Share Sleuth: the stock I’ve sold after a roller-coaster ride

Richard Beddard explains why it’s time to wave goodbye to a company that’s been in the portfolio since late 2016.

5th June 2024 11:18

by Richard Beddard from interactive investor

As I cranked up the Decision Engine on Tuesday 28 May to think about what, if anything, would be my trade for the month, the numbers that would govern the decision were:

- The amount of cash in the portfolio: £5,963, on the day

- The minimum trade size, which is 2.5% of its total value. Share Sleuth’s total value on the day was a smidgen under £200,000, so the minimum trade size was a tiny fraction less than £5,000.

The portfolio had enough money to add shares, but adding shares would empty the tank and reduce my options in June.

Consequently, I was somewhat disposed to sell shares, but my decision would depend on the choices the Decision Engine gave me.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

The Decision Engine calculates an ideal holding size based on the score of each share. If the actual holding size strays further than 2.5% of the portfolio’s total value from the ideal size, it will suggest a trade.

As has been the case for most of the year, the Decision Engine has been willing me to “sell” (no actual money changes hands because Share Sleuth is a virtual portfolio).

Two to add

Let us look at the top 10 shares, where the best “buys” will be:

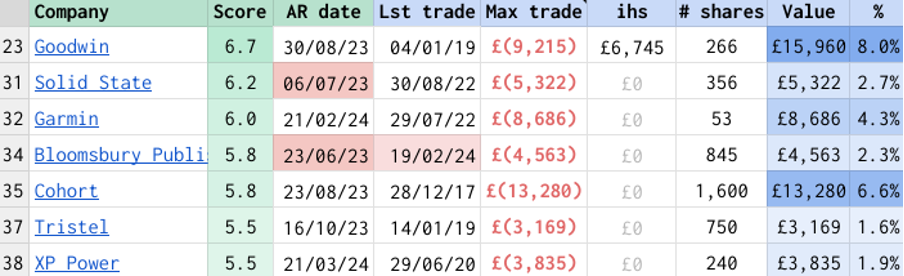

Notes: Max trade = the trade required to make the value of the holding equal the ideal holding size, ihs = ideal holding size (see the link at the bottom of the article for how it is calculated), # shares = number of shares held in Share Sleuth, Value = value of holding, % = Value of holding as a percentage of the total value of the portfolio

Three of my favourite shares, Howden Joinery (LSE:HWDN), Games Workshop (LSE:GAW) and Thorpe (F W) (LSE:TFW), were close enough to their ideal holding sizes that no trade was warranted. The maximum trade value was greyed out.

Oxford Instruments (LSE:OXIG) had a question mark next to its name. A question mark means I am not as confident about a share as I was when I scored it, so the maximum trade was set to zero and greyed out.

As I mentioned in my last article, I am discontinuing the question mark in favour of re-scoring shares midterm when it is necessary. Since Oxford Instruments will publish its annual report next month, I will re-score it then, though.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Six FTSE 100 giants to pay £10 billion dividends in June

That left six shares in the running. I was very unlikely to trade Churchill China (LSE:CHH) and Anpario (LSE:ANP) because they have published their annual reports (AR date column) and I will be re-scoring them in the next month or two.

And it is unusual for me to trade shares that I have traded in the last year or so (Lst trade column), which means I would have had to have had a very good reason to add more shares in Focusrite (LSE:TUNE) or Macfarlane Group (LSE:MACF).

The last shares in this knock-out competition were Dewhurst Group (LSE:DWHT) and Porvair (LSE:PRV).

Dewhurst is mostly a lift component manufacturer, distributor and fitter. It was ranked 3rd and scored 8.5. A maximum trade size of £7,719 would have raised it to its ideal holding size.

Porvair is a manufacturer of filters and laboratory equipment. It was ranked 7th and scored 8.1. A maximum trade size of £6,719 would have raised it to its ideal holding size.

I do not like to overthink trades. Dewhurst is the portfolio’s top “buy”, especially as Porvair’s chief executive of more than two decades has decided to retire, which adds an element of uncertainty.

At least four to liquidate

The field of potential sales was pregnant with opportunity, which is not comfortable for a buy and hold investor.

Max trade = the trade required to make the value of the holding equal the ideal holding size, ihs = ideal holding size (see the link at the bottom of the article for how it is calculated), # shares = number of shares held in Share Sleuth, Value = value of holding, % = Value of holding as a percentage of the total value of the portfolio

The Decision Engine seeks to reconcile quality and price. All the shares at the bottom end of the table are deemed poor value either because the price is a high multiple of normalised profit, or they are of suspect quality, or both.

Except for XP Power Ltd (LSE:XPP), the issue is mostly price, and that makes me a very reluctant seller. These are high-quality businesses. They are doing very well. Many of them are unique to the portfolio, some are unique in the stock market, and I suspect some are unique full-stop.

Except for Goodwin (LSE:GDWN), the Decision Engine has calculated that their ideal holding size is less than the minimum trade size so it wanted me to sell out completely.

The obvious decision was to liquidate XP Power. It had the lowest rank, 38th, and scored 5.5. My reckoning of management and the company’s strategy have taken a blow, which was reflected in the score I gave the firm in April.

Since then the company has rejected a series of bids from a rival, Advanced Energy Industries, which has lifted the price somewhat, and contributed to XP Power’s low rank.

