Share Sleuth: my first trades of 2022 lead to a new holding

2nd March 2022 08:49

by Richard Beddard from interactive investor

This company won a three-way battle with two existing holdings to win a place in the portfolio.

Despite a new year’s resolution to reduce the size of the portfolio from 28 companies to 25 or so, my first trades of the year have instead grown Share Sleuth to 29.

I have reduced the size of the portfolio’s holding in Victrex (LSE:VCT), but not eliminated it, and I have added shares in a new company, RWS (LSE:RWS).

Reducing Victrex

Victrex, which I re-scored three weeks ago, is the dominant manufacturer of PEEK, a polymer stronger, lighter, and more hard wearing than other polymers and the metal it replaces in planes, spinal implants and automobiles, to name just three end-uses.

Victrex has strong competitive advantages in terms of patents, expertise, and the company’s dedication to PEEK, but the Annual General Meeting confirmed what I had already concluded. Developing new applications for PEEK is harder work than the directors’ predecessors envisaged when they embarked on a series of mega-programmes eight years ago.

In fragmented industries like dentistry, persuading individual dentists to adopt a new material has proved exhausting. The company is now relying on its manufacturing partner to commercialise PEEK, and it has scaled down its expectations.

- Richard Beddard: why picking shares can be easier than we think

- Share Sleuth: what I learned from attending my first AGM since 2019

- Shares for the future: how I pick the best ones

- Richard Beddard: this UK innovator’s strategy has to prove itself

In more concentrated industries like oil and gas and medical implants, Victrex or its manufacturing partners must convince ‘majors’ like Petrobras or Johnson & Johnson that PEEK makes better pipelines, or better knee implants. These companies can be risk averse, having profited from existing technology.

If Victrex were to convince a major, volumes would probably ramp up very quickly but we are unlikely to get much warning. The decision would be something of a tipping point, and we do not know when that will be.

Victrex already supplies PEEK into thousands of applications, and the company says this core business is growing modestly, but it is under pressure from other manufacturers, more diversified companies that produce less sophisticated forms of PEEK. There is also the possibility of competition from other materials.

I have focused more on the risks, because they are becoming more apparent but the company’s mega-programmes may still deliver mega-money. My decision not to sell the entire holding reflects the fact that I am torn and only a little impatient.

You can see from the chart below that I have traded the shares at the beginning of the year soon after the publication of the annual report and very soon after I have scored it. I added Victrex shares for the first time in early 2016, and added more in early 2020 and early 2021.

Past performance is not a guide to future performance.

On the day of the trade, SharePad, the data platform I use to track the portfolio, told me Share Sleuth had made a cumulative 10% return on its investment after costs and including dividends, which is 1.6% annualised.

So far Victrex has not been a good trade, but I would not allow that fact alone to influence me.

On Wednesday 23 February I removed 242 Victrex shares at a price of just under £19.49. After deducting £10 in lieu of broker fees, the trade released £4,705, which I immediately re-invested.

Adding RWS

RWS, a translator and localiser of legal, financial, medical and technical documents, media and software, won a three-way battle with James Latham (LSE:LTHM), a timber importer and flooring distributor already in the portfolio, and Focusrite (LSE:TUNE), the designer of electronic equipment for making and recording music, and speakers.

All three score 7 out of 9, so in the event of a tiebreak I went with my instinct, which took me in the opposite direction of my plan to concentrate the portfolio.

I should have added to the existing holding, James Latham, but I am concerned that Share Sleuth is already somewhat dependent on admittedly dependable specialist firms supplying the construction industry.

The portfolio includes lift component manufacturer Dewhurst (LSE:DWHT) and lighting manufacturer F W Thorpe (LSE:TFW) as well as James Latham. These companies do not just operate in the same industry, they share many of the same qualities, notably a reputation for quality and service and the long-established relationships with customers that follow from that.

These are all good attributes, indeed RWS shares them, but at least it is in a different industry.

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Richard Beddard: could this firm be a stock market darling again?

- Read more of Richard Beddard's articles here

- Check out our award-winning stocks and shares ISA

Focusrite was an even closer call. This is a company run by enthusiasts for enthusiasts, which can be a potent combination. It is probably a worthy addition to the portfolio. Focusrite has a shorter record as a listed company than RWS, and in the last two years it experienced a windfall from locked down musicians, so perhaps recent history has treated the company especially kindly.

I scored RWS only two weeks ago, so it may just have been freshest in my mind!

Should I experience regret at passing up on Focusrite, I will have another chance when I ponder my trades for March. Then I expect to have scored another company for the first time.

Should Focusrite or another share join the portfolio it would take Share Sleuth to thirty constituents.

You may well ask where this leaves my plan to concentrate the portfolio. It leaves it in tatters.

By nature I am uncertain, so I diversify. That is easier in a market where prices are falling.

By nature I am a bottom-up investor, so I resist edicts from on high, even if they come from me!

Past performance is not a guide to future performance.

