Share Sleuth: tempting stock is new addition to the portfolio

Richard Beddard explains his thought process when considering contenders to reduce the portfolio’s cash pile.

2nd October 2024 09:52

by Richard Beddard from interactive investor

Earlier in the year, the Decision Engine urged me to sell lots of shares I treasured because the Share Sleuth portfolio was bent out of shape.

High performers in the portfolio had grown into large positions, but their high share prices weighed on their scores. Since the score determines how many shares of a particular company the portfolio should own (the ideal holding size or IHS), the holdings were too big.

The situation is a little less extreme now.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

In recent months, I lifted Cohort (LSE:CHRT) out of the sell zone when I re-scored it. I right-sized the portfolio’s holding in Howden Joinery Group (LSE:HWDN) and halved an enormous position in Goodwin (LSE:GDWN).

Earlier in the year, I liquidated a holding in XP Power Ltd (LSE:XPP), reduced the size of the portfolio’s holding in Bloomsbury Publishing (LSE:BMY) and trimmed4imprint Group (LSE:FOUR).

XP Power was the exception that proved the rule. It was not the high share price or the size of the holding that provoked the trade. I finally lost confidence in the business.

Shares to sell

But there is still plenty of selling to be done.

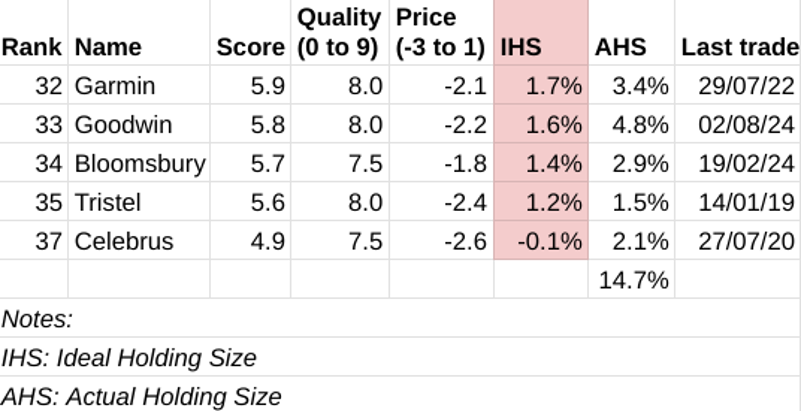

Decision Engine scores can be divided into two components. The first measures the quality of the business, whether it is dependable, distinctive and directed (scored out of 9). And the second measures its share price (scored in a range from -3 to +1).

The table below shows the five shares the portfolio would still have me sell. The fourth and fifth columns decompose the score into quality and price. For example, Garmin Ltd (NYSE:GRMN)’s score of 5.9 comes from combining a quality score of 8 out of 9 with a price score of -2.1 (8-2.1 = 5.9).

All the companies are good quality, but their share prices are a high multiple of normalised earnings and so their price scores are negative.

I decide the quality scores every time I evaluate or reevaluate a company. The price score is calculated daily according to a formula described in the guide linked at the end of this article.

Value is determined by the combination of quality and price. Because of their low scores and low ranks, these are among the 10 most overvalued shares of the 40 in the Decision Engine.

The Decision Engine wants me to liquidate these holdings because their ideal holding sizes are all below 2.5% of the Share Sleuth portfolio’s total value.

Of these shares, only Garmin and Celebrus Technologies (LSE:CLBS) are eligible to trade. I have already reduced the portfolio’s holdings in Goodwin and Bloomsbury Publishing this year, and Tristel (LSE:TSTL) reports its full-year results next month.

And shares to buy

In any case, the portfolio has spare cash to invest.

Decision day was Friday 20 September, when the portfolio’s cash balance was £12,358 and its minimum trade size (MTS) was £5,040. Like the IHS, the MTS is also 2.5% of the portfolio’s total value.

This was the choice that confronted me:

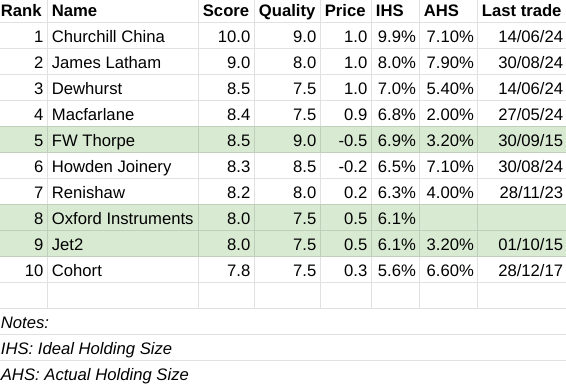

Only three shares were available for investment. All just as good quality as the shares the Decision Engine would have me sell, but trading at less demanding multiples of normalised profit.

They are Thorpe (F W) (LSE:TFW) (rank 5, score 8.5), Oxford Instruments (LSE:OXIG) (rank 8, score 8) and Jet2 Ordinary Shares (LSE:JET2) (rank 9, score 8).

The others were ruled out because I had traded them recently, or the difference between their ideal holding sizes and their actual holding sizes was less than the minimum trade size.

For example, the Renishaw (LSE:RSW) holding is 4% of the portfolio’s total value and its IHS is 6.3%, a difference of 2.3%. Since the minimum trade size is 2.5%, I would have to lift Renishaw to above its IHS and I might soon have to think about selling the shares I had just bought.

FW Thorpe manufactures lighting systems. It is a great business that Share Sleuth has held almost since its inception.

The chart shows the initial addition in 2010, a top-up in 2015, and a reduction in the size of the holding in 2016. Since then, I have sat on the shares and collected the dividends.