If nothing comes of the bid approach, I hope XP Power recovers, but the Share Sleuth portfolio is not in the business of hope. I am not confident enough in the company’s prospects to hold on to the shares.

Past performance is not a guide to future performance.

It has been a roller-coaster ride, and astonishingly, a profitable one. SharePad, the software I use to track the portfolio, tells me that my holding has returned about 40% since I first added the shares in November 2016, achieving an annualised return of just under 5%.

Taking profits in June 2020 saved my bacon. Had I not done that, a poor investment would have been a dreadful one.

Liquidating XP Power

Of course, I slept on the decision. Then, on Wednesday 29 May, I sold 240 shares in XP Power, the portfolio’s entire holding.

The sale price was £15.80, which raised £3,782 after deducting £10 in lieu of fees.

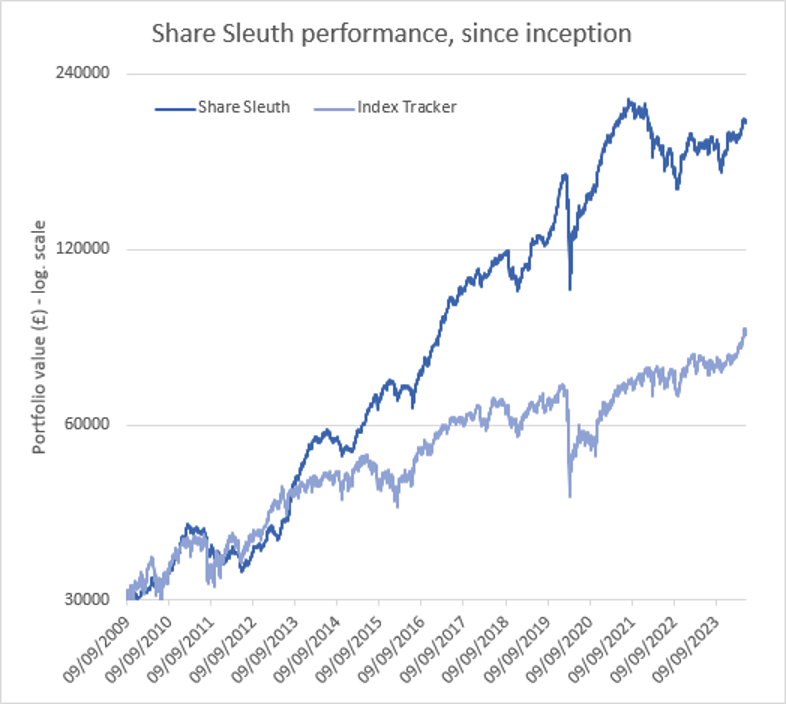

Share Sleuth performance

At the close on Friday 31 May, Share Sleuth was worth £200,666, 569% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £86,269, an increase of 188%.

Past performance is not a guide to future performance.

After dividends paid during the month from 4imprint Group (LSE:FOUR), Games Workshop, Howden Joinery, and Macfarlane, Share Sleuth’s cash pile is £9,975.

The minimum trade size, 2.5% of the portfolio’s value, is £5,017.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 9,975 | ||||

Shares | 190,691 | ||||

Since 9 September 2009 | 30,000 | 200,666 | 569 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,264 | -5 |

ANP | Anpario | 1,124 | 4,057 | 3,203 | -21 |

BMY | Bloomsbury | 845 | 3,203 | 5,155 | 61 |

BNZL | Bunzl | 201 | 4,714 | 5,901 | 25 |

CHH | Churchill China | 1,058 | 12,223 | 11,744 | -4 |

CHRT | Cohort | 1,600 | 3,747 | 13,120 | 250 |

CLBS | Celebrus | 1,528 | 3,509 | 3,438 | -2 |

DWHT | Dewhurst | 532 | 1,754 | 6,304 | 259 |

FOUR | 4Imprint | 116 | 2,251 | 7,528 | 234 |

GAW | Games Workshop | 100 | 4,571 | 9,985 | 118 |

GDWN | Goodwin | 266 | 6,646 | 16,173 | 143 |

GRMN | Garmin | 53 | 4,413 | 6,827 | 55 |

HWDN | Howden Joinery | 2,020 | 12,718 | 18,332 | 44 |

JET2 | Jet2 | 456 | 250 | 6,056 | 2,322 |

LTHM | James Latham | 750 | 9,235 | 9,206 | 0 |

MACF | Macfarlane | 3,533 | 5,005 | 4,257 | -15 |

PRV | Porvair | 906 | 4,999 | 6,487 | 30 |

PZC | PZ Cussons | 1,870 | 3,878 | 2,064 | -47 |

QTX | Quartix | 3,285 | 7,296 | 5,256 | -28 |

RSW | Renishaw | 234 | 6,227 | 9,360 | 50 |

RWS | RWS | 2,790 | 9,199 | 4,855 | -47 |

SOLI | Solid State | 356 | 1,028 | 5,322 | 418 |

TET | Treatt | 763 | 1,082 | 3,815 | 252 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,300 | 231 |

TSTL | Tristel | 750 | 268 | 3,150 | 1,074 |

TUNE | Focusrite | 2,020 | 14,128 | 7,828 | -45 |

VCT | Victrex | 292 | 6,432 | 3,761 | -42 |

Notes:

29 May 2024: Liquidated XP Power

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £200,666 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £86,269 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, close on Friday 31 May 2024.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all the shares in the Share Sleuth portfolio except Tristel.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.