Share Sleuth: putting profits to work to add a new holding

Richard Beddard takes the number of companies in the Share Sleuth portfolio up to 27.

7th October 2020 10:54

by Richard Beddard from interactive investor

Richard Beddard takes the number of companies in the Share Sleuth portfolio up to 27.

I reduced the Share Sleuth portfolio’s holding in Games Workshop (LSE:GAW) by 37 shares from 113 to 76 at a price of £95.75 on 24 September. The transaction raised a total of £3,533 after deducting £10 in lieu of broker fees, equivalent to about 2.5% of the total value of the portfolio. The remaining holding is worth about 5% of Share Sleuth’s total value.

It was an all-but automatic decision, nothing to do with the prospects of the business, which are probably very good, and everything to do with the share price, which is high relative to normalised profit. Games Workshop makes Warhammer, a fantasy modelling and wargaming hobby, and nearly everybody thinks its prospects are good.

This is not the first time I have taken profits. I did it in February 2018 and again in February 2020. The shares are the gift that keeps on giving. So why am I cutting the flowers to water the weeds? I hate market aphorisms like this, even though it is attributed to one of my investing heroes - Peter Lynch.

I believe all the shares I follow closely are flowers, it is just that some of them are not flowering yet. Here is a price chart of Games Workshop, showing when I added the shares [b] and the subsequent reductions [s].

Source: SharePad

For a long time after I added it to the portfolio, Games Workshop did not bloom, and then all of a sudden it did (admittedly, it is producing quite an extravagant show).

I reduced the number of Games Workshop shares in the portfolio because the company’s prospects may not be good enough to justify such a handsome price, and my algorithm told me the holding had grown too big, given my level of confidence in the share price, to take the risk of an outsized position.

I described this algorithm in the last Share Sleuth update, so I will not do it again here - especially as I have been thinking harder about adding shares than removing them...

Additions

Before I can add a company to the portfolio, I must have scored it and ranked it against all the companies I follow in my Decision Engine.

While they are all probably good long-term investments, my objective is to have more money invested in the higher ranked shares.

Prime candidates for the portfolio are shares that score more than seven out of 10 that are under-represented, especially those I have not traded recently.

If I have a chance to add a new share and diversify, I will usually take it. But with 26 shares the portfolio is diverse enough so the compulsion is not strong.

This month the shares under consideration were:

- Victrex (LSE:VCT) (rank 3, score 9)

- Next (LSE:NXT) (rank 4, score 8)

- PZ Cussons (LSE:PZC) (rank 6, score 8)

- Howden Joinery (LSE:HWDN) (rank 7, score 8)

- 4imprint (LSE:FOUR) (rank 11, score 7)

The first four companies are already modest-sized holdings. The fifth, 4Imprint, would be a new addition. I tend to look first at the highest ranked shares and new additions.

Throwing good money after good

I have already added to the portfolio’s Victrex holding in January and should I add more, it will become one of the portfolio’s largest.

I am not ready to take that step for two reasons. First, Victrex has just reached its year-end, which means I will re-score it soon. Second, Victrex supplies high-performance polymers to industrial and healthcare sectors that are cyclical, susceptible to the pandemic, or both.

Victrex should survive and ultimately prosper because it is cash rich and uniquely capable, but the portfolio is quite exposed to these sectors through two other holdings, Renishaw (LSE:RSW) and Trifast (LSE:TRI).

After my unusual mid-term reappraisal of Next in last week’s Decision Engine update, the retailer is a strong contender. Trading has been surprisingly resilient during the pandemic owing to the broadness of the company’s product range and its large and profitable internet capability. I am also energised by its strategy to exploit its own infrastructure to enable other internet retailers.

PZ Cussons (LSE:PZC), meanwhile, has experienced internal ructions as well as external. Its chief executive Alex Kanellis left under a cloud, and we do not yet know how new chief executive Jonathan Myers plans to change the company’s strategy. Reassuringly, he has bought more than £100,000 worth of shares, but I do not expect to trade Cussons again until his first annual report, probably next summer.

Howdens, the fitted kitchen supplier, is a perennial candidate for new investment, although it is the lowest ranked of the four existing members of the portfolio.

New candidate: 4Imprint

Skipping to the bottom of the list, 4Imprint would be a new addition and the portfolio owns nothing quite like it. The company is a direct marketer of promotional products printed with corporate logos and messages.