The only thing stopping me from adding more shares is the proximity of FW Thorpe’s full-year results announcement. It is due next month.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Stockwatch: buying this small-cap for its 9% dividend yield

Oxford Instruments, a manufacturer of scientific equipment, is also a tempting investment. I scored it only recently, and it would be a new addition to the portfolio.

I do not know it as well as FW Thorpe, but it would result in a smaller holding so I would be putting less money at risk.

Buying Oxford Instruments

Of course, I slept on the decision, which meant waiting until Monday 23 September. Then I added 341 shares in Oxford Instruments.

The actual price, quoted by a broker, was £20.78 per share, which cost £5,042.53 after deducting £10 in lieu of broker fees and £25 in lieu of stamp duty.

Share Sleuth performance

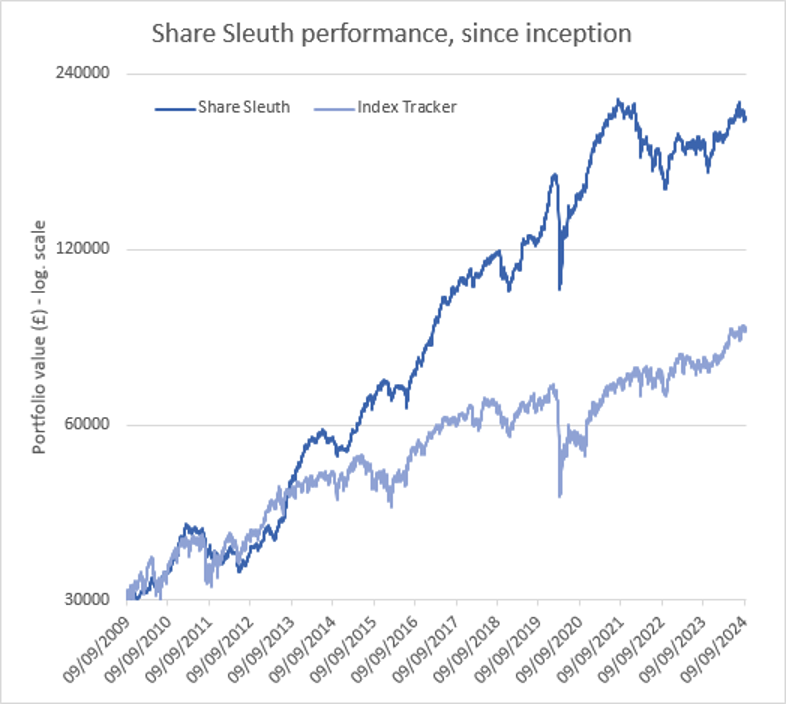

The portfolio is 15 years old! Next month, courtesy of Share Sleuth friend Mark Senior, we will bring you a more detailed performance analysis.

At the close on Friday 27 September, Share Sleuth was worth £202,331, 574% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £87,962, an increase of 193%.

After dividends paid during the month from 4imprint, Games Workshop Group (LSE:GAW), Garmin, Quartix Technologies (LSE:QTX) and Solid State (LSE:SOLI), Share Sleuth’s cash pile is £7,653.

The minimum trade size, 2.5% of the portfolio’s value, is just under £5,200.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 7,653 | ||||

Shares | 194,678 | ||||

Since 9 September 2009 | 30,000 | 202,331 | 574 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,372 | -3 |

ANP | Anpario | 1,124 | 4,057 | 3,597 | -11 |

BMY | Bloomsbury | 845 | 3,203 | 5,678 | 77 |

BNZL | Bunzl | 201 | 4,714 | 7,148 | 52 |

CHH | Churchill China | 1,495 | 17,228 | 13,455 | -22 |

CHRT | Cohort | 1,600 | 3,747 | 14,432 | 285 |

CLBS | Celebrus | 1,528 | 3,509 | 4,355 | 24 |

DWHT | Dewhurst | 938 | 6,754 | 11,209 | 66 |

FOUR | 4Imprint | 116 | 2,251 | 5,893 | 162 |

GAW | Games Workshop | 100 | 4,571 | 10,820 | 137 |

GDWN | Goodwin | 133 | 3,112 | 9,789 | 215 |

GRMN | Garmin | 53 | 4,413 | 6,893 | 56 |

HWDN | Howden Joinery | 1,476 | 10,371 | 13,535 | 31 |

JET2 | Jet2 | 456 | 250 | 6,521 | 2,508 |

LTHM | James Latham | 1,150 | 14,437 | 15,813 | 10 |

MACF | Macfarlane | 3,533 | 5,005 | 3,975 | -21 |

OXIG | Oxford Instruments | 241 | 5,043 | 5,121 | 2 |

PRV | Porvair | 906 | 4,999 | 6,016 | 20 |

PZC | PZ Cussons | 1,870 | 3,878 | 1,823 | -53 |

QTX | Quartix | 3,285 | 7,296 | 5,141 | -30 |

RSW | Renishaw | 234 | 6,227 | 8,845 | 42 |

RWS | RWS | 2,790 | 9,199 | 4,721 | -49 |

SOLI | Solid State | 356 | 1,028 | 4,147 | 303 |

TET | Treatt | 763 | 1,082 | 3,388 | 213 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 6,600 | 199 |

TSTL | Tristel | 750 | 268 | 2,970 | 1,007 |

TUNE | Focusrite | 2,020 | 14,128 | 5,555 | -61 |

VCT | Victrex | 292 | 6,432 | 2,867 | -55 |

Notes

23 September: Added Oxford Instruments

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £202,326 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £87,962 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, close on Friday 27 September 2024.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in FW Thorpe, Oxford Instruments, and all the shares in the Share Sleuth portfolio except Tristel.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.