Share Sleuth: why I picked this share out of eight contenders

8th June 2023 09:03

by Richard Beddard from interactive investor

Richard Beddard has cash to spend after taking some profits in Games Workshop. He examines the eight highest-ranked shares and explains how he arrived at his decision to add to one of them.

May’s trade ought to have been as simple as April’s, when a rise in the price of Games Workshop Group (LSE:GAW) meant the shares were over-represented in the Share Sleuth portfolio and I summarily cut the holding back down to size.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Cranking up the Decision Engine

When I sat down to trade on 18 May, the Decision Engine was telling me to make a very similar trade: sell Judges Scientific (LSE:JDG), after a melt-up in the share price of the manufacturer of scientific instruments.

I did not take the notional money and run though, because the portfolio already had £8,234 spare cash, more than enough to fund additions at the minimum trade size of 2.5% of the portfolio’s total value. This money had, of course, been liberated by the sale of Games Workshop, and augmented by dividends collected in recent months.

Since my goal is to keep the portfolio fully invested, I looked instead at what my spreadsheet was telling me to add. The following table shows all the shares scoring 8 and 9, the highest-ranked shares, and the Decision Engine’s verdict rewritten in plain English:

Rank/ score | Ticker | Holding size (%) | Ideal size (%) | Trade size (%) | Verdict |

1/9 | TUNE | 3.3 | 8.9 | 5.6 | Last added shares in March |

2/9 | HWDN | 7.6 | 8.5 | 0.9 | < min trade size of 2.5% |

3/8 | DWHT | 3.2 | 7 | 3.8 | Candidate. Check liquidity |

4/8 | RWS | 1.3 | 7 | 5.7 | Best candidate on paper |

5/8 | PRV | 3.1 | 6.9 | 3.8 | Candidate |

6/8 | LTHM | 5 | 6.9 | 1.9 | < min trade size |

7/8 | CHH | 5.2 | 6.6 | 1.4 | < min trade size |

8/8 | NXT | 3.9 | 6.2 | 2.3 | < min trade size and scoring soon |

Although shares that score 7 out of 9 are also worthy of consideration, since there were opportunities in the 8’s and 9’s I did not need to look any further.

We can quickly rule out buying more shares in Howden Joinery Group (LSE:HWDN), Latham (James) (LSE:LTHM), Churchill China (LSE:CHH) and Next (LSE:NXT). The difference between their ideal sizes and their trade sizes was less than the 2.5% minimum trade size so they are already fully represented in the portfolio (to find out more about how these sizes are calculated, please see the links at the bottom of this article).

Top-ranked Focusrite (LSE:TUNE) has fallen a lot in price since I added it to Share Sleuth in March 2022, and further since I added more in March 2023. This is one of the reasons it scores so highly.

The other, or course, is that I think Focusrite is a good business, but since I avoid trading individual shares more than once a year, we can pass over the electronic music equipment maker too.

- Two attractive stocks that could leave you sitting pretty

- Small-caps – why it might be time to consider an allocation

Third-ranked Dewhurst Group (LSE:DWHT), a lift component manufacturer, is the highest-ranked candidate. The shares are thinly traded, hence the note in the table about liquidity, and although I could have bought enough shares in the market that day, I chose not to.

That is because Dewhurst shares account for 3.2% of the portfolio. We can knock fifth-ranked Porvair (LSE:PRV) out at this stage too. It is a 3.1% holding.

By comparison, Share Sleuth’s holding in fourth-ranked RWS Holdings (LSE:RWS) is only 1.3% of the portfolio’s total value.

The scores of these three shares are separated by only the tiniest of fractions and the difference between them is meaningless, so on paper the best decision is to top up the tiddler, the most under-represented share in the top eight, and bring more balance to the portfolio.

Adding RWS

But, there is a but. RWS announced half-year results on 25 April, after I scored the company in March.

RWS reported lower profit than the same period in 2022 and it expects a full year outcome of £128 million adjusted profit before tax, a near 6% decline compared to the previous year.