Promotional products are often given out in person at meetings, conferences, exhibitions and so on. 4Imprint has experienced a massive drop in demand during the pandemic, but I do not believe the virus will put it out of business.

The company has an abundance of cash, no debt and during the first six months of the financial year from January to June it just about broke even while achieving positive cash flow.

Inevitably 4Imprint will earn much less profit in 2020 than it did in 2019, but perhaps it is wise to look beyond the company’s immediate prospects to the likelihood that it will emerge from the pandemic in a stronger competitive position.

4Imprint claims to be the leading direct marketer of promotional products in the US. It was one of the first to embrace the internet, and talks convincingly of its superior culture and technology, which connect customers to suppliers efficiently.

Smaller, less conservatively financed rivals with inferior systems and less well-motivated staff may not find survival as straightforward, or be able to respond as quickly when the US economy recovers.

Decision

On Monday 28 September, I surprised myself by adding 190 4Imprint shares at a price of £19.26. The transaction cost £3,688, the equivalent of about 2.5% of the portfolio’s total value, including £10 in lieu of broker fees and £18 in lieu of stamp duty.

The Share Sleuth portfolio now has 27 members. This is a large number, and I wonder if there are shares ranked in the bottom half of the Decision Engine table that I should remove to liberate funds for those shares I have more confidence in.

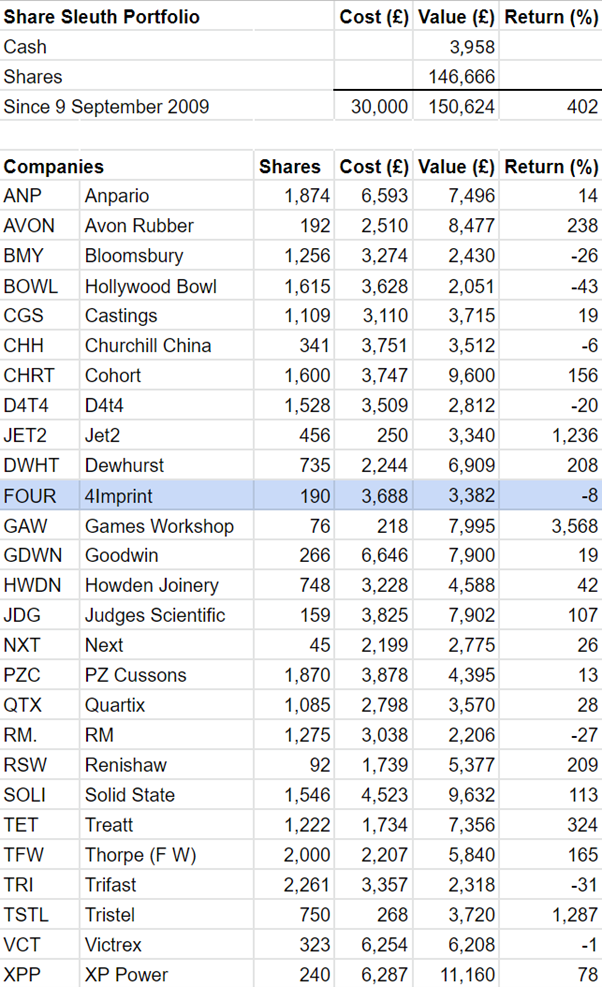

Table notes:

- Costs include £10 broker fee, and 0.5% stamp duty where appropriate

- Cash earns no interest

- Dividends and sale proceeds are credited to the cash balance

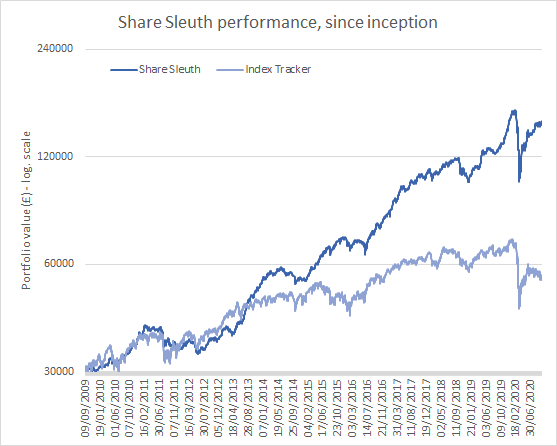

- £30,000 invested on 9 September 2009 would be worth £150,624 today

- £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £55,390 today

- Objective: To beat the index tracker handsomely over five-year periods

- Source: SharePad, 5 Oct 2020

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.