Share Sleuth: why I’ve halved my largest position

Richard Beddard explains why he’s sold half the shares of a company he first bought 10 years ago.

7th August 2024 09:09

by Richard Beddard from interactive investor

Having emptied Share Sleuth’s coffers last month by increasing the portfolio’s holdings in Churchill China (LSE:CHH) and Dewhurst Group (LSE:DWHT), this month I have finally started to confront the large number of shares the Decision Engine would have me sell.

As always, the Decision Engine’s recommendations are based on the scores I give each of the 40 businesses I follow closely, and their ever-fluctuating share prices.

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

When it comes to portfolio building and rebalancing, the idea is to own more of the highest-ranked shares and less, or none, of the lowest ranked (see the link to the guide at the end of this article for more detail).

A sea of sells

Even after dividends from Anpario (LSE:ANP), Bunzl (LSE:BNZL), and RWS Holdings (LSE:RWS), the portfolio’s cash balance stood at just £669 on Thursday 1 August, when I sat down to consider which shares, if any, to trade.

The portfolio’s minimum trade size, 2.5% of its total value, was much higher. It was £5,388, so there could be no new additions.

To fund future additions I would have to liquidate some of the eight Share Sleuth shares languishing near the bottom of the Decision Engine table, or wait a long time for dividends to build the cash balance back up to the minimum trade size.

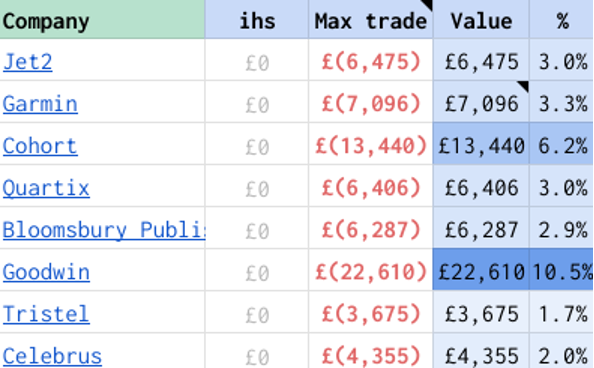

The candidates range from Jet2 Ordinary Shares (LSE:JET2), ranked 29 on the day, to Celebrus Technologies (LSE:CLBS) ranked 38:

Source: Richard Beddard. “ihs” is the ideal holding size based on the company’s score, “Value” is the value of the portfolio’s holding, and “%” is the value of the portfolio’s holding as a proportion of its total value.

All eight shares have an ideal holding size (ihs) of zero. This means their scores are so low that the Decision Engine recommends a holding size smaller than the minimum holding size, which, like the minimum trade size, is 2.5% of the portfolio.

I use a simple formula to derive how much of a share to own as a percentage of the portfolio’s total value. The Decision Engine spreadsheet takes each share’s score, deducts it from 10 and then deducts that result from the score (ihs = score - (10 - score):

For example the highest scoring share of the octet was Jet2, the leisure airline and package holiday company. It scored 6.2, so:

10 - 6.2 = 3.8

6.2 - 3.8 = 2.4

The formula recommends holding 2.4% of the portfolio in Jet2, just under the minimum holding size.

It is so close to 2.5%, I could turn a blind eye. There are more compelling reasons to reduce or liquidate other holdings, and I have another reason to go easy on Jet2. It publishes its annual report later this month.

The annual report will trigger me to re-score the business, so I do not want to pre-empt that. The same is true for Cohort (LSE:CHRT), a gaggle of defence technology companies. Celebrus, a marketing and fraud prevention software as a service business, has already published its annual report. It is on my to-do list.

Technically, engineer Goodwin (LSE:GDWN) is in the same boat. Its results are due on 8 August, around the time this article will be published.

The results may well make me look like a chump, because I have decided to halve the portfolio’s holding in Goodwin.

Reducing Goodwin

In doing so, I chose not to reduce or liquidate the portfolio’s smaller holdings in hospital disinfectant maker Tristel (LSE:TSTL), consumer and academic publisher Bloomsbury Publishing (LSE:BMY), vehicle tracking service Quartix Technologies (LSE:QTX), or sports watch and instrument manufacturer Garmin Ltd (NYSE:GRMN).

Goodwin was in the firing line because of the holding’s size. At a value of £22,610 (10.5% of the portfolio’s total value), it was Share Sleuth’s biggest holding, but it was ranked 36 by the Decision Engine.

Even if I give Goodwin top marks when I re-evaluate the business when it publishes its annual report, a small upgrade, a maximum score of 9 out of 9 would not be sufficient to justify holding as many shares as the portfolio does.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Stockwatch: a recovering finance stock at a discount

That is because of the share price. The shares cost 31 times normalised profit, which translates into a price score of -2. At today’s price, the maximum total score Goodwin could achieve is 7 (9 - 2), once we deduct the price score.

That translates into an ideal holding size of about £8,500, way below £22,610.

However compelling Goodwin’s results are, the holding is too big.

Happily, the rising share price is also the reason the holding has grown. SharePad, the software I use to track the portfolio, tells me Share Sleuth has made a 253% return from its three investments in Goodwin so far, which is 14% annualised.

Past performance is not a guide to future performance.

My first trade in 2014 was exquisitely badly timed. Then, Goodwin’s biggest earner was check valves for oil pipelines but a crash in the oil price stymied investment in new infrastructure and consequently Goodwin’s revenue and profit contracted.

