Share Sleuth: the share I passed up on in 2009, but have now bought

When the chance to buy the shares at a reasonable valuation presented itself, Richard Beddard took it.

6th May 2021 18:53

by Richard Beddard from interactive investor

When the opportunity to buy the shares at a reasonable valuation presented itself, Richard Beddard took it.

This month’s trade has perhaps been the longest in the making of any Share Sleuth holding. I have been following Porvair (LSE:PRV) since 2009, and hindsight tells us it would have been a good investment then, but I thought it was borderline and I passed up on the opportunity. It has been the same story ever since.

Porvair felt borderline again when I scored it 7 out of 9 in April, but it was on the right side of the border, and on Thursday 29 April I added 906 shares at a price of just under £5.48. This was the actual price quoted by a broker. After deducting £10 in lieu of broker fees and nearly £25 for stamp duty, the entire transaction cost £4,999.25, which was just over 2.5% of the value of the portfolio.

My reluctance revolves around a nagging feeling that there may be limits to the growth of a subset of the companies in the portfolio that includes Porvair now. So far, this subset has proved me wrong.

- Share Sleuth: the FTSE 100 stock I have added to the portfolio

- Shares for the future: everything you need to know

- Richard Beddard: nerdy but essential changes to the Decision Engine

Between the financial crisis of 2008 and the pandemic, which has, temporarily I think, ended Porvair’s growth run, the company has prospered in part by acquiring other companies.

It joins six other shares that could be labelled serial acquirers: Bloomsbury Publishing (LSE:BMY), Bunzl (LSE:BNZL), Cohort (LSE:CHRT), Judges Scientific (LSE:JDG), Solid State (LSE:SOLI), and Trifast (LSE:TRI). There are four more that are occasional acquirers: Dewhurst (LSE:DWHT), FW Thorpe (LSE:TFW), RM (LSE:RM.), and XP Power (LSE:XPP). That, of course, means the majority of shares (15 of them) are not keen acquirers, although any one of them could surprise us.

Although most of the portfolio's acquirers have been profitable investments so far, the portfolio’s three biggest successes, Games Workshop (LSE:GAW), Jet2 (LSE:JET2), and Tristel (LSE:TSTL), have not made an acquisition between them this millennium.

Acquisitions complicate things. They complicate the accounting of businesses, they complicate the management of them, and they make it more difficult for investors to understand them.

I avoid companies that make big, often heralded as transformational, acquisitions because the acquisitions change the nature of the business I thought I understood too radically, and they require copious amounts of financing. They are too risky for me.

All of Share Sleuth’s acquirers make modest-sized acquisitions, and fund them using their own cash flow and, sometimes, a modest amount of debt.

For some of Share Sleuth’s acquirers, like Bunzl, the risks are low because they are straightforward businesses acquiring much smaller versions of themselves.

- Your chance to win £1,000: take part in the Great British Retirement Survey

- How to be a better investor

- Read more of our content on UK shares here

Bunzl is a distributor of everyday consumables, and it can slot distributors into its vast sourcing network easily to extend its geographical reach. The economies of scale make Bunzl more efficient. These acquisitions are low risk, which is probably why Bunzl has been able to grow so big and remain so profitable.

Others, and Porvair may be in this category, are not so simple. Porvair has three divisions connected by a common capability in filtration, but each market has its own requirements and the products are often bespoke.

The most profitable of the divisions, which grew out of Porvair’s microfiltration capability, makes laboratory equipment for water analysis, but it has also diversified into the allied niche of sample preparation and the robotic handling of samples.

The Laboratory division is a big asset, but to my feeble mind greater complexity puts a greater burden on management. Instinctively I heel to companies that are making themselves simpler, which is why buying Porvair chafes.

That said, I think Porvair’s management can handle complexity better than I can, and when the opportunity to buy the shares at a reasonable valuation presented itself, I took it.

Trades I did not make

I could have done nothing this month, that is my default setting, or I could have done something else. The “max trade” column in this table shows the trades I considered (trades in brackets are sells), all suggested by my Decision Engine:

Rank | Name | Description | Score | Max trade | Value | % |

1 | Casts and machines steel. Processes minerals for casting jewellery, tyres> | 8 | £5,688 | £8,299 | 4.2% | |

12 | Manufactures personal care and beauty brands | 7 | £5,027 | £4,862 | 2.5% | |

18 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6 | £(6,119) | £13,914 | 7.0% | |

38 | Operates tenpin bowling centres | 5 | £(3,819) | £3,819 | 1.9% |

Click on the company names to see how I scored them The Decision Engine suggested I add more shares in top-ranked Goodwin (LSE:GDWN), but I am reluctant to do that. I have invested three times in Goodwin but the returns have been slight and I will need to do some soul-searching before investing any more.

I may add more shares in PZ Cussons (LSE:PZC), ranked twelve. In March, the company unveiled its new strategy, which promises more focus.

Solid State (LSE:SOLI) has grown too big for its score of 6 according to the Decision Engine. It wants me to sell half the holding to reduce the portfolio’s 7% exposure. While I am unlikely to be as savage as that, I might reduce the holding by less, particularly if I want to fund a new addition.