Since my intention is to hold RWS in the portfolio for 10 years or more, I am not generally concerned about annual ups and downs in profit. The company is experiencing a slowdown due to specific issues like the introduction of the European Unitary patent and a bottleneck in US drug approvals, which impacts some of its more specialist work in patent translation and drug documentation. General market conditions are weak too.

- Stockwatch: this might be a useful defensive share in tough times

- Shares for the future: one of my 26 good value shares just hit a record high

Growth in the Language and Content Technology divisions, which provides translation and content software platforms, is being held back as customers switch to paying for software as they go.

This division has been augmented by TrainAI, a service that uses the experience and capabilities RWS developed making its own AI platforms to collect and prepare data for all kinds of AI.

This development is, perhaps, more significant than the profit forecast, at least in the long term.

In one sense it is unsettling because more value is being added by technology and less by people, where RWS has traditionally been strong.

But it is also reassuring. RWS is one of the very biggest language services companies in the world. It has the customers, an established machine translation platform, and the translators to train the machines, check the work they do and do the work they cannot do.

A weak year does not invalidate the company’s strategy, and TrainAI is more evidence that artificial intelligence is an opportunity as well as a threat.

Following the money

The pace of change in the language services industry means we cannot take much for granted, though, and I felt duly conflicted about this trade.

A factor I do not consider consciously, may have subliminally pushed me over the line. Since the half-year results, the directors have between them invested over £200,000 in the company at prices above and below the 250p share price on the day I was considering the trade.

Director | Trade | Price/Value | Date |

Ian El-Mokadem chief executive | Buy 40,000 | 253.8/£101,520 | 2 May |

Christopher Lewey, corporate cev’t | Buy 7,855 | 254.88/£20,097 | 28 April |

Frances Earl, non-exec | Buy 3,000 | 251.4/£7,542 | 27 April |

Ian El-Mokadem chief executive | Buy 10,000 | 238.2/£23,820 | 25 April |

Candida Davies, chief financial officer | Buy 20,000 | 241.93/£48,386 | 25 April |

I must caution against using the apparent confidence of directors to justify trades. £100,000 to a chief executive of a reasonably large company like RWS is like £1,000 or £10,000 to many private investors, and like us they can have different motivations, or be wrong.

As usual, I slept on the decision. In theory, I could have added up to 5.7% of the portfolio’s total value in RWS shares, but I rarely go large and reflecting my caution this time I added 1,790 shares at a price of £2.51 on Friday 19 May.

The total transaction cost Share Sleuth £4,503, including £10 in lieue of fees. This was roughly equivalent to 2.5% of the portfolio’s total value, the minimum trade size.