Growth in another division, refractory engineering, kept the group afloat as it enlarged its steel foundry so it could make even bigger components, and win new business from the nuclear and defence industries. That business is now building.

It did not always feel like it, but Goodwin was quite an easy turnaround to back. Although the foundry lost money, the group as a whole remained reasonably profitable and its debt never troubled me. It continued to be relatively prosperous through thick and thin.

- Insider: bosses buy shares in this trio after results

- The Income Investor: why UK-focused shares offer dividend appeal

My cautious nature and my affection for Goodwin have stopped me liquidating the holding. Instead I decided to halve it.

I slept on the decision. Then, on Friday 2 August, I removed 133 Goodwin shares from the portfolio.

The actual price, quoted by a broker, was £81.09, which raised £10,775 after deducting £10.00 in lieu of broker fees.

The remaining 133 shares were also worth £10,755, which is about 5.2% of the total value of the portfolio.

Share Sleuth performance

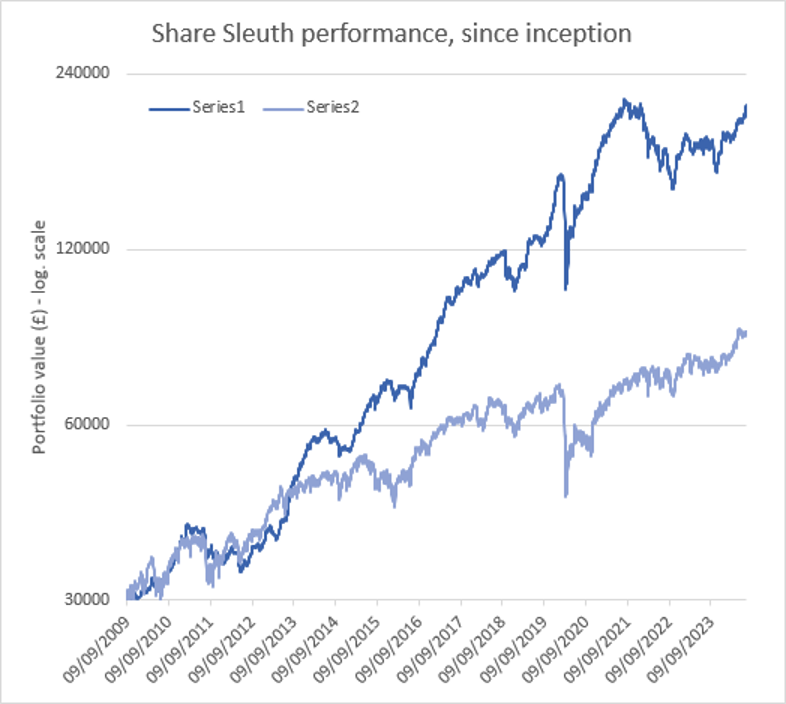

The market is selling off as I type, but at the close on 2 August, Share Sleuth was worth £207,585, 592% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £86,662, an increase of 189%.

Past performance is not a guide to future performance.

After the reduction in the portfolio’s Goodwin holding and dividends paid during the month from Anpario, Bunzl, and RWS , Share Sleuth’s cash pile is £11,444.

The minimum trade size, 2.5% of the portfolio’s value, is £5,190.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 11,444 | ||||

Shares | 196,141 | ||||

Since 9 September 2009 | 30,000 | 207,585 | 592 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,578 | 2 |

ANP | Anpario | 1,124 | 4,057 | 3,400 | -16 |

BMY | Bloomsbury | 845 | 3,203 | 5,983 | 87 |

BNZL | Bunzl | 201 | 4,714 | 6,364 | 35 |

CHH | Churchill China | 1,495 | 17,228 | 17,791 | 3 |

CHRT | Cohort | 1,600 | 3,747 | 13,312 | 255 |

CLBS | Celebrus | 1,528 | 3,509 | 4,240 | 21 |

DWHT | Dewhurst | 938 | 6,754 | 10,553 | 56 |

FOUR | 4Imprint | 116 | 2,251 | 6,624 | 194 |

GAW | Games Workshop | 100 | 4,571 | 9,990 | 119 |

GDWN | Goodwin | 133 | 3,112 | 10,241 | 229 |

GRMN | Garmin | 53 | 4,413 | 6,992 | 58 |

HWDN | Howden Joinery | 2,020 | 12,718 | 17,887 | 41 |

JET2 | Jet2 | 456 | 250 | 6,265 | 2,406 |

LTHM | James Latham | 750 | 9,235 | 10,800 | 17 |

MACF | Macfarlane | 3,533 | 5,005 | 4,399 | -12 |

PRV | Porvair | 906 | 4,999 | 5,853 | 17 |

PZC | PZ Cussons | 1,870 | 3,878 | 1,889 | -51 |

QTX | Quartix | 3,285 | 7,296 | 6,307 | -14 |

RSW | Renishaw | 234 | 6,227 | 8,061 | 29 |

RWS | RWS | 2,790 | 9,199 | 5,095 | -45 |

SOLI | Solid State | 356 | 1,028 | 5,002 | 387 |

TET | Treatt | 763 | 1,082 | 3,361 | 210 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 6,840 | 210 |

TSTL | Tristel | 750 | 268 | 3,619 | 1,249 |

TUNE | Focusrite | 2,020 | 14,128 | 7,626 | -46 |

VCT | Victrex | 292 | 6,432 | 3,072 | -52 |

Notes

2 Aug: Reduced Goodwin

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £207,585 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £86,662 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, close on Friday 2 August.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Goodwin.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.