Hollywood Bowl (LSE:BOWL) is the lowest-ranked share in the Decision Engine, and its bowling alleys and indoor crazy golf centres are still not open. Call me stubborn. Call me sentimental. But I am clinging on to it for now even though it may well lead a hand-to-mouth existence until the pandemic properly abates.

Share Sleuth performance

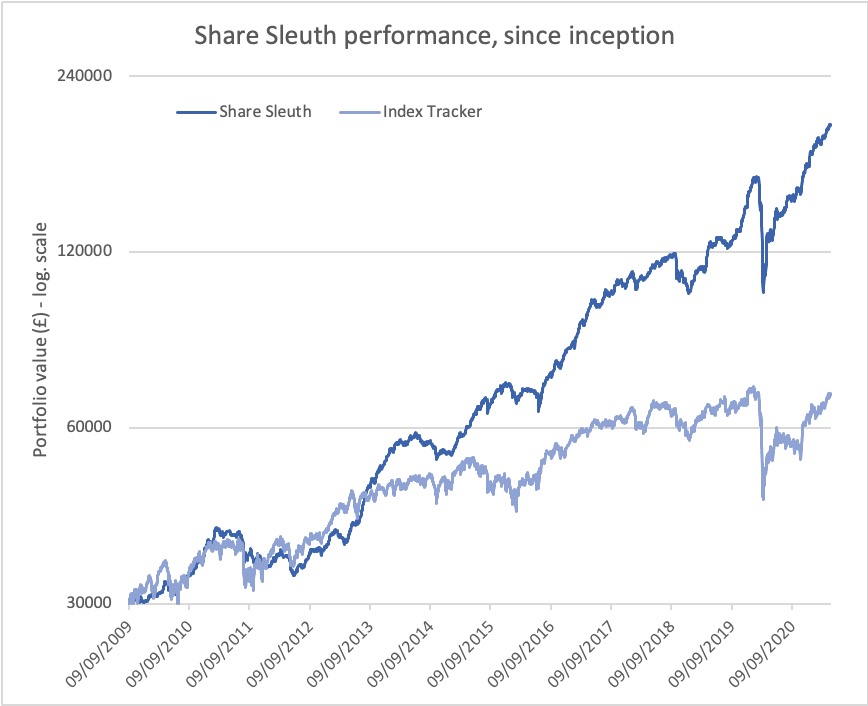

At last Friday’s close (immediately before the bank holiday), the Share Sleuth portfolio was valued at £198,105, 560% more than the notional £30,000 invested over the course of its first year starting in September 2009.

In comparison, the same amount invested in accumulation units of a FTSE All-Share Index tracking fund would be worth £68,241, a return of 127%.

The cash balance is only £1,291, so I will need to reduce or eliminate a holding to fund new purchases or wait until dividends accrue to nearly £5,000, which is 2.5% of the portfolio’s total value and my minimum trade size.

| Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 1,291 | ||||

| Shares | 196,814 | ||||

| Since 9 September 2009 | 30,000 | 198,105 | 560 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ANP | Anpario | 1,874 | 6,593 | 11,244 | 71 |

| BMY | Bloomsbury | 1,295 | 3,274 | 3,898 | 19 |

| BNZL | Bunzl | 201 | 4,714 | 4,677 | -1 |

| BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,836 | 6 |

| CHH | Churchill China | 341 | 3,751 | 5,081 | 35 |

| CHRT | Cohort | 1,600 | 3,747 | 10,272 | 174 |

| D4T4 | D4t4 | 1,528 | 3,509 | 5,348 | 52 |

| DWHT | Dewhurst | 735 | 2,244 | 14,296 | 537 |

| FOUR | 4Imprint | 190 | 3,688 | 4,465 | 21 |

| GAW | Games Workshop | 76 | 218 | 8,246 | 3,683 |

| GDWN | Goodwin | 266 | 6,646 | 7,927 | 19 |

| HWDN | Howden Joinery | 748 | 3,228 | 6,050 | 87 |

| JDG | Judges Scientific | 159 | 3,825 | 9,158 | 139 |

| JET2 | Jet2 | 456 | 250 | 6,801 | 2,621 |

| NXT | Next | 106 | 6,071 | 8,270 | 36 |

| PRV | Porvair | 906 | 4,999 | 5,364 | 7 |

| PZC | PZ Cussons | 1,870 | 3,878 | 4,937 | 27 |

| QTX | Quartix | 1,085 | 2,798 | 5,317 | 90 |

| RM. | RM | 1,275 | 3,038 | 2,901 | -5 |

| RSW | Renishaw | 92 | 1,739 | 5,764 | 231 |

| SOLI | Solid State | 1,546 | 4,523 | 13,914 | 208 |

| TET | Treatt | 763 | 1,082 | 8,622 | 697 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 7,580 | 244 |

| TRI | Trifast | 2,261 | 3,357 | 3,618 | 8 |

| TSTL | Tristel | 750 | 268 | 4,500 | 1,577 |

| VCT | Victrex | 534 | 10,812 | 12,538 | 16 |

| XPP | XP Power | 240 | 4,589 | 12,192 | 166 |

Table notes: Added more shares in Porvair

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £198,105 today £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £68,241 today

Objective: to beat the index tracker handsomely over five-year periods

Source: SharePad, 30 April 2021.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all of the constituents of the Share Sleuth portfolio.

For more on how Share Sleuth and Decision Engine work, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.