Share Sleuth: the shares I could not bring myself to remove

Richard Beddard resists the urge to tinker as the Share Sleuth portfolio hits a new record high.

7th July 2021 09:06

by Richard Beddard from interactive investor

Richard Beddard resists the urge to tinker as the Share Sleuth portfolio hits a new record high.

I have not made any trades in the Share Sleuth portfolio since I last updated you on June 3.

The Decision Engine is urging me to remove the portfolio’s entire holdings of Bloomsbury Publishing (LSE:BMY) and Hollywood Bowl (LSE:BOWL) since their scores are below five out of nine.

The scores are derived from my annual appraisal of each business, profitability, risks, strategy and fairness, and continually fluctuating share prices.

The main reason Bloomsbury’s score is so low is a gratifying one, its share price has appreciated strongly. But I may also have been too negative about the publisher of books and academic resources when I scored it last year, so I am in no hurry to offload it. Bloomsbury has just published its annual report, and I will review its score in the next few weeks.

- Share Sleuth: taking profits from one holding and adding to another

- Shares for the future: building a forever portfolio

- The inflation-proof shares fund managers are backing

I added shares in Hollywood Bowl, which operates tenpin bowling alleys and indoor crazy golf centres, to the portfolio on 28 February 2020. The share price was down sharply, due to fears about the coronavirus, which was then mostly foreign news. I noted the worst-case scenario (an “epidemic” here) would not be good for Hollywood Bowl, but evidently I could not conceive of how significant the impact would be or how likely it was.

Amazingly, the portfolio’s holding has increased 22% in value since then, although to show how investor sentiment crumbled and then recovered, a chart does a better job:

Past performance is not a guide to future performance.

My initial rationale for investing even though we might have been on the cusp of calamity was that a testing economic event of one kind or another is likely to come along in the 10 years minimum I intend to hold a share. Since I was confident enough to buy with the intention of holding the share through thick and thin, it did not matter if the test was imminent. That logic kept me from selling out once my worst-case scenario came true.

I have considered jettisoning Hollywood Bowl as the vaccines have proved effective and the share price has recovered. In addition, I have some doubts, principally the company’s dependence on outside finance, which I fear will rise further as a result of pandemic restrictions and the aggressive expansion it has planned.

It remains at risk, and perhaps if I had a strong compulsion to add a share, Hollywood Bowl would be sacrificed to fund the trade.

The shares I could not bring myself to add

The Decision Engine would have me add more shares in engineering company Goodwin (LSE:GDWN) and PZ Cussons (LSE:PZC), a manufacturer of health and beauty products, because their high scores justify bigger holdings. It would also like me to add shares in Portmeirion (LSE:PMP), a manufacturer of homewares, back to the portfolio only a year after I removed it. I am resisting for similar reasons. Niggling doubts about my scores are holding me back.

This does not reveal a lack of confidence in my system. The other 23 shares in the Share Sleuth portfolio are held in the proportions determined by their scores.

Maybe my reluctance betrays a flicker of individuality, and a desire not to be constrained completely by rules, even if they are my own. It almost certainly demonstrates that I hate trading, and find it particularly difficult when my analysis and my gut are giving me different signals.

New high for Share Sleuth portfolio

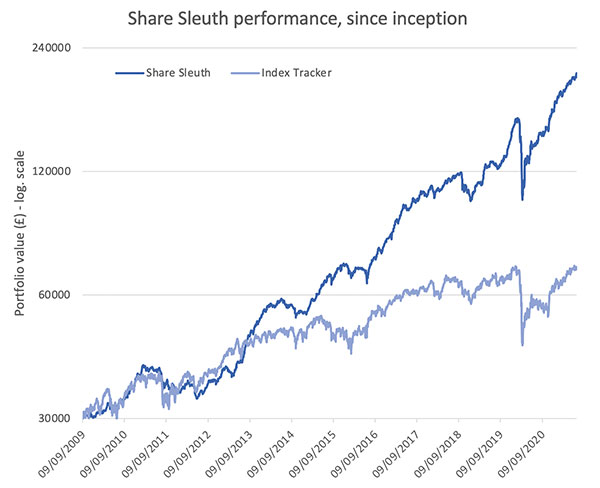

At Monday’s close, the Share Sleuth portfolio was worth £208,367, 595% more than the notional £30,000 invested in the year following its inception in September 2009.

The same amount invested in accumulation units of a FTSE All-Share Index tracking fund would have appreciated to £70,409 over the same period.

The cash balance has risen slightly due to dividends, but at £1,990 it is lower than my minimum trade size of 2.5% of the portfolio’s total value, which is about £5,000.

Consequently, any new additions must be funded from disposals.

| Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 1,990 | ||||

| Shares | 206,378 | ||||

| Since 9 September 2009 | 30,000 | 208,367 | 595 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ANP | Anpario | 1,874 | 6,593 | 12,462 | 89 |

| BMY | Bloomsbury | 1,295 | 3,274 | 4,507 | 38 |

| BNZL | Bunzl | 201 | 4,714 | 4,904 | 4 |

| BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,973 | 10 |

| CHH | Churchill China | 341 | 3,751 | 5,840 | 56 |

| CHRT | Cohort | 1,600 | 3,747 | 9,184 | 145 |

| D4T4 | D4t4 | 1,528 | 3,509 | 5,386 | 53 |

| DWHT | Dewhurst | 735 | 2,244 | 16,317 | 627 |

| FOUR | 4Imprint | 190 | 3,688 | 5,301 | 44 |

| GAW | Games Workshop | 76 | 218 | 8,846 | 3,958 |

| GDWN | Goodwin | 266 | 6,646 | 8,060 | 21 |

| HWDN | Howden Joinery | 1,368 | 8,223 | 11,480 | 40 |

| JDG | Judges Scientific | 159 | 3,825 | 9,540 | 149 |

| JET2 | Jet2 | 456 | 250 | 5,721 | 2,188 |

| NXT | Next | 106 | 6,071 | 8,416 | 39 |

| PRV | Porvair | 906 | 4,999 | 5,309 | 6 |

| PZC | PZ Cussons | 1,870 | 3,878 | 4,740 | 22 |

| QTX | Quartix | 1,085 | 2,798 | 5,317 | 90 |

| RM. | RM | 1,275 | 3,038 | 3,060 | 1 |

| RSW | Renishaw | 92 | 1,739 | 4,655 | 168 |

| SOLI | Solid State | 986 | 2,847 | 10,254 | 260 |

| TET | Treatt | 763 | 1,082 | 8,775 | 711 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 8,800 | 299 |

| TRI | Trifast | 2,261 | 3,357 | 3,052 | -9 |

| TSTL | Tristel | 750 | 268 | 4,853 | 1,709 |

| VCT | Victrex | 534 | 10,812 | 13,969 | 29 |

| XPP | XP Power | 240 | 4,589 | 13,656 | 198 |

Table notes:

No trades since the last update

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £208,367 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £70,409 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, 5 July 2021.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all the Shares in the Share Sleuth portfolio.

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.