Share Sleuth performance

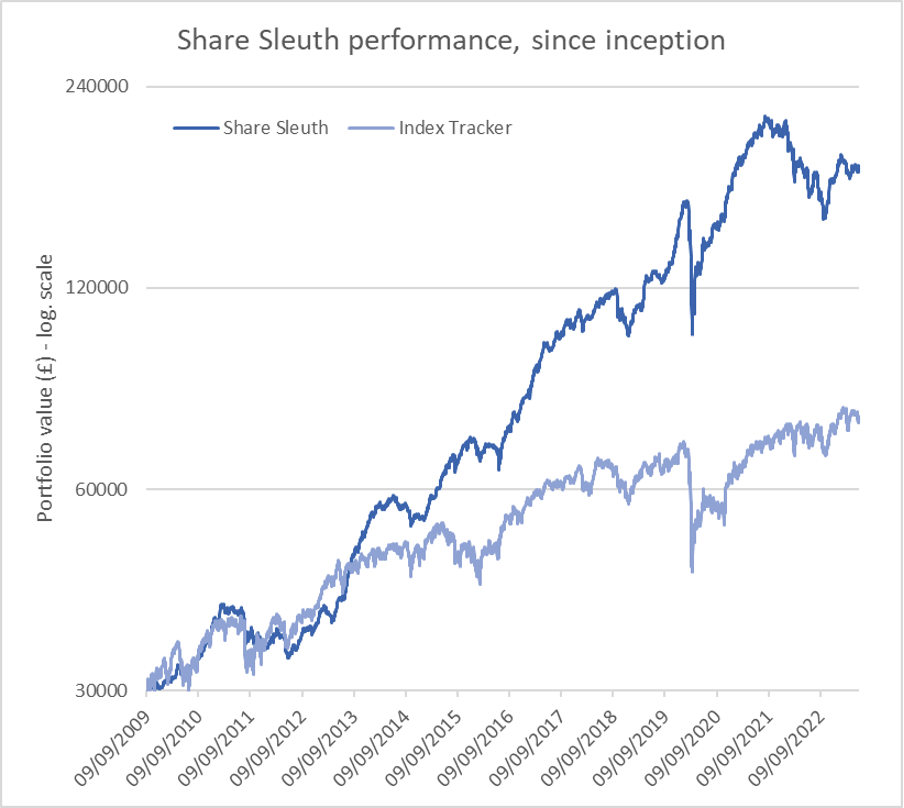

At the close on 5 June, Share Sleuth was worth £182,759, 509% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £77,048, an increase of 157%.

Past performance is not a guide to future performance.

After dividends paid during the month from Games Workshop and Howdens, and a dividend and special dividend from 4imprint Group (LSE:FOUR), Share Sleuth’s cash pile is £4,732, more than sufficient to fund another addition in June.

The minimum trade size, 2.5% of the portfolio’s value, is £4,569.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 4,732 | ||||

Shares | 178,027 | ||||

Since 9 September 2009 | 30,000 | 182,759 | 509 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 2,473 | -39 |

BMY | Bloomsbury | 1,681 | 5,915 | 7,060 | 19 |

BNZL | Bunzl | 201 | 4,714 | 6,279 | 33 |

CHH | Churchill China | 682 | 8,013 | 9,378 | 17 |

CHRT | Cohort | 1,600 | 3,747 | 7,680 | 105 |

D4T4 | D4t4 | 1,528 | 3,509 | 2,674 | -24 |

DWHT | Dewhurst | 532 | 1,754 | 5,719 | 226 |

FOUR | 4Imprint | 190 | 3,688 | 9,377 | 154 |

GAW | Games Workshop | 100 | 4,571 | 9,535 | 109 |

GDWN | Goodwin | 266 | 6,646 | 11,997 | 81 |

GRMN | Garmin | 53 | 4,413 | 4,507 | 2 |

HWDN | Howden Joinery | 2,020 | 12,718 | 13,441 | 6 |

JDG | Judges Scientific | 85 | 2,082 | 8,543 | 310 |

JET2 | Jet2 | 456 | 250 | 5,796 | 2,218 |

LTHM | James Latham | 750 | 9,235 | 9,563 | 4 |

NXT | Next | 106 | 6,071 | 6,837 | 13 |

PRV | Porvair | 906 | 4,999 | 5,889 | 18 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,557 | -8 |

QTX | Quartix | 1,085 | 2,798 | 2,713 | -3 |

RSW | Renishaw | 92 | 1,739 | 3,774 | 117 |

RWS | RWS | 2,790 | 9,199 | 6,389 | -31 |

SOLI | Solid State | 356 | 1,028 | 4,005 | 290 |

TET | Treatt | 763 | 1,082 | 5,394 | 398 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,320 | 232 |

TSTL | Tristel | 750 | 268 | 3,075 | 1,046 |

TUNE | Focusrite | 1,050 | 9,123 | 5,114 | -44 |

VCT | Victrex | 292 | 6,432 | 4,637 | -28 |

XPP | XP Power | 240 | 4,589 | 5,304 | 16 |

Notes

May: Added more shares in RWS

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £182,759 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £77,048 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, 5 June 2023.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in RWS.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.