Share Sleuth: three firms on the buy list. Here’s the one I chose

Richard Beddard names the shares on his radar, and those at risk of being reduced or cut from the portfolio.

6th February 2025 09:09

by Richard Beddard from interactive investor

Having decided the Share Sleuth portfolio is in good shape, I’m making small adjustments to keep it that way.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

A trio of additions

My scheduled trading day last month fell on Monday 20 January, when the portfolio had just over £8,500 in cash. That was more than enough to fund a meaningful-sized trade, which I define as one worth more than 2.5% of the portfolio’s total value (just under £5,000).

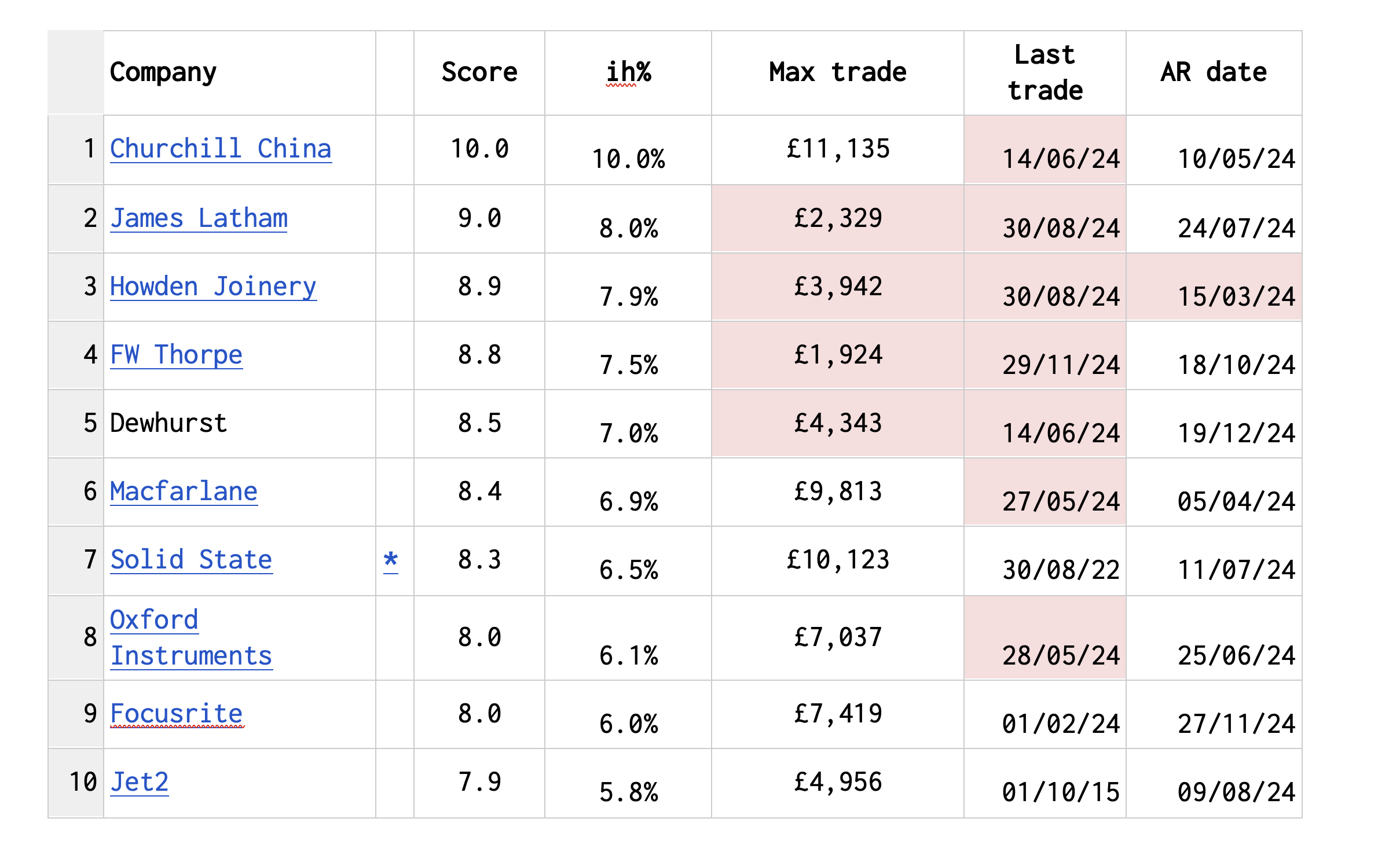

These were the shares my Decision Engine ranked most highly that day:

The shares are ordered by scores I give businesses when they publish their annual reports. They are also influenced by changes in share prices.

