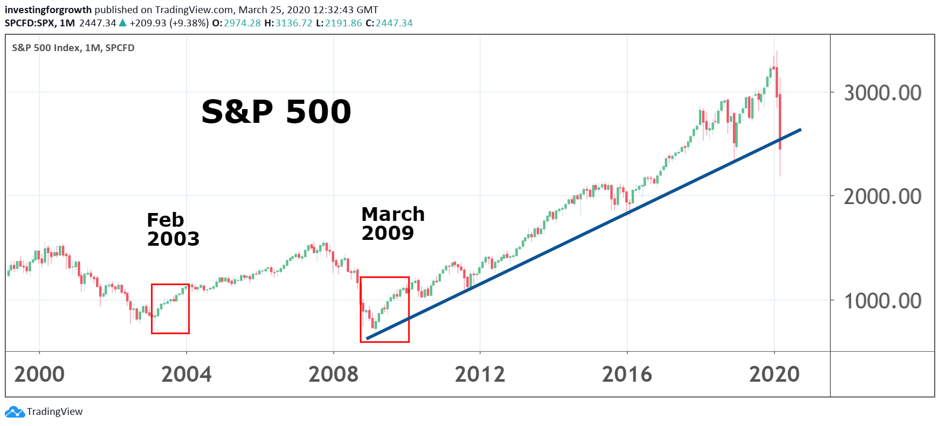

Looking back to February 2003 and March 2009 rebounds, they note that 21% and 35% of the S&P 500's gain over the following two years happened in the first two months. They recommend investors look for resilient stocks and longer-term winners, as well as those with exposure to a potential recovery in Asia economies.

Source: TradingView Past performance is not a guide to future performance

The success of nimble investors in making some of their money back from the recent crash has been across a broad base of sectors in recent days, with airline easyJet (LSE:EZJ) and hotels group InterContinental Hotels (LSE:IHG) among those viewed as oversold. Shares in both jumped 10% at one point this morning and by around 30% since last Wednesday night.

In the FTSE All-Share, public transport operator FirstGroup (LSE:FGP) has doubled in value and National Express (LSE:NEX) and Go-Ahead (LSE:GOG) are up 84% and 81% in less than a week. Pub chains Mitchells & Butlers (LSE:MAB) and JD Wetherspoon (LSE:JDW) have jumped more than 60%, and bookmaker William Hill (LSE:WMH) is 91% higher.

The gains are put into perspective by the fact that most of these stocks are still down more than 50% since February 20, when the market sell-off kicked in. There's also no respite from wild volatility, with the FTSE 100 surrendering all of today's earlier gains at one point. Meanwhile, income streams have been a dealt a savage blow after dividends were cancelled in many cases.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.