Share Sleuth: Why I trimmed one share and was bowled over by another

Richard Beddard does some pruning and gets the ball rolling with another new holding for the Share Sleu…

26th March 2020 12:25

by Richard Beddard from interactive investor

Richard Beddard does some pruning and gets the ball rolling with another new holding for the Share Sleuth portfolio.

This month, I’ve made two trades. The first was perhaps the easiest I have ever made; and the second – well, it should have been easy but a virus intervened.

I mentioned that Share Sleuth’s Games Workshop holding was first in line for a trim last month. It owns the Warhammer fantasy modelling and wargaming franchise. Warhammer is enjoying an explosion of popularity and profitability because the company has revamped just about everything about the business: the models, games, stores and online marketing presence, for example. The shares have not just been one of the portfolio’s top performers – they are among the market’s top performers.

Too much of a good thing

You can have too much of a good thing, though, and immediately before I reduced the portfolio’s holding, Games Workshop scored 6.4 according to my Decision Engine – about average for Share Sleuth. It is a very good business but was weighed down by a hefty valuation. Because of the vertiginous trajectory of its share price and despite a previous reduction in the size of the holding in February 2018, Games Workshop had grown to be the portfolio’s biggest holding, worth about 9% of its total value.

I was already primed to shed some shares when the company announced that its chief executive, finance director and chairman had sold substantial proportions of their holdings. A few days later on 13 February, I reduced the portfolio’s holding by about 43%. The trade, at a price quoted by my broker of just over £71.40, raised £6,064.

While I don’t usually read anything into other people’s trades, I wouldn’t blame them for thinking about diversifying, as I was.

The second trade was a new addition to the portfolio, Hollywood Bowl. This is another very strong business, which you can read about in this month's Share Watch. My misgivings about adding the shares had nothing to do with the business and everything to do with the way an attractive valuation had come about.

I added the shares at the end of a week of falls in share prices, the like of which we have not seen since 2008. By the time you read this, you may know whether the Covid-19 epidemic is a global pandemic, but as I write, an epidemic here in the UK is just one scenario, admittedly an increasingly likely one. Needless to say, the worst-case scenario would be bad for tenpin bowling.

So why was I crazy enough to add the shares? Pandemics aside, I believe in the business, and like the other shares in the portfolio I intend to hold on to Hollywood Bowl for 10 years or more. Over that timeframe, a serious market dislocation is highly likely, but the possibility we are entering a thin period shouldn’t deter me from adding them. Indeed, it’s that possibility, and the falling share price, that lifted the company to a score of 7.5 according to my Decision Engine.

On 28 February, I added 1,615 shares in Hollywood Bowl at a price of £2.23 per share, also the actual price quoted by a broker. After fees, the transaction cost £3,626, which is very close to the minimum I will trade at one time (2.5% of the portfolio’s total value). Unbeknown to me I added the shares on the same day that Laurence Keen, Hollywood Bowl’s chief financial officer, bought considerably more.

I am not going to make a habit of synchronising my trades with those of company directors, but let’s hope it works out on this occasion!

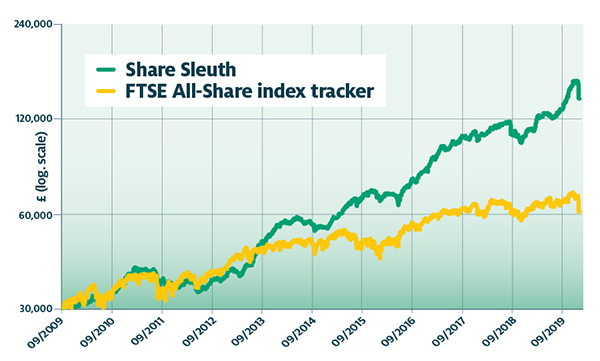

Still comfortably ahead of the FTSE

Games Workshop had a 9% weighting

table.tableizer-table {

font-size: 12px;

border: 1px solid #CCC;

font-family: Arial, Helvetica, sans-serif;

}

.tableizer-table td {

padding: 4px;

margin: 3px;

border: 1px solid #CCC;

}

.tableizer-table th {

background-color: #104E8B;

color: #FFF;

font-weight: bold;

}

| Portfolio | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 4,632 | ||||

| Shares | 136,610 | ||||

| Since 9 September 2009 | 30,000 | 141,243 | 371 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ALU | Alumasc | 938 | 999 | 1,018 | 2 |

| ANP | Anpario | 937 | 3,168 | 3,280 | 4 |

| AVON | Avon Rubber | 192 | 2,510 | 5,021 | 100 |

| BMY | Bloomsbury | 1,256 | 3,274 | 3,077 | -6 |

| BOWL | Hollywood Bowl | 1,615 | 3,628 | 4,038 | 11 |

| CGS | Castings | 1,109 | 3,110 | 4,181 | 34 |

| CHH | Churchill China | 341 | 3,751 | 5,712 | 52 |

| CHRT | Cohort | 1,600 | 3,747 | 9,680 | 158 |

| DTG | Dart | 456 | 250 | 5,098 | 1,939 |

| DWHT | Dewhurst | 735 | 2,244 | 7,644 | 241 |

| GAW | Games Workshop | 113 | 324 | 7,085 | 2,086 |

| GDWN | Goodwin | 266 | 6,646 | 7,182 | 8 |

| HWDN | Howden Joinery | 748 | 3,228 | 4,804 | 49 |

| JDG | Judges Scientific | 159 | 3,825 | 7,696 | 101 |

| NXT | Next | 45 | 2,199 | 2,712 | 23 |

| PMP | Portmeirion | 349 | 3,212 | 2,007 | -38 |

| PZC | PZ Cussons | 1,870 | 3,878 | 3,460 | -11 |

| QTX | Quartix | 1,085 | 2,798 | 4,015 | 43 |

| RM. | RM | 1,275 | 3,038 | 3,290 | 8 |

| RSW | Renishaw | 92 | 1,739 | 3,128 | 80 |

| SOLI | Solid State | 1,546 | 4,523 | 7,962 | 76 |

| TET | Treatt | 1,222 | 1,734 | 5,670 | 227 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 5,880 | 166 |

| TRI | Trifast | 2,261 | 3,357 | 2,905 | -13 |

| TSTL | Tristel | 750 | 268 | 3,233 | 1,105 |

| VCT | Victrex | 323 | 6,254 | 6,667 | 7 |

| XPP | XP Power | 339 | 6,287 | 10,170 | 62 |

Notes: Reduced holding in Games Workshop, added Hollywood Bowl. Transaction costs include £10 broker fee, and 0.5% stamp duty where appropriate. Cash earns no interest. Dividends and sale proceeds are credited to the cash balance. £30,000 invested on 9 September 2009 would be worth £141,454 today. £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £61,369 today. Objective: To beat the index tracker handsomely over five-year periods. Source: SharePad, 2 March 2019.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.