The lowest-ranked share in the table,Jet2 Ordinary Shares (LSE:JET2), has a score of 7.9, which is well above the lower bound of good value which I somewhat arbitrarily set at 7.0

The top 10 is a good place to draw a line because there are three clear investment opportunities in it, and the shares immediately outside it are not prime candidates for long-term investment even though their scores are high enough.

I added shares in #11, Softcat (LSE:SCT) last month, which disqualifies it, and #12 is Games Workshop Group (LSE:GAW), already a substantial shareholding.

The ih% column shows the ideal holding size of each share as a percentage of the total size of the portfolio. The higher the score, the higher the ideal holding size.

- 16 UK stocks least likely to be impacted by Trump tariffs

- 10 hottest ISA shares, funds and trusts: week ended 31 January 2025

Share Sleuth was worth just over £198,000, when I made this table. Churchill China (LSE:CHH), the highest-ranked share, had an ih% of 10%, so its ideal holding size in money terms was £19,800 (you can find out more about how the ih% is calculated in the Share Sleuth explainer).

The Max trade column shows the difference between the ideal holding size in money terms and the value of each holding. It is the amount I would need to invest or reduce a holding by to achieve the ideal holding size.

The pink highlights are meant to discourage me from investing in a share.

Shares 2 to 5 are all near their ideal sizes. The difference is less than the minimum trade size of 2.5%, so I was not interested in trading them.

Seven shares are ruled out because I have traded them in the last year.

Howden Joinery Group (LSE:HWDN) is out of contention because it will report soon, a year after last March’s annual report.

Excluding these shares leaves Solid State (LSE:SOLI) (score 8.3 rank 7), Focusrite (LSE:TUNE) (8.0, rank 9) and Jet2 (score 7.9, rank 10).

A pair of reductions

One of two conditions are required to reduce or eliminate a holding:

- A holding is too large, its value is at least 2.5% of the portfolio’s total value more than its ideal holding size.

- The share’s score is less than 6.25, which equates to an ih% of 2.5%. Anything less than this is too small to bother holding.

Here are the Decision Engine’s recommendations:

Five of the shares are not holdings, so they cannot be traded (max trade is zero).

The other six shares met the second condition. Their score was less than 6.5, so their ideal holding sizes were less than 2.5% of the portfolio’s total value. The Decision Engine set the max trade to the same value as the value of the holding. It was telling me to liquidate these holdings.

Since I have already traded Cohort (LSE:CHRT) and Goodwin (LSE:GDWN) in the last year, they got a reprieve.

Quartix Technologies (LSE:QTX) and Garmin Ltd (NYSE:GRMN) also received a stay of execution because I will re-evaluate them shortly, when they publish their annual reports.

That left Bloomsbury Publishing (LSE:BMY) (score 6.0, rank 30) and Celebrus Technologies (LSE:CLBS) (score 5.1, rank 37) in the frame.

Adding Solid State

I have written before about how I hate parting with good-quality shares unless something big has rocked my confidence in their long-term business prospects. Both Bloomsbury and Celebrus fit this scenario.

- 10 funds to generate a £10,000 income in 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Their scores are relatively low because their share prices are relatively high, not because I believe they are bad businesses.

With cash in the bank, I was predisposed to favour adding shares.

Of course, I slept on the decision. Then on Thursday 21 January I added 3,229 shares in Solid State to the portfolio’s holding.

I am trying not to overthink, so I went with the Decision Engine verdict.

I was tempted by Solid State last month, and of the three shares in the frame it was marginally the highest ranked and most under-represented.

The actual price, quoted by a broker, was 154.7p, which cost £5,005.26 after deducting £10 in lieu of fees.

A decade of trading Solid State. “B” indicates additions to the portfolio. “S” indicates reductions.