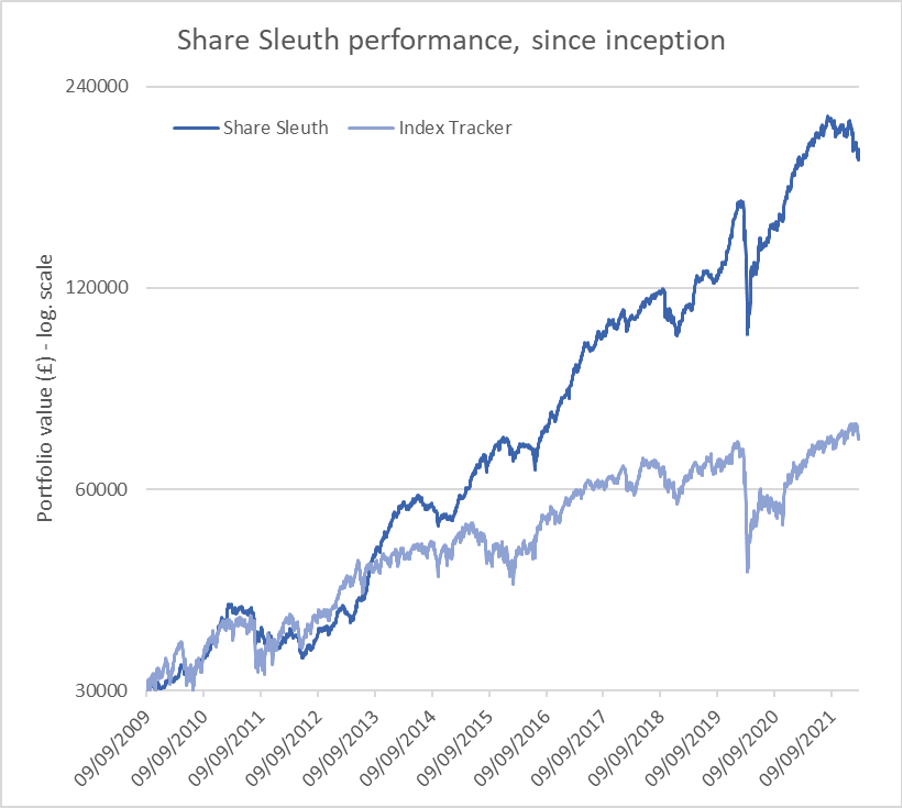

At the close on Monday 28 February, the Share Sleuth portfolio was worth £193,684, 546% more than the notional £30,000 invested in the portfolio’s first year, from September 2009.

The portfolio’s cash balance has swollen to £5,049 thanks to dividends from Cohort (LSE:CHRT), Solid State (LSE:SOLI), Victrex and Games Workshop (LSE:GAW). It is sufficient to fund new additions at a minimum trade size of 2.5% of the portfolio’s total value (about £4,700).

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 5,049 | ||||

Shares | 188,635 | ||||

Since 9 September 2009 | 30,000 | 193,684 | 546 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 6,294 | 55 |

BMY | Bloomsbury | 2,676 | 8,509 | 10,891 | 28 |

BNZL | Bunzl | 201 | 4,714 | 5,968 | 27 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,642 | 0 |

CHH | Churchill China | 341 | 3,751 | 5,354 | 43 |

CHRT | Cohort | 1,600 | 3,747 | 8,848 | 136 |

D4T4 | D4t4 | 1,528 | 3,509 | 4,454 | 27 |

DWHT | Dewhurst | 532 | 1,754 | 8,672 | 394 |

FOUR | 4Imprint | 190 | 3,688 | 5,149 | 40 |

GAW | Games Workshop | 76 | 218 | 5,681 | 2,506 |

GDWN | Goodwin | 266 | 6,646 | 8,286 | 25 |

HWDN | Howden Joinery | 1,368 | 8,223 | 11,672 | 42 |

JDG | Judges Scientific | 159 | 3,825 | 11,607 | 203 |

JET2 | Jet2 | 456 | 250 | 5,853 | 2,241 |

LTHM | James Latham | 400 | 5,238 | 4,960 | -5 |

NXT | Next | 106 | 6,071 | 7,274 | 20 |

PRV | Porvair | 906 | 4,999 | 5,971 | 19 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,936 | 2 |

QTX | Quartix | 1,085 | 2,798 | 4,177 | 49 |

RM. | RM | 1,275 | 3,038 | 2,040 | -33 |

RSW | Renishaw | 92 | 1,739 | 4,322 | 149 |

RWS | RWS | 1,000 | 4,696 | 4,600 | -2 |

SOLI | Solid State | 986 | 2,847 | 11,142 | 291 |

TET | Treatt | 763 | 1,082 | 7,477 | 591 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 8,640 | 292 |

TRI | Trifast | 2,261 | 3,357 | 3,109 | -7 |

TSTL | Tristel | 750 | 268 | 2,513 | 837 |

VCT | Victrex | 292 | 6,432 | 5,688 | -12 |

XPP | XP Power | 240 | 4,589 | 10,416 | 127 |

Added RWS and reduced Victrex in the last month.

Costs include £10 broker fee, and 0.5% stamp duty where appropriate.

Cash earns no interest.

Dividends and sale proceeds are credited to the cash balance.

£30,000 invested on 9 September 2009 would be worth £193,684 today.

£30,000 invested in accumulation units of a FTSE All-Share index tracking fund over the same period would have appreciated to £72,517.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Victrex.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.