Share tips: Best international picks of 2019

Our overseas investing expert shares some knockout analysis and rounds up his tips performance for 2019.

18th December 2019 10:32

by Rodney Hobson from interactive investor

Our overseas investing expert has had a great year, with some knockout analysis. Here’s a round-up, including some that are yet to come good.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

With stocks generally on the rise in 2019, the past year for investors should have been one of steady progress with the occasional inevitable setback that happens to us all.

My selection of overseas stocks over the past 12 months has generally worked well with the odd misfortune thrown in.

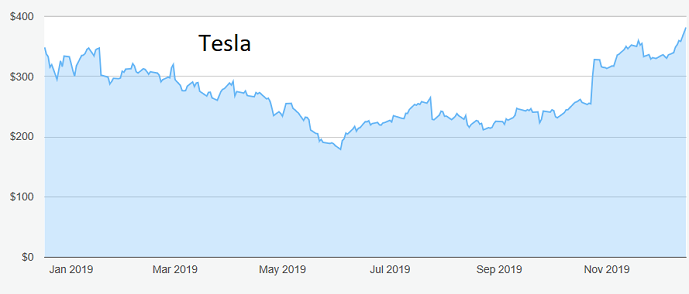

I wasn’t joking at the beginning of April when I warned of the dangers of investing in companies coming to market, especially those not paying a dividend. After looking at the biggest ones to hit New York in recent years I picked car technology upstart Tesla (NASDAQ:TSLA) and Chinese conglomerate Alibaba (NYSE:BABA).

Source: interactive investor Past performance is not a guide to future performance

Tesla promptly slumped from $285 to $180, a drop of more than a third, as results covering the first half of 2019 showed six months of losses. However, a summer recovery brought fresh hope. A return to profit plus strong cash generation in the third quarter boosted the shares and they have reached $380, double the year’s low and 35% up on my tip price.

- Nine of the biggest IPOs ever: Are they still a 'buy'?

- Looking to diversify your portfolio? ii’s Super 60 recommended funds is full of great ideas

Alibaba was also adrift by the end of May, though not so dramatically, and it has also climbed all the way back and further. The shares now trade at $208 compared with $180 when I made my pronouncement. At this stage, Tesla looks the riskier of the two and the shares are likely to move more erratically, offering fresh buying opportunities on the downswings.

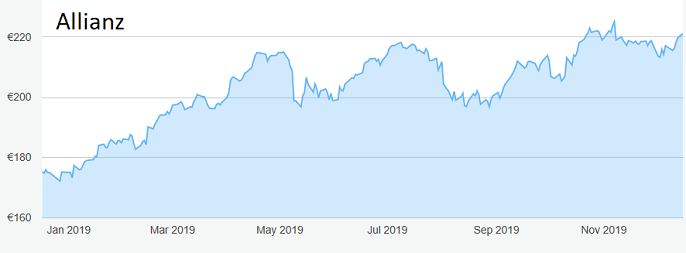

I was right in my hunch that Munich-based financial services company Allianz (XETRA:ALV) had hit the floor at just below €200. My worst fears that the shares could sink to €195 proved unfounded; instead, they have moved erratically above the tip level and currently look to be settling above €220.

Source: interactive investor Past performance is not a guide to future performance

I wouldn’t be thinking of taking profits yet, but don’t be concerned if they do happen to slip back as that would be a new buying opportunity. The December low of €213 could well be a new floor.

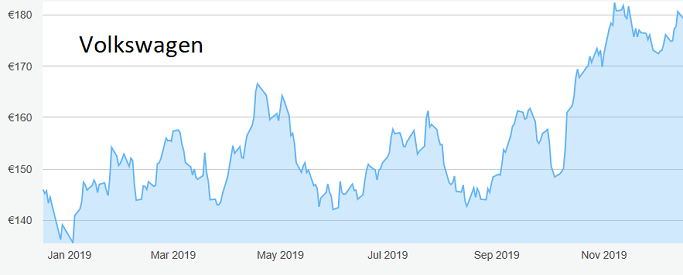

Sometimes it’s best to back your horses – or in this case cars – both ways. I took a favourable view of BMW (XETRA:BMW) and Volkswagen (XETRA:VOW) at the beginning of March. The former is only just ahead after an erratic 10 months but Volkswagen has come into its own lately, topping €180 compared with €157 in March. I said buy up to €165. The scandal over fiddled diesel pollution figures has been put into the past.

I think there is considerable pent-up demand for new cars from drivers who have postponed purchases in the past two years. Both companies are worth considering.

Source: interactive investor Past performance is not a guide to future performance

It’s been an up and down year for shareholders in online retailer Stitch Fix (NASDAQ:SFIX), which I suggested buying at $27 in February. The shares have been as high as $33 and as low as $18 since – well, I did warn that they were not for the fainthearted. They are currently back around the tip price and my advice still holds: buy around this level but be prepared to take profits if they rise strongly. Sit it out if they fall again as they will head higher over the long term.

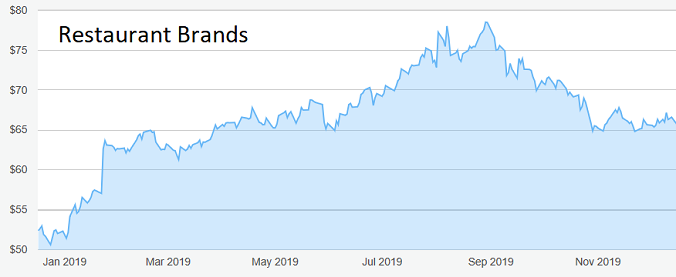

Restaurant Brands (NYSE:QSR), which includes Burger King and Tim Horton, has proved a major disappointment. They had come off their best when, in mid-August, I suggested the dip presented a buying opportunity at $75. I was a little premature. The shares have been as low as $65, which proved a ceiling on the way up but has been a solid floor on several occasions this year. They are starting to pick up again and represent an exciting opportunity at $66.

Source: interactive investor Past performance is not a guide to future performance

Chart restaurant brands

A week earlier I looked to be having better luck with McDonald’s (NYSE:MCD), which soon added $7 to my suggested buying price of $214, but those who took quick profits did well, for this food chain also suffered in September. Like Restaurant Brands, the shares are picking up again and are well worth snapping up below $200. I believe they will pull back to my original tip level in the New Year. Surely at least one of these two chains will be in favour in 2020.

Spanish bank Banco Santander (XMAD:SAN) has been another disappointment. I felt sure in July that the floor at €4 would hold, as it had done for the past nine months, but it didn’t. They are currently on an upswing but I fear that €4 could now prove to be a ceiling. I would now look to buy below €3.80.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.