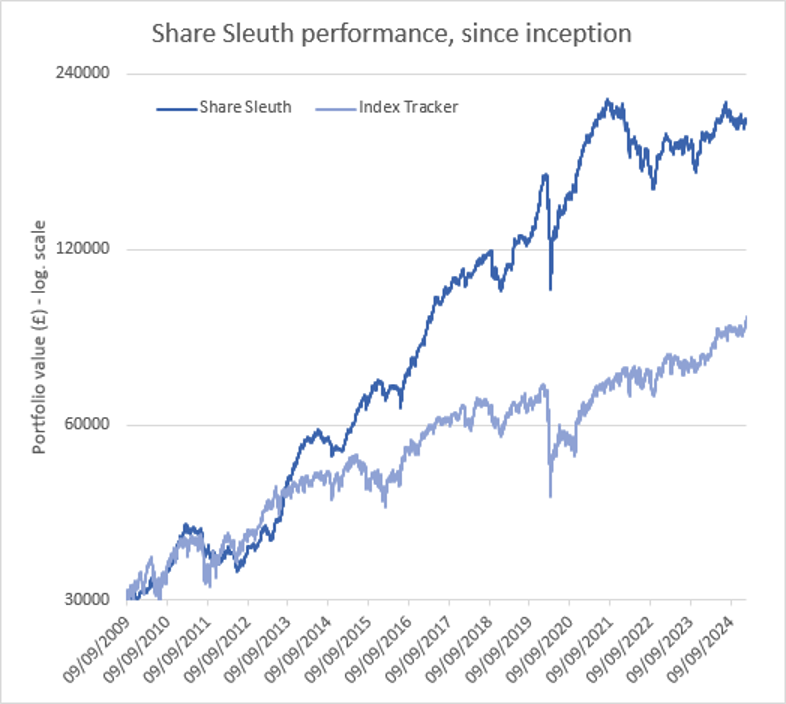

Share Sleuth performance

At the close on 31 January 2025, Share Sleuth was worth £192,282, 564% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £92,161, an increase of 207%.

After dividends paid during the month from Celebrus, Latham (James) (LSE:LTHM), and Oxford Instruments (LSE:OXIG), Share Sleuth’s cash pile is £3,589.

The minimum trade size, 2.5% of the portfolio’s value, is £4,982.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 3,589 | ||||

Shares | 195,692 | ||||

Since 9 September 2009 | 30,000 | 199,282 | 564 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,107 | -9 |

ANP | Anpario | 1,124 | 4,057 | 4,777 | 18 |

BMY | Bloomsbury | 845 | 3,203 | 5,628 | 76 |

BNZL | Bunzl | 201 | 4,714 | 6,930 | 47 |

CHH | Churchill China | 1,495 | 17,228 | 9,194 | -47 |

CHRT | Cohort | 861 | 2,813 | 9,902 | 252 |

CLBS | Celebrus | 1,528 | 3,509 | 3,469 | -1 |

DWHT | Dewhurst | 938 | 6,754 | 10,037 | 49 |

FOUR | 4Imprint | 116 | 2,251 | 6,995 | 211 |

GAW | Games Workshop | 100 | 4,571 | 14,560 | 219 |

GDWN | Goodwin | 133 | 3,112 | 9,762 | 214 |

GRMN | Garmin | 53 | 4,413 | 9,301 | 111 |

HWDN | Howden Joinery | 1,476 | 10,371 | 12,111 | 17 |

JET2 | Jet2 | 456 | 250 | 6,981 | 2,693 |

LTHM | James Latham | 1,150 | 14,437 | 13,513 | -6 |

MACF | Macfarlane | 3,533 | 5,005 | 3,851 | -23 |

OXIG | Oxford Instruments | 241 | 5,043 | 5,061 | 0 |

PRV | Porvair | 906 | 4,999 | 6,233 | 25 |

QTX | Quartix | 3,285 | 7,296 | 5,831 | -20 |

RSW | Renishaw | 234 | 6,227 | 8,436 | 35 |

RWS | RWS | 2,790 | 9,199 | 3,833 | -58 |

SCT | Softcat | 326 | 4,992 | 5,229 | 5 |

SOLI | Solid State | 5,009 | 6,033 | 6,637 | 10 |

TET | Treatt | 763 | 1,082 | 3,220 | 197 |

TFW | Thorpe (F W) | 4,362 | 9,711 | 13,260 | 37 |

TUNE | Focusrite | 2,020 | 14,128 | 3,939 | -72 |

VCT | Victrex | 292 | 6,432 | 2,897 | -55 |

Notes

21 January: Added to Solid State

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £199,282 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £92,161 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, close on Friday 31 January 2025.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all the shares in the Share Sleuth portfolio.

For more on the Share Sleuth portfolio, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.